- CEO of Egypt’s new sovereign wealth fund says it’s creating new investment opportunities for the private sector —Enterprise interview. (Speed Round)

- Zarou is reportedly leading the race for stake in Siemens power plants. (Speed Round)

- Egypt to offer at least USD 1.5 bn in triple-tranche USD eurobonds. (Speed Round)

- e-Finance to finish legal procedures this year ahead of 2020 IPO. (Speed Round)

- Etisalat Misr to invest EGP 4.5 bn in Egypt to next year. (Speed Round)

- Egypt’s exports to grow 20% y-o-y in 2019 -Nassar. (Speed Round)

- FinMin considering new tax breaks to insurance providers. (Speed Round)

- MPs to vote on medical tourism legislation “soon.” (Speed Round)

- The Market Yesterday

Wednesday, 13 November 2019

Sovereign wealth fund’s CEO: We’re creating new investment opportunities for the private sector

TL;DR

What We’re Tracking Today

The launch of Egypt’s sovereign wealth fund (which we now know is called THARAA, or “wealth” in Arabic) again dominates headlines this morning. CEO Ayman Soliman held a media roundtable, and we had a chat with him later about the fund, its operating principles, and how it aims to attract the private sector to Egyptian opportunities. We have edited excerpts of our talk and a roundup of news of the fund in the first two stories of this morning’s Speed Round, below.

It’s interest rate day tomorrow: The CBE meets on Thursday to review interest rates, with five of the six economists we surveyed last week predicting a rate cut. A Reuters poll of economists saw the 12 of 14 surveyed expecting a rate cut, with two anticipating a 50 bps cut, eight anticipating a 100 bps cut, and two saying the Monetary Policy Committee could get aggressive with a 150 bps cut. Another two economists predict rates to remain on hold.

Our friends at AmCham are hosting the US-Egypt Future Prosperity Forum on Monday, 18 November, with Prime Minister Moustafa Madbouly, US Deputy Assistant Secretary of Commerce for Manufacturing Ian Steff, and several Egyptian ministers scheduled to speak. You can check out the full agenda here.

The maiden Egypt Economic Summit wrapped up yesterday. Panels looked at banking and finance, ICT, industry, investment, and real estate. Youm7 has a rundown on the 41 recommendations for each sector provided by the panelists.

EFG’s new mortgage financing arm Bedaya will begin operating before the year is out, CEO Karim Awad said in a statement yesterday. “We proactively built a strong and growing NBFI platform over the past few years as we continue to actively explore new venues for further expansion to lead the market with new products,” Awad noted.

A Vietnamese Industry and Trade Ministry delegation will visit Egypt from 1-6 December to kick the tires on investment in logistics and trade, Vietnamese media reported yesterday.

Somabay is home to five luxury resorts, a lively marina, and outlets for premium entertainment and relaxation. Somabay caters to diverse tastes with a common thread of well-being,

Somabay is home to five luxury resorts, a lively marina, and outlets for premium entertainment and relaxation. Somabay caters to diverse tastes with a common thread of well-being,

relaxation, and sheer enjoyment of life that is reflected in all its hotels & facilities

Individual investors will need to max out their bids if they want to get in on the Aramco offering. A company statement yesterday said retail investors will need to bid at the upper end of the price range if they want to get a piece of potentially the largest IPO in history, according to Bloomberg. Refunds or additional shares will be handed out if the final price is lower than the top end, the statement said. The price range will be announced on 17 November and the final price on 5 December.

Saudi has launched a marketing blitz to get as many citizens as possible to invest in the company, the Wall Street Journal reports. Banks are handing out loans to purchase shares, a state media campaign is urging people to invest, and the listing adorns billboards and ATMs across the country.

Lebanon calls on Arab states for aid: Lebanese President Michel Aoun yesterday asked Arab ambassadors for financial assistance to rescue the country from a growing economic crisis, Bloomberg reports.

The world’s rich are penciling in a “major” sell-off next year, with a large number of wealthy investors converting their assets into cash, UBS Global Wealth Management said, according to Bloomberg. Of the 3,400 respondents in a survey, around 80% said they expect volatility to rise next year, and more than half anticipate “a significant market sell-off before the end of 2020.”

A Merrill Lynch survey offers a markedly different view, suggesting that the amount of cash-on-hand among asset managers is at its lowest level since 2013, falling to 4.2% as investors take on more risk.

This suggests fresh record highs on US indices will keep investors ploughing money into equities. Recession fears have faded into the background, as investors become more concerned with riding the current sugar high in the US markets generated by hopes of a US-China trade agreement. CNBC has more on the survey.

So-called alternative data is gaining credibility as a vehicle for investors to assess global economics and politics, supplementing official government reports and corporate filings, Bloomberg reports. This alternative data includes a wide range of material — from vehicle sales and electricity consumption shedding light on a country’s annual growth to tweets about jobs providing information about the state of a country’s employment. Using this data to identify patterns that can then be used to determine particular economic trends is becoming big business, with global spending on alternative data providers due to soar to USD 900 mn by 2021, almost double the level it was in 2017.

Google is creeping on your health records: Google has been collecting personal health data on “mns” of US residents without notifying the patients in question nor their doctors in an initiative dubbed “Project Nightingale,” the Wall Street Journal reports.

Enterprise+: Last Night’s Talk Shows

It was a surprisingly uneventful night on the airwaves: The chattering heads were strangely mute on the sovereign wealth fund roundtable meeting, which dominated the news cycle in the print media.

What did our trusted anchors decide was more important? The “Ayat girl” case, for one, which received blanket coverage. General Prosecutor Hamada El Sawy said there will be no legal repercussions for 15-year-old Amira Rizk, who stabbed a bus driver to death in self defense after he attempted to [redacted] assault her. Al Hayah Al Youm’s Khaled Abu Bakr (watch, runtime: 5:36), Masaa DMC’s Eman El Hosary (watch, runtime: 1:46), and Hona Al Asema’s Reham Ibrahim (watch, runtime: 2:51) all took note.

The Egypt Economic Summit also got some screen time, with Abu Bakr giving us his summary of proceedings (watch, runtime: 4:38). Trade Minister Amr Nassar said during his opening speech that Egypt invested EGP 900 bn in infrastructure over the past five years. Youm7 has a rundown on the 41 recommendations given by panelists for the financial, IT, industrial, and housing sectors.

One small step for Egypt: Egypt will launch on 22 November its first communication satellite, Tiba-1, from the French Guyanese town of Kourou, Abu Bakr reported (watch, runtime: 1:16). Tiba-1 will provide internet services to Egypt and some North African countries.

Speed Round

Speed Round is presented in association with

Our exclusive talk with Ayman Soliman, CEO of THARAA — Egypt’s new sovereign wealth fund: Egypt’s sovereign wealth fund could see its authorized capital increased to EGP 1 tn from a current EGP 200 bn. “We expect to increase our licensed capital within three years to EGP 1 tn or less … it all depends on the investors’ response and investment appetite,” newly appointed CEO Ayman Soliman told the press yesterday (see, for example, Reuters). His statements confirm those by Planning Minister Hala El Said last week, and back President Abdel Fattah El Sisi’s statements that the fund could see its capital raised into the several tn EGP range. “The sectors we will work in include industry, traditional and renewable energy, tourism,” Soliman added.

Soliman also revealed that the name of the fund will be THARAA (Arabic for wealth) at a press roundtable. He went on to state that Egypt has plenty of state assets and projects that would be of interest to investors, according to Al Mal.

We had an exclusive chat with Soliman that dove deeper into the weeds, looking at the fund’s strategy, how it will operate, its primary pitch to investors and how it will operate in a challenging global macro climate? Edited excerpts from our discussion:

The goal: In a nutshell, THARAA hopes to attract and steer investment toward sectors that the state sees as vital to the economy, Soliman tells us. The fund, through its investments and its subsequent sub-funds, aims to sustainably generate income and create value. The long-term ambition is significant: Soliman aims to see more Egyptian multinationals grow out of the investments that THARAA makes, saying their success will help raise Egypt’s regional and global economic clout.

The strategy: THARAA will operate through three types of partnerships. The first will see it partner with private-sector investors in specific industries. The second will see it partner with other sovereign wealth funds, while the third will see it partner with the private sector on specific projects through PPP, JVs and other sub-funds, Soliman said. The fund’s strategy will see it follow a private equity-style model of investing, he added, so we can expect a flurry of M&A coming from the fund. The model will see THARAA offer stakes of variable sizes in companies and projects across industries, suggesting that the fund does not plan to hold majority stakes in all of its projects.

The fund’s focus industries include: Food, pharma, industry, infrastructure and energy, among others. Down the road, it will also explore the agrifoods business. Soliman says there has been significant interest from regional and global investors, particularly in Egyptian power plants, pharma, and agrifoods. Soliman had revealed on Monday that as many as six international investors have expressed interest in the Siemens-combined cycle power plants transaction.

The fund has no intention whatsoever in crowding out the private sector, Soliman assured us. “We do not plan to get involved in any project where investors are already involved and locked in on,” adding that “We will create opportunities exclusive to the fund, or opportunities that would benefit from the fund’s involvement.”

THARAA is currently focused on institutional investors, with plans to draw in retail investors at a later stage.

IPOs and other exits are on the fund’s long-term agenda, he added.

The fund will also take a long-term approach to its portfolio investments, creating its own sustainable yield curve within four years of operation, Soliman said.

Timeline: Currently, the fund’s focus is on creating partnerships for specific projects and sectors, he said. We’ve seen that with the announcement that THARAA is looking to acquire a sizeable stake in the Siemens / Orascom Construction / Elsewedy Electric power plants, with an eye towards closing the transaction next year.

Where is the opportunity for investors? “What distinguishes THARAA from other funds is that it will provide access and exclusive opportunities to investors that would not be available to them otherwise,” Soliman said. It will open up important and niche sectors that have often remained closed and make them accessible to the private sector, he added, giving as an example the management of historic sites and monuments, to which the private sector may have access through the fund. It is also authorized to invest in infrastructure projects through PPP and other frameworks, including the newly introduced transfer-own-operate (TOO) framework.

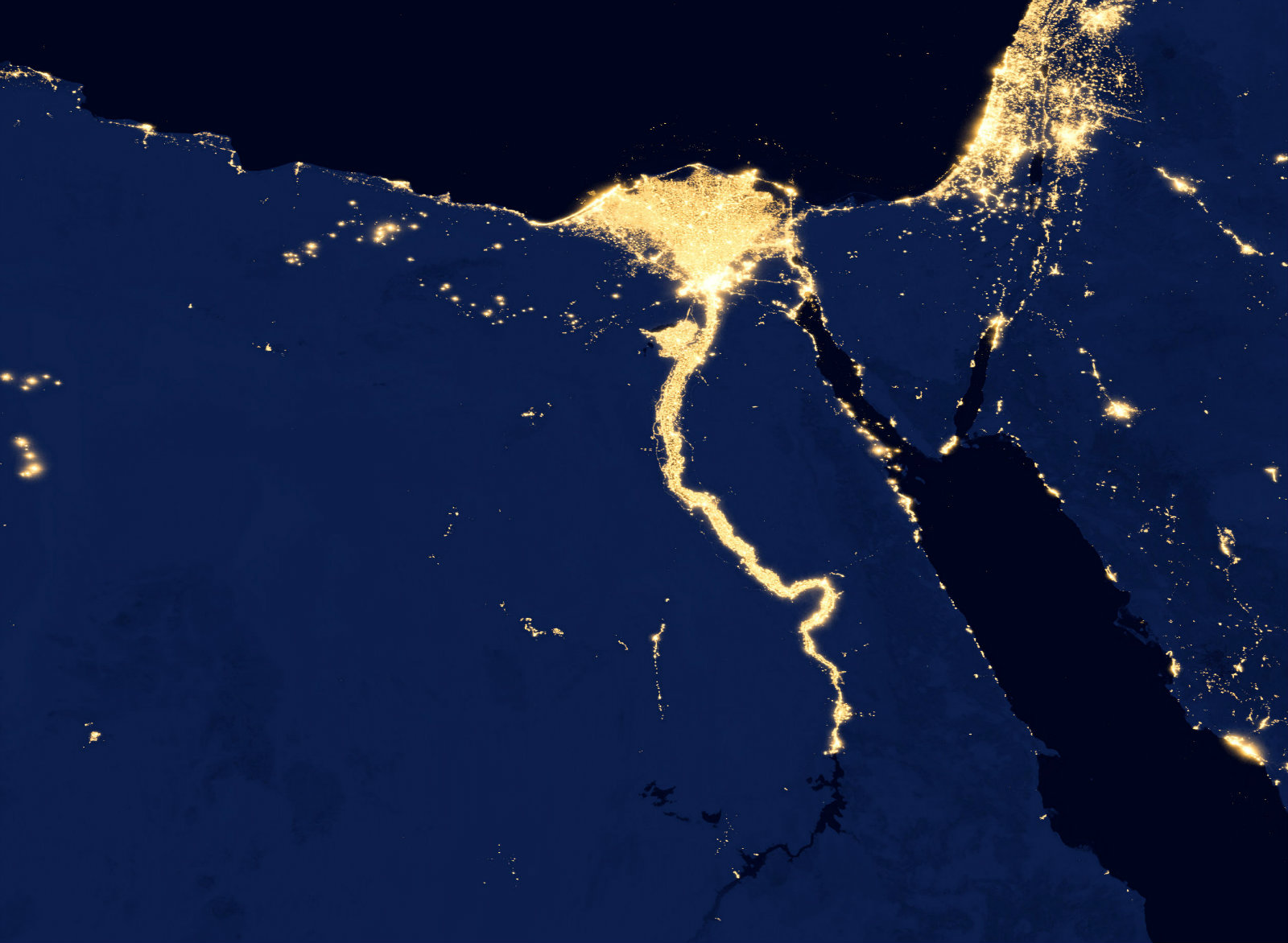

Why launch THARAA now? “We see that now we have an 18-month window before traditionally strong emerging markets, which have seen a downturn this year, start picking back up again,” said Soliman. Broadly speaking, Egypt is among the most attractive emerging market economies today, said Soliman: It has strong fundamentals as well as the demographics, consumer market and needed to drive growth. Egypt also offers above-average yields, drawing in portfolio investors, he said.

Launching THARAA amid a challenging global macro climate: Soliman sees opportunity in launching THARAA in a challenging global macro climate for a variety of reasons. He sees Egypt’s solid investment case as hooking investors who exited emerging markets this year. He also notes that Egypt managed to bring in hot-money portfolio investors in the worst of times thanks to high yields. THARAA can leverage this to draw them into more long-term instruments, says Soliman, who sees this as possibly providing a catalyst to re-energize capital markets here and spur the rise of things such as the corporate bond market in Egypt. Furthermore, big emerging markets are expanding economically outside their borders, such as China’s Belt and Road initiative. Egypt is strategically placed to take advantage of this, he added.

Ensuring THARAA doesn’t become 1MDB: How can we ensure the fund will be managed with transparency and good governance? “First, through the quality of our partners and partnerships,” said Soliman. By virtue of bringing in foreign and well-established partners, the fund is obliged to operate on the strictest standards of transparency, he said. Furthermore, the process of taking projects and companies to market is, by design and requirement, transparent. THARAA is also a member of the International Forum of Sovereign Wealth Funds, which promotes adherence to corporate governance and transparency requirements.

Zarou is the top contender for stake in Siemens power plants: Blackstone Group’s Zarou is reportedly the frontrunner out of six investors looking to acquire a stake in the Siemens / Orascom Construction / Elsewedy combined-cycle power plants, unnamed Electricity Ministry sources tell Al Mal. The energy development company has reportedly submitted the best financial offer of the six received by Egypt’s THARAA sovereign wealth fund, which is now in control of the plants until a new ownership structure is decided. The fund plans to select an international consultant this month to evaluate the offers.

Plans to sell only one plant in the meantime, says fund CEO: The newspaper suggests that Zarou could acquire a stake in all three plants — which are located in Burullus, Beni Suef, and the new administrative capital. THARAA’s newly-appointed CEO Ayman Soliman, however, said yesterday that an agreement to sell a stake in only a single plant is expected to be finalized in less than a year. Stake sales in the other two plants would then follow. Soliman didn’t disclose which of the three plants is in play, but noted that the remaining stake in the plant will be transferred to THARAA’s energy sub-fund.

Sub-funds under the THARAA umbrella: The energy sub-fund is one of three the fund is planning in the near-term. A fund for tourism and antiquities will be launched before the end of 2019, while a third will focus on the manufacturing sector. More details on all three will be announced in the coming weeks, Soliman said. A planned fourth sub-fund is also in the works and will channel investment into the agriculture and agro-industrial sectors.

How the power plant transaction(s) might unfold: Soliman told Bloomberg on Monday that the fund is planning to acquire 30% of the plants’ equity, and offer the remaining stake to an international investor as part of its efforts to encourage foreign participation in the economy. Other than Zarou, we heard that Edra Power Holdings is among the investors looking to get in on the action. Post-sale, the shareholders could establish a joint venture that would then sign a power purchase agreement to sell the plants’ output to the government. There are two alternative scenarios that the fund is looking at, including one in which it takes a 60-70% stake in the plants, leaving a minority stake for the private sector. It is not known which option the fund prefers. The three 14.4 GW plants were co-built by Siemens, Orascom Construction, and Elsewedy Electric, and were inaugurated in July 2018.

The fund will see EGP 50-60 bn-worth of assets transferred to it during the first phase of its operations, Soliman also said. Those assets will comprise ownership transfers, asset management contracts, and usufruct frameworks. Public Enterprises Minister Hisham Tawfik said later in the day that the ministry will hand over four hotels, three of which need refurbishment, and two pharma companies. He did not specify whether this will be a management contract or ownership transfer. Tawfik said the goal of the move is to increase revenues.

THARAA also signed two MoUs with the Public Enterprises Ministry and the National Investment Bank to cooperate on future investment and increase the role of the private sector. An agreement was also inked with the Antiquities Ministry to acquire rights to use several historical landmarks in the tourism sub-fund.

Bab El Azab area development seems to be moving forward: The agreement with the Antiquities Ministry will pave the way for a planned investment to develop the Bab El Azab (Cairo Citadel) area in partnership with the private-sector company Al Ismaelia For Real Estate Investment, with which the fund signed a cooperation protocol. Al Ismaelia focuses on renovating historical landmarks in downtown Cairo. The company will handle the project’s implementation, with the investment coming from the fund and, reportedly, bn’aire Samih Sawiris.

Regional cooperation: THARAA is also in talks with three counterparts in the region to set up joint funds, Soliman said, without providing names or any further details.

Gov’t to offer at least USD 1.5 bn in triple-tranche USD-denominated eurobond issuance: Egypt’s upcoming USD-denominated eurobond issuance will be split into three tranches, with the bonds carrying tenors of four, 12, and 40 years, according to a document seen by Reuters. The exact value of the issuances remains unclear, but the document indicates “the bonds will be of benchmark size, which generally means upwards of USD 500 mn per tranche,” the newswire says. That would bring the total value of the issuance to at least USD 1.5 bn. The Finance Ministry signalled in September that it will offer USD 2.5-3 bn in eurobonds either at the end of this year or the beginning of 2020, after it tapped 20 international investment banks and 7-8 local and international law firms to advise on the offering.

The timing of the issuances is also unclear; the ministry had said last month it will bring the bond sale to market sometime in FY2019-2020.

Advisors: The government had named Citibank, JPMorgan, BNP Paribas, Natixis and Standard Chartered as joint bookrunners for the offering on the Luxembourg Stock Exchange. Al Tamimi & Company was selected as local legal advisor, while Dechert was selected as international counsel.

Egypt’s eurobond plans come as eurobond issuances in the Middle East are on the rise, currently accounting for 27% of all sovereign debt sales in emerging markets, according to the Financial Times. This is a marked departure from the region’s eurobond activity back in 2016, when the Middle East accounted for “less than one-tenth of EM supply,” the FT says. The salmon-colored paper makes no mention of Egypt, as the increased issuances appear to come as dropping oil prices have net exporting countries scrambling to fill their financing gaps with debt. Analysts expect the trend to be sustained for the foreseeable future, with a chunk of Qatari debt maturing next year and Saudi Arabia’s budget deficit expected to widen.

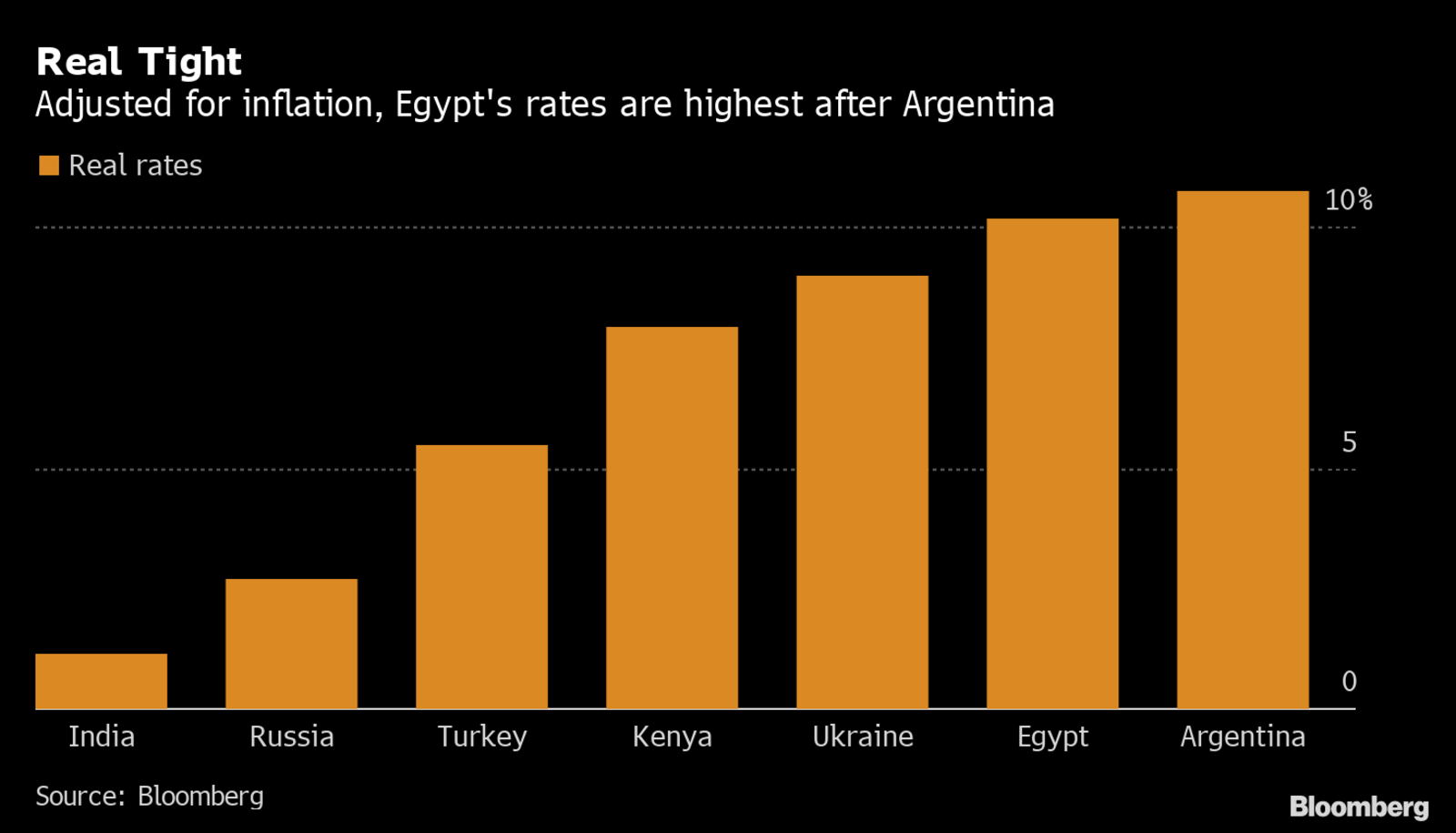

Egypt’s real interest rates are only outmatched by Argentina thanks to our “steep” inflation slowdown, Abeer Abu Omar writes for Bloomberg. Annual headline inflation dropped to a nine-year low of 2.4% in October, while annual urban inflation decelerated to 3.1%. According to the Bloomberg Barclays Local Currency Government Universal Index, Egypt’s inflation-adjusted bond returns are currently at 9.42%, which is nearly double the 5.14% offered by Turkey. To calculate a sovereign’s real rate of interest, the inflation rate is subtracted from the average monthly yield of 10-year local-currency sovereign debt.

IPO WATCH- e-Finance to wrap up legal procedures for IPO by the end of the year, timing still undecided: Payments platform e-Finance will wrap up by 31 December a handful of pending legal procedures for its planned initial public offering, Chairman and Managing Director Ibrahim Sarhan said yesterday at the Egypt Economic Summit, according to Masrawy.

What needs to be done? The company still needs to wrap up its business plans and expansion strategy and decide on the size of the stake it wants to offer, Sarhan said. The exact size of the IPO will then be determined by the government committee in charge of the state privatization program, he added.

Advisors: Pharos Holding is joint global coordinator for the transaction. Renaissance Capital is acting as e-Finance’s financial advisor and will decide on the timing of the listing after the company has tied up its legal loose ends.

Background: As far as we know, Banque du Caire (BdC) and e-Finance are the first two companies in line to IPO under the state privatization program. Sources said in August that the government will choose between the two companies for which will go first. The offerings were originally expected to take place this year, but Public Enterprises Minister Hisham Tawfik told us in September that the wave will kick off in the new year. We don’t know of a timeline for e-Finance, but BdC is expected to go to market in 1Q2020, the central bank’s governor, Tarek Amer, said earlier this month. As always, remember that timing of any transaction is indicative: Market conditions change.

Corrected on 13 November: Updated to include Pharos Holding as joint global coordinator.

INVESTMENT WATCH- Etisalat Misr appears to be following through on plans to invest EGP 4.5 bn in Egypt next year, after Chief Corporate Affairs Officer Khaled Hegazy said yesterday that the mobile network operator will invest the sum in the modernization of its network, according to Al Mal. CEO Khaled Metwally told Reuters earlier this year that Etisalat would deploy EGP 4.5 bn in Egypt this year. According to Hegazy, the bulk of the investments will be dedicated to developing smart applications and data transfer services. Separately, Hegazy said Etisalat is ready on the technical front to begin offering 5G services once it becomes available in Egypt.

INVESTMENT WATCH- A group of unnamed Canadian companies are looking to set up a USD 70 mn gold processing facility in Egypt, Canadian Chamber of Commerce President Fayez Ezz El Din tells the local press. The facility is expected to be complete in two years’ time. The companies plan on using Egypt as a hub for their gold processing activities in Africa, with a long-term plan of expanding to other countries in the continent, Ezz El Din said.

The government is expecting Egypt’s exports to be growing at a clip of 20% y-o-y by the end of this year, Trade and Industry Minister Amr Nassar said yesterday, according to a Cabinet statement. Nassar said the increase should be achievable in light of the government’s export subsidy program and structural reforms, which have supported the industrial sector. The ministry had previously said it wants to see industry growing at an 8% annual clip by 2020 — and wants to see manufacturers account for 21% of GDP, up from 18% today.

LEGISLATION WATCH- FinMin to make concessions to insurance providers: Insurance providers could receive tax exemptions under draft proposals currently being looked at by the Finance Ministry, minister Mohamed Maait said yesterday on the sidelines of insurance industry forum Sharm El Sheikh Rendezvous. The ministry could introduce the incentives within the coming two months, Maait said, providing little else in the way of detail. The move seems to be designed to lessen the impact on insurance companies of the 150% hike in minimum issued and paid-in capital contained in the proposed Insurance Act amendments. When details of the draft changes were leaked in January, the Insurance Federation of Egypt reportedly voiced concerns that the hike is unnecessarily high.

LEGISLATION WATCH- The House of Representatives should review and vote on the Medical Tourism Act “soon,” after the House Tourism and Aviation Committee wrapped drafting of the bill and had it signed off on by the Defense Ministry, committee head Amr Sedky told the local press. The bill, which was introduced in December 2018, would regulate the medical tourism industry by creating a national authority for the industry. This would accredit, rather than license, companies working in the sector, and defines heath tourists as those who come to receive hospital treatment, “ecotourists” visiting natural-healing sites, and disabled individuals entering the country for “accessible tourism.” The legislation could bring in at least 250k more tourists to visit over 16 sites and USD 1 bn in tourism inflows each year.

LEGISLATION WATCH- House aims to pass Clinical Trials Act by December: The special committee formed in the House of Representatives to discuss President Abdel Fattah El Sisi’s objections on the Clinical Trials Act is in the process of drafting an amended version of the bill, Deputy House Speaker El Sayed El Sherif said, according to Youm7. The committee will then refer the final draft of the proposed legislation to parliament’s plenary session for review, with the aim of finalizing any outstanding issues and holding a final vote by next month, according to El Sherif.

Background: It's been over a year since House Speaker Ali Abdel Aal ordered the establishment of a sub-committee to review the law regulating medical research and clinical trials. The law had passed during the previous legislative session, but El Sisi refused to sign the bill into law, citing concerns over several clauses, including provisions that set harsh penalties for the transfer of human research samples outside of Egypt without government approval. El Sisi said these provisions could be problematic for future scientific exchange with other countries.

STARTUP WATCH- UAE-based trucking network Trukker is to expand into the Egyptian market before the year is out, CEO Gaurav Biswas tells Bloomberg. Biswas was tight-lipped on additional details, including expected investments and the exact timeline for the company’s expansion to Egypt. Trukker has just raised a USD 23 mn series A funding round led by Saudi technology VC fund STV, marking the fourth-largest series A round in the Middle East. The company will enter a field in Egypt that is presently dominated by Maadi-based startup Trella, which is backed by our friends at Algebra.

Corrected on 13 November

An earlier version of this story incorrectly said that Trukker raised a USD 2.7 mn series A funding round. The correct figure is USD 23 mn.

EARNINGS WATCH- EFG Hermes’s net profit after tax and minority interest rose 34% to EGP 358 mn in 3Q2019, compared to EGP 279 mn in 3Q2018, according to the company’s earnings release (pdf). Revenues grew 25% to reach EGP 1.2 bn during the quarter. On a nine-month basis, the regional financial services corporation’s net profit after tax and minority interest surged 45% to EGP 1 bn in 9M2019, while revenues reached EGP 3.5 bn.The strong growth was driven by both the investment bank and non-banking financing businesses. The third quarter saw EFG close eight transactions both locally and regionally worth a combined USD 1.4 bn.

Looking ahead: “Our ambition is to solidify … our leadership in newly entered frontier emerging markets by growing our market shares and continuing to provide our world-class advisory services to key frontier companies seeking ECM, DCM and M&A transactions,” Group CEO Karim Awad said, noting that EFG has made “significant progress in our strategy of product diversification and geographic expansion.”

Cement producers Suez Cement and Tourah Cement report continued losses in 9M2019: Suez Cement reported a net loss of EGP 736.8 mn during 9M2019, compared to profits of EGP 267.3 mn during the same period last year, according to the company’s financial statement (pdf). Tourah Cement, which is 66.12%-owned by Suez Cement, reported a net loss of EGP 516.6 mn during the first nine months of the year, a 26-fold increase from its 9M2018 losses of EGP 19.7 mn, according to a bourse filing. Suez Cement suspended operations at Tourah Cement in May, citing “deteriorating financial results and the accumulated losses.”

Al Tawfeek Leasing’s net profits rose 2.9% in 9M2019 to EGP 52 mn compared to EGP 50.565 mn in the same period last year, the company said in a bourse disclosure (pdf). The total revenues during the same period increased to EGP 383.9 mn compared to EGP 360.5 mn in the same period with a growth rate of 6.5%.

Raya Contact Center’s net profit dropped 33% y-o-y to EGP 93 mn in 9M2019, down from EGP 138.7 mn in the same period last year, according to a bourse disclosure (pdf). The company's revenues also fell from EGP 623.55 mn from EGP 672.19 mn.

Sidi Kerir Petrochemicals Company’s net profits also fell 43.5% y-o-y in the first nine months of 2019 to EGP 521 mn down from EGP 922 mn in the same period last year, according to its disclosure (pdf).

Egypt in the News

The news that Mohamed Salah will miss the two upcoming Afcon 2020 qualifiers is making waves in the foreign press. The Egyptian star could be sidelined for the next two weeks after picking up an ankle injury during Liverpool’s 3-1 win against Man City on Sunday. This would mean that he misses Egypt’s ties with Kenya tomorrow and the Comoros next Monday. The Associated Press │BBC │Sky Sports │Daily Mail │The Sun.

The biggest story of the day according to the UK tabloids: A British family has accused travel operator Love Holidays of fraud after promising them a stay in a five-star hotel in Hurghada that turned out not to exist. The company then sent them to another hotel which was in the process of being demolished, before forcing them to pay an GBP 8k ‘holding deposit’ at a third hotel. The UK yellow press is all over this story: The Sun │The Daily Mail │The Mirror │The Daily Star.

Other headlines to skim this morning:

- Human rights: Reuters covers the video published by the government over the weekend highlighting a visit by security officials to Torah Prison.

- Confederation Cup: BBC Sport notes that Al Masry and Pyramids have been drawn in the same group in the Confederation Cup, alongside Mauritania’s Nouadhibou and Nigeria’s Enugu Rangers.

- Revolution on the walls: The Atlantic Council talks to Egyptian street artist Ammar Abo Bakr about the revolutionary graffiti that once adorned the walls of downtown Cairo.

Diplomacy + Foreign Trade

Russia-Egypt defense meeting signals growing military ties: Russian Defense Minister Sergey Shoygu yesterday called for closer defense ties during talks with President Abdel Fattah El Sisi and Defense Minister Mohamed Zaki, two days after the two countries concluded a joint military drill in Egypt. Shoygu said the two governments should develop closer military and security links, particularly in efforts to counter terrorism and find international solutions for regional crises such as the Libya and Syria conflicts. Russia and Egypt have been holding joint military exercises since the end of October, prompting some commentators to opine on Moscow’s growing military involvement on the continent — especially in the wake of last month’s Russia-Africa summit. Russia sent two nuclear bombers to train in South Africa at the end of October, a move apparently timed to coincide with the opening of the summit. The Friendship Arrow air drill wrapped up on Sunday.

Energy

South Disouq natgas field begins production

UK oil and gas firm SDX Energy announced yesterday that natural gas production at its South Disouq concession began on 7 November, according to City AM. All four of the concession’s discovery wells have been tested and gas has begun flowing at rates expected to meet the company’s 50 mscf/d target by 1Q2020. SDX Energy owns a 55% stake in the Nile Delta concession, and will sell all of its production to state gas company Egas.

Eight local, international companies bid for new capital solar tender

Eight local and international companies have submitted bids for a tender to install solar panels on 64 buildings in the new administrative capital, sources told the press. The bidders include Elsewedy Electric, Infinity Solar, the Arab Organization for Industrialization, and China’s Chint Electric. The tender is being managed by the New Administrative Capital Company for Urban Development, which will review the offers before the end of the year, and award the contract in 1Q2020.

Basic Materials + Commodities

El Rashidy El Asly inaugurates new EGP 200 mn factory

Confectioner El Rashidy El Asly inaugurated the first phase of its EGP 200 mn factory in Sixth of October City, which will triple the company’s current production levels, according to Al Mal. The factory was partially financed through a loan from the European Bank for Reconstruction and Development, and is scheduled to reach full production capacity by March 2020. The company had reportedly planned to complete the factory in 2018.

Manufacturing

Healthcare outfit ICMI invests EGP 30 mn to expand production

Healthcare outfit the International Company For Medical Industries (ICMI) has invested EGP 30 mn to finance its expansion plans in complementary pharma products, Chairman Hisham Saber told the local press. The company recently acquired two factories from New Alfa and Alfa Medical, which will be used to manufacture syringes and solution infusion equipment by early 2020.

Egyptalum to start EGP 7 bn upgrade project in early 2020

Egypt Aluminum (Egyptalum) will begin a EGP 7 bn project to upgrade a production line in early 2020, Mahmoud Agouz, the coordinator of a company committee responsible for upgrade projects, said. The upgrade is expected to increase the state-owned manufacturer’s annual production capacity to 445k tonnes from 320k. The move appears to be part of the company’s broader EGP 13.9 bn expansion project that aims to increase capacity to 570k tonnes.

Automotive + Transportation

Egypt to receive 10 new locomotives from GE at the end of November

The Railway Authority will receive 10 new locomotives from General Electric on 28 and 29 November, Transport Minister Kamel El Wazir said, according to Al Mal. The delivery is part of a USD 575 mn agreement to supply 100 new locomotives and refurbish another 81. The US company will build the first 50 locomotives, and deliver them over five batches. The remaining 50 will be manufactured in partnership with local companies.

On Your Way Out

Egyptian digital printing startup Fabrigate plans to rejuvenate the Red Sea’s fragile reef ecosystem by 3D-printing coral, Egyptian Streets reports. The company claims printing realistic replicas out of biodegradable plastic will help to support marine life if pollution and warming waters continue to damage reefs.

The Market Yesterday

EGP / USD CBE market average: Buy 16.08 | Sell 16.21

EGP / USD at CIB: Buy 16.09 | Sell 16.19

EGP / USD at NBE: Buy 16.08 | Sell 16.18

EGX30 (Tuesday): 14,670 (-0.7%)

Turnover: EGP 698 mn (5% below the 90-day average)

EGX 30 year-to-date: +12.5%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.7%. CIB, the index’s heaviest constituent, ended down 0.4%. EGX30’s top performing constituents were Egyptian Resorts up 5.2%, Palm Hills up 2.9%, and Madinet Nasr Housing up 1.7%. Yesterday’s worst performing stocks were Sidi Kerir Petrochemicals down 6.0%, Eastern Company down 5.0% and AMOC down 2.1%. The market turnover was EGP 698 mn, and regional investors were the sole net sellers.

Foreigners: Net long | EGP +9.7 mn

Regional: Net short | EGP -26.6 mn

Domestic: Net long | EGP +16.9 mn

Retail: 64.6% of total trades | 68.6% of buyers | 60.5% of sellers

Institutions: 35.4% of total trades | 31.4% of buyers | 39.5% of sellers

WTI: USD 56.75 (-0.1%)

Brent: USD 62.06 (-0.2%)

Natural Gas (Nymex, futures prices) USD 2.63 MMBtu, (+0.2%, December 2019 contract)

Gold: USD 1,457.90 / troy ounce (+0.3%)

TASI: 7,981 (+0.7%) (YTD: +2.0%)

ADX: 5,075 (-0.2%) (YTD: +3.3%)

DFM: 2,662 (-0.4%) (YTD: +5.3%)

KSE Premier Market: 6,259 (+0.0%)

QE: 10,226 (-0.8%) (YTD: -0.7%)

MSM: 4,053 (-0.5%) (YTD: -6.3%)

BB: 1,510 (-0.4%) (YTD: +12.9%)

Calendar

November: Suez Canal Conference for Investment, organized in cooperation with the European Union.

November: The government will host the Egypt Economic Summit with 40 speakers and experts across all economic fields to discuss the country’s vision post the IMF program.

November: British Egyptian Business Association’s Annual door knock mission, United Kingdom.

November: ITIDA to announce the winning bid in a tender to manage three new innovation centers.

November: A financial advisor for Siemens/OC/Elsewedy power plant stake sale could be named this month.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

13-15 November (Wednesday-Friday): Africa Early Stage Investor Summit, Cape Town, South Africa.

14 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

17 November (Sunday): The share price for the Aramco IPO will be announced (expected).

18 November (Monday): AmCham’s US-Egypt Proposer Forum in Cairo. US trade delegation visits Cairo to discuss investments in health, energy and information technology as part of the gathering.

20-29 November (Wednesday-Friday): Cairo International Film Festival, Cairo Opera House, Egypt, Cairo, Egypt.

20 November (Wednesday): The Investment Ministry and the Islamic Development Bank will organize the “leaders for change” startup competition as part of the Fekretak Sherketak initiative, location TBD, Cairo, Egypt.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

23 November (Saturday): HHD extraordinary general assembly to approve the 10% stake + management request for proposal

24 November (Sunday): Arabia Investments lawsuit against French Peugeot (after being postponed)

25 November (Monday): Global Trade Matters international dialogue on climate neutrality, Marriott, Cairo.

December: A Chinese automotive company delegation will visit Egypt to sign an agreement with El Nasr Automotive Manufacturing Company

December: Indian automotive delegation to visit Egypt

1-6 December: Vietnamese trade delegation visits Egypt.

1-4 December (Sunday-Wednesday): E-payment and Innovative Financial Inclusion Expo and Forum (PAFIX), Egypt International Exhibition Center, Nasr City, Cairo.

3 December (Tuesday): Emirates NBD / Markit PMI for Egypt released.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

4 December (Wednesday): Subscription to the Aramco IPO will begin (expected).

5-7 December (Thursday-Saturday): RiseUp Summit, American University in Cairo, New Cairo Campus

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10 December (Tuesday): Egypt Automotive summit, Nile Ritz Carlton, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

11 December (Wednesday): First day of trading on the Aramco IPO (expected)

12-14 December (Thursday-Saturday): 16 Egyptian real estate development companies will showcase their products at IPS Riyadh, Riyadh, Saudi Arabia

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

17-21 December (Tuesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.