- Will Fawry pull the trigger on Egypt’s biggest IPO since Emaar in time for Eid? (Speed Round)

- Potential amendments to the corporate universal healthcare tithe have been pushed to parliament’s fall legislative session. (Speed Round)

- HyperOne is investing EGP 5 bn to open new branches and develop its existing ones. (Speed Round)

- Orascom Investment Holding withdrew its offer to acquire Nile Sugar. (Speed Round)

- Ride-hailing companies are expanding, suggesting the industry is doing just fine. (Speed Round)

- Egypt is filing a civil lawsuit against Christie’s for its King Tut bust sale. (Egypt in the News)

- Private equity may be down, but it’s going strong. (What We’re Tracking Today)

- The Market Yesterday

Wednesday, 10 July 2019

Is Fawry going to IPO before Eid Al Adha?

TL;DR

What We’re Tracking Today

It’s interest rate day tomorrow: There was a consensus among the nine economists we spoke to this week that the central bank will leave rates unchanged when its Monetary Policy Committee meets tomorrow. All agreed that the bank would wait until at least September before cutting rates due to the inflationary effects of last week’s fuel and electricity subsidy cuts. Reuters’ poll published yesterday produced similar results, with 14 of 15 respondents predicting a hold. The central bank last cut rates in February, when it reduced the overnight deposit and lending rates by 100 bps to 15.75% and 16.75% respectively.

A lone dissenting voice: “We expect a big drop in annual CPI, which could increase the real interest rate to about 5-6% as of June numbers, in our view, leaving some room for a 100 bps cut,” Naeem Brokerage’s Allen Sandeep told us yesterday, but said that an unexpectedly high inflation reading today could switch his forecast to a hold.

Inflation figures for June are expected out today, setting the stage nicely for the week’s blockbuster event tomorrow. Annual headline inflation unexpectedly rose in May to 14.1% from 13.0% in April, while core inflation fell slightly to 7.8% from 8.1% over the month.

Egypt is “concerned” with Turkey’s plans to explore for oil and gas in Cyprus’ territorial waters, the Foreign Ministry said in a statement. The ministry warned that the move is “a continuation of unilateral measures that serve to increase tension in the Eastern Mediterranean region.”

Maait talks Egypt’s reforms, growth on CNBC: Finance Minister Mohamed Maait took some time out during the first day of the 2019 Paris Europlace International Financial Forum to talk to CNBC about the progress Egypt is making on economic growth, regional stability, and bureaucratic reform (watch, runtime: 01:50).

The Antiquities Ministry will launch this month the tender for the management and operation of the Grand Egyptian Museum, government sources tell the local press. The tender will be open to the five companies and consortiums who qualified to participate, and will grant the companies a three-month window to submit their bids by October. The ministry will select and announce the winning bid before the end of the year. An Egyptian-Italian, Egyptian-American, Egyptian-French, and Egyptian-French consortium and an Emirati company have all qualified for the tender. The USD 1 bn museum is set to open its doors to the public next year.

It’s Elmohamady’s turn to plead for forgiveness: Egypt’s national football team captain Ahmed Elmohamady wrote an apology on social media for crashing out of Afcon against South Africa on Saturday. The apology wasn’t well received, though, with many fans blasting the captain for his defense of Amr Warda and a gesture he made after scoring in a group stage game.

Speaking of our Afcon flop, was the EFA’s resignation ordered? The Egyptian Football Association’s president and board members were apparently not intending to resign after the game on Saturday, but were instead pressured by the government to do so, sources said, according to the National. Authorities were acting to contain public anger, especially as the government hiked fuel and cooking gas prices a day before the loss, the newspaper writes.

Private equity activity may be down but it’s still going strong. A new report from data analysis firm Prequin looking at the global PE industry says that despite a global decline in buyouts, exits, and venture capital agreements during 2Q2019, funds are still performing well and posting strong double digit returns overall. The total number and value of venture capital agreements fell by more than 1k to 3,263 agreements during the quarter, primarily driven by a slowdown in investment in China. The value of buyout agreements fell by more than 25%, reaching USD 75 bn from USD 102 bn during the quarter.

Investor appetite is still substantial and competition is becoming more intense, with around 4k (and counting) PE funds at market. The field is absolutely dominated by the largest funds, 5% of which are targeting nearly two-thirds of all capital sought. The PE industry raised significant capital through relatively few fund closures, the report finds, with total fundraising for 2Q standing equal to 1Q at USD 109 bn.

An increasing number of mutual funds are offering investments in pre-IPO companies to small investors. Investments by mutual funds in pre-IPO businesses were up USD 8 bn in 2015 from USD 16 mn in 1995, which clearly shows investor appetite, the Wall Street Journal reports. Getting in on the action comes with its own set of risks, though, not least of which is the difficulty of actually assessing a pre-IPO company’s impact on a fund’s overall performance.

Virgin Galactic to go public later this year: Sir Richard Branson is planning to take his space unit Virgin Galactic public through a merger with former Facebook executive Chamath Palihapitiya’s special-purpose acquisition company (SPAC) Social Capital Hedosophia Holdings, according to the Wall Street Journal. The latter will invest c. USD 800 mn for 49% of the Virgin, valuing it at a little over USD 1.6 bn and making it the first publicly traded commercial space flight company later this year. The proceeds will give Virgin sufficient funds until it starts turning profits.

Trump, Darroch saga continues: Donald Trump has been lambasting the UK’s ambassador to the US Kim Darroch since diplomatic cables leaked on Sunday showed that the latter regards the Trump administration as “inept, hobbled by infighting, and unlikely to improve,” reports the Associated Press. Trump slammed Darroch as a “wacky ambassador” and a “pompous fool” in a series of tweets after Prime Minister Theresa May stood by her senior diplomat.

Drake will finally be able to spam the world’s poorest countries with album ads to his heart’s content: Spotify has announced a new ‘Lite’ version of its app that targets people living in developing economies with slower mobile networks and limited data plans, Bloomberg reports. The Android app has been released in 36 countries in the Middle East, Africa and Latin America, and will be available for free via an ad-supported service while the premium, no-ad version will be charged at the standard price.

So you think you can dance? Sorry to burst your bubble, but we’re almost certain you have nothing on Snowball the cockatoo and his 14 distinct (and unique) dance moves — which scientists now believe are actually highly creative, choreographed routines.

New Cairo: 34 years in 20 seconds. The Guardian features New Cairo in its ‘Cities from Scratch’ series of time-lapse satellite images.

PSA- The Harvard Business School admissions team is coming to Cairo for the first time to host an information session for prospective MBA students on Wednesday, 17 July at the Greek Campus at 5:00 pm CLT. Did you attend HBS? The admissions team also wants to connect with alumni, and will host a separate reception exclusively for alumni before the presentation. To RSVP, email eileen_chang@hbs.edu.

Enterprise+: Last Night’s Talk Shows

The nation’s airwaves offered little in the way of actual news last night.

Parliamentary Affairs Minister Omar Marwan explained the structure of the government and parliament, and how his ministry operates in an interview with Al Hayah Al Youm’s Khaled Abu Bakr. Marwan described his ministry as “the government within parliament,” saying that its main role is to get the views of “the people,” as represented by the House of Representatives, across to the executive branch of the government. There is a good degree of “constructive cooperation” between the government and parliament, and little conflict between them, Marwan said (watch, runtime: 1:41).

Egypt’s beef with London auction house Christie’s over the USD 6 mn auctioning of a Tutankhamun sculpture got some airtime on Yahduth fi Masr.Authorities have handed over a request to the UK government to stop issuing permits for Egyptian artefacts sold at auctions to leave British soil, among other decisions taken in retaliation by the Egyptian National Committee for Antiquities Repatriation (NCAR), NCAR general supervisor Shaaban Abdel Gawad told host Sherif Amer (watch, runtime: 3:51). We have more on this in Egypt in the News, below.

New capital airport trial run: Amer also took note of the soft launch of a new facility, which will officially be known as the Capital International Airport (watch, runtime: 0:45).

Speed Round

Speed Round is presented in association with

IPO WATCH- Fawry to pull the trigger on Egypt’s largest IPO (since Emaar) before Eid? E-payment platform Fawry will reportedly offer 45% of its shares in an initial public offering (IPO) on the EGX before Eid Al Adha in August, sources close to the matter told the domestic press. The company is eyeing proceeds between EGP 2 and 2.5 bn, which would make the offering the largest Egypt has seen since Emaar Misr raised EGP 2.28 bn in 2015. It would also value Fawry at EGP 4.5-5.5 bn. The offering will consist of a substantial international component, with the roadshow is set to cover the GCC, European, US, and South African markets.

The IPO appears to be moving forward, fast: Financial advisor FinCorp, which Fawry hired to conduct a fair value study, is due to submit its report to the Financial Regulatory Authority within two weeks, after which the bookbuilding process will begin, the sources added. Fawry Managing Director Mohamed Okasha recently said the company is mulling a listing sometime in 2019 or 2020 to finance its expansion plans, but had not indicated the IPO plans would move ahead anytime soon. Fawry’s expansion plans include increasing its points of sale, buying new payment machines, and developing Fawry Pay. Fawry also signed an agreement with Dubai Islamic Bank last month to launch a trial run of its services in the UAE this summer.

The major shareholders: Back in 2015, a consortium comprising Helios Investment Partners, the Egyptian-American Enterprise Fund, EFG Hermes’ MENA Long-Term Value Fund, and the International Finance Corporation acquired a majority stake in Fawry worth USD 100 mn. The sources who spoke to the press yesterday said the IPO could see partial and full exits of 10 major shareholders, among them international financiers.

Advisers: Fawry tapped EFG Hermes to lead the transaction, and Zulficar & Partners is said to be on board as legal counsel.

LEGISLATION WATCH- Gov’t postpones amendments on healthcare tithe to next parliamentary session: The government has postponed talks over setting a cap on the corporate universal healthcare tithe until the next parliamentary session, the local press reported, citing unnamed government officials. Delaying the debate will allow for more input from other stakeholders, the sources said. Under current plans, businesses will be charged a 0.25% levy on their revenues in order to finance the government’s universal healthcare scheme. The current parliamentary session was expected to finish at the end of June, but was extended into July due to unfinished legislative business. The new session is scheduled to begin in October.

Limiting the tithe: The Finance Ministry is studying a proposal that would set a limit on the tithe paid by businesses to fund the new healthcare system. Under the proposed measure, businesses would still pay the 0.25% levy on revenues, but the payment would be capped at an amount equivalent to 1.5% of total net profits.

Background: The government began rolling out its EGP 600 bn health insurance plan in Port Said earlier this month, and more governorates will be added gradually over the course of the next 11-13 years. The ministry started collecting taxes (including the 0.25% tithe) to fund the scheme this fiscal year. The levy will be charged on revenues and will not be tax deductible for this year.

LEGISLATION WATCH- Cabinet issues executive regs for settling building code violations: Prime Minister Moustafa Madbouly has issued the executive regulations for a temporary law to settle building code violations, Housing Minister Assem El Gazzar said, according to Al Mal. The regulations allow fines of 5-100% of the land plot’s value to be imposed in cases of building code violations. The fine breakdown is as follows:

- A 5% fine is levied if the building does not follow the architectural plan;

- A 20% fine is charged if it does not conform to the construction plan;

- A 25% fine will be applied if neither the construction nor the architectural plans are followed but the building abides by regulations limiting plot size and the number of stories;

- A 50% fine will be levied if the property follows the building code but has been built without a permit;

- A 100% fine is charged if the property violates the building code, is constructed without a permit and is built in an unsuitable area.

Fines can be paid in installments: Fees for requesting settlement are capped at EGP 5k, and settlement fines can be paid over quarterly installments over a maximum of three years after paying a minimum of 25% of the fine up front. A committee comprised of accredited real estate experts from the Financial Regulatory Authority’s registry and a Finance Ministry representative will value land plots.

Background: The House of Representatives had approved earlier this year the temporary bill, which permits authorities to negotiate settlements on structures that meet structural integrity requirements and that are not built on state-owned or agricultural land. The law will sunset after three months.

INVESTMENT WATCH- HyperOne to invest EGP 5 bn on developing new and existing branches: Retail chain HyperOne will spend EGP 5 bn on new and existing branches “in the coming period,” regional legal advisor Mohamed Magdy Saleh told Amwal Al Ghad. The retailer is planning to open a branch in New Sphinx early next year, followed by two more at unspecified locations towards the end of 2020. HyperOne currently has two branches near Cairo — one in Sheikh Zayed and another on the Cairo-Ismailia desert road. The latter was inaugurated more recently.

Other investment plans: HyperOne has recently signed a final MoU with the Supply Ministry’s Internal Trade Development Authority to operate a subsidized commodities outlet. It was among eight others who inked contracts with the ITDA earlier this week to take part in EGP 23 bn-worth of planned commercial facilities in a number of governorates. We noted last year that HyperOne is looking into a potential EGX debut by the end of this year.

M&A WATCH- Sawiris’ Orascom Investment backtracks from Nile Sugar acquisition: Orascom Investment Holding (OIH) has withdrawn its offer to acquire Nile Sugar after failing to reach an agreement on the terms and conditions with the company’s shareholders, OIH said in a bourse filing (pdf). The company said that it will continue to pursue other investment options in the agro-industrial sector.

Background: The USD 3.6 bn acquisition had been on track to close by the end of 2018, but carried over into this year. OIH had asked in April for more time to close the acquisition of Nile Sugar to update its valuation report for the transaction based on Nile Sugar’s most recent financial results. The bid had come under criticism over its “inflated valuation” of Nile Sugar, which OIH denied.

LEGISLATION WATCH- House gives preliminary nod to Economic Court Act amendments: The House of Representatives’ general assembly gave its preliminary approval yesterday to proposed amendments to the Economic Courts Act, which aim to expand the scope of the nation’s economic courts to cover new business and finance activity, according to Youm7. If passed in a final vote, the changes would expedite court proceedings, allowing cases to be filed electronically and certain procedures to be completed online. The changes would also expand the courts’ jurisdiction to cover more cases — including those arising from new non-banking financial services (namely transferable guarantees, microfinance, and sukuk), and from money laundry and bankruptcy. Al Shorouk has a leaked draft of the changes.

Egypt’s banking sector to see 15% y-o-y earnings growth in 2Q -EFG Hermes: The Egyptian banking sector will see bottom line growth of 15% y-o-y in 2Q2019, according to EFG Hermes forecasts. Earnings growth will be driven by lower provisioning costs and a 12% y-o-y rise in revenues thanks to higher net interest income, the bank says.

But earnings to fall quarter-on-quarter: A seasonal slowdown in loan growth will cause earnings to fall 9% in 2Q compared to 1Q, EFG says. This will come despite 3% q-o-q growth in revenues.

STARTUP WATCH- Looks like the ride-hailing market is alive and kicking after all: Mass transit startup Wasel has launched 15 new lines from Cairo to other governorates, bringing its total lines to 43, founder Ahmed Elrawy said. The company last year secured USD 26k (c.EGP 500k) in funding from the British Embassy, and has now introduced lines in Minya, Beni Suef, Assiut, Fayoum, and Hurghada.

Dubci, a new ride-hailing company, is launching in Egypt within the next few weeks, the company said in a statement yesterday. In other signs that the ride-hailing space in Egypt is doing just fine, Cairo-based tuk-tuk and motorcycle ride-hailing startup Halan also launched earlier this week an advertising service, while Swvl pulled off the largest ever funding round for an Egyptian startup in late June, raising USD 42 mn in series B2 funding.

Will the ECA calm down now? The string of ride-hailing expansions put to be concerns repeatedly voiced by the Egyptian Competition Authority (ECA) regarding a recent merger between Uber and Careem. The ECA had said that the agreement could “lead to a significant impediment on effective competition in the markets” and previously threatened each company with a fine of up to EGP 500 mn.

CORRECTION- We incorrectly wrote yesterday that the government currently deducts 35% of monthly salaries worth between EGP 1,670 and EGP 5,710. It actually deducts 35% on variable salaries up to EGP 4,040. The story has since been corrected on our website.

** WE’RE HIRING: We’re looking for smart, talented journalists and analysts to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in people with writing plus either audio or video skills.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

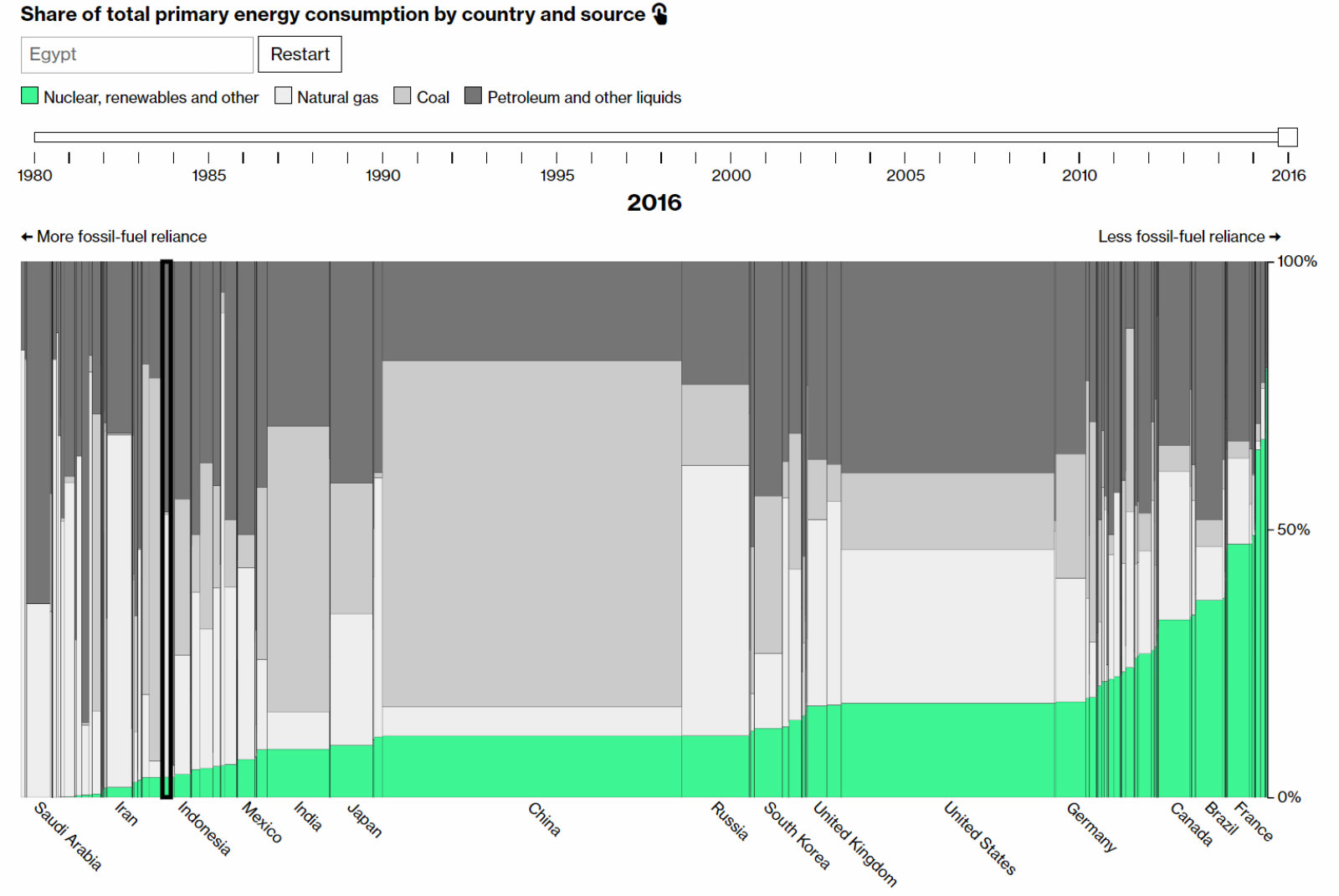

Image of the Day

Global energy consumption from 1980-2016, by country: This super-slick interactive chart brought to you by Bloomberg charts the evolution of global energy consumption since 1980. Watch for China’s rapid expansion over the first decade of the millennium, and the very gradual increase of nuclear/renewable energy over the four decades.

Egypt in the News

Egypt is planning to take legal action against the sale of a Tutankhamun sculpture for USD 6 mn by Christie’s auction house in London last week, Antiquities Minister Khaled El Anani told the BBC. Arguing the artefact was likely stolen in the 1970s, Egypt said the sale was “inconsistent with relevant international treaties and conventions.” Christie’s has denied any wrongdoing, insisting the sale was legal. The Egyptian National Committee for Antiquities Repatriation (NCAR) said it would go to a British law firm to file a lawsuit, which, according to the BBC, will be funded by a number of Egyptian businessmen and civil society actors. The NCAR said it would also ask Interpol to issue an order to "track down the illegal sale of Egyptian artefacts worldwide.” The story was also picked up by the Associated Press, France's AFP, the National, and Euronews.

Other headlines worth a skim this morning:

- Egypt’s Jewish community dwindles further: The death of Marcelle Haroun, mother of the current president of Cairo’s Jewish community, leaves only five known Egyptian Jews living in Cairo, the Jerusalem Post reports. Some 80k Egyptian Jews lived in Egypt in 1948.

- Egypt’s transfer of Tiran and Sanafir to Saudi Arabia is once again making headlines here at home, Al Monitor notes.

- Dahab remains a marvel for adventurers and thrill-seekers from the world over, Breana Wilson writes for Forbes' contributor network.

On The Front Pages

The issuing of executive regulations for a temporary law to settle building code violations topped the front page of state-owned Al Akhbar this morning. We recap the story in full in this morning’s Speed Round, above. Both Al Ahram and Al Gomhuria’s websites are still down this morning.

Diplomacy + Foreign Trade

Afreximbank dedicates USD 1 bn to support AfCFTA: Afreximbank has decided to allocate USD 1 bn to help countries that fear facing losses as a result of the AfCFTA agreement, President Benedict Oramah said on the sidelines of the African Union summit in Niger. The money aims to encourage countries to ratify the treaty by providing financial assistance.

Egypt-Tanzania business summit kicks off: Investment Minister Sahar Nasr inaugurated yesterday with Tanzanian Prime Minister Kassim Majaliwa the Egypt-Tanzania business summit, the Investment Ministry said in a statement. During the summit, Majaliwa invited Egyptian businessmen to invest in Tanzania’s agriculture industry while Nasr called on Tanzanian businessmen to increase their investments in Egypt.

Japan wants more investment incentives in Egypt, particularly in the automotive industry: Japan’s External Trade Organization (JETRO) has been meeting with Cabinet and Trade and Industry Ministry officials to request more investment incentives for Japanese companies in Egypt, JETRO Egypt’s general manager Takashi Tsunemi tells the local press. JETRO is looking for incentives specifically in the automotive sector, as Tsunemi says Japanese manufacturers are struggling to compete with their European counterparts after tariffs on European cars fell to zero at the beginning of the year.

Energy

Egypt talks investment options with Germany’s Wintershall DEA

The Oil Ministry met with a delegation from Germany’s Wintershall DEA yesterday to explore investment options, according to a ministry statement. The two sides also discussed an agreement they signed in March for DEA to extend its ownership of the Ras Budran and Zeit Bay oil fields in the Gulf of Suez for a further five years. Wintershall DEA, which announced a merger in May, has consolidated its Egyptian assets, giving it six onshore and offshore concessions throughout the country, with the most significant being its 17.5% stake in the West Nile Delta concession. The merged plans to invest USD 500 mn through 2020 to develop the asset as well as its Desouk and Gulf of Suez fields.

Empower gets preliminary nod from BdC for EGP 70 mn loan

Renewable energy company Empower has reached a preliminary agreement with Banque du Caire to take out a EGP 70 mn loan, Chairman Hatem El Gamal told Mubasher. The money will be used to partially fund the establishment of a EGP 100 mn waste-to-energy plant in Nubareya, which will process around 160 tonnes of waste per day to generate 24 MW of energy. Empower has invested a total of EGP 420 mn in waste-to-energy plants to date. The company is planning to begin directly selling electricity generated from recycling waste for the first time to a local farm in September for around EGP 2/kWh.

Italy’s Eni to drill nine new wells in Egypt’s Zohr until 2020

Italy’s Eni is planning to drill nine new development wells in the Zohr gas field until 2020 to achieve production targets agreed upon with the Oil Ministry, an industry source told the press. Zohr’s development plan involves drilling 20 wells, 11 of which have already been drilled. The company is planning to link the 11th well soon, bringing the supergiant field’s production level to 2.5 bcf/d by the end of the month, up from a current 2.3 bcf, the source added.

Infrastructure

Egypt to begin talks to build desalination plants under PPP framework

The government is planning to begin negotiations next month with several companies to construct desalination plants to treat 150k cbm of water per day under a PPP framework, unnamed sources tell the local press. The companies include Spain’s Aqualia, France’s Schneider Electric, Switzerland’s Aqua Swiss, and water treatment company Metito.

Basic Materials + Commodities

Nuclear Materials Authority, Egyptian Black Sand Co complete phase one of sand treatment factory

The Nuclear Materials Authority and the Egyptian Black Sand Company have inaugurated the first phase of their black sand treatment facility in Rashid, authority boss Hamed Meira said. The second phase will be completed in October. The two sides agreed to have the factory fitted and designed by a Chinese company, which will in turn receive 30% of the untreated sand.

Tourism

Egyptian hotel market continues strong performance in 5M2019

Egyptian hotels saw their average revenue per available room (RevPAR) grow 24% y-o-y during the first five months of 2019, TradeArabia reports, citing the latest Colliers International’s Mena Hotel Forecast. Analysts predict that RevPAR will continue to move upwards throughout 2019, driven by a surge in tourists from overseas.

Automotive + Transportation

AOI inks MoU with Czech company Zetor to locally manufacture farm tractors

The Arab Organization for Industrialization (AOI) has signed an MoU with Czech manufacturer Zetor Tractors to locally manufacture farm tractors, Chairman Abdel Moneim El Teras said, according to Al Shorouk. The MoU will see a technology transfer, and Zetor will provide training to AOI technicians and engineers.

Banking + Finance

Edita finalizes USD 20 mn loan agreement from IFC

Edita finalized yesterday a USD 20 mn loan agreement from the International Finance Corporation (IFC), according to an emailed statement (pdf). Under the agreement, the snackmaker will receive a seven-year, medium-term facility, “with the contract including an option for a second tranche of an additional USD 10 mn.” Edita and the IFC had reached an agreement for the loan, which will be used to support expansion and growth in Egypt and the wider region, last month.

Blom Egypt Securities applies for short selling license

Blom Egypt Securities has applied for a short selling license from the Financial Regulatory Authority (FRA), Managing Director Mohamed Fathalla told Al Mal. Blom Bank Egypt’s brokerage arm could become the latest to acquire the license after the FRA granted it to EFG Hermes, CI Capital, the Arab African International Securities, and Arqam Securities. The authority issued regulations earlier this year allowing short selling on the EGX through brokerages who will act as market by finding lenders and borrowers of stocks.

Other Business News of Note

Government reaches settlement on El Nasr for Steam Boilers

The government will make a EGP 624 mn indirect payment to Saudi Arabia’s Al Kholoud and Faisal Bank to settle the dispute over El Nasr for Steam Boilers, company chairman Emad El Din Mostafa told Youm7. The government will pay the money to other government entities to which Al Kholoud and Faisal Bank owe money. The holding company will obtain the 29-feddan land plot, which is valued at EGP 864 mn, on which El Nasr’s factory is built. The company will hand over the land to the Oil Ministry instead of repaying the settlement. The government is expected to sign the settlement agreement tomorrow.

Egypt Politics + Economics

14 people charged with negligence appear in court over Ramsis train crash

Fourteen defendants appeared in the Cairo Criminal Court yesterday in the first hearing of the case brought against them for the Ramsis train crash, Egypt Today reports. The defendants have been charged with negligence and the prosecution is calling for the maximum penalty to be enforced. The train disaster occurred in February and resulted in 22 deaths and 40 injuries.

On Your Way Out

Lab-grown meat is about to go mainstream: Synthetic hamburgers could be retailing at supermarkets at a price of USD 10 within two years as they move from being lab-grown to factory-made, according to Reuters. Lab-grown meat first emerged as a possibility six years ago when Dutch Mosa Meat’s co-founder Mark Post grew a burger from animal cells at a cost of EUR 250k (USD 280k) apiece. With concern about climate change, animal welfare and individual health on the rise, demand for the so-called clean meat alternatives is skyrocketing, and the rush to take the tech from labs and apply it in scaled-up factories could bring the cost of producing a burger to as low as EUR 9.

The Market Yesterday

EGP / USD CBE market average: Buy 16.54 | Sell 16.67

EGP / USD at CIB: Buy 16.55 | Sell 16.65

EGP / USD at NBE: Buy 16.57 | Sell 16.67

EGX30 (Tuesday): 14,097 (+0.4%)

Turnover: EGP 552 mn (19% below the 90-day average)

EGX 30 year-to-date: +8.1%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 0.4%. CIB, the index heaviest constituent ended up 0.7%. EGX30’s top performing constituents were Egypt Kuwait Holding up 4.1%, Arabia Investments Holding up 4.1%, and Orascom Development Egypt up 2.6%. Yesterday’s worst performing stocks were Pioneers Holding down 1.7%, Telecom Egypt down 1.3% and Qalaa Holdings down 1.3%. The market turnover was EGP 552 mn, and regional investors were the sole net sellers.

Foreigners: Net Long | EGP +8.5 mn

Regional: Net Short | EGP -34.2 mn

Domestic: Net Long | EGP +25.8 mn

Retail: 69.3% of total trades | 71.1% of buyers | 67.5% of sellers

Institutions: 30.7% of total trades | 28.9% of buyers | 32.5% of sellers

WTI: USD 58.70 (+0.87%)

Brent: USD 64.90 (+0.74%)

Natural Gas (Nymex, futures prices) USD 2.43 MMBtu, (+0.16%, Aug 2019 contract)

Gold: USD 1,395.10 / troy ounce (-0.39%)

TASI: 8,854.49 (+0.31%) (YTD: +13.13%)

ADX: 5,022.17 (+0.23%) (YTD: +2.18%)

DFM: 2,656.20 (0.00%) (YTD: +5.00%)

KSE Premier Market: 6,726.47 (+1.4%)

QE: 10,500.46 (+0.55%) (YTD: +1.96%)

MSM: 3,824.09 (+0.03%) (YTD: -11.56%)

BB: 1,538.31 (+0.36%) (YTD: +15.03%)

Calendar

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

July: The National Railway Authority will launch a tender for the purchase of 100 new locomotives expected to be financed through an agreement with the European Bank for Reconstruction and Development (EBRD).

11 July (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

11July (Thursday): The House of Representatives will end its current legislative session and adjourn for summer recess.

13-14 July (Saturday-Sunday): The Mediterranean Tourism Forum, Alexandria, Egypt.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

21 July (Sunday): Amer Group and Antaradous Touristic Development will face off in court over a 2014 dispute brought by the Syria-based company for a fallout in their partnership to develop the Porto Tartous tourist resort. The date was postponed from 23 June.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

28 July-02 August (Sunday-Friday): Fab15 Conference and Graduation Ceremony, TU Berlin, El Gouna, Egypt.

29 July (Monday): An administrative court will look into charges brought by the Financial Regulatory Authority (FRA) against Raya Holding founder Medhat Khalil in connection to a mandatory tender offer forced on him by the FRA.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

August: The National Railway Authority is expected to sign a 15-year maintenance agreement for 1,300 railcars it had agreed to purchase from Russia’s Transmashholding under a EGP 22 bn contract.

03-04 August (Saturday-Sunday): Fab15 Festival, Tours, and Conference Closing, Greek Campus, Cairo.

7-11 August (Wednesday-Sunday): Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

28-30 August (Wednesday-Friday): Tokyo International Conference on African Development (TICAD), Yokohama, Japan.

29 August (Thursday): Islamic New Year (TBC), national holiday.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

03-04 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

18 September (Wednesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.