- Non-oil business activity expanded for the first time in eight months in April. (Speed Round)

- Thailand’s PTT Energy Resources files USD 1 bn lawsuit against Egypt over EMG. (Speed Round)

- World Bank boss points to Benban solar park as success story, says there’s room for more in agriculture, transport, water and sanitation. (Speed Round)

- IMF delegation in Egypt to hold first meeting with gov’t today as it completes final review. (What We’re Tracking Today)

- Compass completes exit of CI Capital. (Speed Round)

- Maridive Oil Services has won a USD 27 mn services contract for work in Mexico. (Speed Round)

- Robots and AI will eat jobs in emerging markets -OECD. (The Macro Picture)

- Emerging markets: Where will they go from here? Thoughts from Goldman Sachs’ latest podcast. (Worth a Listen)

- The Market Yesterday

Monday, 6 May 2019

Business activity expanded for first time in eight months — happy Ramadan

TL;DR

What We’re Tracking Today

It’s a reasonably quiet news morning in Egypt as we begin the Holy Month, but what news there is is big: Thailand has a new king, and he’d like USD 1 bn from Egypt to mark the occasion. And non-oil business activity expanded last month, snapping an eight-month losing streak.

IMF delegation in Egypt to hold first meeting with gov’t today as it completes final review: An International Monetary Fund (IMF) delegation in town to conduct the final review of Egypt’s economic reform program will hold today its first meeting with the government, a senior official told Enterprise. The delegation will complete its review in two weeks after a series of sit-downs with the authorities focused in part on forthcoming amendments to the Investment Act and other measures to attract investment.

Also on the agenda: Incentives to encourage the growth of SMEs. The government’s drive to convince informal businesses to go legit, the CBE’s monetary policy stance, coming fuel subsidy cuts and the introduction of a new automatic fuel pricing mechanism to more oil products will also be discussed. This review will determine if we will receive by early July the sixth and final USD 2 bn tranche of the USD 12 bn facility.

We’re keeping our eyes peeled for monthly inflation figures, which are due out by the end of the week. Annual headline urban inflation eased slightly in March to 14.2%, down from 14.4% the previous month.

Google Assistant now understands (but doesn’t quite speak) Masry: Google has launched its Android- and iOS-compatible Google Assistant in Egypt and KSA — and says it can understand both colloquial dialects and respond in standard Arabic, according to an emailed press release (pdf). Armed with machine learning, the app will be “will only get better with time.”

Hani Shukrallah has died at age 69. An all-round good human being with a contagious smile, Hani was a veteran journalist, commentator and old-fashioned lefty who counted among his many accomplishments founding Ahram Online, which he led from 2010-2012 after having earlier edited Ahram Weekly. His family will hold an aza at Omar Makram Mosque in Tahrir Square on Thursday. Ahram Online has the official obituary.

Egyptian football fans ❤️Gianni Infantino: FIFA President Gianni Infantino’s plan to expand the Qatar 2022 World Cup to 48 teams could be Egyptians’ only hope of being able to travel to the tournament. The plan would require at least two more stadiums to accommodate the expanded roster, which Qatar is unable to do. Saudi Arabia has now thrown its hat into the ring as a potential co-host — but will Qatar play ball? The Financial Times has more.

On a related note: We’re now officially “enemies”: No visas will be granted to so-called “enemies” of Qatar, thesecretary-general of the statelet’s tourism council said, according to Reuters. “The visa will not be open for our enemies,” Akbar Al Baker said, singling out Egypt during an event designed to promote Qatar as a tourist destination. A Qatari government spokesman later walked back Al Baker’s remarks, saying they “do not reflect the state’s official policy for issuing visas and that it welcomes ‘all people of the world’.”

Jumia struggles to navigate Africa’s rough landscape: Jumia, which is on an investment spree to expand in Africa, is struggling with customer skepticism of online shopping, says the Financial Times. Poor road infrastructure, traffic, and logistics challenges are also issues of major concern to the USD 1.1 bn firm, which has recently became the first Africa-focused tech company to list on a major stock exchange when it went public in New York.

Global business headlines and other news worth knowing this morning:

- Markets are unhappy that The Donald has threatened to hike tariffs on China to 25%. The warning came ahead of make-or-break trade talks scheduled for this week, making the story the top story in the global business press this morning. Start with CNBC and Reuters and then move on to the FT and Bloomberg if you need more.

- Fighting has intensified in Gaza in what the New York Times is calling “the worst combat since the full-blown war in 2014.” At least 22 Palestinians and four Israelis are dead. Reuters also has the story.

RANDOM NOTE: NPR and CBC were staples of our households growing up, so we’re a little verklempt that after 40 years, NPR’s Morning Edition has a new theme song. The New York Times has the rundown, including the new and old clips. Or head to your favorite podcatcher and give a full episode a listen.

Financial inclusion in the Middle East and Africa is the subject of a special package in the FT in which Egypt gets scant mention despite all that’s happening locally in the banks, at the CBE, in the non-bank finance sector and on Planet Startup. Still, the landing page is here and the headline stack includes:

- How developing nations use tech to reach the ‘underbanked’ (name-checks CIB)

- Banks use fintech to further financial inclusion

- Cash culture drags on financial inclusion efforts in north Africa

What we’re tracking today, the Ramadan Edition:

This is how Canada celebrates Ramadan, via Muhammad Lila on Twitter (watch, runtime: 2:18).

A pre-iftar reading list to kill the time between your post-workout shower and the breaking of the fast:

- For the gearheads: The fight for the right to drive. People who love to drive have “deep misgivings about the prospect of a fully autonomous, steering-wheel-less future.” Meet the funky cast of characters who want to keep things like the Cannonball Run alive. (New Yorker)

- Life begins at 60 — the rise of the ‘Young-Old’ society: As we live longer, healthier lives, the worlds of work and leisure are on the cusp of radical change. (Financial Times)

- Why men won’t go to the doctor, and how to change that. Many men view health complaints as a sign of weakness, so health-care providers are looking for ways around their reluctance. Think of it as part a source of inspirational business ideas, half warning to take your health seriously. (WSJ)

RAMADAN PSA #1- It’s a short working day on Planet Finance. Employees work 9am-2pm, while doors are open from 9:30am until 1:30pm for customers. Shares trade hands on the stock market from 10:00am until 1:30pm.

RAMADAN PSA #2- Need help choosing which serial to tune into? Check out lists of mosalsalat with potted plot summaries from Egypt Today (English) and El Cinema (Arabic).

RAMADAN PSA #3- Don’t feel (quite so) guilty about pigging out on konafa. Sugars in honey (like those in maple syrup and the fiber in fruits and whole grains) have been linked to improved levels of probiotics and prebiotics that make happy the “good” bacteria in our guts. The impact on our blood sugar levels is another matter… Go read How eating more of what you love can make you healthier in the Wall Street Journal.

So, when can we eat? Maghrib is at 6:35pm CLT today in Cairo. You’ll have until 3:32am tomorrow morning to caffeinate / finish your sohour.

Enterprise+: Last Night’s Talk Shows

National projects were the topic du jour on the airwaves last night, starring Aswan’s Benban solar complex and new Suez Canal tunnels. Benban earned some airtime thanks to World Bank President David Malpass’ visit to the site, which Al Hayah Al Youm’s Khaled Abu Bakr reminded us was recently named by the World Bank as its top project for the year (watch, runtime: 1:28). We have chapter and verse in this morning’s Speed Round, below.

President Abdel Fattah El Sisi inaugurated four tunnels in Ismailia and Port Said, which should reduce the time it takes to cross the Suez Canal into and from Sinai to ten minutes or less, Hona Al Asema’s Reham Ibrahim highlighted (watch, runtime: 4:49). Reham had a chat with road and transport consultant Emad Nabil, who said the tunnels are “the second most important project after the Suez Canal,” and are a necessity for the Afro-Asian integration project.

Tunnels are key to Sinai development: Masaa DMC’s Eman El Hosary, meanwhile, got her sage advice from Hisham Okeel, Ain Shams University transportation expert. Okeel said the tunnels will facilitate the reconstruction process of Sinai, in addition to linking the region to the rest of the country (watch, runtime: 7:15). Sinai is “strategically important” to national security, Okeel pointed out, adding that the construction of tunnels and bridges in the area will prove economically beneficial to the Suez Canal Development Axis.

Speed Round

Speed Round is presented in association with

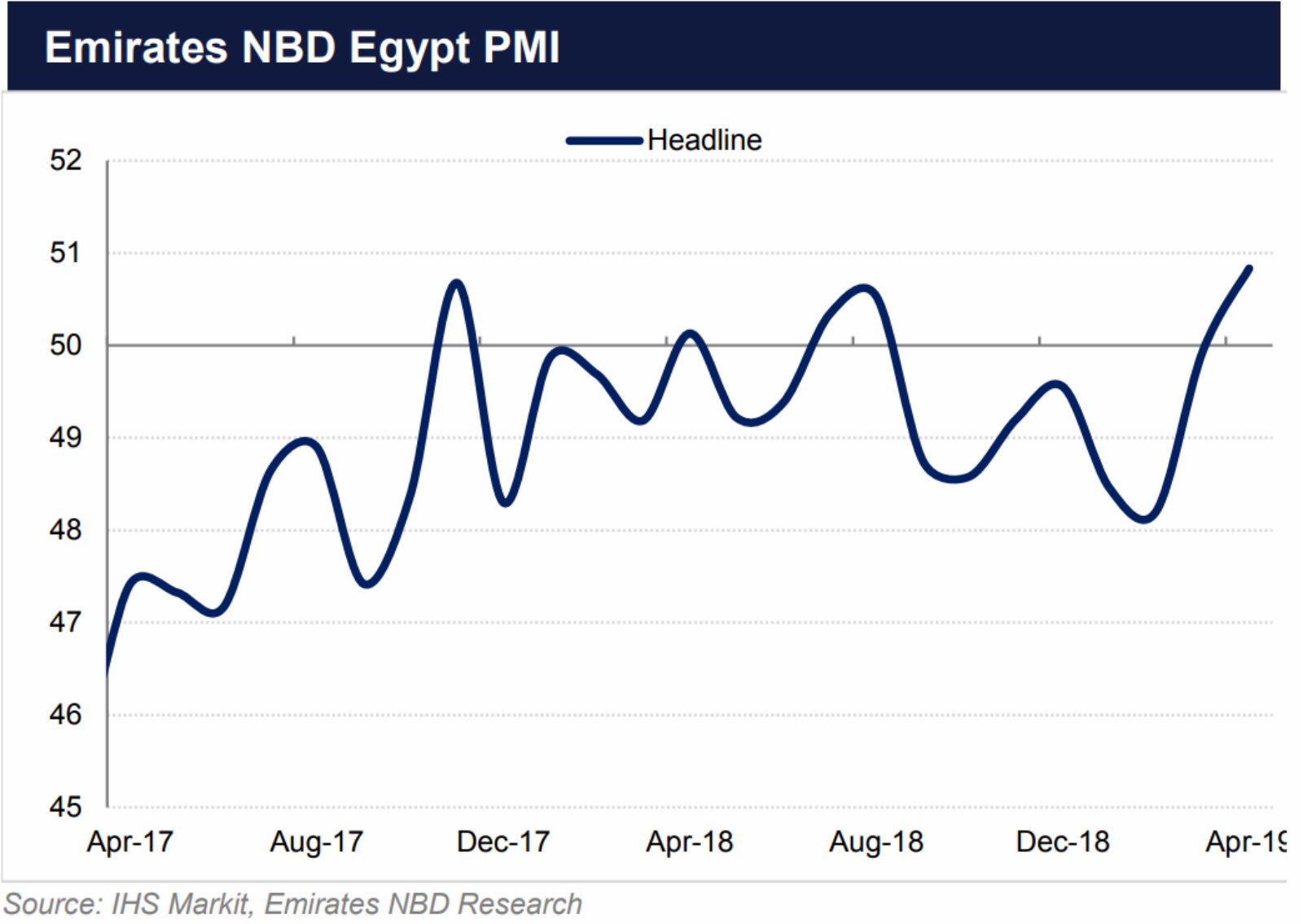

Non-oil business activity expanded for the first time in eight months in April, driven by a rise in domestic orders, according to the Markit / Emirates NBD PMI gauge (pdf). The latest purchasing managers’ index hit 50.8 in April up from 49.9 in March — the largest monthly increase since August 2015.

Making sense of the index: A reading above 50.0 shows that business activity is expanding, while a figure below this indicates contraction.

Output entered positive territory for the first time in 18 months, but remains largely driven by domestic orders. Export orders continued to contract but staged a slight recovery from March. “Firms appear to be shoring up domestic demand by price discounting — output prices dipped back below 50, the third time this year they have declined.”

Rising demand was spurred by price discounting, leading output prices to contract for the third time this year. This, combined with rising input prices, is likely to put pressure on margins over the coming months.

Survey respondents “appear to be more confident with regards [to] future conditions,” Emirates NBD writes, noting that the number of firms expecting output to be greater over the rest of the year is greater than those with a positive outlook during the previous month. “This greater optimism is reflected in their hiring, as employment returned a reading above 50.0 — albeit marginally — for the first time since 2015.”

EXCLUSIVE- Thailand’s PTT Energy Resources has filed a USD 1 bn lawsuit against Egypt over EMG: Thai state-owned energy company PTT Energy Resources is seeking USD 1 bn in damages in a suit filed in the Administrative Court against the Egyptian government. PTT alleges that Egypt failed to meet gas deliveries to Egyptian Mediterranean Gas (EMG) after 2011, according to documents seen yesterday by Enterprise. The case by PTT Energy Resources, which held a 25% stake in EMG, is the latest in a series of legal challenges brought since 2011 by disgruntled EMG shareholders against the government of Egypt, EGAS, and EGPC. The documents suggest that PTT is trying to get in on the settlements reached between other shareholders and the government — the settlements were crucial in securing the agreements that paved the way for Egypt to contract for the import of USD 15 bn-worth of gas from Israel. That agreement, closed in 2018, is key to Egypt’s drive to become the premier regional energy hub.

The case: PTT Energy Resources is alleging that the government broke an agreement to deliver 7 bcf of natural gas per annum to EMG after 2011, causing EMG to fail to meet its contractual obligations to its customers. The suit also alleges that the government failed to maintain and protect the EMG pipeline and claims the government at the time unilaterally changed the price of gas delivered while also revoking EMG’s freezone status.

Same story, new player: The claims here appear to echo those of other EMG shareholders, which led in 2012 to a USD 1.76 bn international arbitration ruling against EGAS, EGPC, and EMG. The government of former Prime Minister Sherif Ismail had made settling the case a precondition of any gas export agreement with Israel. To secure the USD 15 bn export pact (signed in February 2018) with Alaa Arafa’s Dolphinus Holdings, Israel’s Noble Energy and Delek, along with their Egyptian partner East Gas, agreed to acquire a 39% stake in EMG. Sources had told Bloomberg last year that the Egyptian government had reached an agreement to reduce the USD 1.76 bn international arbitration ruling against EGAS, EGPC, and EMG to around USD 470 mn. Bloomberg said at the time the sum would be amortized over a period of around 15 years. The documents seen by Enterprise yesterday do not make clear where PTT was during those earlier settlement negotiations.

The suit is unlikely to put a dent in Egypt’s dream of becoming the eastern Mediterranean’s premier energy hub. Executives from Delek are reportedly interested in selling even more natural gas to Egypt beyond the USD 15 bn agreement, according to reports by Bloomberg in March. The question is whether Israel’s pipeline network has the capacity to deliver the volumes already contracted. Egypt is expected to begin receiving its first shipments of Israeli gas in mid-2019.

Advisers: Shahid Law Firm is serving as legal counsel to PTT Energy Resources.

World Bank boss points to Benban solar park as evidence of Egypt’s support for the private sector: The 1.6 GW solar power park in Benban, which has so far drawn over USD 2 bn in investment, demonstrates Egypt’s commitment to supporting the private sector, newly-appointed World Bank Group President David Malpass said during a trip yesterday to Aswan. “The key is creating a level playing field for the private sector,” Malpass told reporters during his first international trip since he assumed office. He stressed that strong collaboration between the WB and the Egyptian government is behind the success of the project, which the group recently selected as its top initiative for 2019.

How massive is the massive Benban solar park? Just for context: The flagship project is equivalent in size to around 7,000 football fields, or one-fifth of Washington DC, IFC MENA Vice President Sergio Pimenta noted at the press conference. Nineteen of Benban’s power stations with a capacity of 930 MW have already been linked to the national grid. The feed-in-tariff project will operate at full capacity this year, Investment Minister Sahar Nasr said.

Malpass singles out EGP 1.35 bn Hassan Allam-TAQA Arabia facility: While at Benban, Malpass visited the EGP 1.35 bn, 50 MW solar power plant built by a JV of Hassan Allam Holding and Qalaa Holdings subsidiary TAQA Arabia. The facility was financed in part by the World Bank’s International Finance Corporation, according to a statement (pdf). Construction of the plant was finished earlier this year; it began producing electricity in February, the statement says.

Looking beyond energy: It’s important to see similar success stories in other sectors of the Egyptian economy and the region, Malpass said, pointing to the transport, agriculture as well as the water and sanitation sectors. In a meeting with President Abdel Fattah El Sisi and Prime Minister Moustafa Madbouly on Saturday, Malpass had discussed support for Egypt in infrastructure projects, labor force development and for SMEs. The WB president also signed a declaration of intent with SME Development Authority chief Nevine Gamea and visited the Takaful and Karama center in Aswan yesterday.

Compass completes exit of CI Capital: Private equity firm Compass has completed the sale of its remaining equity stake in Cairo investment bank and non-bank financial services company CI Capital, Compass said in a statement (pdf). Compass and a group of investors had acquired CI Capital from CIB in March 2017, taking CI to IPO on the Egyptian Exchange in May 2018. Compass said it generated an average IRR of 102% in EGP terms and a money multiple of 3.22x on its investment over the holding period of just over two years. “Over the course of our investment, CI Capital strengthened its core investment bank services, executed strategic acquisitions that positioned it as a formidable player in the non-banking financial services sector,” Shamel Aboul Fadl, founder and chairman of Compass, said. The transaction came as the IPO lockup period expired; the transaction was executed yesterday.

Maridive Oil Services has won a USD 27 mn services contract for work in Mexico, the company announced in a press release (pdf). The contract includes a USD 12 mn primary service component and a USD 15 mn additional services component and will see the company undertake marine work, diving work and remotely-operated vehicle services. Maridive will begin work in May for 18 months or up to 42 months if the client extends the contract.

Heliopolis Housing and Development (HHD) sold a 1,980-feddan land plot in Sheraton, Heliopolis, for EGP 99.3 mn at auction on Saturday, the company said in an EGX disclosure (pdf). HHD’s Sahar Al Damati said in March the company is planning to sell off part of its land portfolio in the coming months to finance investment plans. HHD is among the lineup of state-owned companies planning to proceed with additional stake sales on the EGX as part of the state privatization program. The company was originally slated to be among the first, but was dropped from the first wave for unspecified reasons. It could either proceed with its planned stake sale in 4Q2019 or be sold to a “strategic investor,” Public Enterprises Minister Hisham Tawfik said last week.

BUDGET WATCH- Parliament begins committee-level review of draft FY2019-2020 state budget: The House of Representatives’ Planning and Budgeting Committee has begun discussing the draft FY2019-20 budget, according to local press reports. Finance Minister Mohamed Maait and Planning Minister Hala El Said are expected to attend a committee meeting to address questions, including the number of ministries subject to program and performance budgeting and income generated through economic authorities and public enterprises. Committee-level approval is required for the draft to make it to the general assembly for a final vote, ahead of being ratified by President Abdel Fattah El Sisi.

Background: The Finance Ministry sent the draft to the House last month, along with a report (pdf) addressing the House speaker. It forecasts revenues hitting 1.13 tn and total expenditure to come in at 1.57 tn — leading to a y-o-y improvement in the budget deficit to 7.2% of GDP from 8.4% in the current fiscal year.

Egypt is one of Franklin Templeton’s top three global market picks for growth, Zawya reports. Salah Shamma, co-head of MENA equities at the fund, predicts greater inflows into equities due to positive macroeconomic conditions, strong consumer confidence and improving investor sentiment. Declining inflation and an anticipated fall in interest rates, perhaps by as much as 200 bps this year, will also provide a boost for Egyptian stocks.

Strong performance expected from Saudi Arabia, Dubai: Shamma also likes equities in Saudi Arabia and Dubai. Saudi Arabia, another of the fund’s top three picks, will reap the benefits of its upgrade to emerging market status by both FTSE Russell and MSCI. Dubai, meanwhile, is in “the midst of an early cycle recovery,” he said.

Egypt’s foreign reserves were essentially unchanged at USD 44.218 bn at the end of April, up slightly from USD 44.112 bn the previous month, the central bank announced yesterday.

EARNINGS WATCH- Our friends at CIB delivered a 31% y-o-y increase in net income of EGP 2.64 bn in 1Q2019 on revenues of EGP 5.60 bn, which rose 35% y-o-y. CIB recorded a capital adequacy ratio of 21.5% by the end of the quarter, which is above the minimum regulatory requirement. Commenting on the bank’s earnings, management said CIB “commenced the year with sturdy performance in light of an overall eventful quarter,” and noted that the bank’s growth prospects were buoyed by the Central Bank of Egypt’s decision to cut corridor rates by 100 bps. The rate cut helped to see CIB’s “local currency loans growing by a decent 9% or EGP 6 bn” during the quarter.

Looking ahead, management is “cautiously optimistic on Egypt’s macroeconomic climate” on the back of “enhanced appetite for Egyptian sovereign securities, and the accompanying drop in local currency sovereign yields.” This, alongside expected rate cuts, should see improved appetite for borrowing by corporations and “a shift in the bank’s asset composition towards institutional lending.” You can read CIB’s full earnings release here (pdf).

Emaar Misr’s consolidated profit fell 16.8% y-o-y in 1Q2019, according to a company earnings release (pdf). The real estate company posted a profit of EGP 418.6 mn in the first three months of 2019, down from EGP 503.2 mn in the same period last year. Revenues declined by almost a third y-o-y, falling to EGP 566.6 mn from EGP 830.7 mn.

Qalaa Holdings expects to record revenues north of EGP 90 bn (USD 5.25 bn) next year, Chairman Ahmed Heikal told Reuters. Some EGP 50-55 bn will come from the investment company’s Egyptian Refining Company, which is expected to produce 2.4 mn tonnes of diesel every year after it begins operations in 3Q2019. Heikal said last month that the refinery will begin commercial production in June before reaching full capacity by September.

The Macro Picture

Robots and AI will eat jobs in emerging markets: Emerging countries are the most vulnerable to job losses caused by the increasing role of automation, artificial intelligence, and robots in the economy, OECD research has found. All 11 emerging markets included in the OECD’s analysis are among the 17 countries which will be most affected by technology-induced job obsolescence. Slovakia is most vulnerable to automation, with almost 65% of jobs seen as being at risk of significant change. More than 60% of Lithuanian jobs are under threat of significant change, while just under 60% of jobs in Turkey and Greece face a similar future.

The threat of reshoring is real: The growth of automation will make it more cost-effective for multinationals to relocate production in the developed world, removing incentives to invest and create jobs in emerging economies. “Technological progress, once a facilitator of globalized supply chains, now challenges emerging market manufacturers’ climb up the value-added ladder and productivity growth,” Marvin Barth, head of FX and EM macro strategy at Barclays Investment Bank, told the FT. “It is apparent in the data for investment, foreign direct investment and relative developed market expenditure on manufactured goods already,” he added.

A ray of light: Automation will not necessarily become an attractive investment for EM businesses any time soon, the OECD says. The high cost of automotive equipment is beyond the reach of many EM entrepreneurs, while the prevalence of cheap, unskilled labor in many developing economies removes incentives for domestic companies to invest in the technology.

The OECD’s message to countries like Egypt: Start preparing immediately to mitigate the negative economic and social effects of automation.

Image of the Day

If this doesn’t scream “Ramadan in Egypt,” we don’t know what does. A cramped shop lined with Ramadan fawanees (lanterns), captured by Salma Hany, is a familiar scene in Egypt, where thousands of the colorful lanterns are sold throughout the month.

Egypt in the News

The foreign press remains occupied this morning with the discovery of an ancient burial site near the Giza pyramids, blessing us with an otherwise quiet day.

Other headlines worth noting in brief include:

- Egypt and Israel’s policy goals in Gaza are directly at odds with each other, an article in Haaretz argues.

- Islamist Hazem Salah Abu Ismail has had a five-year prison sentence upheld by Egypt’s top appeals court, Reuters reports. Abu Ismail, a disqualified candidate in the 2012 presidential race, was handed a jail sentence in 2017 for participating in violent demonstrations at a court in Nasr City in December 2012.

- Egyptian and Chinese women working to build the new capital’s business district talkto Chinese media outlet CGTNabout their professional lives.

- Egyptian police agents thought Italian student Giulio Regeni was a British spy, new testimonials suggest, according to Middle East Online.

On The Front Pages

President Abdel Fattah El Sisi’s inauguration of tunnels running underneath the Suez Canal topped the front pages of the government-owned dailies this morning (Al Ahram | Al Gomhuria | Al Akhbar).

Worth a Listen

Emerging markets: Where will they go from here? After all the gloom of last year’s emerging market zombie apocalypse, this Goldman Sachs podcast offers a rosier outlook for the months ahead (listen, runtime: 18:35). The challenges of 2018 came on the back of four main issues, GS says: Tightening global financial conditions, a rise in oil prices, a slowdown in growth of developed economies, and an increase in protectionism and trade friction. Now, as the US Federal Reserve puts the brakes on rate hikes and oil prices stabilize, emerging markets have enjoyed the best start to a year since 1991.

Data seems to conclusively show a recovery is ahead, even if China and Turkey are being slower to bounce back than other emerging markets. In addition to the helping hand of the Fed and oil market stability, developing economies are now undertaking reforms seen in advanced economies in the 1990s and 2000s. This, according to the podcast, is lending more credibility to EM fiscal policies, creating positive investor sentiment and raising growth prospects for the future.

Basic Materials + Commodities

El Molla signs licensing agreement with Phosphate Misr

Oil Minister Tarek El Molla signed a licensing agreement yesterday with Phosphate Misr authorizing the exclusive extraction of raw phosphate reserves from the Abu Tartoor plateau in the Western desert, according to a ministry statement.

Manufacturing

Steel rolling factories temporarily halt production

A number of steel rolling factories have reportedly halted production due to higher production costs as a result of tariffs imposed on imported iron billets, reports Masrawy. The factories are struggling to source billets locally, as production is insufficient.

Health + Education

Gov’t resumes receiving requests to set up int’l schools in Egypt

The Education Ministry has decided to resume receiving requests to set up international schools, or international divisions within private schools, Al Mal reports. This is a temporary reversal of a 2017 decision to stop accepting said requests.

Real Estate + Housing

NACCUD prepares to tender land for hotel development

The New Administrative Capital Company for Urban Development (NACCUD) is set to launch the first land tender for hotels in the new administrative capital next month, reports the local press. The consultants working on the new capital are currently mapping out the land availability and specifications for the planned hotels.

Law

Baker McKenzie legal adviser to Bank Audi in NBG Egypt branch acquisition

Baker McKenzie Cairo and the law firm’s London office have acted as buy-side legal advisors to Bank Audi in its recent agreement to acquire National Bank of Greece’s Egypt arm, according to an emailed statement.

On Your Way Out

British auction house Christie’s will be hosting a panel discussion on Egyptian art entitled “Egypt’s Creative Journey: Ancient, Modern & Contemporary” in London tomorrow, Egypt Today reports. The event is supported by the British Council and will feature Nadine Abdel Ghaffar, founder of Art D’Egypte, Omniya el Barr, researcher at the V&A museum, and Ramzy Dalloul, collector and founder of Dalloul Art Foundation.

The Market Yesterday

EGP / USD CBE market average: Buy 17.10 | Sell 17.20

EGP / USD at CIB: Buy 17.10 | Sell 17.20

EGP / USD at NBE: Buy 17.10 | Sell 17.20

EGX30 (Sunday): 14,512 (-2.5%)

Turnover: EGP 793 mn (6% below the 90-day average)

EGX 30 year-to-date: +11.3%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 2.5%. CIB, the index heaviest constituent ended down 2.9%. EGX30’s top performing constituent was Sarwa Capital Holding up 0.3%. Yesterday’s worst performing stocks were Eastern Co. down 6.3%, Heliopolis Housing down 4.1% and AMOC down 4.0%. The market turnover was EGP 793 mn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +332.0 mn

Regional: Net Long | EGP +20.1 mn

Domestic: Net Short | EGP -352.1 mn

Retail: 48.1% of total trades | 21.4% of buyers | 74.7% of sellers

Institutions: 51.9% of total trades | 78.6% of buyers | 25.3% of sellers

WTI: USD 60.50 (-2.32%)

Brent: USD 69.35 (-2.12%)

Natural Gas (Nymex, futures prices) USD 2.57 MMBtu, (-0.85%, Jun 2019)

Gold: USD 1,281.30 / troy ounce (+0.73%)

TASI: 9,178.96 (-1.69%) (YTD: +17.28%)

ADX: 5,226.46 (-0.31%) (YTD: +6.34%)

DFM: 2,752.76 (-0.21%) (YTD: +8.82%)

KSE Premier Market: 6,169.78 (+0.72%)

QE: 10,461.49 (-0.18%) (YTD: +1.58%)

MSM: 3,932.69 (-0.81%) (YTD: -9.04%)

BB: 1,436.45 (+0.13%) (YTD: +7.42%)

Calendar

May: 50 Egyptian companies are set to visit Libya to discuss trade, investment and reconstruction.

May: An IMF delegation will be in town to conduct its final review of the reform program ahead of the disbursement of the sixth and final tranche of Egypt’s USD 12 bn IMF loan.

6 May (Monday): First day of Ramadan (TBC).

14 May (Tuesday): Egyptian Private Equity Association annual sohour. Four Seasons Hotel, Cairo.

23 May (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

June: Egypt will host the first economic forum for Union for the Meditteranean (UfM) countries to promote trade and investment in the 43 member states.

June: President Abdel Fattah El Sisi to attend US-Africa Business summit in Mozambique.

4-5 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

5-6 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development.

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International

Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.