- Moody’s bumps up Egypt’s credit rating to B2 with a stable outlook. (Speed Round)

- Budget deficit to grow to EGP 820 bn in FY2019-20. (Speed Round)

- EFG, GB Capital, Talaat Moustafa Group plan new mortgage finance JV. (Speed Round)

- Intro Group subsidiary to inaugurate first phase of 40 MW solar plant in Sharm. (Speed Round)

- PwC thinks investors should pay more attention to Egypt’s education system. (Speed Round)

- How did we do on the 2019 Global Competitiveness Index? Not great. (Speed Round)

- Growth in emerging markets: What are the policy options? (The Macro Picture)

- My Morning Routine: Meet new Australian ambassador to Egypt Glenn Miles. (My Morning Routine)

- The Market Yesterday

Thursday, 18 April 2019

Moody’s upgrades Egypt’s credit rating to B2 with stable outlook

TL;DR

What We’re Tracking Today

Look for purple fingers this weekend as we head to the polls to vote on the proposed constitutional amendments. Polls open on Saturday, 20 April and will close in the evening on Monday. Expats start voting tomorrow, with polls closing on Sunday. You can read the statement by the National Elections Authority here.

An Egyptian delegation is in New York for the UN Financing for Development Forum, which will wrap up today, according to a cabinet statement. The delegation, led by Nada Massoud, economic advisor to Planning Minister Hala El Said, is there to discuss sustainable development policies and put the spotlight on the Benban solar park in Aswan.

[Correction: The version of this story in our email edition incorrectly stated that the delegation was led by Hala El Said.]

Things we’re keeping our eye on next week:

- The RT Imaging Summit & Expo-EMEA will take place at the InterContinental City Stars, Nasr City, on Sunday, 21 April.

- The two-day Egypt CSR Summit will also get underway at the InterContinental on 21 April.

- The Fairmont Nile City Hotel will host a SME Corporate Governance Workshop on 23-24 April.

- President Abdel Fattah El Sisi will be in Beijing for China’s Belt and Road Forum for International Cooperation. The gathering takes place on 25 April.

The long-awaited Mueller report into Russian interference in US elections will be publicly released today, albeit in a redacted form. A separate version with fewer redactions will be given to Congress, according to CNN. Attorney-General William Barr last month announced that Mueller had not found any evidence of collusion between the Russians and the campaign of US President Donal Trump during the 2016 US election

Is the Fed done raising interest rates? A closely watched poll from the Bank of America Merrill Lynch has a slim majority of fund managers saying they believe the Federal Reserve has finished its rate hike cycle, according to the FT. The poll of 187 managers, who collectively have AUM of some USD 547 bn, is widely considered to be a litmus test of investor sentiment.

Will the IPO of two unicorns in the US today hit the “reset” button on sentiment? Pinterest and lesser-known videoconferencing platform Zoom (which we’ve used successfully here at Enterprise) are making their public market debuts today, according to the WSJ. The companies priced their shares yesterday at USD 19 and USD 36, respectively. 2019 is shaping up to be a banner year for IPOs, but with Lyft’s shaky offering earlier this month, how Pinterest and Zoom fare will be a key bellwether moments for assessing the IPO market going forward.

To round off our week of death-by-robots stories: Artificial intelligence will pose a growing threat to economic growth in the developing world as more jobs are lost to automation and robotic technologies — so says Oxford professor Ian Goldin in this BBC piece. Automation will present a growing challenge for policymakers in the coming years, particularly in developing economies that can’t afford the luxury of the kind of social programs currently being debated in some Western capitals.

The smart policy: Policymakers should start planning ahead and finding ways to integrate new technologies into the economy at the lowest possible human cost. In other words: EM growth by investment in medium weight, medium tech, export-led growth may be dead.

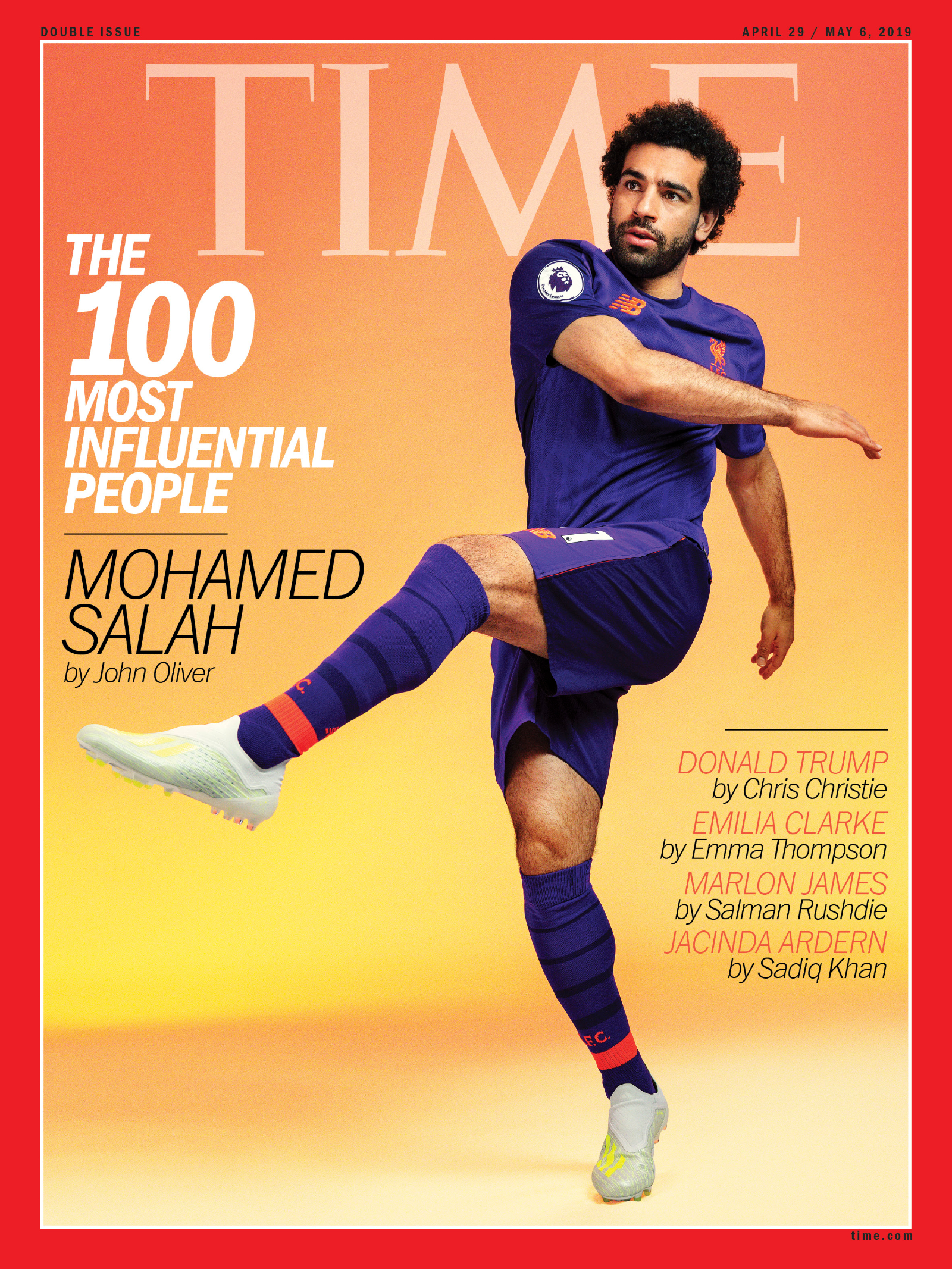

Mohamad Salah is on the cover of Time Magazine’s 100 most influential people of 2019. John Oliver wrote a glowing blurb about Salah, proving once again that the national treasure is one reliable reason for the Western press to write fondly of Egypt. Salah is joined by ‘the other Egyptian,’ actor Rami Malek, alongside Donald Trump, Michelle Obama, and Taylor Swift.

PSA #1- The EGX has a two-day work week the week after next. The EGX confirmed yesterday it will be closed from 25-29 April (Thursday-Monday) in observance of Sinai Liberation Day, Coptic Easter, and Sham El Nessim. The market will reopen on Tuesday, 30 April, and close once again on Wednesday, 1 May for Labor Day. It’s back to business as usual on Thursday, 2 May. Look for the EGX to move to shortened Ramadan hours the following week when the Holy Month begins.

PSA #2- Temperatures in the capital will continue to be mild through the weekend with daytime highs of 24-26°C and overnight lows around 13°C.

Enterprise+: Last Night’s Talk Shows

Artificial intelligence, Mohamed Salah and universal healthcare all got the attention of the talking heads.

An Egyptian company is among the world’s top 20 AI developers: AvidBeam, firm specializing in video analytics and founded by four ex-Intel employees, was recently ranked among the world’s “most important” artificial intelligence (AI) startups, Yahduth Fi Misr’s Sherif Amer said in a sit down with two of its founders (watch, runtime: 5:34). AvidBeam specializes in analyzing camera surveillance footage in real-time, and develops AI platforms with applications in the fields of security, retail, marketing, and self-driving cars, CEO and co-founder Hani El Gebaly told Amer.

“The most promising market for us is in Egypt,” Amr Qais, a second co-founder and the company’s strategic affairs vice president added, (watch, runtime 2:11). The company is headquartered in Beavertown, Oregon but has offices in Maadi and Dubai for it’s EMEA and North Africa-focused operations. We noted last month that Cairo-based VC fund Egypt Ventures invested in AvidBeam’s series A round. AvidBeam was named one of the “20 most promising big-data startups in the world” for 2017 by CIOReview

Salah wasn’t the only Egyptian on Time’s 2019 most influential list: He was joined by Academy Award winner Rami Malek, Al Hayah Al Youm’s Khaled Abu Bakr was sure to point out (watch, runtime: 1:47). For his impressive turn as Freddie Mercury in Bohemian Rhapsody, the 37-year-old actor became the first Arab American to score an Oscar win, Abu Bakr noted.

The government is planning to set up a factory to locally manufacture plasma derivatives. News came following a meeting between President Abdel Fattah El Sisi, Prime Minister Moustafa Madbouly, Health Minister Hala Zayed, and head of the Administrative Control Authority Sherif Seif El Din, Abu Bakr noted (watch, runtime: 1:32). Plasma derivatives are used to treat HIV, hepatitis B, and hepatitis C.

Speed Round

Speed Round is presented in association with

Moody’s has upgraded Egypt’s credit rating to B2 with a stable outlook from B3 with a positive outlook, the ratings agency said in a statement. The agency said that the country’s ongoing commitment to reform will gradually improve the government’s fiscal position and stimulate economic growth. Stronger state finances, together with the country’s banking sector, will mitigate the effects of external financing shocks.

Moody’s changed its outlook to stable due to what it described as “weak debt affordability and large financing needs.” It described Egypt’s fiscal position as “very weak” compared to other countries, and forecast interest payments to continue eating up almost 45% of the government’s revenue going forward.

Egypt’s debt will continue to ease on the back of strong economic growth and falling inflation, Moody’s said, adding that the Sisi administration’s commitment to reforms could produce greater-than-expected economic growth, while the narrowing of the current account deficit may also beat expectations if natural gas exports pick up.

EXCLUSIVE- Egypt’s financing gap is expected to widen to EGP 820 bn in FY2019-20: The Finance Ministry expects the budget deficit to reach EGP 820 bn in FY2019-20, up from EGP 715 bn in the current fiscal year, which is set to end on 30 June, a senior government official tells Enterprise. The government plans to plug the gap with bond issuances and the final USD 2 bn tranche of the IMF facility. Egypt will issue EGP 7 bn of green bonds, USD 5 bn of eurobonds, and raised local debt worth c. EGP 725 bn — including EGP 435 bn-worth of t-bills and EGP 290 bn of long-term bonds. A government official previously told us that Egypt will issue 10 and 30-year bonds to cover interest payments due on 3 and 9-month treasury bills in the next fiscal year.

We also have EGP 375.5 bn in maturing debt in FY2019-20, the source said, while total interest payments in next fiscal year’s budget is projected at EGP 569 bn, including EGP 44.7 bn on foreign debt and EGP 2.2 bn on USD bonds. According to our source, the government estimates a 1% increase in global interest rates, which would raise Egypt’s borrowing costs by EGP 8-10 bn.

Background: The Finance Ministry began last month implementing a comprehensive debt reduction strategy, which aims to reduce debt to 80% of GDP by 2022. The strategy is seeing the government extending the maturities of its debt and speed up inclusion of informal businesses into the formal economy.

EFG, GB Capital, Talaat Moustafa Group to launch mortgage finance JV: EFG Hermes, GB Capital and Talaat Moustafa Group said in a statement (pdf) yesterday that they are launching a mortgage finance company with initial paid-in capital of EGP 150 mn. Each will own one-third of the as yet-unnamed company, which “will offer mortgage finance to all consumers looking to buy move-in homes across TMG’s existing projects and potential developments.” Under an independent chief executive and management team that will be appointed at a later time, the JV plans to finance EGP 450 mn worth of units during its first year of operations. Paid-in capital is expected to increase to EGP 250 mn as the business expands.

Advisors: EFG Hermes Investment Banking acted as sole financial advisor on the transaction.

EXCLUSIVE- Intro Group subsidiary to inaugurate first phase of 40 MW solar facility in Sharm El Sheikh under FiT Phase I: Intro Group, the private Egyptian conglomerate with holdings including oil and gas driller Ades (LON: ADES), exploration and production company NPC , real estate developer M2 Developments, and bakery chain TBS, will inaugurate the first 5 MW phase of what will become a 40 MW solar power generation facility in Sharm El Sheikh. The first 5 MW will come online under the first phase of the national feed-in tariff system for solar energy. Intro Energy is the developer of the facility, with Gila Electric as co-developer and Schneider Electric as equipment and technical assistance provider. Intro is in the final stage of lining up a leading development partner for the remaining 35 MW of capacity, which it hopes to sell under a long-term power purchase agreement with a private off-taker.

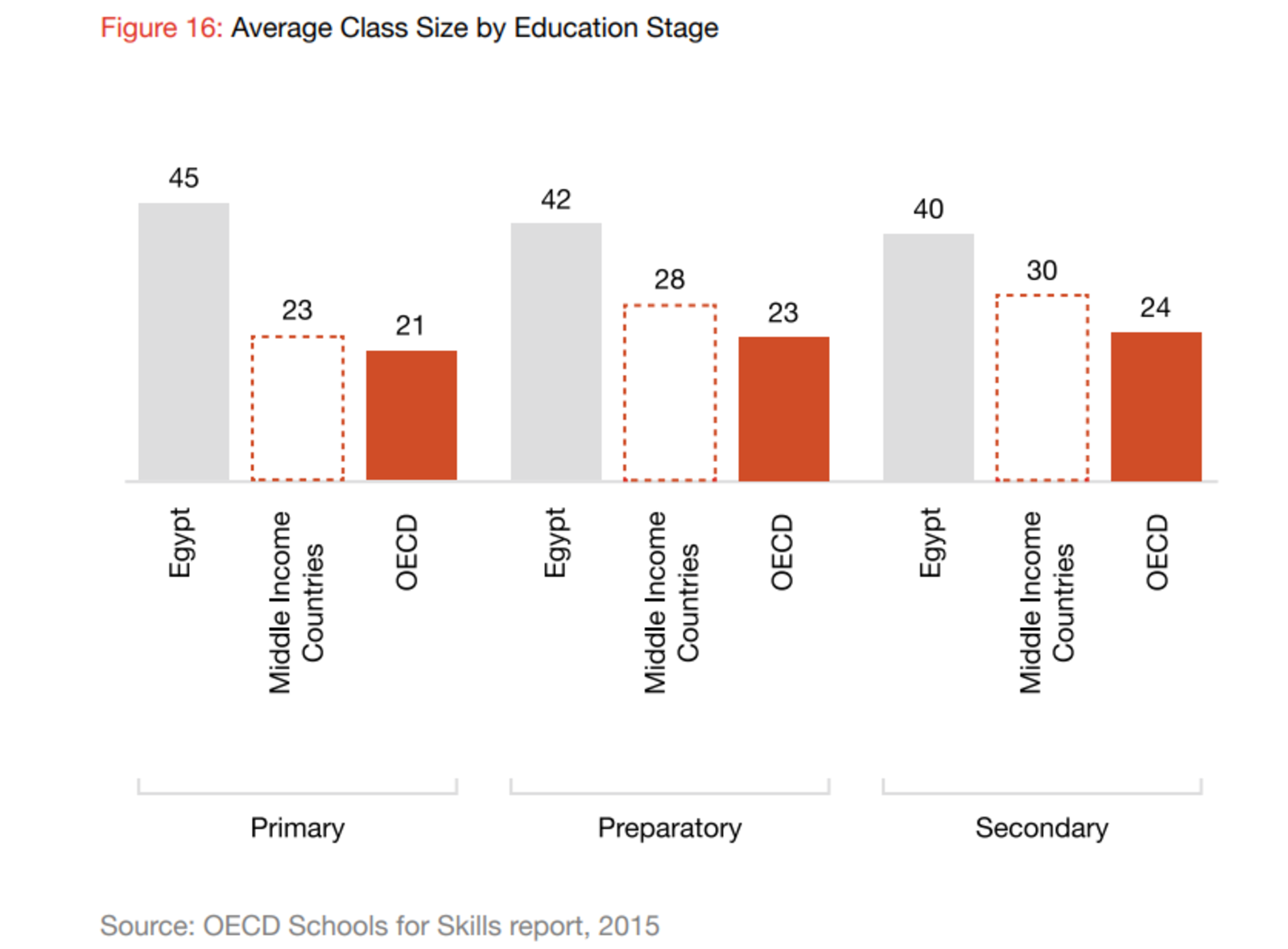

Egypt is a prime market for education providers and investors who want exposure to the Middle East and North Africa, thanks to healthy investment fundamentals and a gap in the available services, PricewaterhouseCoopers says in its Understanding Middle East Education report (pdf). Enrolment figures are above global averages, but Egypt continues to struggle with providing the high quality education needed to meet the labor market’s needs. “Demand for education surpasses the current level of available resources, which adversely affects quality of service provision,” the report says. High demand, combined with an improving economy and a stable education system, means Egypt could be a fertile place of investment for education providers, PWC concludes.

We’re not doing great in terms of math and science education achievement, but neither are our regional peers. According to the report, a mere 5% of Egyptians “reached a high level of science ability compared to over 50% in many Asian countries.” Egypt outperforms Morocco and Saudi Arabia by a thin margin in math achievement, but comes in behind both, as well as the UAE, in science achievement.

A balance between private sector participation and an expansion of the state-funded education system is key to see the overall quality of education improve and meet the demands of the labor market. “While private sector providers enhance parent choice in terms of quality, and relieve governments of capacity pressures, it is essential for government to maintain a balance between public and private education to ensure equitable access to education for all,” the report says.

How did Egypt do on the 2019 Global Competitiveness Index? It’s best not to look: Egypt is ranked 96th globally out of 125 countries featured in 2019’s Global Talent Competitiveness Index published by INSEAD business school. The annual ranking lists countries according to what the authors see as each nation’s ability to attract, grow and retain talent. This year has a focus on harnessing entrepreneurial talent as a means of reducing growing global inequalities. Egypt remains third from the bottom of countries in the MENA region, with only Algeria and Morocco receiving lower rankings. At the city level, Cairo is listed 113th out of 114 cities ranked.

One bright spot is in the ranking of best performers by income group: Within Egypt’s bracket of 27 lower-middle-income countries, we featured in two categories: retaining talent and building global knowledge skills. Regionally, Bahrain, Saudi Arabia, Qatar and the UAE all received high rankings. You can read the full report here (pdf).

LEGISLATION WATCH- Council of State to complete review of proposed Customs Act amendments in days: The Council of State (Maglis El Dawla) is set to complete its review of proposed amendments to the Customs Act “over the next few days”, Customs Authority boss Kamal Negm said, according to Al Masry Al Youm. The final draft of the proposed amendments will then make its way to the House of Representatives for a vote before being ratified by President Abdel Fattah El Sisi. If passed, the proposed amendments would expedite customs clearance, create a “whitelist” of trusted importers, and broaden the Custom Authority’s discretion, according to the final draft released by the Finance Ministry last year.

CABINET WATCH- Holding Co for Roads, Arab Contractors to construct new EGP 2 bn Aswan bridge: The Madbouly Cabinet approved yesterday handing over construction works of a new EGP 2 bn bridge in Aswan to the Holding Company for Roads, Bridges and Land Transportation and Arab Contractors, according to a cabinet statement. Cabinet has also approved setting a EGP 500k ceiling for document registration and accreditation fees paid by real estate contractors looking to work abroad.

EARNINGS WATCH- Apicorp’s 2018 net profits surge to record highs: Multilateral development bank Arab Petroleum Investments Corporation’s (Apicorp) 2018 net profit rose 76% y-o-y to a record USD 182.3 mn, it said in a statement. Company revenues increased last year by 78% y-o-y to USD 252.7 mn. The sale of Apicorp’s stake in National Petroleum Services and growth in net interest income were responsible for the surge in revenues. Last year was “the strongest financial performance achieved by Apicorp” and saw the institution turn in “11% asset growth … while cementing its position as the leading multilateral development bank supporting the Arab world’s broader energy and sustainability industries,” said chairman Aabed bin Abdulla Al-Saadoun. Apicorp completed five medium-term funding transactions worth a total of USD 1.3 bn last year while widening its investor base on the back of “strong interest from the US, Europe, Asia and China.”

The Macro Picture

Growth in EMs through policy? Not so fast. In the wake of the IMF’s latest World Economic Outlook, the FT's Jonathan Wheatley asks the question of the era: “What, if anything, can EM policymakers do to speed up growth and make any recovery sustainable?” With the US Fed pulling back from rate hikes, eurozone countries reluctant to spend, and the IMF projecting only a marginal growth slowdown in developing countries (to 4.4% this year, from 4.5% in 2018), investors are looking to emerging market governments for action.

What kind of action? It depends on the country. China’s stimulus measures have received a positive response from investors and India’s central bank has moved to cut rates over the past few months. Other emerging markets don’t have this sort of freedom to loosen monetary policy though, as John Paul Smith, partner at Ecstrat, points out. “The idea that we can all go on a fiscal binge, or that interest rates are so low that we can all do whatever we like — it just breaks down when you look at the countries,” he told the FT. Mexico, Turkey and Russia are just a few examples where, for economic or political reasons, governments do not have the kind of flexibility enjoyed by the powerhouses of Beijing and Dehli.

It’s the politics, stupid: For Smith, a key area for policy reform in emerging markets continues to be the level of economic involvement by the state, particularly when it comes to off-budget financing through state banks and preferential treatment given to parastatal organizations. Randolph Wrighton, MD at Barrow, Hanley, Mewhinney & Strauss, agrees, arguing that it is perhaps in the interests of emerging market governments to focus on improving transparency rather than embark on economic stimulus programs. “I don’t think it’s in anybody’s interests for them to stretch themselves to help their economies,” he says. “What they can do it keep moving towards first-world policies, with transparency, accountability and rules-based system.”

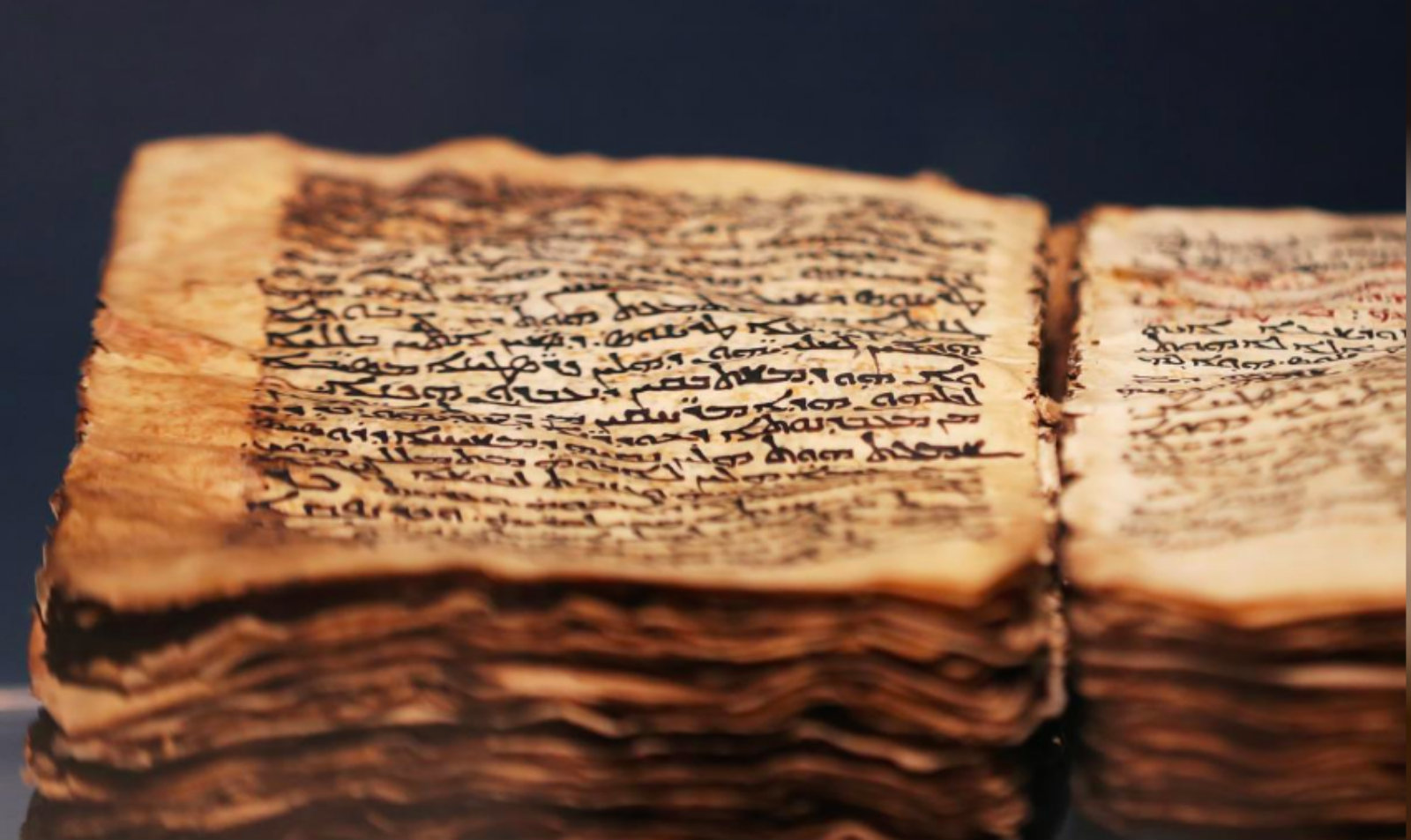

Image of the Day

Researchers digitize ancient manuscripts at St Catherine’s: A team of Greek researchers is photographing the 4,500 ancient manuscripts of the library at St Catherine’s monastery to digitize the priceless pages, Reuters says. The complex imaging process includes merges separate pictures in red, green, and blue light into a single, high-quality image. The team, a collaboration between the monastery, non-profit research organization Early Manuscripts Electronic Library (EMEL), and the UCLA library, is starting with Syriac and Arabic texts. It expects expect that chunk alone to take three years to complete at a cost of around USD 2.75 mn. The team will start publishing manuscripts in full color in the fall of this year.

Egypt in the News

The international press are taking note of the referendum on the proposed constitutional amendments: (AP | Reuters | Voice of America | Arab News | AFP | The National). Turkey’s Anadolu Agency has also taken the liberty of pointing out that Germany voiced concerns over the move. “It is feared that in the course of these constitutional changes the role of the executive and armed forces would be expanded, and a peaceful democratic change in power could be hampered,” it quotes a German foreign ministry spokesperson as saying.

Egypt’s relationship with Sudan is getting ink given the political upheaval happening to our south. Al Monitor, meanwhile, says that Egypt’s past support of former President Omar al-Bashir was primarily to protect its security interests, and that the shift in tone after his ouster underscores the longstanding tensions between the two countries. Al Monitor also notes that Egypt is trying to pressure Khartoum to follow on the removal of ban on Egyptian commodities, and allow them into the Sudanese market.

Also getting ink in the foreign press:

- Sneak a tour through the Grand Egyptian Museum in Giza with The Telegraph before it opens next year.

- Egyptian students of Chinese are publishing Chinese cultural and literary works to build ties between the two countries, writes China’s state-owned Xinhua.

On The Front Pages

The government’s preparations to roll out phase one of the universal healthcare system in Port Said are topping the front pages of the three primary state-owned dailies this morning (Al Ahram | Al Gomhuria | Al Akhbar).

Diplomacy + Foreign Trade

Two Greek home textiles and agricultural investment companies are planning to inject around EUR 70 mn into projects in Egypt, the Trade & Industry Ministry said in a statement. Hotel furniture supplier Titex Home Furnishings is looking to establish a EUR 40 mn textiles factory that would export its product to Greece and EU countries while Gaia Business for Agricultural Investment is eyeing a EUR 30 mn project to set up measurement stations to serve agriculture. Greek companies operating in the automotive and aluminium sectors have also expressed interest in investing in Egypt. Egypt and Greece have agreed to establish a working group to promote bilateral economic cooperation, according to a cabinet statement. The announcement came after a meeting in Athens between Trade Minister Amr Nassar and his Greek counterpart.

An Egyptian delegation met with the Sudanese transitional military government yesterday in Khartoum, according to Al Masry Al Youm. The delegation is expected to evaluate the situation in Sudan while offering Egypt’s support for the aspirations of the Sudanese people during the political transition.

Energy

Jordan cuts natural gas imports from Egypt by 50 mcf/day

Jordan has reduced the quantity of gas it imports from Egypt daily to 300 mcf/d, an EGAS official told the local press. Oil Minister Tarek El Molla had announced last month that Egypt’s natural gas exports to Jordan reached approximately 350 mcf/d, beating its previous export targets.

Basic Materials + Commodities

Egypt’s cotton production to drop 31% in MY 2019-2020 -USDA’s Cairo office

Egypt’s production of cotton is forecast to drop 31% in marketing year (MY) 2019-20 to 337k bales, down from 489k bales in MY 2018-2019, according to a report by the US Department of Agriculture’s Cairo office. Total land in cultivation will also fall by 31% to 97k hectares (230,952 feddans) in MY 2019-20, down from 141k hectares (335k feddans) in MY 2018-19. The report attributes the sharp fall in production to low cotton prices in 2018 and a surplus carried over into 2019. Egypt’s exports of cotton are also forecast to drop 24% to 220k bales as prices begin to increase in MY 2019-20. Imports of the crop, meanwhile, will increase by 2% to 510k bales during the MY. The 2019-20 MY runs from July 2019 to June 2020.

Health + Education

Egyptian International School earns IB accreditation for Middle Years Program

The Egyptian International School in Sheikh Zayed has received the International Baccalaureate (IB) accreditation for its “Middle Years Program,” covering students aged 11 to 16, according to a cabinet statement. The government-run school is one of only a few in the region to become IB accredited.

Tourism

Four Seasons coming to Luxor

Real estate developer TMG is looking to bring the Four Seasons brand to Luxor, according to statements from CEO Hisham Talaat Moustafa reported by the local press. The company is also developing a Four Seasons property in Madinaty and expanding the existing hotel in Sharm El Sheikh.

Other Business News of Note

Madbouly meets with CEO of Kuwaiti Al Kharafi Group

Prime Minister Moustafa Madbouly met yesterday with the CEO of the Al Kharafi Group to discuss how the company can expand its investments in Egypt, according to a cabinet statement. The Kuwaiti company is part of one of eight consortiums bidding to construct the USD 8.5 bn Alamein-Ain Sokhna electric railway.

Egyptian Iron and Steel Company to consider tender from Russia’s MetProm

The Egyptian Iron and Steel Company is considering an offer from Russian company MetProm in a tender to help the company develop and modernize, according to reports from the local press.

My Morning Routine

My Morning Routine looks each week at how a successful member of the community starts their day. Extracts from our conversation this week with Glenn Miles, Australian Ambassador in Cairo. This is his second tour in our fair city.

My name is Glenn Miles and I’m the newly-appointed Australian ambassador in Cairo. I’m married to Katherine, and we’ve just celebrated our 30th wedding anniversary. We have three kids: two boys and a girl: 25, 22, and 18. And Oscar, the dog, as well.

I usually wake up at 5:45 am and the first thing I do is reach for my phone and check email. The time difference means that it’s 3 pm in Australia, so I spend about 10-15 minutes dealing with any urgent messages. My plan to exercise at 6:10 is usually thwarted by procrastination, but by 6:30, guilt overwhelms me and I go for a run or a workout with a history podcast or music in the background. Breakfast is cereal or some toast with Vegemite, a piece of fruit, and a couple cups of coffee while I’m reading Enterprise and the Australian newspapers to catch up on politics and sports.

Once I get in to work, I go through emails and cables from Canberra and speak to my Egyptian and Australian staff to work out the day’s priorities. My staff are a great source of information, helping explain the country and guide us through what we should and shouldn’t be doing. My days can be quite varied. There could be meetings with diplomatic counterparts, ministers or Egyptian authorities, NGOs, and the media.

Often my day will involve visits to projects we support around Cairo and Egypt through our Direct Aid Program (DAP) — a small, community-style grants program. Unlike other programs where we never see the people impacted by those programs, DAP lets us get out and see its impact. Our projects could be supporting a school renovate its classrooms, or providing medical equipment to a center focused on serving the poor. We also focus on women and children. Visiting these projects is a chance to see the people affected, which gives you a real sense of the country and our ability to improve our impact.

What’s the best thing I’ve watched or read lately? My wife watches Netflix, but I’m not the best Netflix watcher — I normally fall asleep halfway through. Right now, I’m reading “Cairo, The City Victorious” by Max Rodenbeck.

How did I get into the diplomatic circle? I had a different entry than most. I was interested in international relations but after graduating, I wound up working with Centerlink as a trainer, teaching our staff how to work with people with disabilities. Then one day I thought I wanted something different. An opportunity came up with the Department of Foreign Affairs and Trade, so I applied and — to my surprise — I was successful. My first posting was to Cairo in 1995-96.

It’s good coming back after all these years. I don’t think Egyptians believe me, but it seems there’s less traffic this time, at least in Zamalek. I think the infrastructure has improved since then. It also seems to be less polluted. During my last posting, the cars were older and they were using leaded petrol, whereas now the cars are unleaded and a lot newer. And the vibe of the place is quite good. There’s a growing artistic scene. I see a lot more art when I walk around; it’s a bit more hipster. I’m very much enjoying being back. The kids aren’t with me this time, but they’re looking forward to coming to visit.

One of the more challenging aspects of my job is understanding the history and the connections of the country you’re in. It doesn’t matter which country you’re in; they’re all complicated. I’ve served in Egypt, which has a population of 100 mn, and Tuvalu, the third smallest country in the world. Every country has its own complicated political dynamics. Understanding what’s going on and making sure you get out and talk to people are key things for a diplomat. It’s easy to stay in and around the embassy, but you have to get out to get a real feel of the country. Too often we’re constrained in the capital city, but that’s not the whole country.

A big misconception of our work is that Australians often think the embassy can do more than we actually can. For example, one of the hardest things to handle is explaining to Australians who come into the embassy seeking help that we can’t exercise Australian law here or ignore Egypt’s sovereignty. Another tricky thing is that you’re working across a range of sectors. In the morning you could be addressing a trade issue, a fallout with consular, and a management issue, then a visit to an aid project, and then a cultural event, all the while trying to sound authoritative.

I rely on my staff a lot to stay organized. As an ambassador, you have to delegate and give people responsibility. We try to give staff the tools and support they need so that they’re fully empowered to make a decision.

There’s no single issue driving Canberra’s relationship with Egypt at the moment. A healthy bilateral relationship cuts across a range of sectors. We have a longstanding trade relationship with Egypt, which we’re looking to build up. And we have to cooperate on a range of security issues as well. The world is much smaller now. Countries no longer have security issues in isolation, which we saw with the unfortunate events in Christchurch.

We’re fortunate to have around 100k Australians of Egyptian descent because the strongest bilateral relationships have solid people-to-people links. We work on trade and cultural diplomacy, but the job is really about bringing people together. The embassy’s role is to raise awareness of what Australia has to offer in Egypt and what Egypt has to offer in Australia, and bringing people together is the best way to achieve this.

What do I do in my time off? I don’t get much at the moment. I’ve been taking visitors around in the last few weeks. I’m taking up kitesurfing and I have lessons lined up in Ain Sokhna during the Easter and Eid holidays. I also did the Pyramids half marathon, and on the weekends I try and do a run around Zamalek, occasionally venturing into Downtown if I’m early enough.

The best advice I’ve received was from my father when I was young. I was playing a football match and he said, “Don’t be a spectator, make sure you go in and get the ball.” The “don’t be a spectator” line is something I’ve tried to live by, making sure I become involved and enjoy the moment. I also encourage others to be involved in whatever they’re doing, whether it is work, the arts, or sport.

The Market Yesterday

EGP / USD CBE market average: Buy 17.21 | Sell 17.31

EGP / USD at CIB: Buy 17.20 | Sell 17.30

EGP / USD at NBE: Buy 17.20 | Sell 17.30

EGX30 (Wednesday): 14,864 (-0.7%)

Turnover: EGP 437 mn (49% below the 90-day average)

EGX 30 year-to-date: +14.0%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.7%. CIB, the index heaviest constituent ended down 0.9%. EGX30’s top performing constituents were GB Auto up 0.7%, Sarwa Capital Holding up 0.65%, and Ezz Steel up 0.5%. Yesterday’s worst performing stocks were Elsewedy Electric down 3.2%, Arab Cotton Ginning down 2.4%, and Heliopolis Housing down 2.1%. The market turnover was EGP 437 mn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +2.0 mn

Regional: Net Long | EGP +9.7 mn

Domestic: Net Short | EGP -11.7mn

Retail: 54.7% of total trades | 48.8% of buyers | 60.6% of sellers

Institutions: 45.3% of total trades | 51.2% of buyers | 39.4% of sellers

WTI: USD 63.72 (-0.06%)

Brent: USD 71.62 (-0.14%)

Natural Gas (Nymex, futures prices) USD 2.51 MMBtu, (-0.40%, May 2019 contract)

Gold: USD 1,276.60 / troy ounce (-0.02%)

TASI: 9,238.05 (+1.08%) (YTD: +18.03%)

ADX: 5,237.07 (+0.45%) (YTD: +6.55%)

DFM: 2,813.22 (+0.76%) (YTD: +11.21%)

KSE Premier Market: 6,174.95 (+0.11%)

QE: 10,308.17 (+0.48%) (YTD: +0.09%)

MSM: 3,977.19 (-0.19%) (YTD: -8.02%)

BB: 1,444.73 (+0.10%) (YTD: +8.04%)

Calendar

April: Russian companies will receive the first 1 square-km plot in the 5.2 square-km Russian Industrial Zone within the Suez Canal Economic Zone

April: The EUR 250k first phase of Egypt’s national waste management program will kick off.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna, Austria.

21 April (Sunday): A court will look into a lawsuit by a subsidiary of Arabian Investments, Development and Financial Investment Holding Co. (AIND) against Peugeot Citroen. The lawsuit, seeking EUR 150 mn in damages, was postponed from 17 March.

21 April (Sunday): RT Imaging Summit & Expo-EMEA, InterContinental City Stars, Nasr City, Cairo, Egypt.

21-22 April (Sunday-Monday): Egypt CSR Summit, InterContinental City Stars, Nasr City, Cairo, Egypt.

23-24 April (Tuesday-Wednesday): SME Corporate Governance Workshop, Fairmont Nile City Hotel, Cairo, Egypt.

25 April (Thursday): Sinai Liberation Day, national holiday.

25 April (Thursday): Belt and Road Forum for International Cooperation, Beijing, China.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

30 April-1 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

May: 50 Egyptian companies are set to visit Libya to discuss trade, investment and reconstruction.

May: An IMF delegation will be in town to conduct its final review of the reform program.ahead of the disbursement of the fifth and final tranche of Egypt’s USD 12 bn IMF loan.

1 May (Wednesday): Labor Day, national holiday.

4 May (Saturday) An administrative court will look into an appeal by Emirati business figure Mohamed Alabbar’s Adeptio AD Investments against a Financial Regulatory Authority order to submit a mandatory tender offer (MTO) for Americana.

6 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

June: Egypt will host the first economic forum for Union for the Meditteranean (UfM) countries to promote trade and investment in the 43 member states.

4-5 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

5-6 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International

Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.