- Egypt closes USD 4 bn eurobond issuance, offering 5x oversubscribed. (Speed Round)

- Germany’s Senvion looking to invest USD 1 bn in Egypt wind farms. (Speed Round)

- Bank Audi working on due diligence for National Bank of Greece’s Egypt arm. (Speed Round)

- CBE studies issuing licenses for SME-focused tier 2 lenders. (Speed Round)

- Expect a recovery in sovereign sukuk issuance this year. (The Macro Picture)

- What could the corporate sector learn from Mexico’s most notorious druglord? (Worth Reading)

- Egypt’s Turkey-style migration agreement with the EU takes a step forward next week. (What We’re Tracking Today)

- My Morning Routine: Ahmed Zahran, co-founder and CEO, KarmSolar

- The Market Yesterday

Thursday, 21 February 2019

Eurobond issuance is closed and 5x oversubscribed

TL;DR

What We’re Tracking Today

Turkey-style migration agreement with the EU takes a step forward next week: The EU-Arab League summit is set to take place on Sunday, 24 February in Sharm El Sheikh. The summit’s agenda will heavily feature illegal immigration, terrorism and development, Prime Minister Moustafa Madbouly said during yesterday’s weekly cabinet meeting. The meeting is widely seen as a precursor for the EU and Arab League nations to develop a Turkey-style agreement that would see the latter hold back the flow of migrants and refugees to Europe in exchange for aid.

UK Prime Minister Theresa May will be holding bilateral meetings with European leaders during the summit, an unnamed senior British government official tells Reuters. The meeting is not meant to be about Brexit, however, the official stressed.

To infinity… from Russia: The Egyptian data satellite Egypt Sat A will launch today, local press reported. The satellite, manufactured in Russia in cooperation with Egypt, will be launched from Russian spaceport Baikonur in Kazakhstan.

54 Egyptian border bases are bracing for potential locust attacks, according to Asharq Al-Awsat, in a coordinated effort with neighboring countries to contain agricultural damage from the flying insects. UN data suggests that a square-kilometer swarm of 40 mn locusts can eat the same amount of food as 35,000 people, 20 camels, and six elephants in one day. For more information, tune into Locust Watch.

CBE officials are in Bahrain today to join other Arab central bankers at the Middle East & Africa FinTech Forum, according to a press release picked up by Zawya. The one-day forum will convene leaders in fintech and AI to discuss financial inclusion, banking innovations, and the impact of AI on the financial industry.

Nasr to sign grant agreement today with AfDB country manager: Investment Minister Sahar Nasr will sign today a grant agreement for an unspecified amount with country manager of the African Development Bank (AfDB) Malinne Blomberg, according to a ministry statement (pdf). The bank will also present a report to Nasr and representatives of other international financial institutions on Egypt’s economic performance.

EM stocks rise on US-China trade hopes: The MSCI emerging-market stock exchange rose by 1.02% as traders sensed progress in the ongoing US-China trade negotiations, Reuters reports.

Lebanon nominated investment banker Ziad Hayek to lead the World Bank on Monday, issuing the sole challenge (so far) to senior US Treasury official David Malpass, The Donald’s chosen nominee. Bloomberg sees the move as indicative of the international push for a non-American pick due to the increasing strength of emerging markets.

The Trump administration is reportedly in a hurry to transfer sensitive nuclear technology to Saudi Arabia due to “strong commercial interests,” according to a new congressional report. A Democratic-led House panel will now lead an inquiry into whether this is actually a good idea. The BBC has more.

Enterprise+: Last Night’s Talk Shows

The execution of nine people charged with the killing of former Prosecutor General Hisham Barakat in 2015 was in the spotlight on last night’s talk shows. The story is also guiding the conversation on Egypt in the foreign press. We have more in Egypt in the News, below.

The independence of the Egyptian judicial system is a key message to send to the world following the executions, Barakat’s daughter, Marwa, told Masaa DMC’s Osama Kamal (watch, runtime: 06:47). Kamal recapped the main developments in the case (watch, runtime: 02:09), while Al Hayah Al Youm aired the convicts’ confessions (watch, runtime: 04:09).

Egypt’s successful eurobond issuance was also in the limelight yesterday, with Finance Minister Mohamed Maait and Cabinet spokesman Nader Saad each underscoring the significant appetite investors showed in the issuance (watch, runtime: 03:58 and runtime: 06:51). We have chapter and verse in Speed Round, below.

The Supply Ministry is looking into selling bread loaves to citizens outside the subsidy system for EGP 0.60 per loaf, which is EGP 0.05 less than the price of production. If implemented, the mechanism would also allow subsidy card holders to purchase extra loaves outside their daily five-loaf allocation at the market price, Yahduth fi Masr’s Sherif Amer said (watch, runtime: 01:09).

Speed Round

Egypt closes USD 4 bn eurobond issuance, offering 5x oversubscribed: Egypt successfully issued USD 4 bn USD-denominated eurobonds on Tuesday, the Finance Ministry said in a statement yesterday. The offering was more than 5x oversubscribed, attracting USD 21.5 bn in bids from 250 investors, according to the statement. The three-tranche issuance was made up of USD 750 mn in five-year bonds, USD 1.75 bn in 10-year bonds, and USD 1.5 bn in 30-year bonds, carrying yields of 6.2%, 7.6%, and 8.7%, respectively. The final rates were 40 bps lower than the initial yield during the bookbuilding process. The 10- and 30-year bonds attracted the highest number of bids, Vice Minister of Finance Ahmed Kouchouk Reuters. The prospectus for the issuance is available here (pdf).

Sentiment is up: The oversubscription shows positive sentiment that’s in line with the improvement in the general perception of emerging markets since the beginning of this year, EFG Hermes’ Mohamed Abu Basha told Enterprise. “The issuance was clearly well received, which was a bit of a challenge seeing there was already decent Egypt supply in the market. The country has a good story to sell and we can see it’s well received in the high coverage and tighter yields,” he said.

EXCLUSIVE- More issuances on the way: Egypt is planning to move ahead with another EUR 1-1.5 bn eurobond issuance next week, a senior government official told Enterprise on Wednesday. The government expects strong appetite judging by this week’s positive eurobond performance. The official also said yields raised from this week’s issuance will be transferred to the state treasury within days to support FX reserves and pay off obligations while an EGP equivalent will be disbursed to the Finance Ministry to fund the state budget. Finance Minister Mohamed Maait said yesterday that the ministry plans to issue more foreign currency-denominated bonds before the end of the current financial year. The minister said in January that the ministry is looking to offer up to USD 7 bn in FX bonds in 1Q2019, and more USD- and EUR-denominated bonds by the end of 2Q2019.

Egypt could be included in JPMorgan’s emerging-market bond indexes as early as March, which would support the government’s strategy to cut borrowing costs and boost inflows from the debt market, the official also told us. Maait confirmed to Bloomberg last month plans that the ministry has approached the bank to request inclusion in its index. Unnamed sources had told the news information service about the ministry’s plans back in September.

Egypt to increase issuances of long-term treasury bonds: The Finance Ministry plans to increase its issuance of domestic long-term bonds to 70% of annual offerings by 2020, Kouchouk revealed in a separate interview with Bloomberg. Bonds with long maturities accounted for just 5% of domestic issuances in FY2017-18. The reliance on short-term T-bills has meant that the government has had to return to the debt markets to both refinance maturing debt and embark on new debt financing. But by issuing greater quantities of long-term bonds, the ministry hopes to increase the average maturity to five years by 2022 — double the level in FY2017-18.

Diversification of debt tools, currencies: “We want to diversify our debt instruments and currencies and also our local and international investor base to enhance completion and secure the best yields,” Kouchouk said, adding that the ministry has already started the process this year. Continuing down this path “would allow us to come up with a consistent and efficient medium-term package on the revenue side that allows us to meet our fiscal and deficit targets,” he said.

INVESTMENT WATCH- Germany’s Senvion to invest USD 1 bn in wind farms in Egypt: German wind energy company Senvion is looking to invest USD 1 bn to construct wind farms in Egypt over the coming years, Financial Manager Ahmed Elsawaf told the domestic press. The company is currently bidding in a tender for a 250 MW plant in the Gulf of Suez among other projects. Senvion is looking at long-term investments in the country, including potentially setting up a turbine manufacturer when demand justifies it, Elsawaf said.

INVESTMENT WATCH- Eight companies sign MoUs to invest in SCZone’s Russian Industrial Zone: Eight Russian companies signed yesterday MoUs with the Russian Exports Center to invest in the planned USD 7 bn Russian Industrial Zone (RIZ) in the Suez Canal Economic Zone, according to an SCZone statement. The companies signing the MOUs included solar energy developer Hevel Solar, fertilizer manufacturer Schelkovo Agrohim, metallurgy company Metprom — which plans to build a steel factory — agricultural engineering company Agroidea, and Eco Technical Center, which produces fertilizers from waste and operates in land reclamation. An Egyptian-Russian company will be set up in April to operate and manage the planned RIZ, which spans 5.25 sqkm and will be implemented over three phases in 13 years.

M&A WATCH- Bank Audi to complete due diligence for NBG Egypt bid by month-end: Bank Audi will complete by the end of the month due diligence on the Egypt subsidiary of National Bank of Greece (NBG) ahead of a planned acquisition of its assets and portfolio, unnamed sources told Reuters. The central bank gave Bank Audi the green light last month to move ahead with the due diligence before proceeding with the acquisition. NBG, which owns 17 branches in Egypt, had decided to exit the market as part of a wider plan to reduce its overseas presence under an EU-supervised restructuring.

Advisors: NBG has reportedly tapped Ernst & Young as financial advisor and Matouk Bassiouny and Freshfields Bruckhaus Dinger as legal advisors on the sale.

DISPUTE WATCH- Ibnsina confirms antitrust fine reduced to EGP 160 mn from EGP 2.04 bn: Ibnsina Pharma confirmed yesterday in an EGX disclosure (pdf) that a Cairo appeals court has reduced to EGP 160 mn an original EGP 2.04 bn antitrust fine handed by the Cairo Economic Court. “Ibnsina Pharma asserts its strict adherence to the law and to the highest corporate governance standards in its day-to-day activities, policies and procedures. Ibnsina Pharma will maintain its legal right to defend its position and to safeguard the interests of its shareholders,” the company said in an emailed statement (pdf).Ibnsina’s executives can appeal the verdict before the Court of Cassation “within the permissible legal time frame,” the statement said. Read why this case matters.

Market reaction: Ibnsina shares jumped 14.61% on Wednesday, closing at EGP 12.47. Shuaa Securities has adjusted its 12-month price target to EGP 13 per share, a 20% increase from Ibnsina’s close price on Tuesday, it said in a research note on Wednesday.

CBE studies licenses for SME-focused lenders: The Central Bank of Egypt (CBE) is mulling issuing licenses for new institutions specialized in SME financing, Governor Tarek Amer announced, according to CNBC Arabia. The institutions, known as “tier 2” lenders, are non-banking financial service providers. Amer’s announcement came days after the IMF released a research paper (pdf) on bringing SMEs into the formal banking system in the Middle East and Central Asia. IMF director for the area Jihad Azour stressed during a seminar at the American University in Cairo last week that startups and SMEs account for 50% of the area’s labor force yet attract just 7% of overall banking sector lending.

There is potential for such a drive to do much more for SMEs if licensing the new lenders eventually leads to a legislative framework to accommodate new tools, the European Bank for Reconstruction and Development’s Regional Principal Manager for SMEs Reem El Saady said, according to CNBC. Tools like crowdfunding or peer-to-peer lending could be introduced through unified e-platforms, and eventually culminate in the creation of a central coordinating agency for national SME development programs, akin to SME Corp Malaysia, El Saady added.

CABINET WATCH- Cabinet ratifies c.EUR 113 mn French funding agreements: The Moustafa Madbouly Cabinet ratified during its weekly meeting yesterday two c.EUR 113 mn-worth of funding agreements from the French Agency for Development (AFD), according to a statement. The first agreement will fund women-led SMEs through extending up to EUR 50 mn and grant up to EUR 1 mn to the SMEs Development Authority. The second will make available to the government up to EUR 60 mn and grant EUR 2 mn to support our new national healthcare system under the Universal Healthcare Act.

The ministers also signed off on raising the Education Ministry’s budget for purchasing online content for school curricula. The additional funding will be sourced from the Education Support Fund. No further details were provided.

EARNINGS WATCH- Etisalat Misr reported revenues of AED 2.81 bn (c.EGP 13.4 bn) for FY2018 on total consolidated group revenues of AED 52.4 bn, the company said in its earnings release (pdf).

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Research analysts whose strength runs to words as much as models;

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech;

- Events managers who know how to produce outstanding live content.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Up Next

The EGP 500 mn phase 4A of Cairo Metro Line 3 is due to open “soon,” Cairo Governor Khaled Abdel Aal said, according to Ahram Gate. The 4 km phase will link four stations in Cairo: Harun, Heliopolis, Alf Maskan and Shams Club.

100 leaders of the biggest Saudi companies are expected to attend a Cairo meeting of the Saudi Egyptian Business Council on 23 February, according to the domestic press.

Talk introducing uses for blockchain outside crypto: The UN Technology Innovation Lab Egypt, Egypt Technology Innovation & Entrepreneurship Center, UNDP, and IBM Egypt are hosting on 26 February a talk to introduce blockchain and its uses outside of cryptocurrencies. You can find more details and register for the event here.

A Russian delegation will visit Sharm El Sheikh and Hurghada airports sometime soon to run a final security sweep ahead of a decision on whether to allow the resumption of direct flights, AMAY reported.

The gov’t will begin rolling out its debt control strategy next month, Finance Minister Mohamed Maait told Al Mal. The four-year strategy aims to bring down Egypt’s public debt to 80-85% of GDP by the end of FY2021-22.

Egypt will be ready to supply Sudan’s power grid with up to 40 MW of electricity by end-March, Electricity Minister Mohamed Shaker said, according to a Cabinet statement.

The Macro Picture

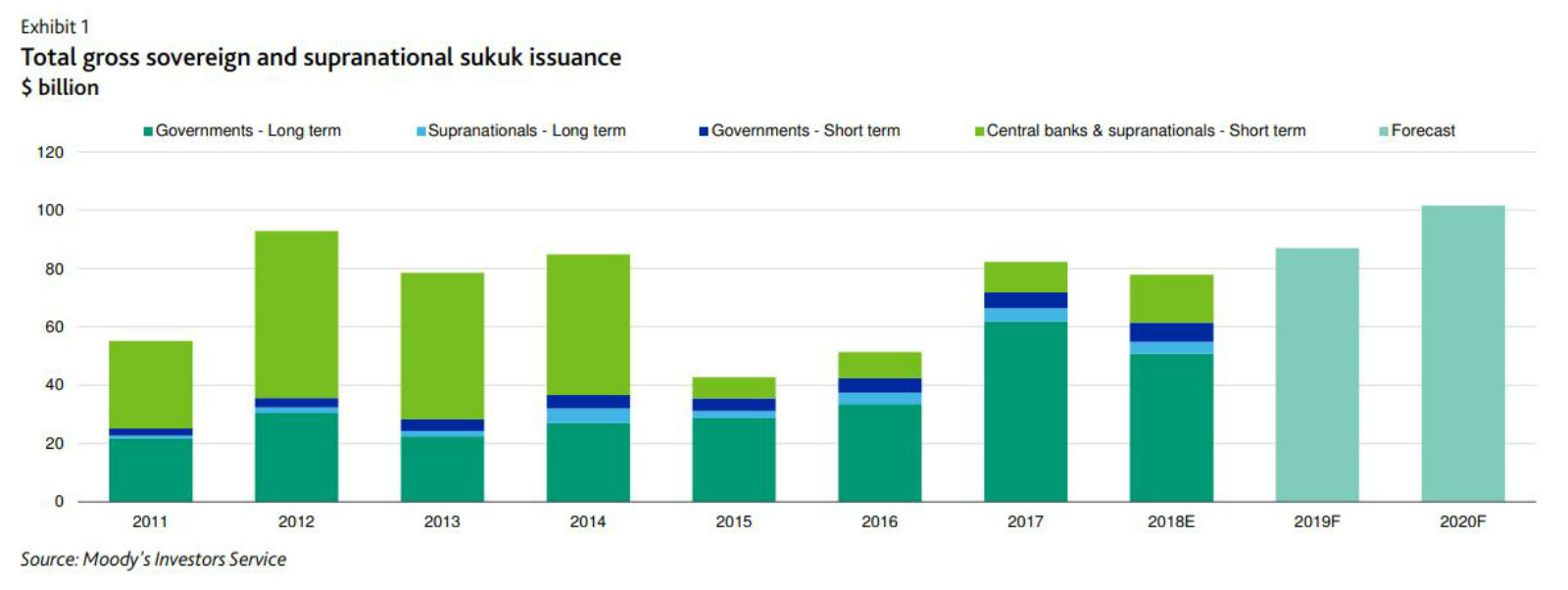

Expect a global recovery in sovereign sukuk issuances this year: Sovereign sukuk issuances will stage a recovery this year to reach USD 87 bn, up from USD 78 bn in 2018 when they declined, Moody’s rating agency says in a new report. This figure will rise again in 2020 toward USD 100 bn, beating the current record (USD 93 bn) for annual issuance volumes. The agency said that increasing needs for deficit financing and a higher sukuk maturity rate will mean that governments are likely to boost the total net issuance. “In the medium-term, gross issuance will rise further as the sukuk issued by the GCC governments begin to mature and are refinanced via a new issuance,” said Alexander Perjessy, VP and senior analyst at Moody’s.

Movements in the oil markets will play a large part in the accuracy of Moody’s latest forecasts, which used an average price of USD 75 bbl over the year. Lower prices will result in widening deficits among oil-producing countries such as Saudi Arabia and Qatar, which may force them to increase sukuk issuances. The opposite occurred last year, when issuances experienced a 5% slowdown, dropping to USD 78 bn from USD 82 bn the previous year. Higher oil prices eased pressure on deficits and reduced the need to debt finance.

Image of the Day

Barcelona-based Egyptian artist Hossam Dirar hopes to impart a message for the freedom and emancipation of women through his artwork, he tells Emirates Woman. Much of his inspiration comes from Ancient Egypt, as shown here with a piece from his Nefertiti collection.

Egypt in the News

Leading today’s coverage of Egypt in the Western press is the execution of nine men yesterday for the 2015 assassination of then-Prosecutor General Hisham Barakat, Reuters reports. Amnesty International had called for their release, citing unfair trials and confessions extracted under torture, then issued a statement following the executions stating that they demonstrate “Egypt’s absolute disregard for life.” The Guardian picked up the story, noting that this brings the total number of executions to 15 in under three weeks. Deutsche Welle and AFP also have coverage.

Reuters spotlights population control program: “Two is Enough,” the population control program run by the Social Solidarity Ministry is the focus of an in-depth feature by Reuters. The program aims to reduce the birth rate from 3.5 children per woman to 2.4 by 2030. Egypt’s population is projected to reach 100 mn by 2020, a huge number of people given water and job scarcity.

Other headlines worth noting in brief include:

- The constitutional amendments amount to a constitutional coup, writes former Egyptian diplomat and Dartmouth professor Ezzedine C. Fishere, in The Washington Post.

- The Alexandria-Cape Town road is a mega project meant to help achieve sustainable development in Africa, writes Ahmed Elleithy in Al-Monitor.

On The Front Pages

The independence of Egypt’s judiciary and the country’s efforts to combat terrorism are the two topics the government wants us all to think about this morning. On the front pages of Al Ahram and Al Akhbar: President Abdel Fattah El Sisi’s statements at a Middle East and North Africa terrorism-focused conference confirming that Egypt’s judiciary is independent. Al Gomhuria is also running with statements from the president at the conference, but focuses on the anti-terrorism angle.

Worth Reading

What could the corporate sector learn from Mexico’s most notorious druglord? Apparently quite a lot, writes Nicole Hong in the Wall Street Journal. Convicted in New York on Tuesday on ten criminal counts of narcotics trafficking and money laundering, Joaquín Guzmán Loera (“El Chapo”) may spend the rest of his life in a US prison, but his legacy — and the influence of his deadly Sinaloa cartel — lives on in Mexico.

The larger than life figure who powered an empire: What emerges from his trial is an almost-too-fantastic story of daring smuggling operations using tunnels, trains, and even jalapeño cans, an alleged payoff to Mexico’s then-president-elect Enrique Peña Nieto, and two prison escapes by a man who started life as a “semi-literate farmhand” and then rose to make at least USD 14 bn in profits from the illicit business. But what is equally clear is that Guzmán was, in many ways, a highly astute businessman, who along with other cartel bosses established a “profit-sharing model to protect against [narcotics] seizures by law enforcement” and whose subordinates referred to the cartel’s “detailed infrastructure, accounting ledgers, supply-chain issues and the need to ‘protect the capital of the investors.’”

Mexico’s narcotics war is nowhere near over. Despite Mexican President Andrés Manuel López Obrador renewing the country’s fight against the trade of illicit substances, cartel and Mexican security experts and investigative reporters argue that it is actually going from strength to strength. An estimated USD 19-39 bn in profit from illicit substances are returned to Mexico every year, and increasing trade is also fueling a spate in violence.

Energy

Dubai’s Alcazar completes works on 200 MW solar power plants in Benban

Dubai’s Alcazar Energy has completed construction works on four 200 MW solar power plants in Aswan’s Benban solar park, CEO Daniel Calderon told the domestic press. Trial operations for the plants will kick off in March. Alcazar is planning to launch other projects and bid in a number of tenders for solar and wind power projects, Calderon said without specifying a time frame or planned investment value.

Infrastructure

OC subsidiary, LaFarge Egypt to complete Marsa Matrouh-Siwa road extension

A consortium made of a subsidiary of Orascom Construction (OC) and LaFarge Egypt is planning to complete an extension to the 300 km Marsa Matruh-Siwa desert road, LaFarge Egypt CEO Hussein Mansi said. The consortium will break ground on the two-year project as soon as the government awards it the contract.

Basic Materials + Commodities

GASC purchases 360k tonnes of wheat

The General Authority for Supply Commodities (GASC) purchased 360k tonnes of wheat, reports Al Shorouk. The purchase includes 60k tonnes from each of Romania, Russia and Ukraine, and another 180k tonnes from France. The lack of US representation in the tender resulted in wheat futures hitting a seven-month low, according to Reuters.

Telecoms + ICT

Orange Egypt to provide triple play services to Tatweer Misr’s Fouka Bay

Orange Egypt signed an agreement to provide triple play services in Tatweer Misr’s Fouka Bay compound in the North Coast, Tatweer Misr said in a statement. The services are expected to be launched by June this year. Triple play service provides landline, television, and Internet services through one outlet based on fiber optic cables.

Banking + Finance

AT Lease seeking EGP 1 bn of financing from banks this year

Al Tawfeek Leasing (AT Lease) is seeking EGP 1 bn in financing from banks this year to raise its available financing to EGP 4 bn, the company said in a bourse filing (pdf). The company allocated last year EGP 1.8 bn to financing leasing contracts.

Banque du Caire close to issuing 450k “Meeza” debit cards

Banque du Caire has begun issuing “Meeza” debit cards, CEO Tarek Fayed said, according to Al Mal. The state-owned bank plans to issue 450,000 cards this year, Youm7 reports. Banque Misr and the National Bank of Egypt began issuing the state-backed debit card last month. The central bank had said last year that it plans to roll out Meeza to encourage financial inclusion and Egypt’s transition to becoming a cashless society. The card comes as part of the government’s e-payments drive and will make state benefits available electronically to pensioners, civil servants, and subsidy recipients.

Egypt Politics + Economics

State employees who embezzled EGP 30 mn arrested

Two Egyptian state employees have been arrested by the authorities after embezzling some EGP 30 mn allocated as compensation for state-appropriated property, Ahram Online reports. The Administrative Control Authority said that specialists are investigating the crime and examining loopholes to understand how the employees were able to embezzle the funds.

Sports

Six venues in Egypt announced for AFCON

The Egyptian Football Association has announced the six venues chosen for the African Cup of Nations (AFCON) running from 21 June to 19 July, Reuters writes. Cairo Stadium, Borg el Arab Stadium, Ismailia Stadium, June 30 Stadium, Suez Stadium, and Port Said Stadium will host matches. Separately, President Abdel Fattah El Sisi met with Confederation of African Football head Ahmad Ahmad to stress the government’s commitment to ensuring the success of the championship, Ittihadiya said. El Sisi also met with PM Moustafa Madbouly to follow up on the preparations, Ittihadiya said in another statement.

My Morning Routine

Ahmed Zahran, co-founder and CEO of KarmSolar: My Morning Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Ahmed Zahran, co-founder and CEO of KarmSolar, Egypt’s largest private off-grid solar energy integrator.

I’m Ahmed Zahran and I’m a co-founder and the CEO of KarmSolar. Looking at the question of who I am from a more existential perspective, I’m a person with a point to prove. I want to prove that things can work in this country without the need to be corrupt or well-connected. You can build an institution the way institutions should be built. This is something I struggle with and think about every day — how can I work towards achieving this goal — to the extent that it’s taken over my life and become part of who I am.

My main job is to be an enabler. It’s up to me to create the context or environment and build the organization where people can achieve their potential, and where they have the resources to do their best. So I create a setup where people are motivated, and then I throw challenging ideas at them. I might then start pushing back or arguing with them to see what can and cannot be done. It’s all part of catalyzing and enabling the processes.

I have three different morning routines. If I’m traveling to one of our sites, I like to start very early in the morning so I wake up at 5 or 5:30 am. Sometimes I get to play sports (playing tennis is something I really enjoy), and sometimes not. I try to be consistent. Then I hit the road to visit our sites. These are really some of my best times. I love visiting our sites, looking at the sites that are under construction, and imagining how they will end up looking, just as I love looking at our existing products and remembering how they looked before we started work. If I’m traveling abroad, I make sure that I have a good stock of things to read and watch. When I fly, I spend a lot of time thinking, scribbling ideas, reading and watching new things. I love that process of discovering new things. If I’m spending the day in Cairo, I wake up at around 7 am to make sure I’m in the office at around 10 am. Sometimes I get to exercise first thing in the morning and sometimes I do it in the evening, at 8 pm.

I usually have a lot of meetings and some days I just hop from one to the next. When I’m in the office, I try to regularly go around and talk to people, or ask them what they’re working on. I love eating with the team, which helps me understand what’s happening in the company and what people are thinking about. We have a food culture, so we have a team lunch every day, and twice a week this is sponsored by the company. It’s a time when people can get together and sometimes they invite their friends. I also keep a tiny library in my office, so sometimes when I feel that I need to take a break I’ll either take a quick nap on the floor or I’ll read. Our days are long, and I only sleep 3-4 hours a day, so I have to take naps every now and then. I’m working hard to go home earlier.

One recent read that has affected me a lot is The Enigma of Reason, a book that could be described as behavioral economics. It helps you understand the origin of logic in human beings, and it’s an amazing book if you want to understand how humans function, how we think, what incentivizes us and how we take decisions. I also enjoyed watching the two Fyre Festival documentaries recently — both Hulu and Netflix. There’s a lot to learn from this situation. You understand how the media can corrupt people. When it comes to film, there’s a Spanish movie that I loved and would recommend to anyone, called A 12 Year Night.

The origin story of KarmSolar is an interesting one. There were four of us who were fired from a big company in 2011. The company was led by someone who did not believe in innovation or renewable energy, so when we established KarmSolar in October 2011 we wanted to prove to ourselves and obviously to him that our vision could actually work. We started in Arabica, a small cafe in Zamalek. The thing I love is that the people who gave us our initial investment were people working in the company we were fired from, who believed in us and wanted to support us.

KarmSolar’s niche is brain power. We’re very innovative, and we never accept things as they are. We’re constantly developing and changing our business model — not to be ahead of the competition, but to be at the forefront of development for its own sake. We’re trying to push existing knowledge, and we’re literally redesigning the energy structure business model. I truly think we will be the first proper solar utility globally. And I mean that.

People often think we’re a solar developer or a solar technology company, but we’re neither of those things: We’re a solar utility. We’re the power company of the future. All of our infrastructure is built around conventional methods of generating, distributing, and managing power. But so far there has never been a utility built around renewable energy, so this is what we’re working to build. Solar development is an opportunistic role that we play to build solar stations, but it’s just a very small part of what we do. What we’re really doing is designing solar utilities and the heart of our work is figuring out what they’ll be like.

It’s exciting to be at the forefront of change in the industry. Internally, innovation guides everything we do. We’re looking at things, both commercially and technically, in a very new way. Externally, we’re playing an active role, working with regulators and the government to imagine and draft the regulations of the future. Many of the things we work on don’t have existing references — and this is one of the most interesting parts of the job. We literally have a blank piece of paper we’re filling with the most creative commercial and technical ideas.

The best business advice I’ve ever been given came from my mentor and best friend of 15 years. He encouraged me to engage in silent thinking, where you periodically retreat from everything and avoid distractions, but just think about what you are doing, your future plans, your competitive edge. Sometimes we become the slaves of failure or success. It disorients us and we can’t see what to do next. He was an expert at just stopping to think silently. I learned this from him and I try to do it as much as I can. He also taught me how to learn business strategy or methodology from areas not necessarily related to business. So I learned how to use anecdotes to try to understand things and how to look for things I could use for strategic planning in documentaries, movies, or art. Finally, he taught me how to develop myself as a human being — not as an entrepreneur, businessman, or technical professional — but as a human being. This is very important because we need to have a comprehensive view of ourselves.

How do I stay organized? Who says that I stay organized? That’s a presumptuous question. I’m not organized, although I try to be. I jump around a lot. If you aren’t able to stay organized, the best thing is to have a lot of organized people around you, and I think that’s my approach. My team is far more organized than me, and they force me to be organized.

The Market Yesterday

EGP / USD CBE market average: Buy 17.52 | Sell 17.62

EGP / USD at CIB: Buy 17.53 | Sell 17.63

EGP / USD at NBE: Buy 17.49 | Sell 17.59

EGX30 (Wednesday): 15, 213 (+0.4%)

Turnover: EGP 1.6 bn (79% above the 90-day average)

EGX 30 year-to-date: +16.7%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 0.4%. CIB, the index heaviest constituent ended up 0.4%. EGX30’s top performing constituents were Arab Investments up 5.1%, Arab Co. for Asset Management and Developments up 2.8%, and Pioneers Holding up 2.8%. Yesterday’s worst performing stocks were Global Telecom down 1.7%, Telecom Egypt down 1.6% and AMOC down 0.5%. The market turnover was EGP 1.6 bn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -64.8 mn

Regional: Net Long | EGP +13.1 mn

Domestic: Net Long | EGP +51.7 mn

Retail: 58.2% of total trades | 59.8% of buyers | 56.6% of sellers

Institutions: 41.8% of total trades | 40.2% of buyers | 43.4% of sellers

WTI: USD 56.30 (+0.37%)

Brent: USD 66.47 (+0.03%)

Natural Gas (Nymex, futures prices) USD 2.65 MMBtu, (+0.57%, Mar 2019 contract)

Gold: USD 1,346.60 / troy ounce (+0.13%)

TASI: 8,567.24 (+0.59%) (YTD: +9.46%)

ADX: 5,060.89 (+0.51%) (YTD: +2.97%)

DFM: 2,632.08 (+2.58%) (YTD: +4.05%)

KSE Premier Market: 5,481.15 (+0.37%)

QE: 10,077.82 (+0.96%) (YTD: -2.15%)

MSM: 4,053.94 (-0.07%) (YTD: -6.24%)

BB: 1,405.29 (+0.91%) (YTD: +5.09%)

Calendar

21 February (Thursday): The Middle East & Africa Fintech Forum, Nile Ritz Carlton Hotel, Manama, Bahrain.

21-24 February (Thursday-Sunday): Furnex & The Home Exhibition, Egypt International Exhibition Center (EIEC), Cairo, Egypt.

23 February (Saturday): The Supreme Administrative Court will rule in an appeal by Uber and its competitor Careem against a lower court ruling ordering the suspension of their operations.

23 February (Saturday): Saudi Egyptian Business Council Meeting, Cairo, Egypt.

24-25 February (Sunday-Monday): EU-Arab League summit, Sharm El-Sheikh, Egypt.

26 February (Tuesday): BLOCKCHAIN: What is it? Potential Applications Beyond Cryptocurrencies, TIEC Smart Village Building (B5), Cairo, Egypt.

26-28 February (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral

Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

March: Execs from 50 Japanese companies will be in Cairo to discuss potential investments.

03-06 March (Sunday-Wednesday): EFG Hermes One-on-One Conference, Dubai.

8 March (Friday): SHE CAN women’s entrepreneurship event, Greek Campus, Cairo.

10 March (Sunday): CIB to hold EGM meeting to look into planned capital increase.

March (date TBD): Traders Fair, Nile Ritz Carlton, Cairo, Egypt.

17 March (Sunday): A court will look into a lawsuit by a subsidiary of Arabian Investments, Development and Financial Investment Holding Co. (AIND) against Peugeot Citroen, seeking EUR 150 mn in damages.

17-18 March (Sunday-Monday): OPEC Joint Ministerial Monitoring Committee meeting, Baku (Bloomberg).

18-19 March (Monday-Tuesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

27-30 March (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

28 March (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe according to Al Shorouk.

April: The EUR 250k first phase of Egypt’s national waste management program kicks off.

April: The final draft of proposed legislation which will regulate real estate development should be ready in two months’ time, Prime Minister Moustafa Madbouly said.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna (Bloomberg).

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

30 April-1 March (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

June: International Forum for small and medium enterprises (SMEs).

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

30 June (Sunday): June 2013 protests, national holiday.

11 July (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

23 July (Tuesday): 23 July revolution, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Cairo, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Cairo, Egypt.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.