- FRA suspends Beltone Investment Banking for six months. Here are the questions we all need to be asking. (Speed Round)

- Terrorists kill seven, wound nine Coptics Christians in Minya attack. (Speed Round)

- EBRD sees Egypt economy improving on Zohr, rising FDI, strengthening exports, improved competitiveness. (Speed Round)

- Egypt to cap foreign borrowing at USD 14.3 bn in the next fiscal year? (Speed Round)

- Medhat Khalil considers forming consortium for EGP 500 mn take-private bid on Raya. (Speed Round)

- ACWA, Hassan Allam sign PPA for USD 2.3 bn power plant. (Speed Round)

- Misr Insurance, Misr Life Insurance IPOs postponed pending restructuring. (Speed Round)

- Potatogate: Egypt competition watchdog raids Agriculture Export Council. (Speed Round)

- Flurry of announcements suggests NUCA making a push on New Alamein City. (Real Estate + Housing)

- The Market Yesterday

Sunday, 4 November 2018

Beltone’s investment banking arm hit with six-month suspension

TL;DR

What We’re Tracking Today

** Our apologies for being a few minutes late this morning, but we had some technical issues with our dispatch engine. They’re solved now and we’ll be back to our usual time tomorrow.

It is an exceptionally busy news morning with an unprecedented six-month suspension handed on Thursday to the investment banking arm of one of the nation’s “Big Five” firms and the murder by Islamist terrorists of at least seven Coptic pilgrims this weekend.

That presages a busy month. November is always packed, between the scramble to close transactions before year’s end and the House of Representatives hitting its stride. Highlights in the coming days will include:

- The Markit / Emirates NBD purchasing managers’ index for Egypt will be out tomorrow morning;

- US sanctions on Iranian oil go into effect tomorrow;

- The release of a draft of the SME Act, which will aim to bring more businesses into the formal economy;

- The central bank next reviews interest rates on 15 November.

Will Egypt get an exemption from America’s sanctions on Iranian oil? The US will temporarily allow eight countries, including Japan, India and South Korea, to continue buying Iranian oil after it imposes sanctions Tehran this week in an effort to prevent oil prices from jumping, a senior US government official told Bloomberg. The exemption is contingent on these countries cutting off other Iranian imports. The news raises the question of whether Egypt, which, as CNBC notes imports Iranian oil for its Sumed pipeline, will be included on the list. The UAE, China and Turkey could also be included in the list, which is expected to be formally announced tomorrow.

Oh, and The Donald would very much like you to know that sanctions are coming, tweeting the following image over the weekend (and prompting speculation, after a top Iranian official responded in kind, that we have reached peak stupid in international relations):

It’s all enough to make us very happy that Tuesday is Stranger Things Day, according to a video posted on the Netflix show’s Twitter feed.

Meanwhile:

Your menu of T+0 trading options just got a bit deeper: Last Tuesday’s decision by the Financial Regulatory Authority (FRA) to allow same-day trading on stocks that are on its category ‘B’ list of securities eligible for “specialized activities” will come into effect today, the EGX said in a statement picked up by Youm7.

Also today: Intraday trading clearing fees to fall by 50%: Clearinghouse MCDR will reduce clearing fees on intraday trading (T+0) 50% to 0.000125% starting from today, Misr Clearing MD Tarek Abdel Bary tells Al Mal. The move, coupled with a decision to allow T+0 on category ‘B’ companies, could raise trading volumes by up to 50%, as T+0 trades make up 10-15% of all daily volumes, he added.

The second edition of the World Youth Forum kicked off yesterday in Sharm El Sheikh, and is set to wrap on Tuesday.

In miscellany this morning:

- Shares of listed asset managers tumble on both sides of the Atlantic as the sector has its worst year since 2008. (Financial Times)

- Warren Buffett can’t find anything he wants to buy, so he’s buying back nearly USD 1 bn in stock. (Wall Street Journal)

- The new retirement plan: Save almost everything, spend virtually nothing. Or: The Wall Street Journal discovers the FIRE movement.

- The case for using a paper planner. Try as we might to go all-digital, we just can’t. (New York Times)

PSA- Clocks fall back in the United States and Canada this morning. Egypt no longer observes daylight saving time (remember that year we changed the clocks four times?), so New York and Toronto will be seven hours behind CLT later this morning.

Enterprise+: Last Night’s Talk Shows

The World Youth Forum was the belle of the ball on last night’s talk shows, with some shows (including Masaa DMC and Al Hayah Al Youm) taking the night off to make room for wall-to-wall coverage.

The forum is meant to send a message of strength from Egypt despite its struggle with terrorism, political analyst Moataz Abdel Fattah told Hona Al Asema’s Reham Ibrahim (watch, runtime: 30:03). El Hekaya’s Amr Adib was of the same mind, saying Friday’s deadly attack against Copts in Minya (the full details of which are in Speed Round, below) was unsuccessful in putting a damper on that message (watch, runtime: 5:22).

Rep. Ghada Agamy took to the airwaves to defend her proposed bill that would ban the niqab in public sector workplaces, saying that Egypt’s current security situation necessitates “decisive action.” The bill will be up for discussion at the House of Representatives next Sunday, 11 November (watch, runtime: 10:40).

Happy second float-aversary, everyone: On the second anniversary of the CBE’s decision to float the EGP, Hona Al Asema’s Reham Ibrahim had a prolonged chat with economist Ibrahim Mostafa and deputy Chemical Industries Export Council had Hani Cassis about the country’s progress over the past two years. Both gentlemen praised the move, but noted that the state budget remains strapped, which means enabling private sector investment is key to development (watch, runtime: 13:58 and runtime: 14:58).

Speed Round

FRA suspends Beltone Investment Banking for six months: With barely 30 minutes left in Thursday’s trading session, the Financial Regulatory Authority (FRA) suspended Beltone Financial’s investment banking arm, banning it from carrying out any market activities for a six-month period.

Regulator gave no reason for the suspension, which had immediate effect: The order, which gave no explanation for the suspension, instructed the EGX and Misr Central Clearing, Depository and Registry (MCDR) to “take all required procedures to implement the order.” The FRA also instructed Beltone’s brokerage arm to take on more insurance against potential client claims: The firm has one month to raise its insurance cover to EGP 50 mn and must maintain it at that level for a year. You can read a copy of the order here (pdf).

Beltone is cooperating with investigators, we’re told, but senior execs don’t know why the firm’s IB unit has been suspended: The firm said in an overnight statement (pdf) that it found the decisions “surprising” and noted that it had “yet to be informed of … reasons for their issuance.” Beltone, owned by Naguib Sawiris’ Orascom Investment Holding (OIH) is seeking an explanation and said it will “pursue the appropriate legal actions to safeguard its interests and those of its shareholders and clients.” The firm said the same thing to Reuters on Thursday.

Beltone’s brokerage arm is still trading: “The company also affirms that Beltone Securities Brokerage continues to conduct normal business operations, and that all of the group’s companies continue to operate in line with the aforementioned FRA decisions,” Beltone’s statement said.

Rumors are flying fast and furious on this one, and some of it really is the province of the Tin Foil Hat Brigade. We’re going to instead suggest we all start with some basic questions everyone should be asking this morning:

QUESTION #1: Is this related to the Sarwa IPO? Beltone ran last month’s IPO of consumer and structured finance firm Sarwa Capital, shares of which fell 11% in their EGX debut despite an institutional offering more than 10x oversubscribed and a retail component that was even more in demand. The FRA announced after the start of trading that a committee would look into the IPO. Some in the local press are drawing a connection between that probe and the suspension on Thursday of the IB unit.

QUESTION #2: Or was it triggered by a bid by Beltone’s parent company for c. 30% of Sarwa? The FRA ordered the suspension only one day after Beltone parent company OIH announced that it is looking to acquire a non-controlling stake of at least 25% in Sarwa Capital. OIH CEO Tamer El Mahdi told Bloomberg that “the company fundamentals are very strong, and we have no concerns in terms of the stock’s performance since the IPO.”

QUESTION #3: Did the regulator suspend Beltone because of Sarwa’s aftermarket share performance? It’s unlikely, we think: That would be exceptionally bad news for the market in general, to say nothing for companies heading to IPO in 2019 and the investment bankers advising them. It’s inconceivable that, absent fraud, a company or a bookrunner would be punished because a share flops after the start of trading.

To wit: It’s not unheard of for a company’s shares to fair poorly at IPO. Consider ADT Securities (down 12% in New York on their first day of trading this January in an IPO run by Morgan Stanley) or Facebook (down nearly 50% from its IPO price in the first three months of trading). ADT shares are still underwater, while Facebook are up nearly 300% since their 2012 debut.

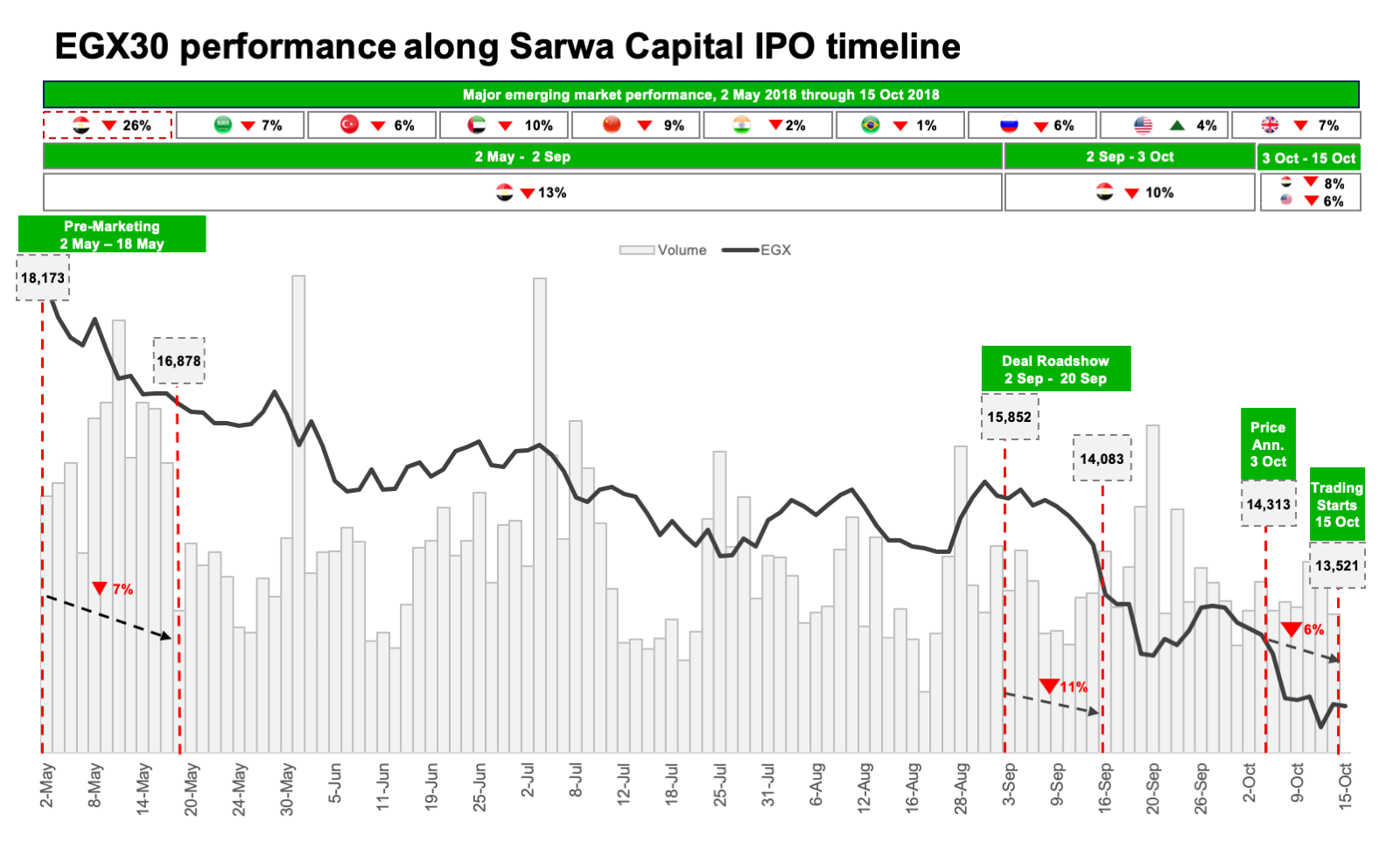

Keep in mind: Sarwa went to market as the EM Zombie Apocalypse was biting Egypt particularly hard. The EGX30 tumbled nearly 26% between when Sarwa and Beltone first started pre-marking activities back in May and when the shares made their EGX debut on 15 October. The benchmark tumbled 11% during the IPO roadshow and then 6% between the announcement that Sarwa shares had been priced at EGP 7.36 (pdf) and the first day of trading.

Also: Gulf investors pulled back from Egypt on the same day as Sarwa’s EGX debut as investors had to meet margin calls following the cratering of the Tadawul in Saudi Arabia. The next day, even more oxygen left the market as investors piled into MNHD shares following the announcement that SODIC was seeking 51% of the real estate developer. The graph at the end of this story brings it to life.

(Is how an IPO is priced a mystery to you? Check out Investopedia, which runs you through the bookbuilding process used in most major global markets, including Egypt. It’s how Beltone priced Sarwa, and it’s the market standard used by others including EFG Hermes and CI Capital. In short: Investment bankers guide on a price range. Then, during a roadshow in which they get to grill company management, qualified institutional investors place orders for a certain number shares at their desired price. The investment bankers then decide, with the company, the price at which shares will make their trading debut — and which investors get how many shares. Retail investors are then offered the shares at the same price.)

QUESTION #4: Was the order book for Sarwa inflated? We’re told by a source close to the transaction that defaults on orders were within the “normal range” and the “magnitude was small in view of the size of the offering.” The source also claimed that “70% of the demand and coverage came from institutional and foreign investors.” Allocation of shares is at the sole discretion of the investment bankers and the company, and at allocation over 80% of shares “went to institutional and foreign investors,” our source says. “25% of the book was local institutions and 55% from foreign investors from the US, Europe, South Africa and the GCC.”

QUESTION #5: Did IPO money go missing? That’s one of the wilder rumors we’ve heard, and it really isn’t possible: Egypt’s delivery-versus-payment (DVP) mechanism effectively leaves no room for an investment bank to keep cash raised in an IPO and not hand over shares.

QUESTION #6: Will the regulator make clear this morning (or this week) why it suspended Beltone? It should, for the good of the market as a whole.

QUESTION #7: Will OIH push on with its offer for a big chunk of Sarwa, or will it pull back amid the uncertainty? If they’re not withdrawing the offer, the next step is to file paperwork.

QUESTION #8: How will the market react to all of this? The news hit on Thursday with only 30 minutes or so left in the trading session.

Terrorists kill seven, wound nine Coptics Christians in Minya attack: Terrorists opened fire on buses carrying Coptic Christians making their way to the monastery of St. Samuel the Confessor in Minya on Friday, killing seven on board one bus, according to the Coptic Orthodox Church. The church said that two other buses were also targeted, resulting in the injury of at least 19, but Interior Ministry sources maintained that the attack was contained to one bus and that only seven were injured. Six of the seven victims were members of the Shehata family, including 15-year-old Beshoy Shehata and his younger relative Maria Shehata. The shooting took place close to the area where similar attacks claimed 29 lives in May 2017.

President Abdel Fattah El Sisi offered his condolences and vowed in a tweet on Friday to step up Egypt’s fight against terrorism. Al Azhar also issued a statement condemning the attacks.

Daesh claimed responsibility through their Amaq propaganda outlet, according to the Guardian. The group said the attacks were revenge for Egypt’s imprisonment of “our chaste sisters,” apparently referring to the detention of former Ikhwan deputy leader Khairat El Shater’s daughter, Aida, and six other women one day earlier. If their claims are verified, this would mean the return of the group targeting Christians after a near-year-long stint of major attacks on Copts, says the New York Times.

The story gained significant traction in the foreign press over the weekend, with the BBC citing past accusations by Copts that Egyptian authorities are making “only token gestures to protect them,” and following up a day later to document the victims’ funeral service. The incident is “the most serious attack on a minority in more than a year,” Reuters noted, while the Associated Press said the attack is “likely to cast a dark shadow on one of el-Sissi’s showpieces — the World Youth Forum.” The National called Friday’s attack an “abomination” and Singapore’s Straits Times noted how radical extremism continues to be a problem despite authorities’ obvious efforts against terrorism. The Washington Post, The Independent, France 24, and several others also followed the story.

EBRD sees Egypt economy improving on Zohr, rising FDI, strengthening exports, improved competitiveness: The European Bank for Reconstruction and Development (EBRD) is projecting that Egypt’s GDP growth will reach 5.5% in FY2018-19, up from 5.3% in FY2017-18, according to the November 2018 update to its Regional Economic Prospects Report (pdf). Growth is expected to be driven by a number of factors. “These include the continued boost in confidence, recovery in tourism, increase in foreign direct investment, improved competitiveness, continued strengthening of exports, the start of natural gas production from the Zohr field, the implementation of business environment reforms and prudent macroeconomic policies,” the report says. The EBRD notes that net exports and investment were the main drivers of growth since the economic reforms began in FY2016-17, benefitting from gains in competitiveness and confidence. It also notes the recent early signs of recovery in the non-oil private sector, as indicated by a rise in the PMI.

Egypt appears to be among the strongest performers in the southern and eastern Mediterranean region, helping drive up GDP growth there to 4.4% in 2018, up from 3.8% in 2017.

Best year for tourism regionally since 2010: Currency devaluations in Egypt and Tunisia saw the region post its best year in tourism since 2010, according to the report.

Regional losers: The EBRD’s forecasts for growth in Jordan and Lebanon have been revised down from earlier predictions in May after the roll out of reforms in those two countries were held up because of social unrest and political instability. “In both Jordan and Lebanon, the projected growth in 2018 remains below the growth rate of the population, implying a decline in real per capita incomes,” the report said. Morocco’s GDP growth is expected to slow in FY2018 to 3%.

Egypt to cap foreign borrowing at USD 14.3 bn in the next fiscal year? The government is aiming to limit foreign borrowing to USD 14.326 bn in its next 2019-2020 fiscal year, according to a government document seen by Reuters on Thursday. Egypt expects total foreign debt to reach USD 102.863 bn and aims to repay USD 10.326 bn to foreign lenders in the FY2019-20, according to the documents. An unconfirmed report last week suggested the Madbouly government had set a foreign borrowing cap of USD 16.733 bn for the current 2018-19 fiscal year and expects total foreign debt to reach USD 98.863 bn. The government will have to borrow USD 10.51 bn this fiscal year to meet external debt payments. The projections, which come as the Madbouly Cabinet begins working on next fiscal year’s budget, comes as the government prepares to issue foreign currency-denominated bonds later in the year or early next year and announce the details of its debt control strategy.

M&A WATCH- Medhat Khalil considers forming consortium for EGP 500 mn take-private bid on Raya: Raya founder Medhat Khalil is putting together a group of investors to take Raya Holding for Financial Investments private via a mandatory tender offer (MTO) to acquire 100% of the company, Khalil told Al Mal in an interview on Thursday. Khalil estimates that he would need EGP 500 mn buy the outstanding 58% of Raya, noting that he would be forced to acquire at a premium.

Caught by surprise: Khalil confirmed reports that the Financial Regulatory Authority (FRA) had ordered that Khalil launch an MTO or sell off shares, saying that the order caught him by surprise. Khalil and family members control 32% of shares, less than the 33% required to trigger an MTO, he said. But the FRA decided to count the 10% stake owned separately by his brother-in-law as a related party, bringing the Khalil group’s total stake at 42%.

What’s next: Khalil said It was unlikely that he will sell any of his shares. This leaves him between the hammer of having to execute the MTO before the FRA’s deadline of 27 November, and the anvil of paying fines of up to EGP 1 mn, he said. He is currently studying legal options to address the MTO. He is also consulting with a number of investment banks, including EFG Hermes, to see what is the best way to go, he added.

INVESTMENT WATCH- ACWA, Hassan Allam sign PPA for USD 2.3 bn power plant: The Egyptian Electricity Transmission Company has signed a key power purchase agreement (PPA) with Saudi Arabia utility developer ACWA Power and Hassan Allam Holding for a 2.3 GW, USD 2.3 bn power plant, ACWA said in a Thursday statement. The Luxor plant, which will run under a build-own-operate (BOO) framework, is expected to come online in 2022 and operate at full capacity by 2023, ACWA said. It will help meet the growing demand for electricity in southern governorates.

The PPA comes after talks on the 2.3 GW plant had previously stalled after it was pushed to the ministry’s 2022-2027 five-year plan from the 2017-2022 plan due to a current generation surplus. “Signing the PPA today represents a significant step in the development of the project, more importantly it demonstrates the commitment of the Egyptian government to encourage the participation of the private investors in infrastructure projects,” ACWA CEO Paddy Padmanathan said. Reuters and The National also took note.

IPO WATCH- Misr Insurance, Misr Life Insurance IPOs postponed pending restructuring: The IPOs of state-owned Misr Insurance and Misr Life Insurance as part of the state privatization program have been postponed until the two companies undergo restructuring, Public Enterprises Minister Hisham Tawfik said. The timeline for the listings (and their initial valuations) are contingent on their restructuring, which includes focusing on the companies’ sales and marketing performance, as well as developing their tech systems. Misr Life Insurance Chairman Ahmed Abdel Aziz had said in July that the company was working on completing a valuation study and hiring advisers in time to offer 15-30% of the company’s shares in 1Q2019.

INVESTMENT WATCH- EKH releases additional info on EGP 3 bn wood investment: Egypt Kuwait Holding (EKH) issued a clarification on Thursday on its recently announced plans to invest in wood production. The company is investing EGP 2 bn in a compressed wood plant in Beni Suef, which will be built over two phases, according to a bourse statement by EKH (pdf). 50% of the plant would be self-financed, while the other half would be funded through loans, the note read. EKH is planning to invest EGP 1 bn to grow feedstock for the plant and is seeking land on which to grow trees. Local press reports citing statements attributed to Chairman Moataz El Alfy at a press conference implied that the project was either moved from Beni Suef to Minya, or that a separate facility was being developed, prompting the company to issue Thursday’s statements.

Potatogate: Egypt competition watchdog raids Agriculture Export Council: Officials from the Egyptian Competition Authority (ECA) and the police raided the offices of the Agriculture Export Council on allegations of “monopolizing agriculture exports and involvement in raising the price of potatoes,” according to a statement on Thursday by the ECA (pdf). The ECA did not reveal the details of the investigation or the raid, except to say that it was prompted by complaints from farmers that a group of exporters that are members of the council had engaged in anti-competitive behaviour. The statement did not explain how these members were involved in the recent spike in the price of potatoes currently causing hysteria in the nation.

ECA also investigates Damietta transport companies: The ECA had also brought lawsuits against a number of transportation and freight companies in Damietta, accusing them of colluding to fix freight prices, the statement said.

Business associations to ECA: Miami Vice called, and it wants its script back: A number of business associations issued statements on Thursday condemning what they describe as “heavy-handed” tactics by the ECA. The Federation of Egyptian Chambers of Commerce (known by the unfortunate acronym FEDCOC) and the Egyptian Businessmen’s Association also denounced previous ECA raids on several member divisions of the Federation of Egyptian Industries, and the Federation of Egyptian Chambers of Commerce in Cairo and Alexandria. The statements said the competition watchdog’s tactics were hurting the investment climate and discouraging exporters. The EBA described the move as “irresponsible,” Youm7 reports.

LEGISLATION WATCH- Mineral Resources Act will focus on “value-added” minerals: The amendments to the Mineral Resources Act reflects a desire by the government to focus on resources that can be refined, used for industry or move up the value chain, Oil Minister Tarek El Molla said on Thursday. Speaking at a workshop on the amendments, El Molla reiterated that part of the objectives of the mining sector reforms was to make the industry attractive to both domestic and foreign players, according to AMAY, which noted little of what said about the fine print of the law. El Molla had said last month that the amendments to the act would be presented to the House of Representatives in three months.

Why the private sector loves the new reforms: Previous reports indicate that the reforms will see Egypt scrap the current oil-and-gas-style production sharing agreement and move to a tax, rent and royalty model — and eliminate the requirement of a 50:50 JV with EMRA. The bill is also expected to allow exploration companies to acquire exploration ground without first obtaining exploration licenses. The amendments have received the overwhelming support of the industry, with top execs at Aton Resources, Thani Stratex Resources and Resolute Egypt signing an exclusive op-ed for Enterprise praising the reforms.

LEGISLATION WATCH- Insurance Act to require insurance on electronic banking transactions: The Insurance Act, which is currently under review by the Financial Regulatory Authority (FRA) board, is expected to introduce compulsory insurance on internet banking to protect banks against cyber attacks, FRA boss Mohamed Omran said. The legislation, which would make FRA the primary regulatory for the insurance sector, is also expected to introduce compulsory insurance for SMEs and make insurance cover mandatory for public gatherings and venues. FRA plans to send the first draft of the proposed legislation to the Public Enterprises Ministry, the Insurance Federation of Egypt, and the Egyptian Healthcare Management Society before mid-month.

CABINET WATCH- Cabinet discusses IMF review, staff-level agreement to disburse fifth tranche: The Madbouly Cabinet discussed during its weekly meeting on Thursday a staff-level agreement Egypt reached with the IMF last week to disburse the fifth USD 2 bn tranche of its USD 12 bn extended fund facility, according to a Cabinet statement. The fifth tranche will bring the total payments disbursed under the facility to USD 10 bn in two years.

The ministers also ratified a 2017 decision to establish the SME Development Authority, which then-Prime Minister Sherif Ismail decided would replace the Social Fund for Development. Cabinet also discussed trade liberalization and the establishment of a Retail Syndicate.

EFG Hermes topped the EGX’s brokerage league table for October with a market share of 20.4%, according to figures released by the EGX (pdf). Beltone Financial came in second this month with a 17.2% market share, followed by CI Capital (8.1%), HC Brokerage (4.9%), and Pharos (4.2%).

EARNINGS WATCH- CI Capital reported a net profit after tax and minority interest of EGP 304.7 mn in 9M2018, up 128% y-o-y, in a statement on Thursday (pdf). Total revenues for 9M2018 were up 51% y-o-y to EGP 1.8 bn.

Oriental Weavers saw its net income fall 12% y-o-y in 3Q2018 to EGP 96 mn, the company said in its earnings release (pdf). Total revenues fell 2% y-o-y in 3Q2018 to EGP 2.6 bn.

CORRECTION- We had picked up an incorrect report from the domestic press last week claiming that Egypt’s non-oil exports rose 7% y-o-y in 9M2018 to USD 16.6 bn. Exports actually rose 11% y-o-y during the period to reach USD 18.5 bn compared to USD 16.6 bn during the same period last year, according to a Trade Ministry statement (pdf). We’ve fixed the mistake on our web edition.

Egypt in the News

The arrest of prominent rights activists topped foreign coverage over the weekend: Authorities arrested 19 human rights activists “in raids that reflect the country’s security state is widening its assault on government critics,” Jared Malsin writes for the Wall Street Journal. Newspapers around the world have picked up wire service coverage of the story since Thursday.

Also worth noting:

- “Arab NATO”: The military exercises taking in place in Egypt between five Arab countries is a preview of the “Arab Nato” alliance suggested by US President Donald Trump, Haaretz says.

- Human Rights Watch issued two statements on Thursday condemning the Egyptian government. The first statement concerns the alleged torture of Khaled Hassan, while the second condemned the imprisonment of journalists.

- The release of human rights and labor lawyer Haytham Mohamdeen is “a small but welcome victory,” Amnesty International said last week. Mohamdeen was detained in May pending investigations over his involvement with a banned group and participating in illegal protests.

Diplomacy + Foreign Trade

A European Parliament delegation was in town last week for the 12th inter-parliamentary meeting with Egyptian members of parliament, according to an EP statement. The delegation called for increased EU-cooperation, and said the EU is hoping to “foster a political dialogue” based on shared respect for human and personal rights.

Basic Materials + Commodities

Strong appetite among traders for Egypt’s first int’l rice tender

As of last Thursday, the General Authority for Supply Commodities (GASC) received 22 offers from traders bidding on Egypt’s first international rice tender, which took place a week prior, the Supply Ministry said, according to Reuters Arabic. GASC will continue to take offers until 12 November.

Manufacturing

AOI, Lindenberg sign agreement to manufacture railway generators in Egypt

The Arab Organization for Industrialization (AOI) has signed a cooperation agreement with Germany’s Lindenberg-Anlagen to begin manufacturing railway power generators in Egypt, AOI head Abdel Moneim El Teras said, according to Al Shorouk. No further details were provided.

Real Estate + Housing

CIRA to build educational complex in New Alamein City

The New Urban Communities Authority (NUCA) has allocated a 14.3k sqm land plot for Cairo Investment and Real Estate Development (CIRA) to build an educational complex in the New Alamein City. No further details were provided.

Andalusia Group to establish new healthcare facility in New Alamein City

Healthcare provider Andalusia Group is planning to establish a new medical facility in New Alamein, and will purchase land from the New Urban Communities Authority (NUCA) soon. The company is required to submit a feasibility study to NUCA within two months of NUCA determining the value of the land plot allocated for the project. No further details were provided. The group had previously announced a three-year plan to invest US 50 mn in the domestic market.

Mariout Hills Development to invest EGP 8 bn in New Alamein developments

Real estate company Mariout Hills plans to invest EGP 8 bn in developing projects in a New Alamein, Chairman and founder Ahmed Hassan said, according to Al Shorouk. The company is also in talks to acquire 100 feddans in New Mansoura as part of its plan to develop projects in five new cities across Egypt, including the new capital, New Assiut and in Upper Egypt. The New Urban Communities Authority had issued last month tenders for private sector real estate development in New Mansoura and New Alamein.

First phase of New Mansoura to attract EGP 45 bn in investments

The first phase of the New Mansoura project is expected to draw in EGP 45 bn of investments, New Mansoura Authority Deputy Chairman Yasser Kahla said. Arab Contractors will carry out EGP 10 bn worth of infrastructure developments in the coastal city, which will take around three years to complete.

Tourism

Lufthansa flights return to Hurghada; TUI and FlyNas to launch new Egypt flights

The first Lufthansa flight to Hurghada since 2015 landed at the Red Sea town on Thursday with 200 tourists from Munich on board, reports Egypt Independent. The German national carrier also launched another weekly direct route to Marsa Alam on Friday. This comes as UK-based travel firm TUI is planning new charter flights to Marsa Alam and Hurghada from Birmingham as part of its winter 2019 holiday packages, according to BirminghamLive. Saudi national carrier Flynas will also be launching daily direct flights to Cairo from Dammam on 24 November, the company announced.

Automotive + Transportation

Lack of appetite pushes monorail tender deadline

Contractors’ lack of interest in bidding on the new capital-6 October monorail has led the government to push the deadline for submitting offers to November, sources tell Al Mal. This is the second time since September that the committee has postponed the deadline for the tender. The winning bid was supposed to have been announced last month. The tender project had been fraught with delays since 2015.

Transport Minister meets with AfDB to discuss funding for transport projects

Transport Minister Hisham Arafat met with the African Development Bank’s country manager for Egypt, Malinne Blomberg, on Thursday to discuss additional funding packages for Egypt’s transport projects, Al Mal reports. Among the projects discussed: Developing railway train tracking and control and train-to-train communication networks from Luxor to Aswan, as well as upgrading the maritime transport crisis management and dry ports centers.

Banking + Finance

State banks are considering issuing letters of guarantee for Dabaa nuclear project

The Nuclear Power Plant Authority (NPPA) is negotiating with local banks for letters of guarantee worth USD 300-400 mn to cover its loans for the Dabaa nuclear project, unidentified sources tell Al Shorouk. Banque Misr and the National Bank of Egypt had agreed last December to provide USD 580 mn in trade finance facilities to the NPPA for the implementation of the Dabaa project.

Other Business News of Note

NUCA rescinds decision to seize land from 21 “distressed” factories

The New Urban Communities Authority (NUCA) has rescinded a decision to seize land from 21 investors from the New Cairo 1,000 factories project, NUCA’s deputy head of real estate and commercial affairs Tarek El Sebaie said. The investors have been granted a final three-month ultimatum to begin construction. The Industrial Development Authority has previously issued several warnings and ultimatums to investors in the project, several of whom have run into repeated infrastructure and regulatory hurdles since the zone was developed.

Egypt Politics + Economics

Lebanon exempts Egypt from aluminum import tariffs

Lebanon has exempted Egypt from recent tariffs it imposed on Egyptian, Emirati, Saudi, and Chinese aluminum imports, according to a Trade and Industry Ministry statement.

National Security

Russian-made fighter plane crashes during training in Egypt

A Russian-made MiG-29 fighter plane crashed during a training flight in Egypt due to a technical malfunction in the aircraft’s control tools, Egyptian army spokesman Tamer El Rifai said in a statement. Technical experts from Russian aerospace and defense company United Aircraft Corporation will help carry out investigations, according to Russian newspaper Kommersant. Sputnik and Reuters also picked up the story.

On Your Way Out

One fifth of marriages in Egypt end within three years: Out of Egypt’s annual 980k marriages, 198k fail to make it past the third year. The figures, cited by Cabinet spokesperson Nader Saad, mean that Egypt has a 20% early divorce rate, according to Egypt Today. Early divorces are particularly concentrated among couples aged 25-35, according to Saad. The government is apparently preparing an initiative to encourage couples to stay together rather than seek divorce.

The Market Yesterday

EGP / USD CBE market average: Buy 17.86 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Thursday): 13,202 (-0.4%)

Turnover: EGP 902 mn (28% above the 90-day average)

EGX 30 year-to-date: -12.1%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session down 0.4%. CIB, the index heaviest constituent ended down 0.3%. EGX30’s top performing constituents were Emaar Misr up 3.5%, and Egyptian Resorts up 2.2%, and Abu Qir Fertilizers up 1.5%. Thursday’s worst performing stocks were Sidi kerir Petrochemicals down 7.6%, Orascom Investment Holding down 4.5% and Ezz Steel down 3.4%. The market turnover was EGP902 mn, and regional investors were the sole net buyers.

Foreigners: Net Short | EGP -38.6 mn

Regional: Net Long | EGP +48.0 mn

Domestic: Net Short | EGP -9.5 mn

Retail: 57.9% of total trades | 61.1% of buyers | 54.6% of sellers

Institutions: 42.1% of total trades | 38.9% of buyers | 45.4% of sellers

Foreign: 25.2% of total | 23.1% of buyers | 27.4% of sellers

Regional: 13.2% of total | 15.8% of buyers | 10.5% of sellers

Domestic: 61.6% of total | 61.1% of buyers | 62.1% of sellers

WTI: USD 63.14 (-0.86%)

Brent: USD 72.83 (-0.08%)

Natural Gas (Nymex, futures prices) USD 3.28 MMBtu, (+1.45%, December 2018 contract)

Gold: USD 1,233.30/ troy ounce (-0.43%)

TASI: 7,879.37 (-0.35%) (YTD: +9.04%)

ADX: 4,920.67 (+0.38%) (YTD: +11.87%)

DFM: 2,805.22 (+0.74%) (YTD: -16.76%)

KSE Premier Market: 5,262.86 (+0.55%)

QE: 10,280.96 (-0.19%) (YTD: +20.62%)

MSM: 4,422.17(-0.02%) (YTD: -13.28%)

BB: 1,313.22 (-0.11%) (YTD: -1.39%)

Calendar

03-06 November (Saturday-Tuesday): World Youth Forum 2018, Maritim Jolie Ville Golf Course, Sharm El Sheikh, Egypt.

05 November (Monday): Egypt’s Emirates NBD PMI for October released.

05-07 November (Monday-Wednesday): World Travel Market London exhibition, London, England, UK.

06-07 November (Tuesday-Wednesday): 2018 IIF MENA Financial Summit, Al Maryah Island, Abu Dhabi, United Arab Emirates.

13-29 November (Tuesday-Thursday): UN Biodiversity Conference, Sharm El Sheikh, Egypt.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.15 November (Thursday) The T20 Invest in Healthcare Conference 2018, Nile Ritz Carlton Hotel, Cairo, Egypt.

17-19 November (Saturday-Monday): ElectricX-Energizing The Industry, Egypt International Exhibition Center, Cairo, Egypt.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

End of November: A delegation from the Egypt-Greece Business Council will visit Athens at the end of November to promote investment, the council’s chairman, Hani Berzi, said.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

13-15 December (Thursday-Saturday): Forum on “ The Role of Digital Financial Communication and Solutions in Enhancing Financial Inclusion,” Sharm El Sheik, venue TBD.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.