- Gov’t studies raising stamp tax on select activities in insurance, construction, and mining sectors. (Speed Round)

- When government policy works: The white cab program slashed Egypt’s carbon dioxide emissions by 310k tonnes in 2013-2017. (Speed Round)

- Egypt’s SWF to be managed by Egyptian. (Speed Round)

- Cabinet is expected to receive the final draft of the Customs Act this week for review. (Speed Round)

- Hurghada receives first EasyJet flights after three-year hiatus. (Tourism)

- El Sisi kicks off four-day visit to Germany. (Diplomacy + Foreign Trade)

- Profit and work-life balance are not enemies. (Worth Reading)

- Is the Pharaoh Hound the direct descendant of a breed of ancient Egyptian hunting dogs? (On Your Way Out)

- The Market Yesterday

Monday, 29 October 2018

White cab program slashes Egypt’s CO2 emissions

TL;DR

What We’re Tracking Today

Sometimes Mondays roar to life. Others, we’re left wondering, “We got out of bed early / worked overnight for this?” It’s a case of the latter today, at home and abroad. More often than not, that means we’re in for a rather busy day.

Spooky pre-Halloween fact: “With European and emerging market equities already down for the year before October’s turbulence, analysts at Bank of America Merrill Lynch estimate that just over 60 per cent of global stocks are now in a bear market. There are plenty of considerations for those investors having to judge whether this provides a buying opportunity.” (Read)

Khashoggi? Saudi is too big to ignore, investors say: Investors bullish on KSA see that the murder of Washington Post contributor Jamal Khashoggi will not hurt the kingdom’s investment prospects as the country is simply too big to ignore. This comes despite the KSA main index’s 30-day historical volatility climbing to the highest since 2016 and the yield on its USD 5 bn worth of 10-year notes rising to a record. “It will probably create some negative headlines but at the end of the day, people will forget after a while and it will have minimum impact on Saudi Arabia’s economic activities and also the credit quality,” a senior money manager at Hong Kong-based Nexus Investment Advisors tells Bloomberg. “It’s the fear over potential actions from the international community that’s driving the market now,” says Mohamed Elmi, an EM money manager at Federated Investors UK. “Nothing changes concerning the overriding credit quality of the overall Saudi credit complex,” he added.

Speed-bump on the road to a post-oil future? Perhaps the most visible long-term economic impact of the Khashoggi murder could be the derailing of Mohammed bin Salman’s push away from big oil. Leading oil companies made a strong showing at last week’s “Davos in the Desert” conference — far stronger than the tech and IT sector, which the Crown Prince had been wanting to draw. Out of USD 50 bn in new transactions and agreements, USD 30 bn have been in the traditional sectors of oil and refining, notes Reuters.

Oh, and don’t call the Future Investment Summit “Davos in the Desert” — that apparently makes the World Economic Forum people most unhappy.

When research gives private equity a rash: US private equity players are flexing their muscles — in a dermatology journal, of all places. “Early this month, a respected medical journal published a research paper on its website that analyzed the effects of a business trend roiling the field of dermatology: the rapid entrance of private equity firms into the specialty by buying and running practices around the country. Eight days later, after an outcry from private equity executives and dermatologists associated with private equity firms, the editor of the publication removed the paper from the site. No reason was given.” Read the full story in the New York Times.

The latest on rapprochement with Israel: Just days after Benjamin Netanyahu visited Oman and met Sultan Qaboos, the national anthem of our neighbors to the east was played for the first time in Abu Dhabi after an Israeli competitor won gold at the Abu Dhabi Judo Grand Slam. More in the Jerusalem Post and on Tweeter.

Brazil has elected a far-right politician as its next president. “Jair Bolsonaro won Brazil’s presidential election on Sunday, promising to clean up politics, shrink the state and crack down on crime, in a dramatic swing away from the left in the world’s fourth-largest democracy.” (Reuters)

We’re one week out from the 5 November (re)imposition of US sanctions on Iran, and nobody quite knows how that will shake out.

Americans head to the polls in midterm elections a week from tomorrow.

In miscellany this morning:

- You can reboot your career at any age with an MBA, even if you’re in your 50s and 60s. (Financial Times)

- Family offices are attracting young investment professionals with a demonstrated interest in impact investing. (Financial Times)

Apple will announce new hardware tomorrow. The device maker is expected to unveil new iPad Pros (iPads Pro?), a successor to the MacBook Air and possibly lots more. The Verge’s Chaim Gartenberg has a solid rundown on what you can expect, and MacRumors goes even deeper. Or you can wait to be surprised tomorrow at 4pm CLT and tune in on Apple’s event page.

Enterprise+: Last Night’s Talk Shows

It was another night of random selections on the airwaves, with topics ranging from the crackdown on private tutoring, to potato prices, and Habib El Adly’s ongoing trial.

The Education Ministry is cracking down hard on private tutoring. The ministry is two weeks away from presenting the Madbouly Cabinet with a law proposal that criminalizes the act of establishing an unsanctioned tutoring center, setting hefty fines and prison sentences, Deputy Minister Mohamed Omar told Al Hayah Al Youm. The bill would also require teachers to obtain a license that allows them to work at private tutoring centers, or face punishments that also include jail time and dismissal, he said (watch, runtime: 6:08).

Potato prices appear to have miraculously dropped overnight. Wholesale prices are down 30-40% and the retail price of spuds are following suit, the deputy head of the Obour market union, Hatem El Naguib told Hona Al Asema’s Reham Ibrahim. He said that the combined efforts of the ministries of supply and interior, as well as civil society groups, have helped convince traders to keep their profit margins on potatoes low at 10-20% to make sure the commodity remains accessible to the public. Prices should dip further after the upcoming November harvest (watch, runtime: 9:12). The Agriculture Ministry’s Mahmoud Atta said more of the same on Masaa DMC (watch, runtime: 7:45).

Subsidized baby formula imports: The Health Ministry will be supplying Egyptian Pharmaceutical Trading Company outlets with imported baby formula at EGP 50 apiece, the head of the ministry’s population and family planning division, Soad Abdel Meguid, told Hona Al Asema (watch, runtime: 7:18) and Masaa DMC (watch, runtime: 3:36). The ministry has provided some 1 mn units since last week, she said.

Egyptian-British cardiothoracic surgeon Magdi Yacoub established a new research center in Egypt, Eva Pharma Chairman Riad Armanios told Hona Al Asema. The center employs more than 80 scientists and is said to be the largest of its kind in the region. Yacoub is also planning to build a surgical cardiac center in the new capital similar to his Aswan facility (watch, runtime: 4:36).

Meanwhile on El Hekaya, Amr Adib followed up on the latest trial of former Interior Minister Habib El Adly. Adib shared snippets of Adly’s testimony, wherein the former minister talks about conspiracies and plots to bring Egypt down during the period leading up to 25 January 2011. Ex-president Hosni Mubarak is reportedly set to testify in the case as well, which also implicates his successor Mohammed Morsi, according to Adib (watch here, runtime: 22:07 and here, runtime: 3:28).

Speed Round

** #1 EXCLUSIVE- Gov’t studies raising stamp tax on select activities in insurance, construction, mining sectors: The government is studying raising the stamp tax payable for select activities in sectors including insurance, real estate and mining, Finance Ministry sources told Enterprise. The proposal would see higher stamp tax rates paid to take out building permits, mining licenses and insurance policies. It would be the first stamp tax increase on those activities since 2006, one of the sources noted. The news comes a day after we reported that officials are mulling whether to scrap a fee on new mobile lines in favor of a new service fee or hiking the stamp tax on mobile phone bills.

** #2 When government policy works: The white cab program slashed Egypt’s carbon dioxide emissions by 310k tonnes in 2013-2017: A government scheme to scrap and recycle old taxis in Egypt led to a 310k ton decrease in Egypt’s carbon dioxide emissions between 2013 and 2017, the World Bank said on Thursday. The WB is expecting emission reductions to reach 350k tons by the end of this calendar year. The program took some 45k aging taxis off the streets by providing drivers subsidized financing for modern, fuel-efficient, locally assembled vehicles.

Background: In a bid to combat air pollution, Egypt passed a new traffic law in 2008 that banned renewing licenses of taxis and microbuses that were over 20 years old. To facilitate the transition for cab drivers, the government then allowed taxi owners affected by the law to turn in their vehicles for scrap and buy new vehicles installments. The government at the time lined up World Bank assistance through its Carbon Partnership Facility (CPF). The WB committed up to USD 8.3 mn in funding for the initiative through to 2021.

Rollout to other governorates? The program, originally focused squarely on Cairo, could roll out in the future to other governorates, the World Bank suggests, and is being studied by other African governments.

** #3 Egypt’s SWF to be managed by Egyptian: The Planning Ministry committee charged with selecting the manager of Egypt’s EGP 200 bn sovereign wealth fund has reportedly decided to hire an Egyptian, ministry sources tell Al Masry Al Youm. Egyptians who were in the running to head the new fund have proven to be more than qualified for the job, leading to a hiring preference for a national, the sources added. A short list of names has already been selected from a pool of 220 and will be sent to the Madbouly Cabinet for approval. Egypt will announce the CEO of its new sovereign wealth fund in a month and half’s time, Planning Minister Hala El Said said last week.

** #4 EXCLUSIVE- LEGISLATION WATCH- The Madbouly Cabinet is expected to receive the final draft of the Customs Act this week for review, a senior government official told Enterprise yesterday. Finance Minister Mohamed Maait had said last week that the bill — which means to bring local customs laws in line with international best practices and raise Egypt’s ranking in a number of global indices — was being finalized and would be presented to the cabinet and Council of State (Maglis Al Dawla) soon. Earlier this month, the ministry had released a draft of the act following consultations with business groups and global institutions such as the World Bank and World Customs Organization. The bill is, which is expected to be presented to the House of Representatives during the current legislative term, includes provisions that should expedite the clearance of goods through customs, create a white list of importers, and expand the Customs Authority’s powers.

In other legislative news, MPs say they have not had any talks with the Finance Ministry about the cancellation of a EGP 50 levy on new mobile phone lines. Some of them told Al Mal yesterday that the policy could only be repealed or replaced through a legislative amendment and that they have yet to receive any word from the government. Our sources in the government had told us that the Finance Ministry is considering canceling the duty, which has reportedly weighed down line sales and failed to generate revenues for the state, and is studying two alternative approaches that could see them either introduce a new service fee or double the stamp tax on mobile phone bills.

BOARD MOVES- Mohamed Farag has been named non-executive chairman at Fawry Plus. Farag, who is chief digital officer at CIB, says Fawry Plus is currently waiting on the CBE to grant it a license to carry out electronic banking services.

MOVES- State-owned Misr Insurance Holding Company (MIHC) has officially appointed Basel El Hiny (LinkedIn) as company chairman and managing director, according to a Public Enterprises Ministry press release. El Hiny will chair the newly appointed MIHC board of directors for three years. As we noted last week, El Hiny had previously served as vice chairman of the company and has 26 years of experience in banking and finance.

CORRECTION- Whirlpool will be assembling Whirlpool-branded washing machines in a partnership with MTI Holding. An earlier story in the domestic press, which we noted last week, had said Whirlpool was doing a JV to assemble Ariston-branded white goods. We have updated the story on our website.

***

WE’RE HIRING: We’re looking for smart, talented, and seasoned journalists and editors to join our team at Enterprise, which produces the newsletter you’re reading right now. We’re looking for people who can work on this product and help us launch exciting new stuff. Applicants should have serious English-language writing chops, a strong interest — and preferably some professional experience — in business journalism, and solid analytical skills. The ideal candidate for us is a native-level-writer of English with the ability to read and understand Arabic. We offer the chance to work in a unique and casual work environment that promises to be intellectually challenging and rewarding. If you’re interested, please submit your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Please direct your applications to jobs@enterprisemea.com.

***

Up Next

Pride Capital at ConFEAS 2018: Pride Capital Co-founder and CEO Rami El Dokany will speak about the role of fintech in supporting investment at the Federation of Euro-Asian Stock Exchanges’ annual conference (ConFEAS 2018), which takes place today and tomorrow in Abu Dhabi. El Dokany’s discussion will focus on the latest in Egypt’s fintech scene, as well as the role that fintech companies can play in overall economic development, according to a press release (pdf).

The first annual Middle East Conference on Business Angel Investment will take place on Thursday, 1 November in El Gouna, according to a statement from the Middle East Angel Investment Network (MAIN). The conference will bring together angel investors, venture capitalists and others to discuss the latest trends in fintech, clean tech, health technology and transportation technology.

Egypt’s World Youth Forum 2018takes place in Sharm El Sheikh on Saturday, 3 November.

The draft SMEs Act is expected to be made public within a week, SMEs Development Authority head Nevine Gamea said on Wednesday, according to Al Mal. The draft law sets out incentives — mainly in the form of services and subsidized access to finance — for owners of micro-, small- and medium-sized enterprises to go legit and pay taxes.

The central bank reviews interest rates in a little over two weeks’ time. The CBE’s monetary policy committee meets on Thursday, 15 November.

Image of the Day

Modern-day female monarchs have their Ancient Egyptian predecessors to thank for setting the example. In fact, queens and princesses of the modern age “have rarely possessed the type of power wielded by the female leaders of ancient Egypt,” according to National Geographic. And although the patriarchy has, over time, tried to obliterate their names from history, “these women enjoyed the sort of human rights that their counterparts today are still fighting for—they worked, owned property, ran businesses, and divorced their husbands.”

Egypt in the News

Nothing to see here today, folks. Move along.

Worth Reading

** #7 You can build a company without working your staff to death: Longtime readers will know we are fans of Jason Fried and David Heinemeier Hansson, who run Chicago-based software outfit Basecamp. In their latest book, It Doesn’t Have to be Crazy at Work, the two argue that a company can make profit without driving its employees insane with work. The Economist has taken note, writing in a review that “tired workers will not be productive since creativity, progress and impact do not yield to brute force,” adding that “sleep-deprived managers are likely to be counterproductively impatient.” The pair live by example, with employees working 40 hours per week, except in the summer during which the company runs a four-day, 32-hour week. They’re also entitled to three weeks of vacation per year, a month-long sabbatical every three years and a monthly massage.

Your colleagues are not family and the office isn’t home, no matter how many times your bosses say so: The authors warn against offices who add game rooms or other entertainment facilities, explaining that their intention is to keep employees at the office longer. They also warn against phrases like “we’re all family” explaining that such rhetoric is used to manipulate employees into thinking work is more important than their actual families.

Other helpful tips from the dogmatic duo:

- No one can get any work done in a packed noisy office; a calm environment is essential to maintain a productive workflow;

- Meetings waste everybody’s time; if you can relay your message in an email, please do;

- Keep deadlines realistic;

- Allow workers sufficient time to respond to queries.

Worth Watching

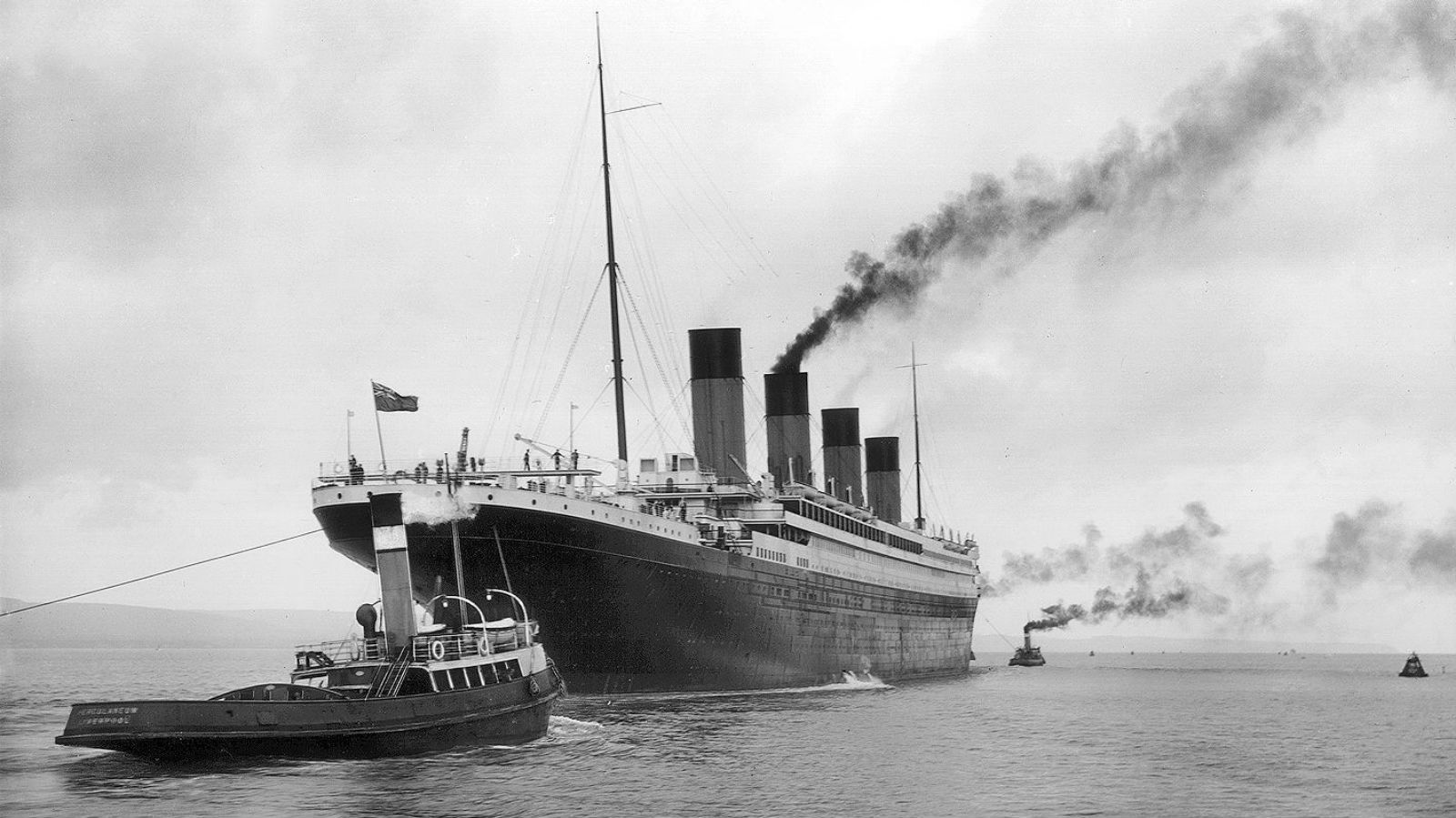

A replica of the infamous RMS Titanic will retrace the original ship’s journey across the Atlantic 110 years later. After budget constraints caused work on the vessel to stop for nearly three years, Australian shipping company Blue Star Line announced that the trip is back on and scheduled for 2022, according to ABC News. The ship will carry passengers from Southampton to New York. The remains of the Titanic were discovered in 1985 (watch here, runtime 4:31)

Diplomacy + Foreign Trade

** #6 President Abdel Fattah El Sisi arrived in the German capital on Sunday for a four-day visit to attend the G20 Compact with Africa conference, according to the State Information Service (SIS). On his first day in Berlin, the President met with execs from the Federation of German Defense and Security Industries to discuss boosting military cooperation as well as the chairman of the Munich Security Conference, Wolfgang Ischinger, for talks on regional security.

El Sisi is scheduled to hold bilateral talks with Chancellor Angela Merkel and German President Frank Steinmeier, other German officials and businessmen, as well as African leaders. The president met a delegation from the German parliament in Cairo ahead of his visit

to discuss cooperation in the fields of investment, health, education, and illegal migration. The delegation had expressed interest in increasing economic support for Egypt, according to an Investment Ministry statement.

The G20 summit holds a special significance for Egypt, as the EU looks to make us the model for an EU-North Africa partnership on combating illegal migration from Africa and Middle East. Egypt’s emerging role — championed by European Council President Donald Tusk and Austrian Chancellor Sebastian Kurz — could see the country’s coast guard patrol the waters off Libya and take any rescued people back to Africa. The push could see Egypt access funding from the EU to cover these missions in a Turkey-style migrant agreement. Director-General for EU Neighborhood Policy and Enlargement Negotiations Christian Danielsson signed earlier this month a EUR 60 mn funding agreement aimed at curbing illegal immigration in Egypt.

The story got some air time on Hona Al Asema (watch, runtime: 4:51) and Masaa DMC (watch, runtime: 17: 44).

Energy

Three bidders to submit financial offers for EUR 260 mn 250 MW Suez wind farm

Three international suitors have qualified to bid on the EUR 260 mn, 250 MW wind farm in the Gulf of Suez, sources from the New and Renewable Energy Authority (NREA) said yesterday. Siemens, Danish wind turbine manufacturer Vestas, and German wind energy solutions Senvion, the qualified companies, have until 9 December to submit their offers. NREA had received seven requests from international companies to take part in the tender, which NREA launched earlier this year.

Infrastructure

ITDA awards UCTD contracts to build EGP 1 bn logistics zone in Qena

The Supply Ministry’s Internal Trade Development Authority (ITDA) has awarded United Company for Trading and Distribution contracts to develop a EGP 1 bn logistics and commercial zone in Qena, ministry aide Ibrahim El Ashmawy said, according to Al Shorouk. The project, for which a tender was launched in September, will see storage facilities, alongside retail outlets and stores developed in Qena over the next three years.

Real Estate + Housing

Arabia Holding to invest EGP 1.5 bn in Galleria and Sun Capital in 2019

Real estate developer Arabia Holding is planning to invest EGP 1.5 bn in its flagship projects Galleria and Sun Capital during 2019, company Chairman Tarek Shoukry said. The company had recently broke ground on Sun Capital, in West Cairo, and is planning to invest EGP 500 mn in its Galleria project in East Cairo.

Tourism

Hurghada receives first EasyJet flights after three-year hiatus

** #5 Hurghada International Airport received yesterday its first two EasyJet flights from Milan after a near three-year hiatus, Al Masry Al Youm reports, citing government sources. The British low-cost carrier had suspended flights to Red Sea destinations after the 2015 Metrojet crash. We had said in August that EasyJet would be making its comeback to Red Sea destinations soon.

Automotive + Transportation

Boudy Group to invest EGP 50 mn in new maintenance center

The local agent for China’s Changhe Automobile, Boudy Group, is planning to spend EGP 50 mn on a new maintenance center in Abu Rawash, Sales manager Gamal Tenna tells Al Mal. The new facility is part of the company’s efforts to expand its after sales division.

Banking + Finance

Wasel in talks with Wamda Capital over USD 200k

Mass transit startup Wasel is in talks with the UAE’s Wamda Capital for a USD 200k funding round to finance its expansion plans in Egypt’s southern governorates, founder Ahmed Elrawy said. The company, which had scored USD 26,000 in funding from the British embassy, is already operating in eight of Egypt’s southern governorates. It allows customers to book affordable bus rides online from and to various locations across the country, and is a direct competitor to the other successful mass transit app Swvl, which set the record for Series A funding in Egypt at USD 8 mn.

Other Business News of Note

Mastercard reaffirms commitment to help drive public-private partnership-led growth

Mastercard’s Chief Product Officer Michael Miebach reaffirmed the company’s commitment to helping Egypt push forward public-private partnerships to drive economic development, in the American Chamber of Commerce’s ministerial panel discussion last week. “Effective public-private partnerships present a tremendous opportunity to drive sustainable and diversified economic development in the country. We have worked to blend our global programs with local experience to meet the needs of Egyptians and how they want to pay and be paid,” said Miebach. He also praised the National Council for Payments initiative, which he says is the first council of its kind in the world. He noted that the initiative reaffirms the Egyptian government’s firm resolve to advance financial inclusion in the country. “We will continue to draw on the right partners to solve real problems with products and solutions that further support Egypt’s continued economic growth,” Miebach added, according to a company statement (pdf).

Egypt Politics + Economics

Egypt freezones exports reach USD 14.7 mn in 9M2018

Exports from companies based in freezones rose to USD 14.7 mn in 9M2018, up from USD 13.6 mn during the same period last year, according to an Investment Ministry statement. There are currently seven operational freezones, hosting a total of 1102 companies, and seven others currently being built across Egypt.

MP proposes tougher punishment for underage marriage in Egypt

Rep. Mohamed El Aqqad is pushing for a bill to punish those involved in underage marriage with prison sentences between 5-10 years or fines of up to EGP 100k, he said in a statement, according to Youm 7. We reported last year that the justice ministry was working on a draft law that would criminalize underage marriage.

National Security

Court adds former Islamist leaders to terror rolls

An Egyptian court yesterday added the names of 164 prominent Islamists to the state’s terrorist rolls, including former Jama’a Islamiyah members Tarek El Zomor, Mohamed El Islamboli, and Assem Abdel Magued. The court also froze their assets, Xinhua reports, citing the state news agency.

On Your Way Out

You can pay your traffic fines at the post office as of November, ICT Minister Amr Talaat said, according to Youm7. The service will be piloted for two weeks first in Cairo before rolling out at upgraded post offices elsewhere in the country, he added.

** #8 Calling all dog lovers (the slow news day is working in your favor). The case of the Maltese dog of Egyptian origins: If the name hasn’t clued you in by now, the Pharaoh Hound is a dog breed suspected to have genetic ties to the Ancient Egyptian hunting dogs depicted on the walls of tombs. They are prevalent in the island of Malta, but their “yoda type” look have led many to believe that they are descendants of the oldest domesticated “Tesem” hunting hounds of ancient Egypt, who made it to Malta on board Phoenician trade ships. However, genetic verification has been hard to come by with many scientists and dog breeders thinking the link a myth (all you need to know about the Pharaoh Hound, runtime: 15:27).

The Market Yesterday

EGP / USD CBE market average: Buy 17.86 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Sunday): 12,981 (-0.3%)

Turnover: EGP 462 mn (34% below the 90-day average)

EGX 30 year-to-date: -13.6%

THE MARKET ON SUNDAY: The EGX30 index ended Sunday’s session down 0.3%. CIB, the index heaviest constituent ended down1.6%. EGX30’s top performing constituents were Pioneers Holding up 4.8%, and Qalaa Holdings up 4.3%, and Palm Hills up 4.1%. Yesterday’s worst performing stocks were Eastern Company down 2.0%, Ibnsina Pharma down 2.0% and CIB down 1.6%. The market turnover was EGP 462 mn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +43.8 mn

Regional: Net Long | EGP +10.7mn

Domestic: Net Short | EGP -54.5 mn

Retail: 68.9% of total trades | 67.8% of buyers | 70.0% of sellers

Institutions: 31.1% of total trades | 32.2% of buyers | 30.0% of sellers

Foreign: 11.0% of total | 15.7% of buyers | 6.2% of sellers

Regional: 12.0% of total | 13.2% of buyers | 10.9% of sellers

Domestic: 77.0% of total | 71.1% of buyers | 82.9% of sellers

WTI: USD 67.60 (+0.01%)

Brent: USD 77.66 (+0.05%)

Natural Gas (Nymex, futures prices) USD -0.03 MMBtu, (-1.07%, November 2018 contract)

Gold: USD 1,235.60/ troy ounce (-0.02%)

TASI: 7,802.65 (-0.42%) (YTD: +7.98%)

ADX: 4,897.57 (+0.31%) (YTD: +11.35%)

DFM: 2,724.83 (-0.42%) (YTD: -19.15%)

KSE Premier Market: 5,217.79 (-0.2%)

QE: 10,144.37 (-0.09%) (YTD: +19.02%)

MSM: 4,453.97 (+0.02%) (YTD: -12.65%)

BB: 1,318.87 (+0.25%) (YTD: -0.96%)

Calendar

28-30 October (Sunday-Tuesday): 1st Sharm El Sheikh Rendezvous, annual meeting of the insurance and reinsurance industry, Savoy Resort, Sharm El Sheikh, Egypt.

November: A delegation of French pharmaceutical and medical equipment companies is set to visit Egypt sometime in November to explore potential investments, according to a Trade Ministry statement.

01-02 November (Thursday-Friday): Annual Middle East Conference on Business Angel Investment, El Gouna, Egypt.

03-06 November (Saturday-Tuesday): World Youth Forum 2018, Maritim Jolie Ville Golf Course, Sharm El Sheikh, Egypt.

05 November (Monday): Egypt’s Emirates NBD PMI for October released.

05-07 November (Monday-Wednesday): World Travel Market London exhibition, London, England, UK.

06-07 November (Tuesday-Wednesday): 2018 IIF MENA Financial Summit, Al Maryah Island, Abu Dhabi, United Arab Emirates.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.15 November (Thursday) The T20 Invest in Healthcare Conference 2018, Nile Ritz Carlton Hotel, Cairo, Egypt.

17-19 November (Saturday-Monday) ElectricX-Energizing The Industry, Egypt International Exhibition Center, Cairo, Egypt.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

End of November: A delegation from the Egypt-Greece Business Council will visit Athens at the end of November to promote investment, the council’s chairman, Hani Berzi, said.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

13-15 December (Thursday-Saturday): Forum on “the Role of Digital Financial Communication and Solutions in Enhancing Financial Inclusion,” Sharm El Sheik, venue TBD.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.