- Foreign investors’ appetite for EGP-denominated debt might be easing; FinMin says it is shifting to longer-term investment -Bloomberg. (Speed Round)

- Report on the IMF / World Bank fall meetings. (Speed Round)

- World Bank’s Egypt Economic Outlook (October 2017) is out — and looks good. (Speed Round)

- Egypt’s banking system is “stable,” Moody’s Investor Service says; Fitch affirms CIB’s long-term issuer default rating. (Speed Round)

- M&A WATCH- EK Holding subsidiary pulls bid for NCMP. (Speed Round)

- Hamas, Fatah reach peace agreement in Cairo. (Speed Round)

- France wins UNESCO leadership after edging out Qatar, Egypt; US and Israel pull out. (Speed Round)

- In a rare interview, YBG says reforms are bearing fruit, interest rates too high. (On Deadline)

- As a financial market, we rank behind Nigeria, Rwanda and Ivory Coast, according to the geniuses at Barclays. (What We’re Tracking Today)

- The Market Yesterday

Sunday, 15 October 2017

Husband, wife win all-Egyptian US Open Squash final.

Plus: Report on IMF / World bank fall meetings and YBG gives a rare interview

TL;DR

What We’re Tracking Today

We’re riding a runaway freight train this morning after a very slow news week last week, so get ready to read, ladies and gentlemen.

The nationwide state of emergency was extended for three months as of last Friday, according to the Official Gazette. Reuters notes that “Egypt first imposed the state of emergency in April after two church bombings killed at least 45 people. It was then extended in July for a further three months.” The new declaration to extend the state of emergency should be approved by parliament within seven days, according to the Associated Press.

Lagarde warns on capital market volatility, trade protectionism and tech: IMF boss Christine Lagarde started bringing the annual meetings of the IMF and World Bank to a close with a warning that the recovery of the global economy “isn’t complete” and could be set back by trade protectionism (of the type being promoted by The Donald) and volatility in capital markets. Lagarde also warned that "I think that we are about to see massive disruptions” thanks to fintech and said it’s too simplistic to dismiss cryptocurrencies as vehicles for fraud. That last bit came as BlackRock boss Larry Fink joined JPMorgan Chase chief Jamie Dimon in saying that world governments will join together to strangle cryptocurrencies, which they argued benefit only criminals.

As a financial market, we rank behind Nigeria, Rwanda and Ivory Coast, according to the geniuses at Barclays. That’s right, folks: The inaugural Barclays Africa Group Financial Markets Index gives Egypt a score of 39, noting our “problems from international reporting standards and contract enforcement,” against Nigeria’s 51, which it notes is a “large economy with good prospects but improvements in transparency needed,” according to the Financial Times. The press release announcing the index (which includes its ranking criteria) is here, or you can go here and register to download the report.

A new petition backing President Abdel Fattah El Sisi in the 2018 presidential race has been gaining a lot of traction, both publicly and on social media, according to Youm7. The campaign ‘Ashan Nebniha (So We Can Build it) has been especially popular among house representatives and celebrities, many of whom have already signed the petition, including MP Mohamed Abu Hamed, as well as Actors Syndicate head Ashraf Zaki, and actors Hussein Fahmy, Sawsan Badr, and Hassan Youssef. The official Facebook page for the campaign is here. El Sisi has yet to declare his candidacy.

Egyptians become first husband and wife combo to win US Squash Open. Both the men’s and women’s finals last night were all-Egyptian affairs that saw “Ali Farag and Nour El Tayeb both upset the seedings in the finals of the 2017 U.S. Open to become the first married couple to win World Series titles — or any major sporting title — together on the same day,” USopensquash.com reports.

EU, US regulators reach compromise on Mifid II: EU and US regulators reached on Friday an agreement that should see global rules for derivatives harmonized, allaying concerns from the financial sectors on conflicting regulations once the EU implements new Mifid II regulations, the Financial Times reports. The two-part agreement will allow US and EU financial groups to trade on each other’s platforms, which they would have been unable to do under Mifid II. Still no word on how the two plan to handle the unbundling of research and trading.

The final trailer for season two of Stranger Things is out, and it’s fantastic, whether you’re a rabid fan of the show (as many of us here are) or whether you’re simply into the 1980s. Watch it here (runtime: 2:48). All episodes drop on Friday, 27 October.

What We’re Tracking This Week

Our friends at AmCham and EFG Hermes will host a special lunch in New York for Investment Minister Sahar Nasr and Finance Minister Amr El Garhy on Monday, 16 October. The gathering will feature keynotes from both ministers, according to a statement (pdf). In addition to EFG Hermes boss Karim Awad, you can expect to see execs from BNY Mellon, PepsiCo and Citi on stage. Garhy will also attend this week a workshop with funds organized by CI Capital, according to a statement from the ministry. El Garhy had attended a similar gathering on Thursday.

The House of Representatives’ Transport Committee is planning to review the Egyptian National Railway’s USD 575 mn agreement with General Electric for the purchase of 100 new locomotives on Tuesday, MP Mohamed Badawi tells Al Borsa. The committee is also waiting on the cabinet to send over legislative amendments that would allow the private sector to participate in the development, management, and operation of the railway sector.

Enterprise+: Last Night’s Talk Shows

It was a night of Qatar-bashing on the airwaves with the statelet accused of bribery in its failed campaign to win the top job at UNESCO. In about the only business-related story of the night, Vice Minister of Finance Amr El Monayer popped up to talk about FY2016-17 tax revenues (watch, runtime 5:04).

Speed Round

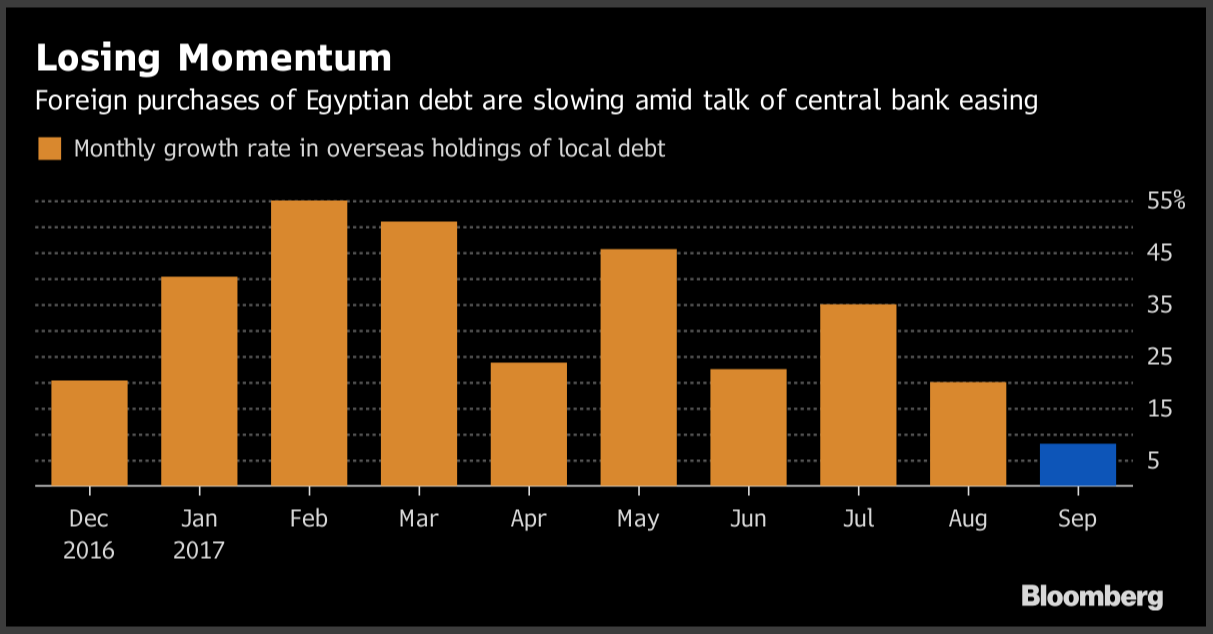

Foreign investors’ appetite for EGP-denominated debt might be easing, Bloomberg suggests. Ahmed Feteha and Mirette Magdy say that “the inflows from foreign funds are still growing, but the pace has slowed to an average of 2% a week since mid-August, down from 8 percent, as policy makers signaled they may lower record interest rates once inflation eases.” Foreign investors now hold a record of over 30% of all outstanding T-bills, “but attention is increasingly turning to the risks of over-exposure and of a sudden selloff in Egyptian assets, according to Bank of America Merrill Lynch economist Jean-Michel Saliba. Interest rates are too high for the economy to grow and the government to borrow, he said, so it needs to find other sources of foreign exchange to meet its funding gap.”

Vice Minister of Finance Mohamed Maait was unfazed by the suggestion, saying “we may not get the same inflows going forward, especially as inflation slows and yields fall … In any case, the coming stage is one where we get more permanent inflows like foreign direct investments — not just portfolio inflows in T-bills.” HSBC regional Chief Economist Simon Williams says that investors are trying to lock in higher returns now, with inflation expected to drop and rates to be cut, although he believes that Egypt has not seen the peak of inflows yet. Elina Ribakova, head of EMEA research at Deutsche Bank, says Egypt’s allure to investors is also a convincing “macro story,” not just high yields. While inflows are now at “capacity,” the country’s improving fundamentals should attract more “sticky money,” she says.

REPORT ON IMF / WORLD BANK FALL MEETINGS- Egypt expects to receive the next USD 2 bn tranche of its IMF extended fund facility not long after the institution’s second review of the reform program concludes in the first week of November, Finance Minister Amr El Garhy said in an upcoming interview with CNBC at the fall meetings over the weekend. El Garhy next delved into the social welfare side of the reform agenda, saying that the government doubled social welfare spending in the FY2017-18 budget. El Garhy also reiterated that the tax code is stable considering the implementation of the value-added tax, according to a ministry statement.

Speaking on the next year’s eurobond issuance program, El Garhy said that the government is still in talks with investment banks on the broad strokes of the program, which is “most probably” happening in 1Q2018, he told Bloomberg in an interview. El Garhy also said as much in a meeting with his French counterpart Bruno Le Maire yesterday in D.C. We had noted on Thursday that the Finance Ministry is accept bids from investment banks interested in advising on the issuance.

The eurobond program comes as part of a wider plan to “diversify” the state’s sources of financing in an effort to plug the budget deficit and meet foreign debt obligations. That’s why the government plans to extend its USD 2 bn repurchase agreement (repo) with a consortium of international banks for another year, El Garhy added. The consortium had offered last month to modify the agreement to a USD 5 bn repo with a five-year maturity instead of one.

Gov’t makes another strong case for investment… Egypt hopes to reduce the budget deficit by an annual 1-1.5% to bring the deficit down to 4-5% by 2022, El Garhy said at a meeting with Standard Bank Group in DC over the weekend, according to a ministry statement. He reiterated that the government is targeting USD 10 bn in foreign direct investment this year. At a separate meeting with a number of US and Egyptian investors, El Garhy announced that the worst is over as far as the reforms are concerned, with markets stable, inflation falling, and the end of the FX crisis.

…and gives quiet nod to investors on privatizing energy, railways: Vice Minister of Finance Mohamed Maait said from DC that the government is looking to make the energy and railway transport sectors “more efficient.” This is a nod to efforts to privatize the energy sectors through the Natural Gas Act and the Electricity Act, as well as to announcements from Transport Minister Hisham Arafat that the private sector will be brought in to manage, operate and maintain railway lines. Arafat’s most recent statement on the issue came on Friday, where he said that the government will hold back on allowing the private sector from operating railway lines until after they have been overhauled. He added that the government would open the door to the private sector to manage and run warehouses and other logistics facilities, AMAY reports.

Investment and International Cooperation Minister Sahar Nasr was also busy making the case for investment in Egypt at meetings with senior officials from the World Bank, IMF and other financial institutes and investors. With the WBG she discussed receiving the third USD 1 bn tranche of its USD 3 bn loan to Egypt and more funding to wastewater projects in Egypt, according to a ministry statement. She invited the European Bank for Reconstruction and Development (EBRD) to hold its next business forum for the southern and eastern Mediterranean (SEMED) region in Egypt, and pushed for the International Finance Corporation to boost its support to SME and the private sector.

While in D.C., Nasr also assumed the chairmanship of the WBG’s 2018 African Caucus, which Egypt is hosting next year. During her tenure, Nasr said she would focus on investment in infrastructure and human capital, particularly in the youth population, according to a ministry statement.

The World Bank expects Egypt’s budget deficit to decline to 8.8% of GDP in FY2017-18, the WBG said in its Egypt Economic Outlook October 2017 (pdf). The bank attributed its outlook — one of the more optimistic ones on the deficit we’ve heard — to the economic reform program, particularly cuts to energy subsidies. “Egypt’s GDP growth is predicted to stand at 4.5 percent in 2017/18, and to grow gradually to reach 5.3 percent by 2019,” the World Bank noted.

Inflation will fall to 23.3% this fiscal year and 22.1% in FY2018-19, then drop to 14% by 2019, the World Bank says. If the current inflation rate continues, Egypt might need to tighten its fiscal policy, “which will affect the economic growth,” the World Bank said. The bank also warned against slowing down the pace of fiscal reforms so as not to affect Egypt’s credit ability in repaying international debts.

Egypt’s economic reform program is moving on the right track, said World Bank President Jim Yong Kim at a press conference on Thursday on the sidelines of the fall meetings. The government saved around USD 13 bn for low-income citizens as a result of the economic reforms, Kim added, according to Al Shorouk. He also noted that the reforms have given investors confidence in the Egyptian economy.

The next stages of the reform agenda should focus on lowering Egypt’s debt level, said IMF Mission Chief to Egypt Subir Lall at a press conference on Friday, according to Al Mal. Lall also sang Egypt’s praises at the fall meetings, reiterating that the reform program was off to a good start.

The timetable on next round of subsidy cuts will be left to the government’s discretion, said the IMF’s director for Middle East and Central Asia Department, Jihad Azour. The fund is now discussing that timetable with the Egyptian cabinet, according to Al Mal. Azour also said that the IMF delegation that will run a second review of the reform program will arrive in Cairo on 25 October and will stay on until 7 November.

The outlook for the Egyptian banking system is stable, as economic growth picks up, loan performance remains broadly resilient and banks benefit from a stable deposit base, Moody’s Investors Service says. “The banks are funded by stable and low-cost domestic deposits, mainly from households, a credit strength … We expect increasing banking penetration and increased remittances to spur deposit growth. Though government-owned banks have significantly increased their market funding over the last two years, this funding is mainly from regional banks and multilateral development banks, where refinancing risks are lower,” says Melina Skouridou, Assistant Vice President at Moody’s. The ratings agency does not expect a material deterioration in loan quality, because corporate debt repayment “is supported by relatively low overall levels of debt, as well as government initiatives to help tourist companies and importers” and “retail loans are confined to wealthier households.” Moody’s wants that delinquency rates could increase as new loans matures but also says capital buffers are expected to improve.

…Separately, ratings agency Fitch affirmed CIB’s long-term issuer default rating at B with a stable outlook. “The bank’s significant exposure to sovereign debt is a key driver of the VR and effectively caps the [viability rating] at the level of the Egyptian sovereign. The Stable Outlook on CIB’s IDR reflects that on Egypt’s sovereign rating.”

M&A WATCH- Egypt Kuwait Holding (EKH) subsidiary International Financial Investments Company (IFIC) has reportedly withdrawn its bid to acquire National Company for Maize Products (NCMP), Al Mal reports. Sources said IFIC did not finish the due diligence process because of the bureaucracy and the length of time associated with the transaction. The EKH affiliate first submitted its bid for NCMP in May. IFIC’s withdrawal now leaves only a unit of Archer Daniels Midland (ADM) and Cairo Three A Group as the remaining bidders. Al Mal says the third bidder, Louis Dreyfus’s local affiliate Al Mona Misr, had withdrawn “two months ago.” The news also comes following last month’s report that ADM representatives were unhappy with the delay in the transaction and have held a meeting with Investment Minister Sahar Nasr in hopes of expediting the process. Pharos Holding is sell-side advisor to Misr Capital Investment (owner of the NCMP stake on offer), while EFG Hermes is advising ADM, and CI Capital is advising Cairo Three A Group.

IPO WATCH- Readymade garment manufacturer Dice is planning to list an extra 50-60% of its shares on the EGX within a month, Al Mal reports. The company is waiting for EFSA to greenlight its fair value assessment. The stake will be issued to existing investors. EFG Hermes is managing the transaction.

INVESTMENT WATCH- The Chinese consortium Acasys Group is reportedly looking for a piece of major infrastructure projects worth up to USD 20 bn in Egypt, Ahram Gate reports, citing a statement from the group. Acasys, which earlier this month offered to build 250k units for the government’s social housing program at a cost of USD 5 bn, is also interested in the fields of energy, power, real estate and infrastructure development, and water treatment. The Group has yet to hear back from the Housing Ministry on its offer.

EARNINGS WATCH- QNB Al Ahli reported net income of EGP 4.25 bn in the first three quarters of 2017, up from EGP 4.06 bn in the similar period in 2016, according to a bourse disclosure.

The Ismail cabinet discussed implementing a national solid waste management plan at its weekly meeting last Thursday, according to a cabinet statement. Decisions taken at the meeting include:

- Approved a funding agreement with the European Bank for Reconstruction and Development to help upgrade sewage and wastewater systems Fayoum;

- Establishing a fund for the victims of terrorism and families of casualties from terrorism;

- Approved kicking off renovations in the Raml tramline in Alexandria which is funded by a USD 100 mn loan from the French Development Agency.

Egypt brokers peace between Fatah and Hamas: Palestinian factions Hamas and Fatah reached a reconciliation agreement during talks in Cairo last week, Hamas chief Ismail Haniyeh said on Thursday, according to Reuters. Under the terms of the pact, Hamas and Fatah agreed to complete the handover of administrative control of Gaza to a unity government by 1 December. The two sides will be in Cairo on 21 November for more talks. Bloomberg notes that there was “no indication that an understanding had been reached on the fate of Hamas’s armed wing, a sticking point which analysts have said could yet scupper reconciliation efforts.”

Israeli Prime Minister Benjamin Netanyahu said on Thursday that the Palestinian accord must abide by international agreements, including recognizing Israel and disarming Hamas, Reuters reports. Bloomberg’s Eli Lake says there is more to these statements than meets the eye, as Israel has been in the loop since talks first started and had displayed no objections. On the flipside, sources tell Asharq Al Awsat that US and Egyptian diplomats have asked Israel not to sabotage the agreement.

…Also finding peace in Cairo on Thursday were Syrian factions that reached a ceasefire agreement in Southern Damascus, Ahram Gate reports. The Associated Press has more.

Former French culture minister Audrey Azoulay was elected the new head of UNESCO, beating Qatar’s Hamad bin Abdulaziz Al Kawari after a fifth round of voting, Reuters reports. Khattab had exited the running after an earlier head-to-head ballot with Azoulay, who went on to beat the Qatari amid allegations the statelet had engaged in bribery in connection with the bid. After initially filing a notice to UNESCO alleging irregularities in the secret ballot, the Egyptian Foreign Ministry issued a statement congratulating Azoulay and another thanking all the countries which gave its support to Khattab’s bid, including China.

The vote came after the US and Israel pulled out of UNESCO on charges that the organization is biased against Israel, Reuters reports. The US provides one fifth of UNESCO’s budget. Azoulay is the first person to run the cultural institution who identifies herself as being Jewish.

Meanwhile, the UN’s human rights agency condemned Egypt, Azerbaijan, and Indonesia for “unjustly arrested dozens of people during anti-gay crackdowns in recent weeks,” according to Reuters.

Saudi Arabia is considering delaying the international tranche of its IPO of Aramco until at least 2019, according to people familiar with the situation. The sources added that the share sale in Riyadh could still happen next year, Bloomberg reports. A two-stage Saudi Aramco IPO is one of several options being considered, while another plan would include listing in Riyadh next year and privately selling a stake in Aramco to one or several cornerstone investors, sources added. There had been talk swirling over a possible delay of the IPO for some time with a contingency plan for the delay being put in place. The FT takes a look at the implications of the postponement.

Image of the Day

An original cover illustration of an early edition of the French comic book Asterix sold for EUR 1.4 mn in a Paris auction, according to the Telegraph. The 1965 cover art Asterix and the Banquet, which was part of departed TV producer Pierre Tchernia’s private collection, went for 7x its expected selling price. Another Asterix cover also exceeded expectations when it sold for EUR 1.2 mn at the same auction.

Egypt in the News

It’s a mixed day for Egypt in the international press, with no single story dominating the narrative.

E-payments firm Fawry is helping lead the delivery of financial services to the 94 mn unbanked citizens of Egypt, writes Heba Saleh for the FT (paywall). The company’s expanding services is grounded on a combination of demographics, low banking penetration and a high rate of mobile phone ownership, says CEO Ashraf Sabry. “Going digital will be mandatory, there is no other solution.” One obstacle he names is the government failing to pay for services provided by platforms such as Fawry. “The payment system in Egypt does not have an incentive model because the government does not pay . . . the processors of electronic payments. The existing law does not allow it,” he says.

The Fawry story is part of a longer package on Arab World Banking and Finance in the FT this morning. Other stories include:

- Legal wrangles dent Dubai’s image as region’s financial centre

- Qatar crisis sends tremors through banking in the Gulf

- Saudi privatisations prove a magnet for foreign banks

- Gulf banks ‘ripe for consolidation’ following FAB deal

- State stakes in Gulf banks bring business advantages — and risks

A number of World Cup-related stories continue to make headlines in the foreign press. Egypt’s successful World Cup qualification campaign comes at the cost of added pressure to allow supporters back into stadiums, James M Dorsey writes for Eurasia Review. “It has also sparked calls for the release of incarcerated, militant and politicized fans who have been at the core of Egypt’s 2011 popular revolt and subsequent anti-government protests.” Meanwhile, Goal.com is projecting that Egypt’s rise to the World Cup will see businesses cough up ad money.

Also this morning: Egypt’s effort to curb imports and improve its trade balance has started to bear fruit, writes David Awad for Al Monitor.

On Deadline

Rare interview with YBG: Egypt finally took the “bitter medication” of economic reform and it will bear fruit in time, former Finance Minister Youssef Boutros Ghali told Al Shorouk on the sidelines of the IMF and World Bank fall meetings. Egypt’s only solution is to be able to reach economic growth rates of 5% and over in order to increase employment opportunity, he says. He is also not concerned by the levels of public debt, but says the government’s budget needs to be tightened. YBG also believes the current interest rate environment to be too high and not conducive to investment. The rate need to be lowered to stimulate credit demand, he says. Looking back to his tenure in government, he said a problem that often faced the government was the long time it took former President Hosni Mubarak to approve decisions, and this made the future reform bill costlier.

Worth Reading

Some Egyptian fisherman say the Nile’s water is now so toxic, they dare not eat the fish they catch, according to an alarming BBC report by Peter Schwartzstein. Booming populations have dirtied and drained the Nile, while climate change threatens to cut its flow, Schwartzstein writes, as he tracks the Nile from its sources downstream. The problem begins with a reduction in rainfall from the Blue Nile’s source in Ethiopia, which is impacting people’s livelihoods and the Grand Ethiopian Renaissance Dam (GERD) is also threatening water supplies to downstream countries Egypt. He says “history suggests that the Nile basin states are unlikely to come to blows over the river any time soon. Transboundary water disputes have a strong record of peaceful resolution … However, Ethiopia’s intense secretiveness over GERD’s ramifications remains a stumbling block, as do the negotiations over how long it will take to fill the dam’s enormous reservoir.” The desert’s encroachment is eating up arable land, Schwartzstein writes and “a lot of this appears to be due to climate change, and it is happening up and down the Nile valley.”

Schwartzstein also points to the impact of urban development along the Nile’s banks and says the quality of the Nile’s water begins to falter where the Blue Nile meets the White Nile in Khartoum. What more, he reports: “The Nile’s final stretch is so poisonous that even out on the open sea, around the river mouth, few species can survive.”

Diplomacy + Foreign Trade

The Egyptian ambassador to Ireland “should be threatened with expulsion” if Ibrahim Halawa is not released, former Irish Justice Minister Alan Shatter said, according to BBC. Halawa was “acquitted of charges including inciting violence, riot and sabotage last month but remains behind bars.”

Energy

Shell’s Andrew Brown discusses company’s ongoing projects with Prime Minister

Shell’s Upstream Director Andrew Brown discussed the company’s ongoing projects in Egypt with Prime Minister Sherif Ismail on Thursday, including the USD 1.6 bn West Delta Deep Marine Phase 9b project and plans to drill 63 wells in the Western Desert, according to a cabinet statement.

Basic Materials + Commodities

Retail sugar prices to drop soon, gov’t source says

Retail prices of sugar are expected to drop to EGP 8.5-9 from EGP 9.5 per kg, a Supply Ministry . The ministry has a “large surplus” of sugar that should drive the price down once released to the market through state outlets.

Manufacturing

Suez Canal Fish Farming looking to setup feed plant for EGP 200 mn

The Suez Canal Fish Farming Company is looking to set up a EGP 200 mn feed plant by the end of the year, according to AMAY. The firm expects to sign agreements this month with foreign companies for the machinery and equipment needed to implement the project.

Saudi’s KBW Investments looks to build LED light factory in Egypt

KBW Investments Chairman Saudi Prince Khaled Bin Alwaleed pitched the idea of an LED lights factory in Egypt to Prime Minister Sherif Ismail and Electricity Minister Mohamed Shaker on Thursday, according to a cabinet statement. The meeting explored the company exporting lamps to other African markets.

Minister Tarek Kabil inaugurates four new production lines in Alex

Trade and Industry Minister Tarek Kabil inaugurated four new production lines yesterday at two Alexandria factories, according to AMAY. At the Egyptian German Porcelain Company, Kabil saw the launch of the EGP 200 mn line that is expected to increase the company’s capacity to 20,000 tonnes a year from a current 15,000. The minister also inaugurated three EGP 120 mn production lines at Madar Group Egypt’s factories. that studies are underway for the expansion of the of Alexandria’s Merghem Plastic Industries Complex.

Tourism

FTI and Thomas Cook to double weekly flights

FTI and Thomas Cook are doubling their weekly flights to Cairo starting November, CEO of Egypt agent Meeting Point, Ali Okda, tells Al Shorouk. The firms are looking to ramp weekly flights up to 144 from 70, but Sharm El Sheikh will remain off their destination lists for now.

Air Cairo relaunches lines from Denmark and Milan

The first flight from Denmark after a two-year pause touched down in Sharm El Sheikh on Friday,according to Al Shorouk. The Air Cairo flight carried 122 passengers and will now operate on a weekly basis. Air Cairo will also be relaunching weekly routes to Marsa Alam and Sharm El Sheikh from Milan on 29 October and 3 December, respectively, after Tourism Minister Yehia Rashed signed an agreement during the TTG Incontri tourism exhibition in Italy last week.

Tourism promotion agreements signed in Italy

The Tourism Promotion Authority signed an agreement with the Italian Federation of Travel and Tourism Associations that will see the latter promote travel to Egypt through more than 1,000 agents, Al Shorouk reports. This comes as a tourism promotion campaign kicks off in Italy this week, featuring half-Egyptian AS Roma star Stephan El Shaarawy as its face.

Egypt part of Marriott expansion into Africa

Marriott International renovated the Sheraton Cairo and the St. Regis Cairo as part of its plan to expand into Africa, the company announced in a press release. Marriott’s broader expansion plan sees over 200 hotels in the continent by 2022.

Telecoms + ICT

ECA dismisses rumors of monopoly conspiracies behind raising of prices on scratch cards

The Egyptian Competition Authority (ECA) believes that mobile network operators did not collude to raise prices on mobile scratch cards, ECA head Mona El Garf tells Youm7. She reiterated that the decision to raise prices on scratch cards by 36% came from the National Telecommunications Regulatory Authority and hence is does not meet criteria for being anti-competitive.

Automotive + Transportation

Morocco to overtake Egypt as North Africa’s largest auto market

Morocco’s automotive market is set to surpass Egypt’s as North Africa’s largest by the end of the year, says a report from BMI. The report finds that Morocco’s market will stand at 169k units this year compared to Egypt’s 152k, with the gap widening even further by 2021.

Uber and Careem ask for group transport licenses to add new public buses to their services

Ride-hailing apps Uber and Careem submitted requests to the Public Transport Authority asking for licenses to include a group transport option to their services, using the authority’s new WiFi-equipped buses, Al Borsa reports. The authority had signed a EGP 35 mn agreement with MAN-Kastour back in July to purchase 13 double-decker buses that will be introduced to Cairo’s streets in early 2018, with plans to issue more tenders soon. Also in July, Careem invested USD 500k in bus service Swvl as part of its plan to expand into group transport. Uber had also said it was planning to launch a new bus service in Egypt once legislation governing the ride-hailing apps was introduced.

Banking + Finance

CIB investing in growing its digital solutions with a focus on the unbanked

CIB has been on the forefront of the banking sector’s digital transformation by investing heavily over the years in its infrastructure, security and digital platforms, the bank said in a statement on Thursday. These included the rollout of talking ATMs for the first time in Egypt, designed for visually impaired customers. The bank has also expanded the ATM’s uses by opening up services to unbanked customers. ATM services are also being digitized and bundled with other retail and corporate digital solutions to support businesses in managing their cash.

Cost of high-yielding CDs up almost 100 bps after reserve ratio increase -source

The central bank’s move to increase the required reserve ratio to 14% from 10% raises the cost of high-yield certificates of deposit issued by state-owned banks by 80-100 bps, sources told Al Mal. Banque Misr, National Bank of Egypt, and Banque du Caire issue certificates carrying rates of 20%. The new reserve requirements increase their cost of issuance to 22.8-23%, the sources said.

Banque du Caire and The Export Development Bank join electricity loan consortium

Banque du Caire will contribute EGP 3 bn and the Export Development Bank a further EGP 1 bn to an EGP 37.4 bn syndicated facility to the Egyptian Electricity Transmission Company, reports AMAY. EGP 18 bn of the loan is committed to upgrading transmission lines in the grid with the remaining EGP 19.4 bn going toward upgrading substations and transformers.

NBE planning on increasing stake in Mortgage Finance Fund

National Bank of Egypt (NBE) is planning on increasing their exposure to the CBE’s Mortgage Finance Fund to EGP 5 bn, said Head of Retail Credit Risk Karim Sous. The bank had previously injected EGP 2.2 bn into the program and now with the CBE upping the size of the fund to EGP 20 bn it appears NBE is following suit.

Other Business News of Note

Banking sector draws in USD 52 bn since float

Egypt’s banking sector managed to draw in some USD 52 bn since the EGP float last November, CBE Deputy Governor Rami Abul Naga tells the state news agency. "The remittances of the Egyptian expats, investments and export revenues were the reasons behind the increase of the FX," he said.

Egypt Politics + Economics

Ismail cabinet refutes legality of independent unions

The Ismail cabinet reportedly said independent labor unions may not be legal at its meeting last Thursday, according to Al Mal. The cabinet issued a response to an official inquiry on the topic, saying that it had nullified a decision by the previous Manpower Minister in 2011 sanctioning independent unions. Under the new Labor Unions Act, independent labor unions will not be allowed, read the statement. This comes as security forces reportedly shut down a planned press conference by the independent union of customs workers to object to the arrest of their colleagues, Al Mal reports.

Coptic priest killed, one injured in knife attack in El Salam City

A Coptic priest was killed and a second injured after they were attacked by a man in El Salam City on the outskirts of Cairo on Thursday, Ahram Online reports. Police have arrested a suspect and no motive for the attack has yet been disclosed.

New anti-debauchery law to be submitted next week

MP Shadia Thabet said she is submitting a new “anti-debauchery” law to the House of Representatives next week, according to AMAY. The draft bill will hand out fines and jail time for those who promote “deviant” behavior, the MP said, hopping on the anti-LGBTQ bandwagon.

National Security

Sinai attack results in the death of six soldiers

Terrorists killed six soldiers in an attack on a military post in El-Arish, an official Armed Forces statement said. The attack has been claimed by the daeshbags, according to Reuters.

On Your Way Out

ON THIS DAY- On this day in 1964, Nikita Khrushchev unexpectedly stepped down as leader of the Soviet Union. Five years earlier, a final conference on the Antarctic Treaty convened in Washington, D.C., and, after six weeks of negotiations, the treaty was signed by 12 countries, preserving the continent for free scientific study. More recently, China became only the third country in history to launch a manned spaceflight, the Shenzhou 5, which was piloted by Yang Liwei, orbited Earth 14 times during the 21-hour flight. Born on this day in 1844 was German philosopher Friedrich Wilhelm Nietzsche and, in 1914, the fabled archetype of the seductive female spy, Mata Hari, was executed for espionage by a French firing squad at Vincennes outside of Paris.

The Market Yesterday

EGP / USD CBE market average: Buy 17.59 | Sell 17.69

EGP / USD at CIB: Buy 17.58 | Sell 17.68

EGP / USD at NBE: Buy 17.6 | Sell 17.7

EGX30 (Thursday): 13,892 (+0.6%)

Turnover: EGP 1.1 bn (19% above the 90-day average)

EGX 30 year-to-date: +12.5%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 0.6%. CIB, the index heaviest constituent closed up 1.0%. EGX30’s top performing constituents were: Oriental Weavers up 4.6%; Elsewedy Electric up 3.7%; and Abu Dhabi Islamic Bank up 1.6%. Today’s worst performing stocks were: Porto Group down 5.9%, Amer Group down 2.6%; and Qalaa Holdings down 2.2%. The market turnover was EGP1.1 bn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +70.5 mn

Regional: Net Short | EGP -17.8 mn

Domestic: Net Short | EGP -52.7 mn

Retail: 68.1% of total trades | 66.4% of buyers | 69.9% of sellers

Institutions: 31.9% of total trades | 33.6% of buyers | 30.1% of sellers

Foreign: 20.4% of total | 23.6% of buyers | 17.2% of sellers

Regional: 5.0% of total | 4.2% of buyers | 5.8% of sellers

Domestic: 74.6% of total | 72.2% of buyers | 77% of sellers

WTI: USD 51.45 (+1.68%)

Brent: USD 57.17 (+1.64%)

Natural Gas (Nymex, futures prices) USD 3.0 MMBtu, (+0.37%, NOV 2017 contract)

Gold: USD 1,304.6 / troy ounce (+0.62%)

ADX: 4,525.88 (+0.24%) (YTD: -0.45%)

DFM: 3,660.27 (+0.62%) (YTD: +3.66%)

KSE Weighted Index: 431.55 (+0.1%) (YTD: +13.54%)

QE: 8,342.09 (+0.1%) (YTD: -20.07%)

MSM: 5,128.48 (+0.13%) (YTD: -11.31%)

BB: 1,274.75 (-0.01%) (YTD: +4.45%)

Calendar

15-16 October (Sunday-Monday): The Marketing Kingdom Cairo 3 conference, Dusit Thani Lakeview Hotel, Cairo.

17 October (Tuesday): The Narrative PR Summit, Four Seasons Nile Plaza, Cairo.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Future of Cities: Innovation, Spaces and Collaboration,” The French University, Cairo. Register here.

21 October (Saturday): The African Leadership Academy will hold its “Beyond Education” seminar on on university readiness and the future of leadership in Africa, at the Dusit Thani, Lakeview, New Cairo and the Hilton Pyramids Golf, 6 October City.

23-27 October (Monday-Friday): 29th Business and Professional Women International Congress themed “Making a Difference through Leadership and Action,” Mena House Hotel, Cairo. Register here.

06-07 November (Monday-Tuesday): Crisis Communications Conference, Four Seasons Nile Plaza Hotel, Cairo.

06-09 November (Monday-Thursday): EFG Hermes’ 7th Annual London Conference on 6-9 November, Arsenal’s Emirates Stadium.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

19-21 November (Sunday-Tuesday): 11th Annual INJAZ Young Entrepreneurs Competition, Four Seasons Nile Plaza, Cairo.

26-29 November (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

01-03 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

17-21 February 2018 (Wednesday-Saturday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.