- It’s World Cup qualifier night for the Pharaohs, kickoff at 7:00pm CLT (Last Night’s Talk Shows)

- Analysts think 400 bps increase in reserve requirement presages interest rate cut. (Speed Round)

- Egypt continues to stand out among emerging markets as the country gets ready for its eurobond issuance in January. (Speed Round)

- Pico’s Cheiron forms JV with Pemex on its Cardenas-Mora project. (Speed Round)

- OTMT puts its bid for Brazilian telecom Oi on hold –Sawiris. (Speed Round)

- EFSA appears to have completed new law to regulate insurance industry. (Speed Round)

- Washington “concerned” by reported arrests LGBTQ citizens in Egypt. (Speed Round)

- The darknet is at the edge of the investable universe. (Speed Round)

- Are you prepared to survive the data apocalypse? (What We’re Tracking Today)

- The Market Yesterday

Sunday, 8 October 2017

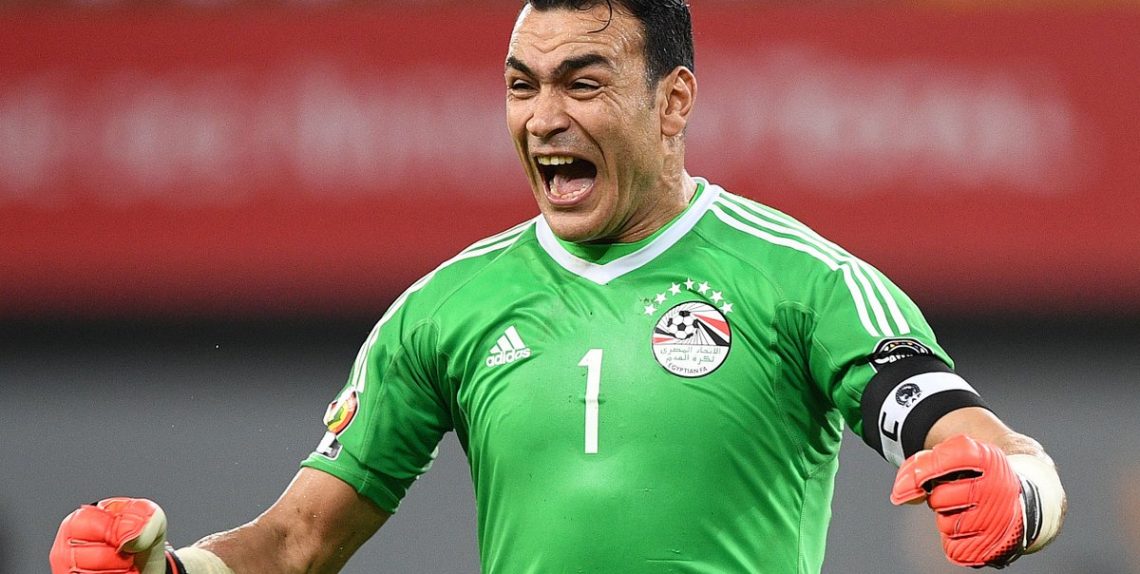

It’s World Cup qualifier night for the Pharaohs, kickoff at 7:00pm CLT

TL;DR

What We’re Tracking Today

Egypt plays Congo tonight in the qualifiers for the 2018 FIFA World Cup in Russia and the Pharaohs are going in with an edge. Its fellow group E teams of Uganda and Ghana drew 0-0 last night, giving Egypt a huge advantage in tonight’s game as a victory over Congo would mean automatic qualification. Stay tuned for the matchup in Alexandria, with a 7:00pm CLT kickoff time.

***

Are you prepared to survive the data apocalypse? The dangers of lax cyber security do not need to be elaborated on. But when the lethal WannaCry and NotPetya ransomware attacks were launched earlier in the year, it did seem like a data apocalypse had come to pass. The attack hit nearly 100 countries and some of the world’s largest organizations, prompting both the private sector and government organizations — including our ICT Ministry and the central bank — to take extensive protection measures. The attacks brought into the forefront how the cyber security is imperative to the survival of organizations and a top national security priority. According to Information Security Buzz, key takeaways from the attack was that no organization is immune from security breaches; there is no silver bullet for protection; and most crucially, paying attention to security fundamentals is paramount. They also conclude that organizations paying attention to security maintenance could make a huge difference.

Where would you start? Global CyberSecurity firm Trend Micro is running a special survey of Enterprise readers to dig into whether companies are being targeted by ransomware and if they are prepared to fight it. The survey will also analyze the impact of ransomware attacks on both direct monetary cost (such as the ransom your company would pay to a hacker) or the indirect cost of employee downtime. You’ll learn a lot by taking it, whether you’re a CEO or a CTO.

***

It’s a holiday in both the United States and Canada. The second Monday in October is Thanksgiving in Canada and Columbus Day in the United States, where it’s a federal holiday and off in many states.

Want to play Stranger Things, the game? If you, like us, are counting the days until season two drops on 27 October, you might want to consider downloading (without charge, we note) the official 16-bit Netflix video game, which came out over the weekend for iOS and Android. “It’s 1984 all over again. Experience an action adventure game just like the ones our heroes would have played back in the day,” the description reads. This link should get you the iOS version, while this one here should get you the Android edition. Or you can tap here to watch a 30-second trailer for the game. Oh, and get this? If you beat the game, you get a sneak preview of season two.

October 27 is also the release date for the next installment in the Assassin’s Creed game series, which — as our resident 10-year-old reminds us at least once a day — is set in ancient Egypt. The Guardian explains that game maker Ubisoft “enlisted leading Egyptologists, historians, and hieroglyphics-deciphering AI to create an authentic experience of the age of Cleopatra.”

Rage Against the Machine has been nominated for the Rock Hall of Fame. Radiohead, Bon Jovi and Judas Priest have, too. But not Soundgarden, proving there is no justice. Rolling Stone has the rundown on this year’s nominees.

What We’re Tracking This Week

Finance Minister Amr El Garhy and Investment Minister Sahar Nasr are heading to Washington this week to attend the IMF and World Bank’s fall meetings which begin tomorrow. Senior members of the Egyptian business community will also attend, and we expect there will be at least one high-profile investment-promotion event on the other side of the pond at that time. The trip comes ahead of a scheduled visit from an IMF delegation later this month to conduct a second review of the reform program.

The House of Representatives is expected to discuss the Industrial Development Authority (IDA) Act in a plenary session on Monday, after the Industry Committee signed off on the bill yesterday. New legislation is expected to give the IDA more autonomy, separating its budget and accounts from the Trade Ministry’s, and granting it authority to sell land without government approval, Industry Committee Chair Ahmed Samir tells Al Mal. The 37-article law will introduce the IDA to the “single-window” policy, in theory to facilitate processes such as applying for industrial permits.

Enterprise+: Last Night’s Talk Shows

Egypt’s 2018 World Cup qualifying match against Congo tonight was the only topic of real interest being discussed on the airwaves on Saturday evening.

Hona Al Asema’s Lamees Al Hadidi was squarely focused on the game, taking on the unlikely role of sports analyst to explain the possible outcomes and how each scenario would impact our bid to qualify for the World Cup (watch, runtime 2:42).

On Kol Youm, Amr Adib asked Egyptians to remain calm before the game to avoid further pressuring the team. Adib told off people who have reportedly been celebrating an early victory (watch, runtime 4:01). He also aired a televised message from Alexandria’s head of security, Mostafa El Nemr, who confirmed that the Borg El Arab stadium will be heavily guarded today (watch, runtime 2:39).

Adib also spoke to veteran football coach Helmy Toulan for a take on our national team’s performance, which Toulan said has been cause for concern due to weak defense (watch, runtime 2:15).

The host stepped away from all the football mania to praise the government’s work on road network upgrades (watch, runtime 6:06).

Back on Hona Al Asema, Lamees discussed Egypt’s changed stance towards Hamas with political science professor Moataz Abdel Fattah, who explained that the shift was a tactical one that would ultimately serve to resolve the Israeli-Palestinian crisis. Hamas also underwent significant ideological changes to help bridge the gap with Fatah and unite the Palestinian front, he said (watch, runtime 21:12).

Over on Mehwar TV’s 90 Minutes, Tourism Ministry Advisor Walid El Batouty said that tourism inflows from the Ukraine saw a 120% y-o-y jump in 8M2017, noting that the Ukrainian market is particularly significant as a gateway for Russian tourists. El Batouty also said that, while German tourist arrivals are steadily increasing, visitors from the UK and Italy remain relatively low (watch, runtime 7:44).

And as if we didn’t get enough talk of social housing during the slow summer days, Housing Ministry spokesperson Hany Younes phoned into 90 Minutes to drone on some more about the ministry’s planned projects (watch, runtime 3:52).

Away from all the football pandemonium, Masaa’ DMC’s Eman El Hosary also spoke to MP Solaf Darwish about the Miss Egypt competition, which has apparently drawn the ire of some for not respecting “our values and traditions.” Darwish said the correct solution would have been to hold the competition (which she described as illegal) under the auspices of the government (watch, runtime 6:20). The only thing worse than our holding a Miss Anything contest would be to hold said contest under state auspices.

Speed Round

The central bank’s move to raise reserve requirements to 14% from 10% signals “that we will see an interest rate cut soon … The central bank is trying to control liquidity using tools other than interest rates,” Radwa Elswaify, head of research at Pharos Holding told Bloomberg. The move brings the ratio back to its 2001-12 levels, before it was gradually lowered to help lenders meet liquidity requirements. Elswaify says “banks are likely to respond by lowering rates offered on customer deposits and by asking for higher yields on government treasuries, raising the cost of borrowing for the government.”

Other economists appear to agree. “We attribute the timing to either an anticipated cut in interest rates that would affect liquidity, or a preemptive move in anticipation of a one-off inflationary shock,” said Beltone Financial’s Alia Mamdouh tells Reuters. “We expect the CBE to signal the shift to an expansionary mode with an initial cut of 1-2% likely to materialize as early as December 2017, and after the base effect drives headline inflation downwards, in November,” said CI Capital’s Hany Farahat. Arqaam Capital senior economist Reham Eldesoki does not expect the decision to impact credit growth negatively, “though it could affect the amount of liquidity available for investing in Treasuries.”

MOVES- We’re pleased to note that our friend Hisham Ezz Al-Arab, CIB’s chairman and managing director, has been tapped by Fairfax Africa to serve on the board of sub-Saharan African financial services group Atlas Mara. Canada’s Fairfax, a top shareholder of CIB, is leading a turnaround at Atlas, having invested USD 159 mn for a 42% stake, Reuters reports. Atlas Mara was co-founded by former Barclays boss Bob Diamond.

Egypt continues to stand out among emerging markets as the country gets ready for its eurobond issuance in January. First off, the EGP has been among new “exotic” currencies attracting EM fund managers breaking from “big name” EM currencies such as the Mexican peso and the Brazilian real, notes Reuters. Investors with currency exposure to Egypt have grown from 2.53% in the 2Q2016 to 45.3% in the same quarter this year, according to data from research firm eVestment. It joins other so-called exotic currencies including Uruguay’s peso and the Czech koruna, both of which are also now in favour with EM investors these days, the newswire reports.

Key here: “While fund managers are diversifying — and some said they are taking a bit of risk off the table after a profitable 2017 so far — none of the 13 interviewed said they expect to see emerging market currencies bull run come to an end soon.”

Egyptian bonds saw the third-largest foreign inflows in emerging markets this year at USD 12.9 bn, according to data from Deutsche Bank which ran in Bloomberg. The money quote: “The overseas share of bond holdings surged to 27 percent from just one percent at the end of last year.” All in all, this is looking good for the state eurobond program in 2018.

Pico’s Cheiron forms JV with Pemex on its Cardenas-Mora project: Cheiron Holdings, a subsidiary of the Diab family’s Pico group — won the rights to partner with Mexican national oil company Pemex on its onshore Cardenas-Mora project, Reuters reported on Wednesday. Cheiron becomes only the second company to become an equity partner of Pemex since the privatization of the sector in 2013 ended the company’s decades-long monopoly and allowed it to develop projects with private and foreign oil companies.

Meanwhile, the first company to form a JV with Pemex, Eni, hopes to replicate its Zohr success in Mexico: Meet Eni’s Chief Exploration Officer Luca Bertelli, the man whose intuition and experience as a geologist helped Eni discover the largest find in the Mediterranean. In an interview with Reuters, Bertelli discussed how the company went from being written off as an explorer and downstream player to making some of the biggest finds, and how it plans to replicate Zohr’s success in other discoveries, particularly Mexico. “We feel there’s room for surprise, even in areas previously explored,” said Bertelli.

Some Zohr backstory: Using a combination of experience in recognizing a thick layer of limestone — carbonate salt ignored by other majors, and bringing in its advanced supercomputer to analyze decades of historical data — Eni beat out other companies to Zohr. This is the formula it hopes will give it an edge in Mexico.

Orascom Telecom Media and Technology Holding (OTMT) is putting its bid for Brazilian telecom Oi on hold, Naguib Sawiris said on Thursday, according to Reuters. Sawiris blamed “infighting and a lack of decision-making at the debt-laden Brazilian mobile carrier” for the decision. OTMT had offered in December an exchange of debt for shares and a capital injection of as much as USD 1.25 bn in Oi, which filed last year for Brazil’s biggest ever bankruptcy protection to restructure USD 20 bn of debt. The Orascom-bondholder group had committed to underwriting the entire capital injection if no other investors step forward. But after four delays of a creditor vote on a restructuring plan to help it exit bankruptcy protection and Oi’s CFO Ricardo Malavazi stepping down last week, Sawiris’ patience may have worn thin.

It looks like the Egyptian Financial Supervisory Authority (EFSA) has completed a new law to regulate the insurance industry and will be shopping it around to industry associations before sending a draft to the Ismail cabinet, EFSA chairman Mohamed Omran told the press on Saturday. Not much by way of details on the act were revealed, but Omran did say the bill aims to expand insurance coverage to SMEs. We believe the bill is likely the “new insurance act” previous EFSA chairman Sherif Samy had announced back in June. Samy had said that the new law would encompass car insurance and private insurance funds as well as turning state insurance funds into autonomous bodies under the supervision of the Finance Ministry and EFSA. It is unclear whether the new law would see EFSA become the sole regulator for the industry.

Egypt should see around USD 2 bn in foreign funding coming its way in the coming months, Investment and International Cooperation Minister Sahar Nasr said on Wednesday, according to Al Masry Al Youm. By her count, Egypt should expect to receive USD 1 bn from the IMF following its second review of the economic reform program in October, and the USD 500 mn third tranche of the USD 1.5 bn African Development Bank loan in January. She added that Egypt will also see USD 500 mn coming from the G7 countries who have pledged to support the economy. Nasr had also sat down with USAID and AmCham over the long weekend to discuss disbursing USD 121.6 mn in USAID funding which was signed last week, according to a ministry statement.

No Dabaa contracts will be signed this year? Just like Bigfoot, UFO sightings, and the Yeti, the rumors swirling around the Dabaa nuclear power plant signing date are endless. Apparently, the contracts have not been fully reviewed by the Council of State (Maglis El Dawla) and it is unlikely signoff will come this year, according to Al Mal, which cites unnamed “high level sources in the Electricity Ministry.” We had heard last week that the contracts were reviewed by the Maglis and sent to Ittihadiya. All we were awaiting on is Russian President Vladimir Putin clearing his schedule to attend the signing, which was supposed to be held this month, with rumors suggesting it would take place at the 75th anniversary of the battle of Alamein on 21 October.

Dabaa and restoring Russian flights might be in question, but we are hearing that actual progress is being made on the Russian Industrial Zone (RIZ). Suez Canal Economic Zone Chairman Mohab Mamish said on Wednesday that an agreement has been reached on the RIZ and he expects them to be signed in the coming months, confirming statements made a day earlier by Trade and Industry Minister Tarek Kabil.

Washington is concerned “by reports of detentions and arrests of LGBTI persons in Azerbaijan and Egypt, respectively,” State Department spokesperson Heather Nauert told the Washington Blade last week. The statement came as Nauert attempted to explain why the US voted against a UN Human Rights Council resolution condemning the use of the death penalty as punishment for LGBT acts. The “no” vote came despite Nauert’s assertion that the US “unequivocally condemns the application of the death penalty for conduct such as homosexuality, blasphemy, adultery, and apostasy.” She says the US voted against the resolution “because of broader concerns with the resolution’s approach in condemning the death penalty in all circumstances,” as it called for the abolition of the death penalty altogether. Joining the US in voting against the resolution: Egypt, India, Bangladesh, Botswana, Burundi, China, Ethiopia, Iraq, Japan, Qatar, Saudi Arabia, and the UAE.

Questions over Egypt’s human rights record are also impacting Egypt’s bid to have Moushira Khattab head up UNESCO, according to the Associated Press. Egyptian civil rights activists are urging UNESCO to reject Khattab’s candidacy, alleging she is complicit in “state attacks on the values for which the UN agency stands.”

House to the rescue? The House of Representatives looks set to put human rights front and center on its agenda — just not in a way that will get us much international sympathy. A parliamentary delegation is expected to file an official complaint against Human Rights Watch (which prepared earlier this year a report alleging systemic torture in Egypt) at a conference of the Inter-Parliamentary Union scheduled for mid-October, according to Asharq Al Awsat. Separately, the House Human Rights Committee wants to see human rights incorporated in the curriculum in both the K-12 and postsecondary education systems, Egypt Independent reports. “The suggestion received preliminary approval from the Education Ministry, the next step is to get ratification from the Parliament,” committee chair Alaa Abed said.

GCC’s Qatar spat drives US military to “opt out” of some exercises: In what could be a bid to spur the GCC into taking more proactive steps to end the rift with Qatar, the US military appears to be scaling down its involvement in regional military exercises. ”We are opting out of some military exercises out of respect for the concept of inclusiveness and shared regional interests. We will continue to encourage all partners to work together toward the sort of common solutions that enable security and stability in the region,” read a statement from US Central Command spokesman John Thomas to Reuters.

The UN blacklisted the Saudi-led military coalition fighting the Houthis in Yemen on Thursday in a report to the Security Council alleging that the coalition killed or injured 683 children in Yemen and attacking dozens of schools and hospitals in 2016. The report also blacklisted the Iran-allied Houthi group for similar violations. The coalition had been briefly added to the blacklist in 2016 and then removed by then UN chief Ban Ki-moon pending review, according to Reuters.

The Macro Picture

The darknet is at the edge of the investable universe: The Dark Net’s potential to disrupt mainstream businesses is growing, Goldman Sachs Research Head of Internet Research Heath Terry says. The darknet — in which messages, goods and services can change hands outside the reach of regulation and law enforcement — remains on the fringes of society today, yet its scale is the most surprising element of it, Terry says. He notes that it has over 400k users in the US alone and says it is creating disruptive risks in two places.

On one hand it impacts how people use the internet, adding an element of privacy that does not make targeting advertising effective and reduces the ability of companies to monetize their online presence — impacting the USD 75 bn online advertising and USD 250 bn e-commerce markets.

On the other hand, the darknet raises regulatory concerns, which Terry sees as could having an impact on regulating the internet as a whole and potentially driving regulators to regulate anonymous communications and getting platforms such as Facebook caught in “the regulatory zeal.”

Ultimately, the darknet could impact the way internet companies grow and ultimately the way they are valued by the market.

Image of the Day

New discoveries from Ancient Egypt: Archaeologists have unearthed a number of Ancient Egyptian artefacts recently, the most striking of which is a red granite obelisk believed to be as old as 4,300 years. A Swiss-French mission dug up the ruin — one of the largest stone fragments ever found — at the Saqqara necropolis, Newsweek reports.

In South Aswan, a team of Egyptian archaeologists uncovered pre-Dynastic runes engraved on sandstone rocks dating back to the same era as other markings in French, Spanish, and Italian caves, Ahram Online reports.

Over by the Red Sea, Polish excavations uncovered a pet cemetery with nearly 100 intact animal skeletons dating back to 75-150 AD, according to Forbes. Meanwhile, Russian scientists say an Egyptian mummy believed to have belonged to a high-born female singer turned out to be a castrated, middle-aged man, despite the practice being uncommon in Egypt.

Egypt in the News

Topping coverage of Egypt in the international news is more blowback from arrests of LGBTQ citizens, with Human Rights Watch claiming that 57 Egyptians have been arrested so far since the supposed crackdown on LGBTQ activists began two weeks ago. The group also condemned the Supreme Media Council’s ban on all “positive” reporting on same-gender relations. HRW’s report and others have been picked up extensively by the newswires, with some calling it the widest LGBTQ crackdown ever.

Patrick Werr is back to writing his usual column for The National and his first order of business to sound the call that Egypt “should be working overtime to attract longer-term investment.” Werr is positing, “citing fixed-income traders and economists,” that the central bank has been keeping the EGP undervalued “by as much as 20%.” He says that if the central bank allows the EGP to strengthen, the inflows of “hot money” portfolio investments to depart, “prompting foreign investors to take their profits and pull their money out of Egypt.” The government should counter this potential by attracting longer-term investment. A starting point would be for the government to stop threatening to intervene in the marketplace, Werr says. “It could also push ahead with the long-promised sale of stakes in large state companies, especially Banque du Caire, which has been repeatedly delayed. Among other reforms, government employees should be taught how to implement the country’s laws … Another would be to reduce to a minimum the huge number of government entities that companies currently must deal to get start up their projects. Yet another reform would be to make it harder to punish employees who make mistakes.”

Did the UAE pay for Egypt’s lobbying efforts in the US in 2013? That’s what emails The Intercept got its hands on seem to be suggesting. The report relies on email exchanges between the UAE’s Ambassador to the US, Yousef Otaiba, and officials from the D.C-based public relations and lobbying outfit Glover Park Group, which reveal that the diplomat had been the main liaison with Cairo, which chose the firm “to be one of its public faces in the US capital.” The correspondence purports to show Otaiba telling a GPG official that the UAE had transferred USD 2.7 mn to Cairo, which accounted for the bulk of the USD 3 mn Egypt then paid to the lobbying firm for its work. Otaiba reportedly also approached journalists and think tank staffers in the US to discuss the positive aspects of President Abdel Fattah El Sisi’s administration, confronting those who were critical and “acting as a sort of de facto ambassador” for Egypt.

Reuters is out with yet another story on tahteeb, the ancient Egyptian martial art. Their angle is how the martial art evolved from being one that could see the loser injured or killed to now being non-contact, with striking not permitted. “Tahteeb requires a great deal of skill and control, and there are rules which govern how to hold the stick and the kinds of blows permitted, some of which were aimed to be deadly before the martial art became a no-contact discipline.”

Other international stories on Egypt worth noting in brief include:

- A lawyer says police arrested seven Nubians who were protesting outside a courthouse over a judge’s decision to extend the detention of relatives detained for protesting for Nubian land rights, the AP notes.

- The Tour N’ Cure medical tourism program is receiving an extensive report from France 24, which also interviewed its managing director Mostafa El Sayed. The biggest challenge for the program is people doubting the efficacy of getting treatment in Egypt, El Sayed says.

On Deadline

Government borrowing that has brought foreign debt to alarming levels mus t be stopped and replaced with measures to increase domestic production with an eye to boost exports, Mohamed Mekky writes in a column penned for Al Shorouk. Mekky points out that foreign debt levels are as equally alarming as booming population growth rates, criticizing the government for claiming our debt levels are manageable when the opposite is true.

Worth Watching

What could be better than Gordon Ramsay barking out inspired insults on TV? John Legend playing the piano and singing said inspired insults, including “you put so much oil in this, the US wanted to invade the [redacted] plate,” and wondering why the chicken crossed road. The master chef himself chimes in with a definitive answer to that question (watch, runtime 1:41).

Diplomacy + Foreign Trade

President Abdel Fattah El Sisi has invited Sudan’s President Omar Al Bashir to Egypt, Sudan’s Foreign Ministry said, according to Sudan Tribune. “Relations between the two countries are marred by difference over Halayeb triangle and Sudan’s support for Ethiopia in the construction of the Renaissance Dam. Also, the conflicting trade relations between the two countries also contributed to widening the gap between the two countries,” the paper notes.

A step in the right direction? This comes as Egypt welcomed the US move to lift economic sanctions on Sudan that had been in place since 1997, in a statement from the Foreign Ministry on Saturday. Sudan has previously accused Egypt of opposing the lifting of UN sanctions on Sudan over the conflict in its western Darfur region, which Cairo denies, according to the AP.

Meanwhile, a delegation from the Egyptian Council for Foreign Affairs will start a four-day visit to Khartoum on Monday to set up a working group to draft a paper on Sudanese-Egyptian relations, Sudan Tribune reports.

Egypt reportedly backs Hamas not discussing disarmament: Reconciliation talks between Hamas and Fatah continued last week with the head of Egypt’s General Intelligence Directorate Khaled Fawzy mediating between them in Gaza and Ramallah, Ahram Online reports. Fawzy reportedly informed Palestinian Authority President Mahmoud Abbas that Hamas will not discuss disarmament and will not consider the possibility before a peace agreement is reached with Israel, the Times of Israel reports.

This comes as we hear that Hamas arrested the leader of Daesh in the Gaza Strip alongside three other of the group’s senior members, according to AFP, which says the move marks a shift in Hamas’ stance on terrorist groups in the area — its support for which had once strained ties with Egypt.

Swiss Economy Minister heads delegation to Egypt on 1 November: A delegation of six Swiss companies and government officials headed by Switzerland’s Economic Affairs, Education and Research Minister Johann Schneider-Ammann will be visiting Egypt on 1 November to discuss bolstering economic ties and trade, Trade and Industry Minister Tarek Kabil said last Wednesday, according to AMAY.

The Trade and Industry Ministry signed three MoUs with the UAE government that will see the latter fund the development of date growing, storage and exporting facilities in various governorates, Al Masry Al Youm reports.

GAFI boss talks investment, cooperation with Indonesian delegation: An Indonesian delegation headed by Presidential Advisor Sri Adiningsih discussed potential investments with General Authority for Investment and Freezones (GAFI) Managing Director Mona Zobaa in Cairo yesterday, Al Mal reports. The talks centered largely on Indonesia’s keenness to boost Egypt’s religious tourism, particularly as many Indonesian students are currently enrolled at Al Azhar University.

Energy

SDX Energy makes new crude discovery in West Gharib concession

SDX Energy made a new oil discovery in Egypt, with its Rabul-2 well unearthing heavy crude in the West Gharib concession, the company announced on Thursday (pdf). "This was our final commitment well in the West Gharib concession and we are encouraged by the result, which reaffirms our view of the area’s significant development potential,” CEO Paul Welch said. This is the latest in a string of good news for the company, which announced in July that reserves in the first phase of its South Disouq concession could reach 180 bcf of gas.

Infrastructure

Polaris Parks conducts feasibility studies for new business zone in Suez Canal Axis

Polaris Parks is conducting technical and feasibility studies for a new business zone in the Suez Canal Axis, Deputy General Manager Bassel Shoeirah tells Al Masry Al Youm. The company expects to submit a proposal to develop infrastructure facilities across a 5 KM stretch to the Suez Canal Authority by the end of 2017.

Basic Materials + Commodities

Saudi Arabia denies entry of a 27-tonne shipment of tomatoes

Saudi Arabia’s quarantine authorities denied entry of a 27-tonne shipment of Egyptian tomatoes, saying it was unfit for human consumption, Al Masry Al Youm reported on Wednesday. Egyptian quarantine officials reportedly confirmed the shipment contains rotten tomatoes. While the move does not appear to be another blanket ban on a particular good from Egypt, it does not look good for Egyptian produce, which has been slapped with multiple bans on pepper and strawberry exports to Saudi, the UAE, and Sudan. The spate in bans has led the government to tighten safety restrictions on agricultural exports.

Matrouh governorate to sign USD 60 mn agriculture agreement with IFAD

The Matrouh governorate is expected to sign a USD 60 mn agreement with the International Fund for Agricultural Development (IFAD) for agricultural and rainwater harvesting projects in November, Governor Alaa Abouzeid announced yesterday, Al Mal reports. The governorate will begin implementing the projects, which are geared towards increasing agricultural sustainability, by January 2018.

AMOC signs agreement with France’s Axens to improve quality of its diesel fuel

The Alexandria Minerals and Oils Company signed an agreement with France’s Axens that will see the latter provide it with technology to help improve the quality of its refined diesel fuel, Al Masry Al Youm reports. AMOC is looking to bring the quality of its diesel fuel up to international standards in a bid to increase its exports and expects the French company to complete its work by 2019 or 2020. The value of the contract was undisclosed.

Real Estate + Housing

Orascom Construction completes work on Al Masah Hotel

Orascom Construction has completed work on the Al Masah Hotel at the new administrative capital, Al Borsa reported last week. The EGP 900 mn hotel, co-developed with and owned by the military’s Engineering Authority, is expected to include a mall, conference hall, and lake area. OC was responsible for developing the area surrounding the hotel, while the New Urban Communities Authority will be constructing on site facilities, the newspaper says.

Tourism

Egypt signs tourism promotion agreement with Italy as Pope blesses Egyptian delegation to Vatican

Tourism Minister Yehia Rashed signed an agreement with Italy’s Minister of Culture and Tourism, Dorina Bianchi, that will see Italy help promote tourism to Egypt, according to a statement from the ministry. Rashed was in Italy last week at the head of a delegation to the Vatican to promote a pilgrimage in the footsteps of the Holy Family’s flight to Egypt. The minister met with Pope Francis, who had a special greeting prepared for the delegation. Tap here for the Pope’s full statement from Radio Vaticana.

Automotive + Transportation

Go Bus to buy 22-bus fleet from Mercedes in 2018

Tourist transportation company Go Bus will buy a fleet of 22 buses from Mercedes in 2018 for EGP 125 mn, Al Borsa reports. The agreement will also see Mercedes run maintenance on 100 buses, said Go Bus head Saad Attia.

Banking + Finance

GPC signs EGP 2.3 bn loan agreement with six-part banking consortium that includes NBE, Banque Misr

The General Petroleum Corporation (GPC) signed a EGP 2.3 bn loan agreement with a consortium of six banks to finance expansion plans and new exploration activities, sources close to the matter tell Al Masry Al Youm. The sum will be disbursed in tranches of EGP 900 mn and USD 80.9 mn and repaid in local currency over seven years. The amount will cover 85-95% of planned projects, which include as much as 16 onshore and offshore wells, as well as two new docking platforms.

Legislation + Policy

MP Margaret Azer to draft legislation criminalizing underage marriage

House Human Rights Committee head Margaret Azer announced she is currently drafting a law to criminalize underage marriage, which she plans to bring to the assembly for discussion during its current session. The law would impose prison sentences of 7-10 years on all those found guilty of facilitating underage marriages, including the children’s parents and the officiant, Al Masry Al Youm reports.

Egypt Politics + Economics

Poverty rate in Egypt stands at 29% -Maait

Egypt’s poverty rate currently hovers around 28-29%, Vice Minister of Finance Mohamed Maait said at a conference yesterday, Al Mal reports. GDP per capita has also seen a drop, Maait said without providing figures. These indicators are compounded by the unemployment rate, which — despite having eased to 11.9% from a previous 14% — remains elevated, he added.

National Security

Libya recovers bodies of 21 Egyptians killed by Daesh

Libya has recovered the bodies of the 21 Egyptian Coptic Christians who were beheaded by Daesh in February 2015, Libya’s attorney general said, Reuters reports. “The bodies were found in the same orange jumpsuits the victims were wearing when they were filmed being killed in the coastal city” of Sirte, a former Daesh stronghold.

On Your Way Out

ON THIS DAY- This day in 1990 was Britain’s first as a full member of the European Monetary System’s Exchange Rate Mechanism (ERM). The system required member states to keep their currency value tied to the German mark, requiring them to adopt German anti-inflation policies, with a view to eventual monetary union. In 2003 Arnold Schwarzenegger was elected governor of California, ousting the incumbent, Gray Davis, three years before his term was due to end. On this day in 2015, the FX crunch was worsening as central bank reserves tumbled to USD 16.34 bn. A symptom of the crunch was the disappearance of hepatitis-C medication Sovaldi.

The Market Yesterday

EGP / USD CBE market average: Buy 17.6012 | Sell 17.7012

EGP / USD at CIB: Buy 17.60 | Sell 17.70

EGP / USD at NBE: Buy 17.60 | Sell 17.70

EGX30 (Thursday): 13,882 (-0.4%)

Turnover: EGP 1.3 bn (42% above the 90-day average)

EGX 30 year-to-date: +12.5%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.4%. CIB, the index heaviest constituent ended down 2.1% among today’s worst performers. EGX30’s top performing constituents were: Egyptian Iron & Steel up 5.9%, Kima up 5.2%, and Sidi Kerir Petrochemicals up 3.9%. Thursday’s worst performing stocks were: Abu Dhabi Islamic Bank down 5.7% and EFG Hermes down 1.7%. The market turnover was EGP 1.3 bn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +74.7 mn

Regional: Net Short | EGP -38.7 mn

Domestic: Net Short | EGP -36.0 mn

Retail: 70.0% of total trades | 66.2% of buyers | 73.8% of sellers

Institutions: 30.0% of total trades | 33.8% of buyers | 26.2% of sellers

Foreign: 11.1% of total | 14.0% of buyers | 8.4% of sellers

Regional: 6.9% of total | 5.4% of buyers | 8.3% of sellers

Domestic: 82.0% of total | 80.6% of buyers | 83.3% of sellers

WTI: USD 49.29 (-2.95%)

Brent: USD 55.62 (-2.42%)

Natural Gas (Nymex, futures prices) USD 2.86 MMBtu, (-2.05%, November 2017 contract)

Gold: USD 1,274.90 / troy ounce (+0.13%)

ADX: 4,414.16 (-0.44%) (YTD: -2.91%)

DFM: 3,591.10 (-0.21%) (YTD: +1.71%)

KSE Weighted Index: 438.29 (+0.20%) (YTD: +15.31%)

QE: 8,132.05 (-0.26%) (YTD: -22.08%)

MSM: 5,213.49 (+0.11%) (YTD: -9.84%)

BB: 1,274.10 (+0.01%) (YTD: +4.40%)

Calendar

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

15-16 October (Sunday-Monday): The Marketing Kingdom Cairo 3 conference, Dusit Thani Lakeview Hotel, Cairo.

17 October (Tuesday): The Narrative PR Summit, Four Seasons Nile Plaza, Cairo.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Future of Cities: Innovation, Spaces and Collaboration,” The French University, Cairo. Register here.

23-27 October (Monday-Friday): 29th Business and Professional Women International Congress themed “Making a Difference through Leadership and Action,” Mena House Hotel, Cairo. Register here.

06-07 November (Monday-Tuesday): Crisis Communications Conference, Four Seasons Nile Plaza Hotel, Cairo.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

19-21 November (Sunday-Tuesday): 11th Annual INJAZ Young Entrepreneurs Competition, Four Seasons Nile Plaza, Cairo.

26-29 November (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

17-21 February 2018 (Wednesday-Saturday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.