- Foreign reserves at new record high of USD 36.143 bn. (Speed Round)

- PMI rose to a 23-month high in August with a reading of 48.9 as export orders “rose sharply.” (Speed Round)

- Egyptian IR pros among finalists for Extel awards. (What We’re Tracking Today)

- Consumer Protection Authority goes after Orange ad for disrespecting oldsters. (What We’re Tracking Today)

- Cairo is ready to sign airport security pacts, but Moscow is asking for changes to Russian industrial zone agreement —Russian ministers. (Speed Round)

- Government to send SMEs law to the House for approval in October. (Speed Round)

- Some actively managed emerging market funds consistently outperform index + Be choosy about which EM you invest in, Bloomberg warns. (The Macro Picture)

- A grim morning for Egypt in the international press. (Egypt in the News)

- The Market Yesterday

Thursday, 7 September 2017

May we simply say: TGIT — may we please have a PSL?

TL;DR

What We’re Tracking Today

We slide into the weekend after a blessedly short work week — and still counting the hours until what we expect is three-day weekend 21-23 September for Islamic New Year, which should fall on the Thursday (the Hijri calendar permitting). Despite the prospect of a very busy fall and a 2018 that we think will be challenging on a number of fronts (more on that soon), we’re exceptionally happy to be down to business once again.

A handful of programming notes before we get underway this morning:

Investment Minister Sahar Nasr will be joining our friends at AmCham for lunch on Tuesday, 12 September. The minister will speak on “Embracing the Future: Unlocking Egypt’s Investment Potential.” The event is open to AmCham members and their guests.

Some of our favourite people are among the finalists for the Extel / MERIS 2017 investor relations awards. The usual Gulfie chauvinism is on display from the top down, but still, special recognition is due to the Egyptian pros short-listed, including:

- Best investor relations by CEO (Middle East) — Hussein Abaza

- Leading corporate for investor relations (Egypt) — CIB, SODIC, GB Auto, Ezz Steel, PHD

- Best investor relations professional (Egypt) — Heba Makhlouf (SODIC); Sherif Khalil, Nelly El Zeneiny, Yasmine Hemeda (all CIB); Menatalla Sadek (GB Auto); Kamel Galal (Ezz Steel)

- Most improved IR team (bluechip) — Juhayna, SODIC

- Most improved IR team (large cap) — PHD

Also, former Egyptian Resorts Company IRO Mohamed Shawky got the nod as a finalist for best IR professional (Kuwait). You can download the full list of nominees here (pdf).

Meanwhile, among the most-clicked links in Enterprise this rather short week, we have:

- The August 2017 Markit / Emirates NBD purchasing managers’ index (Markit, pdf)

- A special message to the Northampton Borough Council from Sandor Clegane, on behalf of Enterprise. (Enterprise)

- The Enterprise fall 2017 legislative primer for business. (Enterprise)

- President Abdel Fattah El Sisi’s speech to the BRICs council. (Full text from Ittihadiya, pdf)

- Finance Ministry’s report for July 2017, landing page (Ministry of Finance)

Senior executives from Orange Egypt promised to commit seppuku and take theiradvertising agency with them after the mobile operator’s latest advert ran afoul of the Consumer Protection Agency (CPA), which claims to have received citizen complaints about the advert via the Social Solidarity Ministry (who says beggars can’t be choosers). CPA boss Atef Yacoub told the press on Wednesday, AMAY reports. (We may be exaggerating there with the suggestion that execs were mulling Japanese ritualized suicide. The Orange bosses have apparently said they would instead re-cut the ad or otherwise censor themselves.)

The complaints said the ad, which ran as part of Orange’s campaign to support Egypt inthe 2018 FIFA World Cup qualifiers, violates basic decorum and is offensive to senior citizens. That’s right, to geezers like some of us here at Enterprise. The ad features elderly, supposedly disease-ridden football fans rapping about how this might be their last chance to see Egypt make it to the FIFA World Cup, which hasn’t happened since 1990. Yacoub said Orange executives agreed to edit out parts viewers found offensive, claiming that their intention was to encourage senior citizens to join the fandom. A change of subsidized adult diapers may be in order, we suggest. You can check out the ad for yourselves here until it’s gone (runtime 1:44).

Guess what? Censorship works: Most of the other ads the Committee for the Promotion of Virtue and Prevention of Vice Consumer Protection Agency ordered censored back in Ramadan 2016 are now dead links on the interwebs, including spots from Juhayna, Birell, Cottonil and Dice. You can read here our original coverage of the ads (and a summary of how the offended).

And y’know what else? The poor and the gullible are being fleeced by psychic hotlines. We’re being scammed by illegal med ads on TV. Warranties are works of fiction at company after company. Those skin-whitening creams are flat-out racist — and unsafe. In fact, unsafe products are on shelves nationwide. The notion that sanitation companies honor their contracts in municipal areas is an outright joke. There are vehicles on the road with safety records that should give Evel Knievel pause. We are, folks, an emerging [redacted] market — consumer safety is bad enough to give a ‘western’ regulator the hives the moment he / she steps off the aircraft onto our fair soil. And “disrespectful” ads are a priority?

On The Horizon

The Council of State is expected to begin reviewing the Investment Act’s executive regulations next week and finalize its work by the end of the month.

Telecom Egypt could be rolling out mobile services nationwide next week, according to Al Mal. TE is looking to snag a 2-3% market share for its first year in operation, or about 2 mn customers. The market had some 100.31 mn subscribers in the 12 month period ending in July 2017, the newspaper reports.

A UK trade delegation headed by trade envoy Sir Jeffrey Donaldson will be visiting Egypt this month to discuss investment in infrastructure, among other topics.

Vice-chairman of the Federal Reserve Stanley Fischer submitted his resignation to US President Donald Trump, according to the FT (paywall). The move comes at a very fluid time for US monetary policy and ahead of the Fed Policy meeting on 19-20 September. The resignation leaves several Fed seats empty, giving Trump room to influence central bank policy. Fischer maintained an active and hawkish fed policy and opposed deregulating Wall Street, something Trump heavily favours. With Fed boss Janet Yellen potentially nearing the end of her tenure, after Trump indicated he may not reappoint her, the Fed could be in for a massive shift in gear. Trump had signalled that he may look to appoint his top economic advisor, Gary Cohn, as Fed chairman, as he may opt to pick a candidate more in line with his policy and going against the mold of previous presidents and maintaining continuity, says writes Craig Torres for Bloomberg.

The shakeup in the Fed comes as inflation in the US continues to be muted despite the American economy expanding moderately in July through to mid-August, according to the latest survey conducted by the Fed on Wednesday. The inflation question has stumped central bankers and will probably the issue guiding the Fed during the policy meeting.

Our own central bank’s Monetary Policy Committee will be meeting on 28 September to decide on Egypt’s interest rates, which we don’t expect to see lowered before the end of the year.

Enterprise+: Last Night’s Talk Shows

From MoFA refuting allegations of systemic torture in Egypt to talk of improving women’s access to divorce, the talk show scene finally showed signs it may begin to return to life last night.

Foreign Affairs Ministry spokesperson Ahmed Abu Zeid attacked Human Rights Watch’s report alleging gross human rights violations by Egypt (we have more in Egypt in the News), which told Masaa DMC is politicized and factually incorrect. Abu Zeid said it is a conspiracy, suggesting the rights group has it out for Egypt and illegally receives funding from unspecified foreign governments. He also suggested that the anonymous sources cited in the report could have instead taken their statements to the “relevant authorities” here in Egypt (watch, runtime 11:53).

Meanwhile on Al Nahar TV, Gaber El Karmouty had a chat with MP Abdel Moneim El Elaimy about a draft law that would amend the Personal Status Law to allow women to seek an uncontested, automatic divorce in the event their husbands marries a second wife without approval from his first wife (watch, runtime 26:05).

More pacts with China: Head of the Egyptian Holding Company for Land and Maritime Transport, Mohamed Youssef, phoned in to Extra News to talk about the three MoUs the company is preparing to sign with Chinese companies. Youssef says the agreements will be geared towards increasing the local component quota to eventually begin manufacturing the vehicles in Egypt. We have further coverage of the MoUs in Diplomacy + Foreign Trade, below (watch, runtime 5:56).

Speed Round

Foreign reserves charting new highs: The central bank’s net international reserves increased to USD 36.143 bn in August, up fractionally from the previous all-time high of USD 36.036 bn in July. The CBE had cashed out some USD 3 bn to meet Egypt’s foreign debt obligations in July and August, including some to the Paris Club, CBE Deputy Governor Rami Aboul Naga told Al Borsa on Wednesday. A CBE official had told Bloomberg on Tuesday that Egypt cleared its foreign-trade and import FX backlog, clearing some USD 49 bn in trade-financing transactions between the EGP float and August.

The good news continues: August’s Markit / Emirates NBD PMI for Egypt rose to a “joint” 23-month high with a reading of 48.9 as export orders “rose sharply.” The PMI also pointed to the weakest contraction in output in the 23-month period as new export work increased markedly. “Egypt’s PMI improved further in August, although it remains in contraction territory at 48.9. New orders declined only marginally after stabilizing in July, and new export orders increased at the fastest rate since May. Inflationary pressure remained high in August however, as electricity tariffs were increased last month,” Khatija Haque, Head of MENA Research at Emirates NBD, commented. The report notes that the rate of reduction in output was only marginal, as “panellists commented that higher cost inflationary pressures and unfavourable economic conditions caused the fall in business activity.” Also, “hopes of better economic conditions and stabilisation in currency markets boosted positive sentiment, with the level of confidence the strongest observed in six months.”

…We are in “caution territory,” Emirates NBD Group Head of Research and Chief Economist Tim Fox, tells Bloomberg TV. He says that while the economy is benefiting from export orders, the domestic economy remains lacklustre because of high interest rates (runtime 01:56).

Tax revenues for FY2016-17 exceed targets for the first time ever by around a third: Egypt exceeded its targeted tax revenues for the first time ever in FY2016-17 by as much as 33%, Finance Minister Amr El Garhy said on Wednesday, confirming what Vice Minister of Finance Amr El Monayer had suggested last month. El Garhy did not disclose the actual figure, saying the official announcement is only a few days away. The amount, though, is likely to surpass the EGP 473.2 bn target set by the IMF for the USD 12 bn loan agreement Egypt signed last year and the EGP 450 bn El Garhy had estimated in July. Al Mal’s calculations place the figure around EGP 575 bn, based on forecasted tax revenues of EGP 433 bn in the FY2016-17 state budget. Egypt had implemented the value-added tax for the first time in the last fiscal year at a baseline rate of 13% that rose to 14% at the start of FY2017-18 in July, which is expected to help the Finance Ministry collect a projected EGP 604 bn in taxes during the year. Other fiscal policy and structural amendments, such as the new stamp tax on capital market transactions and the Tax Dispute Resolution Act are also seen driving an increase in tax collections for the fiscal year.

Egypt told Russia that it’s ready to sign an aviation security protocol that should “theoretically” precede the resumption of air travel between Cairo and Moscow, Russian Transport Minister Maxim Sokolov said yesterday, according to Sputnik. “We are preparing proposals for the resumption of flights, but only to Cairo so far. Regular or charter [flights] — it will depend on the interests of companies, both Russian and Egyptian,” the minister said. This comes one day after Sokolov said that further inspections for Cairo International Airport will not be necessary, confirming that the decision now rests on the Russian government. This coincided with news that President Abdel Fattah El Sisi and Russian counterpart Vladimir Putin had sealed the final contracts on the Dabaa nuclear power plant.

The Bear giveth, and The Bear taketh away: Just as we are seeing potential progress on the resumption of flights (as opposed to faux progress we’ve been hearing for two years), Moscow has apparently postponed the signing of an agreement to establish an industrial zone in Port Said until early 2018, according to Russian Trade Minister Denis Manturov. The agreement is being revised and amended, Manturov said, adding that he doesn’t expect the process to take too long. Sound familiar?

The Ismail government is planning to send legislation regulating small- and medium-sized enterprises to the House of Representatives when MPs reconvene in October, Al Borsa reports. The House SMEs Committee will merge the incoming law with another SMEs bill that was referred to parliament during its most recent session, committee head Hala Abul Saad says. The article provides no details on either law, but the House had been waiting on Cabinet to send over a law on taxing SMEs last October, and the Ismail government had also approved decisions to establish sole proprietorships in August 2016.

The Ismail cabinet gave the green light yesterday to an amended Water Act, according to an official statement. The law outlines how water is distributed, who has the right to use it, and new regulations for Egypt’s sewage systems. The act first emerged back in 2014, and has been amended, killed off, and resurrected several times since. The Irrigation Ministry had completed the latest draft of the bill in June to tackle issues such as the impact of climate change and dangerously high pollution levels in our dwindling water resources. The minister’s’ agenda did not include the executive regulations for the law on repossession of illegally occupied land, which Ismail had said would be discussed during the meeting. Other decisions taken during the meeting include:

- Granting preliminary approval to transferring supervision of oil and gas production in Ras Fanar to the Egyptian General Petroleum Company, until legislation is issued to govern the region;

- Ratifying a 2015 presidential decree to join the UN’s International Agreement on Olive Oil and Table Olives, which sets international standards for olive oils.

Egypt, Vietnam target growing bilateral trade to USD 1 bn: Egypt and Vietnam want to triple bilateral trade to USD 1 bn, with a focus on shipbuilding, IT, maritime transport, manufacturing, and agriculture, according to an Ittihadiya statement (pdf). The announcement came during President Abdel Fattah El Sisi’s visit to Hanoi, the first by an Egyptian head of state to the Southeast Asian nation. “Vietnam is committed to facilitating the entry of Egyptian goods in Vietnam and welcomes the Egyptian President’s support for the import of Vietnamese products,” Vietnamese President Trần Đại Quangsaid, according to Vietnam News Agency.

El Sisi and Quang also presided over the signing of nine MoUs in Hanoi yesterday. The agreements pertain to cooperation in trade and industry, maritime trade, promoting investments, fish farming, building and managing ports and economic zones, and media. The two sides also agreed to set up programs for cooperation in tourism and culture.

El Sisi sat down with Quang in a closed session to discuss counterterrorism cooperation, then met with Prime Minister Nguyễn Phú Trọng to discuss increasing business and cultural cooperation, according to an Ittihadiya statement (pdf). The president, who’s also attending a business forum today, invited the Vietnamese leaders to visit Egypt.

EARNINGS WATCH– Eastern Tobacco restated its FY2016-17 net profit after tax to EGP 1.78 bn, from the EGP 1.74 bn it reported in July, according to an EGX filing.

M&A WATCH- Amazon subsidiary Souq.com has acquired Wing.ae, a startup that is building out a network for Prime-style same-day and next-day deliveries for various e-commerce marketplaces, according to TechCrunch’s Ingrid Lunden. Lunden says “Souq and Amazon are buying into a startup that will help them stay ahead in an area that has been one of Amazon’s traditional strengths, logistics” and Wing.ae can “also potentially can help Amazon build out its Prime business into the region.” The financial terms of the agreement were not disclosed.

Israeli Prime Minister Benjamin Netanyahu said Israeli-Arab relations are at their best ever, according to the AP. Netanyahu said that even though a deal with the Palestinian side isn’t close it hasn’t affected relations with Arabs even if their extent remains out of the public eye.

Other international stories worth noting in brief this morning:

- The United States wants the UN Security Council to impose sanctions on North Korea’s most lucrative exports and set an oil embargo, according to Reuters. A draft resolution is ready and the US may push it as early as Monday. The resolution aims to block oil imports and ban exports of textiles and labourers.

- A draft bill presented at a French cabinet meeting Wednesday proposes to end exploration concessions and halt all oil and gas production by 2040, Bloomberg reports. If passed the law would allow the government to halt 40 exploration requests that have already been made as well as limiting extensions on production licenses.

The Macro Picture

Actively managed emerging market funds may be capable of consistently outperforming their benchmark, research has shown, according to The Financial Times. This improved performance only happens if the funds “are given the freedom to take punchy bets” and notion runs counter to overwhelming evidence from developed markets suggesting that very few funds are capable of consistently beating their underlying index. “Much of this outperformance appears to have come from genuinely active managers’ ability to underweight state-owned (or rather state-controlled) companies, which are commonplace in emerging markets but typically produce poor returns.” Steven Holden, founder of Copley, finessed the research and may have found a way to identify funds with a greater shot at outperforming by looking at the correlation between the fund and its underlying index, “expressed in a weighted R-squared figure, which explains what proportion of the fluctuation in the value of a fund is explained by fluctuations in the index itself.” Holden says “the results show a clear link between fund performance and the level of independence from the benchmark index.”

While we’re on the topic, foreign investors need to be more selective about where they allocate funds in emerging markets, Sid Verma writes for Bloomberg. “Overseas investors now own 27.8% of the region’s bonds, led by South Africa, the Czech Republic and Russia,” the piece says, which puts “markets there at risk of a sudden exodus if US and euro-area officials tighten monetary policy more than analysts expect.” Bloomberg indexes found that “government notes from EMEA [are] up 15% in USD terms, beating the 9.2% average return for all emerging markets.” Egypt, South Africa, Russia, Colombia, and Peru — all markets that are “vulnerable to external shock” — are especially crowded at the moment, suggests Deutsche Bank AG strategist Christian Wietoska, says that levels have not yet reached the extreme but still advises caution.

Egypt in the News

It’s a largely grim morning for Egypt in the international press:

The conversation on Egypt in the global press is being dominated by Human Rights Watch report that claims the nation’s security services “routinely” torture political detainees. The story is getting wide pick-up by the wires as well as The Guardian, CNN, the BBC, Vice and Ireland’s Independent, among many others. The report alleges torture is “widespread and systematic” and could amount to “a crime against humanity.” HRW suggests President Abdel Fattah El Sisi should “direct the Justice Ministry to create an independent special prosecutor empowered to inspect detention sites, investigate and prosecute abuse by the security services, and publish a record of action taken.”

Foreign Ministry Spokesman Ahmed Abu Zeid responded to the report by saying HRW has always been a biased organization due to its sources of funding and have shown an inability to comprehend the situation on the ground in Egypt. Abu Zeid said Egypt’s existing judiciary is competent to deal with any rights violations.

Media in Egypt is “increasingly dominated by businessmen with links to the government and its intelligence services,” according to a report by Reporters Without Borders, cited by the Associated Press. The report says “the regime’s domination of the media continues to grow and is even affecting pro-government media.” Reporters Without Borders’ website is not accessible from Egypt.

Following on The Economist’s report on the 20 Egyptians working to preserve the country’s Jewish heritage, The Guardian’s Ruth Michaelson looks into the project to restore the Eliyahu Hanavi synagogue in Alexandria. The decision to restore the synagogue has struck many as odd, Michaelson writes, “given the size of the country’s Jewish population, believed to be fewer than 50 people, and the government’s unwillingness to engage with Egyptian Jewry.” Antiquities Ministry spokesperson Niven Al Aref says, “There has always been an appreciation of Jewish history and monuments … This will continue in the future, as these are part of Egypt’s heritage.”

“Egypt is going energy mad,” says the Petroleum Economist. If the Dabaa nuclear power plant project succeeds, Egypt’s long-term electricity needs could be covered, especially since the country is close to being self-sufficient in natural gas, as Zohr is due to come onstream end of the year. President Abdel Fattah El Sisi invited his Russian counterpart to come to Egypt for the signing of the final Dabaa contract, at a date yet to be announced.

On Deadline

The solar power plants in Benban, Aswan, serve as an excellent model for further renewable energy projects in villages that are in need of power supply, Ahmed Abdel Tawab writes for Al Ahram. Abdel Tawab points out that the plants in Benban fulfill the village’s electricity needs and produce enough surplus to feed back into the national grid, in addition to creating job opportunities for the local community, all of which are advantages that could be replicated across several governorates. He calls for the community at large to pitch in to fund these future projects, and suggests that mimicking the Suez Canal bank certificate strategy could be a good way to do so.

Worth Watching

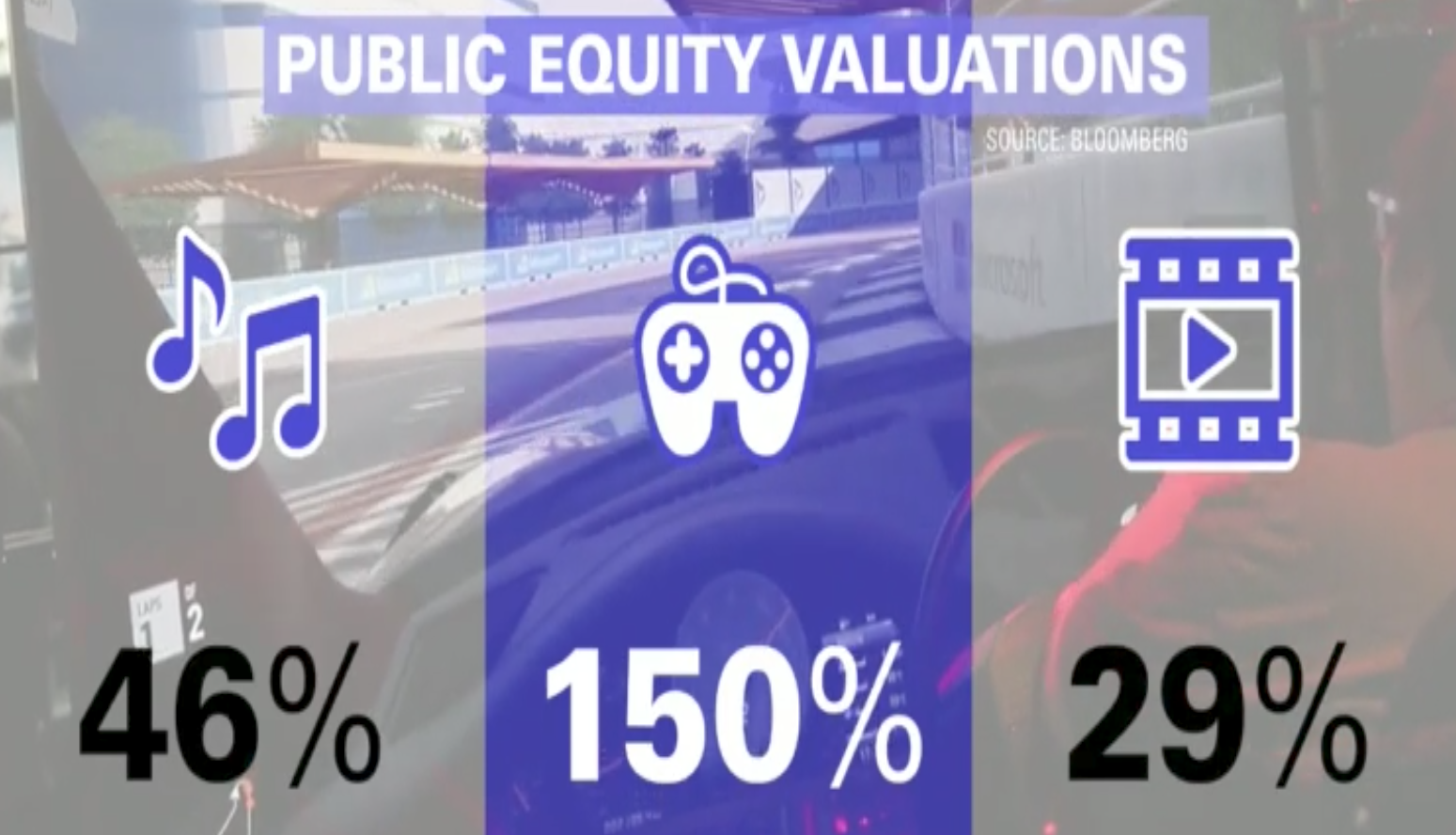

Digital gaming is booming: The digital gaming industry has exploded recently, says Ryan Nolan, technology MD at Goldman Sachs’ investment banking division. The returns for game publishers and developers are now “significantly outpacing those of other content categories such as music, film and TV.” Nolan expects this trend to continue driven by three “powerful forces”: the expanding reach of mobile, which is reflected in having 2.6 bn casual gamers worldwide; the transformation to more efficient and profitable business models; and new forms of engagement that attract a broader audience, evidenced by the dramatic rise of eSports. "The bottom line is the entire ecosystem around digital gaming is only getting better," Nolan says (runtime 03:01).

Diplomacy + Foreign Trade

An agreement with Saudi Arabia on avoidance of double taxation came into effect yesterday after it was published in the Official Gazette, Al Mal reports. The agreement, which was signed in April 2016, applies to any resident, building, or movable properties in both countries. Under the pact, taxes on oil project royalties are set at 10%, while tax on distributed dividends is set at 5%, if the company owns at least a 20% share. The tax rate is at 10% for smaller holdings. Companies owned by either government are exempt from the tax.

Egypt signs more MoUs with China: The Federation of Egyptian Chambers of Commerce signed an MoU with the China Council for the Promotion of International Trade that will see both sides cooperate on settling trade disputes between them, Trade and Industry Minister Tarek Kabil announced yesterday, according to Al Borsa. The Holding Company for Maritime and Land Transport is also preparing to sign three MoUs with Chinese automakers that will see them cooperate on freight transport, Ahram Gate reports. The agreements will be signed at the 2017 China-Arab States Expo that began yesterday and will run until 9 September.

Investigations into the frozen assets of Mubarak-era figures are still ongoingindependently in Switzerland and Egypt, the Swiss embassy said in a statement picked up by Ahram Gate. The statement denies Swiss media reports that claimed Switzerland’s Office of the Attorney General decided to “cease providing legal aid for pending requests from Egypt” and that Swiss proceedings on the issue “at a dead end now,” according to swissinfo.ch. “[The embassy] would like to make it clear that cooperation between the Arab Republic of Egypt and Switzerland on this issue was and is still going very well,” the statement adds. The investigation is looking into the finances of six Mubarak-era figures with combine assets of c. CHF 430 mn (USD 446 mn).

Egypt condemned ongoing violence against the Rohingya Muslims in Myanmar, which has left hundreds and forced thousands more to flee the country, the Foreign Ministry said in a statement yesterday. President Abdel Fattah El Sisi and Russian President Vladimir Putin had both condemned the violence during their meeting at the BRICS summit in China on Monday.

French Foreign Minister Jean-Yves Le Drian feels positive on the situation in Libya following his meetings with different factions across the country this week, according to Reuters. Le Drian met with the two major sides, Prime Minister Fayez Al-Seraj and eastern commander Khalifa Haftar, to build on their accords signed in Paris as well as attempt to rally other factions behind the agreement.

Energy

AfDB approves USD 55 mn loan for three FiT projects

The African Development Bank’s (AfDB) board of directors approved on Tuesday three loans totaling USD 55 mn to fund three 50 MW solar power projects in Benban, Aswan, under phase two of the feed-in tariff program, the bank announced in a statement. Alcazar Energy and its subsidiary, Delta for Renewable Energy, will each receive an USD 18 mn loan. India’s Shapoorji Pallonji will receive USD 19 mn in funding, USD 7 mn of which are a concessional financing facility from the Global Environment Fund. Shapoorji has already signed financing agreements with the AfDB to fund its US 85 mn project.

Elsewedy, Huawei agree to promote their solar power products in MENA

Elsewedy Electric and Huawei signed an MoU to cooperate on promoting each other’s solar power products and services in the MENA region, Elsewedy announced yesterday. The two sides will focus on engineering, procurement, and construction projects. The agreement will leverage Elsewedy’s experience in construction and development and Huawei’s smart PV technology to help provide solar energy development solutions.

Health + Education

Vezeeta to launch operations in Lebanon next week

Clinic and physician booking platform Vezeeta is launching its operations in Lebanon next week, after recently expanding to Jordan, CEO Amir Barsoum tells Al Mal. The company is planning further expansions in the region, including the UAE, during the spring of 2018. Domestically, they are also looking to launch in Mansoura before the year is out to bring the total number of Egyptian cities under their belt to four.

Telecoms + ICT

MNOs start increasing prices of roaming services

Mobile network operators have increased the price of roaming services after receiving approval to do so from the National Telecommunications Regulatory Authority (NTRA), industry sources tell AMAY. MNOs have been petitioning the NTRA to raise prices for some time claiming rising costs (mostly from the VAT) are eating into their margins with Orange’s numbers for the first half making a solid case on that front.

Banking + Finance

QNB capital increase approved

QNB Alahly has received approval to raise its capital to EGP 15 bn from EGP 10 bn, according to the EGX. A rights issue from issued and paid up capital of EGP 1.4 bn was also approved. Some 148.3 mn shares are set to be distributed on 24 September with the last day of ownership before ex-rights being 20 September.

Egypt Politics + Economics

Aswan court orders continued detention of 24 Nubians arrested for unsanctioned protest

A court in Aswan has ordered the continued detention of 24 Nubians who were arrested for participating in an unsanctioned protest on Sunday, Reuters’ Arabic service said yesterday. The protesters had been marching to call for the return of their ancestral homeland, the wire adds. We had said in July that Nubian rights groups were planning to take their case against the state to the African Commission on Human and Peoples Rights. The Associated Press also has the story.

On Your Way Out

Pope Tawadros II met with Australian Prime Minister Malcolm Turnbull and other government officials in Canberra, Australia yesterday, The Associated Press reports. They spoke of “the importance of Egyptian unity and the international fight against extremism,” according to Peter Khalil, Australia’s sole Coptic MP.

ON THIS DAY- On this day in 1952, the Egyptian army forced Prime Minister Ali Maher out of office after General Mohamed Naguib accused him of being slow to carry out social and land reforms demanded. Naguib then formed a new civilian government with himself as prime minister and commander-in-chief. Across the Atlantic, the United States was first nicknamed “Uncle Sam” in 1813 on this day. … Also on this day, music icon Buddy Holly was born in 1936. … In Enterprise two years ago, we were telling our readers how much they needed to be able to spend in order to be considered among the richest 10% in Egypt, covering the ground-breaking prospect of east Mediterranean gas production from Zohr, and taking note of that time Naguib Sawiris said he is in the market for a Greek or an Italian island on which to house refugees.… Just last year on this day, we were faced by the prospect of the government cancelling USD 23 bn worth of coal power plant MoUs and noted the terms for the second phase of the FiT projects as well as starting to see banks restrict cards usage abroad.

The Market Yesterday

EGP / USD CBE market average: Buy 17.6093 | Sell 17.7093

EGP / USD at CIB: Buy 17.60 | Sell 17.70

EGP / USD at NBE: Buy 17.63 | Sell 17.73

EGX30 (Wednesday): 13,318 (-0.7%)

Turnover: EGP 719 mn (19% below the 90-day average)

EGX 30 year-to-date: +7.9%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.7%. CIB, the index heaviest constituent ended down 1.8%, among yesterday’s worst performing stocks. EGX30’s top performing constituents were: Egyptian Financial & Industrial Company up 8.3%, Porto Group up 4.9%, and Egyptian Resorts up 3.7%. Yesterday’s worst performing stocks included: Emaar Misr down 1.7%, and Telecom Egypt down 1.3%. The market turnover was EGP 719 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +7.4 mn

Regional: Net Short | EGP -5.2 mn

Domestic: Net Short | EGP -2.2 mn

Retail: 64.0% of total trades | 64.3% of buyers | 63.6% of sellers

Institutions: 36.0% of total trades | 35.7% of buyers | 36.4% of sellers

Foreign: 19.3% of total | 19.8% of buyers | 18.8% of sellers

Regional: 11.6% of total | 11.3% of buyers | 12.0% of sellers

Domestic: 69.1% of total | 68.9% of buyers | 69.2% of sellers

WTI: USD 49.14 (-0.04%)

Brent: USD 54.13 (-0.13%)

Natural Gas (Nymex, futures prices) USD 3.01 MMBtu, (+0.30%, October 2017 contract)

Gold: USD 1,338.50 / troy ounce (-0.04%)

ADX: 4,457.12 (-0.48%) (YTD: -1.96%)

DFM: 3,642.08 (+0.49%) (YTD: +3.15%)

KSE Weighted Index: 433.25 (+0.24%) (YTD: +13.99%)

QE: 8,684.55 (-1.32%) (YTD: -16.79%)

MSM: 5,064.58 (+0.03%) (YTD: -12.42%)

BB: 1,311.17 (+0.67%) (YTD: +7.43%)

Calendar

06-09 September (Wednesday-Saturday): 2017 China-Arab States Expo (Egypt is the Guest of Honor), Ningxia, China.

08-09 September (Friday-Saturday): Educate Me’s Conference for Egyptian Education (Mo’allem), AUC, Cairo

11 September (Monday): Japanese Foreign Minister Taro Kono is scheduled to visit Cairo to participate in the Arab-Japanese dialogue session at the Arab League, according to a Foreign Ministry statement.

13 September (Wednesday): EIB MED Conference: Boosting investments in the Mediterranean Region, Cairo.

13-15 September (Wednesday-Friday): 2017 Alliance for Financial Inclusion Global Policy Forum, International Congress Center, Sharm El Sheikh.

15-18 September (Friday-Monday): Sharm Travel Market, venue TBD, Sharm El Sheikh.

18-19 September (Monday-Tuesday): Euromoney Egypt conference, venue TBD, Cairo.

19 September (Tuesday): Deadline for applications for funding under the Newton Institutional Links programme.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

21 September (Thursday): Islamic New Year, national holiday.

22-24 September (Friday-Sunday): CairoComix Festival, AUC Tahrir Campus, Cairo.

25-27 September (Monday-Wednesday): Egypt Downstream Summit and Exhibition, Kempinski Royal Maxim Palace, Cairo.

23-25 September (Saturday-Monday): Invest In Africa Conference and Exhibitors Summit, Gala Theater Complex, Cairo.

28 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

September — The House of Representatives is due to begin discussion of the proposed bankruptcy bill.

03 October (Tuesday): Egypt’s Emirates NBD PMI reading released.

03-05 October (Tuesday-Thursday): J.P. Morgan’s Credit and Equities Emerging Markets Conference, London, UK.

06 October (Friday): Armed Forces Day, national holiday.

11-12 October (Wednesday-Thursday): 2030 Mega Projects Conference, Nefertiti Hall, Cairo International Convention Center, Cairo.

11-13 October (Wednesday-Friday): Middle East and Africa Rail Show, Cairo International Convention Center, Cairo.

15-16 October (Sunday-Monday): The Marketing Kingdom Cairo 3 conference, Dusit Thani Lakeview Hotel, Cairo.

17 October (Tuesday): The Narrative PR Summit, Four Seasons Nile Plaza, Cairo.

18-19 October (Wednesday-Thursday): Middle East Info Security Summit, Sofitel El Gezirah, Cairo.

18-20 October (Wednesday-Friday): AfriLabs annual gathering with the theme “Smart Cities,” The French University, Cairo. Register here.

23-27 October (Monday-Friday): 29th Business and Professional Women International Congress themed “Making a Difference through Leadership and Action,” Mena House Hotel, Cairo. Register here.

06-07 November (Monday-Tuesday): Crisis Communications Conference, Four Seasons Nile Plaza Hotel, Cairo.

16 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

26-29 November (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Centre.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Centre.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

17-21 February 2018 (Wednesday-Saturday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.