- CBE seen leaving interest rates on hold tomorrow. (Speed Round)

- The EGX says it was the world’s best-performing market in 2016. (Speed Round)

- Rep. Rohrabacher’s love letter to Egypt and El Sisi. (Speed Round)

- Year in Review: 4Q2016 Enterprise Reader Survey

- Year in Review: What We Did This Year (or: Enterprise’s 2016 in numbers)

- Year in Review: What We Learned About Our Readers in 2016

- Year in Review: What Enterprise subscribers read in 2016

- Thoughts from our readers on what to expect 2017. (On Your Way Out)

- By the Numbers

Wednesday, 28 December 2016

What you expect in 2017

TL;DR

What are you reading?

** Enterprise is taking a little year-end holiday this week, with compressed Speed Round and lots of year-in-review coverage. This morning’s edition includes the results of our 4Q2016 Enterprise Reader Survey, and our homepage this morning features a selection of our favourite stories from the year. You can read part 1 of our Year in Review package here and part 2 here.

We’re off tomorrow and Sunday for the holiday long weekend and will be back to our normal publication schedule on Monday, 2 January 2017. But just for the fun of it, we’ll probably have a little bonus Weekend Edition for you on Friday morning to bid 2016 adieu.

What We’re Tracking Today

The Central Bank of Egypt’s Monetary Policy Committee will discuss interest rates for the last time this year on tomorrow. Consensus appears to be that interest rates will be left on hold.

Sunday, 1 January 2017, is national holiday in observance of New Year’s Day, while Saturday, 7 January 2017 is a national holiday in observance of Coptic Christmas. There remains chatter that 8 January will also be a day off given Christmas falls on a Saturday, but we’ve yet to hear confirmation on that front from any official source.

Speed Round

The central bank is expected to keep its interest rates unchanged at its Monetary Policy Committee (MPC) meeting tomorrow, Reuters reported. Seven of 11 economists polled by the newswire said they expected the MPC to leave rates unchanged, “holding fire on further action until the impact on inflation of last month’s steep hike in borrowing costs becomes clearer.” EFG Hermes’ Mohamed Abu Basha said, “We don’t see [the central bank] moving on interest rates before a few more inflation readings to have a clearer view on inflation trends." Four respondents to the Reuters poll forecast a hike — two of 50 basis points, one of 150 points and one of 200 points.

Welcome back, friends. Air traffic between Russia and Egypt may resume by early 2017, Sputnik reported. “January 2017 is a very plausible deadline for reopening regular air traffic with Cairo,” Transport Minister Maxim Sokolov said, adding that the final decision will be taken by the Russian government. Ahram Online has a photograph of what it says are Russian security officers arriving at Cairo International’s Terminal 2 yesterday for inspections. In other Russia-related news, Energy Ministry spokesperson Ayman Hamza told the domestic press yesterday that contracts for the Daba’a nuclear power plant aren’t ready for a signing ceremony that a Russian report had said could come as early as tomorrow.

Oh, and if the Russians aren’t coming back, China is certainly interested in exporting tourists to us. Chinese state-broadcaster CCTV’s American service has a little package headlined “Egypt looks to growing Chinese tourism to help economy” that covers everything from the tripling of China’s tourism flow to Egypt to 200k arrivals per year since 2014, to trends in China’s outbound travel.

The EGX was the world’s best-performing market in 2016, according to Egyptian Exchange’s year-end report. The EGX notes that this year saw one of the highest volume of foreigners’ net-buying in the market and attracted 883 new funds and institutions. The report is available here in full (in Arabic only).

Rep. Rohrabacher’s love letter to Egypt and El Sisi: Southern California Republican congressman Dana Rohrabacher said President Abdel Fattah El Sisi proved he was a friend of the United States and “a defender of all the good things that we believe in.” El Sisi is “more important than having a new full division in the Army and he’s certainly more important to our national security than the F-35 [fighter jet],” Rohrabacher told Breitbart news, the right-wing website run by the White House’s incoming chief strategist, Steve Bannon. “I would hope that my colleagues open their eyes, when Egypt is doing something as important as that,” he said, pointing specifically at Egypt’s as a “partner for peace.”

France will support Egypt’s energy sector to the tune of EUR 175 mn, including EUR 150 mn for electricity and EUR 25 mn for the oil and gas sector, the International Cooperation Ministry announced. Minister Sahar Nasr reached the agreement with French Minister of State for Development and Francophonie, Jean-Marie Le Guen, during his visit to Cairo this week.

Eni has signed two new shallow-water offshore Mediterranean concession agreements, acquiring rights to the North El Hammad and North El Esh blocks as a result of offers made during state holding company EGAS’ 2015 bid round, the company said in a press release. The news was echoed by Oil Minister Tarek El Molla who said an oil exploration well will be drilled near Zohr gas field in agreement with Eni, Al Masry Al Youm reported. The Ministry signed concession agreements with Eni, BP, and Total, all of which are expected to be unveiled today, the minister said an event yesterday, Al Mal reported.

AfDB still likes the feed-in tariff program? The African Development Bank reportedly earmarked USD 100 mn in funding for four to five projects as part of phase two of the feed-in tariff program which was launched late October, an unnamed source at the bank told Al Borsa.

The FEI is pressuring the central bank to structure a relief program for manufacturers caught upside down by the float of the EGP. To hear the domestic press tell it, the Central Bank of Egypt and Federation of Egyptian Industries discussed yesterday with bankers a series of measures designed to ease pressure on companies struggling to cope with FX losses caused by the float of the EGP on 3 November. The FEI says the measures — which have not been announced by the central bank, and some local media outlets are positioning as having taken the form of “verbal instructions” to banks — could include the earmarking of EGP 20 bn at lower interest rates for industry, the rescheduling of certain debts over a three-year period, and allowing bankers and borrowers to agree to a fixed exchange rate at which companies could repay debt they took on prior to 3 November. CBE Governor Tarek Amer is said to have attended the meeting. Our take: Coverage in the domestic press this morning reads to us a lot like FEI pressuring CBE to offer relief, and there are no statements on the CBE’s website or in our inboxes, making it unlikely this is a ‘done deal.’ The CBE is telling banks to speak with their clients — surprising, right? — and is otherwise kicking the can down the road.

In parallel, industry lobby groups are pressuring President Abdel Fattah El Sisi “to take ‘emergency measures’ to save Egyptian companies and industries” after the float of the EGP, Ahram Online reports, pointing to a full-page ad in state-owned daily Al-Ahram in which second-tier lobby groups focused on the interests of companies in specific areas (including the 10 Ramadan, 6 October, Obour and Sadat City investors’ unions) all “explained that Egyptian companies are facing bankruptcy as they are required to pay back bank loans at the new exchange rate, even though they have already sold their products using the old exchange rate.”

Our friends at the Sharkawy & Sarhan law firm released an explainer for the amendments to the Executive regulation of the Capital Market Law regarding pre-emptive rights of existing shareholders in a capital increase and the new rules on acquisition and control of brokerages companies and investment management companies. EFSA published detailed rules on the two topics last week.

MOVES- Girgis Abd El-Shahid has been named managing partner at Shahid Law Firm as part of what the firm called “major internal changes that aim to boost its growing practice.” In parallel, Jacqueline Saad has been promoted to executive partner, while César R. Ternieden has been named Senior Of Counsel, and Tarek Badawy and Donia El-Mazghouny have made partner in the firm’s international business department. Tarek will head the firm’s aviation, shipping and transportation group, while Donia will be head of the energy group. Mohamed Atef has been named partner and head of the tax and administrative litigation teams. Soad Fayek has been named partner and head of the Economic Courts litigation team, Sameh Attia is now partner and will head the IP and TMT litigation team, and Ahmad Mostafa has been named partner and head of the real estate group. Also promoted: Rasha Maurice (managing associate), Inji Fathalla (senior associate) and Magdy Keshk (senior associate). A copy of the firm’s announcement is here.

2016 was not a great year on the frontier: Frontier markets were one of the world’s worst-performing asset classes in 2016, the Wall Street Journal (paywall) reports, noting that the 22-nation MSCI Frontier Markets Index rose 1.4% in the year to Monday, while the MSCI Emerging Markets Index is up 8.4% and the Dow Jones has returned 18% in the same period. Investors pulled USD 840 mn from frontier market funds through 21 December, the newspaper adds. The newspaper contrasts the views of fund managers actively investing in specific themes and individual FMs with those who “expect frontier markets to rebound only after a long and steady recovery in developed and emerging countries, which would eventually lead assets to trickle down into these small markets.”

Global media coverage of Egypt is relatively quiet this morning, with the world’s most influential English-language newspapers resorting entirely to pickups of wire copy. Coverage is tilted toward the new media law and the Associated Press’ argument that after being a “quiet partner of Israel in a blockade on the Hamas-ruled Gaza Strip … there are signs that Egypt is easing the pressure in a step to repair its shattered ties with the Islamic militant group.”

Also worth noting this morning:

- There are plenty of coded messages for Egypt on everything from the rift with KSA to Egypt’s purported involvement in Syria and Yemen — plus ties to Iran — in this op-ed by the former general manager of Saudi mouthpiece Al-Arabiya.

- Saudi Arabia, India, and Egypt appear to have been the top three acquirers of weapons in emerging markets in 2008-15 (yes, last year — that’s not a typo) while Egypt was the number-one destination in 2015 alone with total acquisitions of USD 5.3 bn, according to a US Congressional report (pdf, Egypt data on pp. 48-49). The report has made headlines in the New York Times.

- An Egyptian-American Muslim high school teacher writes for the Washington Post on “The classroom challenges Trump presents to this immigrant Muslim teacher.”

Among the international stories worth noting this morning as the end-of-year news slowdown begins:

- Carrie Fisher, Star Wars royalty and bestselling author and performer, is dead at age 60. It’s all over the internet, but here’s Reuters’ and the New York Times’ coverage to get you started. [Redacted] you, 2016.

- The New York Times lifts the veil on spending by Saudi royals in a the exceptionally well-researched “Saudi Royal Family Is Still Spending in an Age of Austerity.” Absolutely worth a read — stash it in Pocket to sift through this weekend on your flight to Gouna / Sahl Hasheesh / Paris / wherever if you don’t have time to read it today.

- US Secretary of State John Kerry will lay out a vision Middle East “peace process” today in a speech he’s due to deliver at the State Department, VOA News reports.

- China’s Xi Jinping is going nowhere? As in “showing signs he will not step down” as would be customary after his upcoming second term in office, the Wall Street Journal speculates, noting that Xi has both solidified his personal control over the economy and the armed forces and sidelined potential successors.

- The Eurasian Economic Union (EAEU) confirmed it has approvedproposals to start talks to create free trade zones between the EAEU and Egypt, Iran, India, Singapore. Chairman of the Board of the Eurasian Economic Commission, Serzh Sargsyan, said it will “start an intensive process of preparation of signing agreements with those countries.”

4Q2016 Enterprise Reader Survey

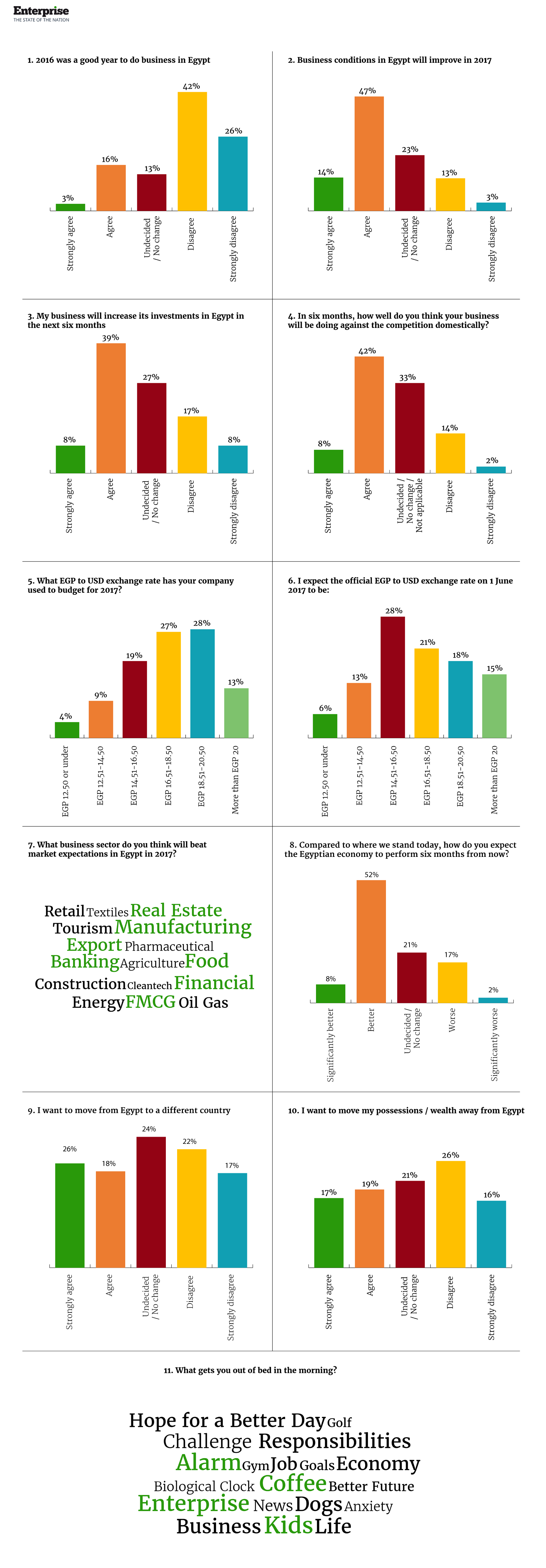

Our 4Q2016 Enterprise Reader Survey finds cautious optimism about 2017

How are Enterprise readers feeling heading into 2017? We think you’re reasonably optimistic, given the annus horribilis that’s now drawing to an end. While 68% of you thought 2016 was a bad year in which to do business in Egypt, 61% of you expect business conditions will improve in the new year, 60% of you think the economy will be doing better in six months’ time, and almost 50% of you see your company or fund increasing its investments in Egypt before the end of the first half of 2017.

You’re a fairly self-confident lot: 50% of respondents expect they’ll be doing better against the competition six months from now, and while you’re slightly more predisposed than not to the idea of moving possessions or wealth away from Egypt, more respondents than not have no intention of leaving Omm El Donia behind.

You’re also being somewhat conservative in your budgeting: 42% of you are forecasting a USD : EGP exchange rate of EGP 18.51 or above, but only 33% of you see the currency in that band by mid-year.

Despite all the chatter about a possible bubble, real estate was your number-one pick for the sector that will beat market expectations in 2017 (just over 9% of respondents), followed closely by banking (just under 9%), export-oriented businesses food and financial services. (You can check out our “word cloud” of your responses to that question at the end of the survey graphs, below.)

Coffee is just fractionally more important than kids in terms of what gets you out of bed in the morning. Both are followed closely by family, your alarm and … Enterprise. (Our parents did not vote a few hundred times each — we checked.)

Some of the best (and / or most entertaining) reader comments we received on the survey form are presented for your reading pleasure in On Your Way Out

What We Did This Year

530 — The number of issues we published this year, including our English and Arabic Enterprise Morning Edition, the English-only Weekend Edition and one breaking news alert.

5,474,251 — The total number of emails we’ve sent this year, as of this morning.

Our English-language readers clicked on 24,253 stories, presentations, videos, images and downloads (between the Morning Edition and the Weekend Edition). Our Arabic-language readers hit 11,628 links.

Just under 30,000 — The total number of subscribers to our email edition, a figure that grows daily.

76.5% — The rate at which our readership grew this year.

26,192 — Our average number of daily active readers of the English and Arabic editions combined across email and web.

128,343 — Unique web readers this year across both our English and Arabic editions.

184 — Total number of countries we reach. Depending on who you ask, there are 195 or 196 countries in the world.

The 10 countries with the largest number of Enterprise readers are (in order) Egypt, the United States, the UK, the UAE, Saudi Arabia, Canada, Russia, Germany, France and Kuwait.

One person reads us in North Korea.

The 10 cities with the most Enterprise readers are (in order): The Greater Cairo Area, Dubai, London, Alexandria, Riyadh, Jeddah, Washington, New York, Moscow, and Paris.

59.9% of Enterprise readers are between the ages of 25 and 44.

Google thinks 70.9% of our readers are male.

67% — The number of subscribers who read us on mobile devices (smartphones and tablets)

iPhone is the favorite device of Enterprise readers by a very, very wide margin, followed by the Samsung Note series and the Samsung S7 Edge. Oddly enough, Blackberry is still a top 10 device for Enterprise readers (at about 1% of total users).

1 — Really big news story we broke this year — the float of the EGP.

Enterprise is written by Moustafa, Hisham, Gaser, Hana, Ingy, Salma, Sherif, Ahmed, Sayed, Hasaballah, Noha, Hadia and Patrick.

4 — Vacant writing and editing positions as of this morning across the English and Arabic editions as we prepare to launch new products in early 2017. Email editorial@enterprise.press if you’d like to apply, enclosing a cover letter and a CV.

3 — Wonderful financial sponsors of Enterprise: Pharos Holding, CIB and SODIC. Without their generous support, there would be no Enterprise for you to read each morning. Thank you, friends, for your support.

What We Learned About Our Readers in 2016

An average of more than 26,000 people read Enterprise each day last week (before the holiday season kicked in). About sixty percent of you read the English edition, with the rest of you preferring the Arabic.

You’re a rather senior group of people, including ‘household name’ CEOs and c-suite officers at major Egyptian corporations, fund and portfolio managers here and in major global financial centers, business owners, and heads of departments / divisions. We’re honored to be read by senior government officials and members of the Egyptian diplomatic service as well as foreign diplomats in Egypt.

(You’ll be hearing from about a dozen of those ‘household name’ CEOs soon after we return from our break in our first-ever CEO poll, wherein we asked some of the smartest chief executives we know to offer their views on what to expect in 2017.)

As last year, banking and finance professionals here and broad, multinationals, government officials (Egyptian) and diplomats (Egyptian and others) are our largest audiences. Next up: Energy / oil and gas folks, industrialists, retailers, tech and telecom, and real estate. And plenty of lawyers, accountants, journalists, and staff at major international financial institutions.

At least two dozen of you are high school students, so far as we can tell — you have no idea how happy that makes us.

You’re a bit less male than last year: Google thinks that about 70.9% of you are male this year, vs. 74.% last year. (Google doesn’t get to talk to our email dispatch system, so that’s just web readers — the majority of our readers consume us on email, so take that figure with a grain of salt.)

The vast majority of you read us before 10am, and more than 1,000 of you usually open each day’s edition within 15-20 minutes of our hitting “send” at 6:05am. Our peak hour: Between 8am and 9am. We also see “bumps” in traffic at about 3pm CLT (when U.S. readers hit the office) and then again in the early evening — maybe on your drive home?

Sundays and Thursday are typically our best readership days, controlling for major news events. Tuesdays are not far behind.

You’re super-engaged: As was the case last year, our open and click rates are well over double the industry average. In fact, our “gross” open rate is better than that reported by the New York Times. Our average “click rate” per issue is up about 25% from last year.

You started your Christmas / year-end holidays around 15 December this year, judging by the seasonal dip in open rate and web traffic.

What you read in 2016

Of the more than 24,000 stories, images, videos, downloads and other links we carried in our English editions this year, here’s what tickled your fancy the most (in descending order within each category):

The most-read story in Enterprise in 2016: Tarek Amer is the 2016 Enterprise Newsmaker of the Year

The most-read issue of Enterprise in 2016: Our special issue on the float of the EGP and the hiking of petroleum product prices

The five most-clicked pieces by Enterprise

- The SODIC “Saving Cairo” series (as a whole, far and away the most-clicked piece in Enterprise this year, edging out even the Tarek Amer interview, which we think says something about your love of our fair city)

- Results of our first-ever reader survey

- Everything you always wanted to know about a value-added tax, but were afraid to ask and House passes VAT law — here’s everything you need to know

- Enterprise conference report: RiseUp 2016

- Uber’s Cairo boss says ridesharing could re-shape Cairo’s streets while creating jobs and economic opportunity

The 10 most-clicked videos:

- This is Egypt (Official tourism promotion ad)

- What about the first Oscar for you? (Leonardo DiCaprio meets the El Sahafa Masriyya)

- The banned Cottonil advertisement (Ramadan 2016, advertisement)

- iPhone 7 morning ride (Apple, advertisement)

- CCTV footage of the Coptic Cathedral blast (Youtube)

- SNL Egypt parodies Lamees El Hadidy and Amr Adib (Facebook video)

- Rami Malek wins an Emmy for Mr. Robot (Acceptance speech)

- The banned Dice advertisement (Ramadan 2016, advertisement)

- A baby iguana is chased by snakes (Planet Earth II, BBC)

- An Egyptian man in New Zealand explains why he calmly walked away from a gunman who held up his convenience store (Enterprise)

The 5 most-clicked images

- That horrible body-shaming ad by Gold’s Gym in Egypt (Facebook, sadly not a parody)

- Amr Diab and his daughter after 50 years (Facebook, parody)

- Pressure cooker bomb discarded by Egyptian security officers in New York as they chose a nifty piece of luggage to take home (NY Daily News)

- Burkini vs. Bikini on the Olympic beach volleyball court (Daily Mail)

- Funeral of victims of the Coptic Cathedral bombing (Georges and Samuel)

The 5 most-clicked stories on domestic issues

- Infographic on customs hikes on this fall’s customs hikes (Al Borsa)

- Finance Minister Amr El Garhy speaks on the eurobond, growth and inflation (Bloomberg, video)

- Africa’s next big currency devaluation seen unfolding in Egypt (Bloomberg, August 2016)

- Egyptian authorities confiscate sugar at country’s largest food producer (Reuters)

- Naguib Sawiris on proposals to cap profit margins (Akhbar El Yom)

The 5 most-clicked Egypt in the News pieces

- Photos From an Abandoned Resort Town Show How Terrorism Destroyed Tourism in Egypt (Gizmodo)

- A Family Weaves an Empire Apartment by Apartment (Wall Street Journal)

- Go Inside China’s Bizarre Theme Park in the Egyptian Desert (Wired)

- Egyptians Take to the Streets Again, Now in Workout Gear (New York Times)

- Coffee, Bikini Waxes, X-Rays: Almost Anything Can Be Sent to Homes in Cairo (New York Times)

The 5 most-clicked documents and reports

- Enterprise’s XLS sheet of parallel market USD prices from November 2015 through mid-October 2016 (XLSX download)

- Leaked draft of the executive regulations of the value-added tax (Al Mal, pdf)

- Schedule of all Egyptian athletes competing at the Olympic Games (Egypt Sports Network, pdf)

- Schedule of customs tariffs after this fall’s rate hike (Official Gazette, pdf)

- A necessary but insufficient devaluation (BNP Paribas report, October 2016) (tie)

- Crédit Suisse report placing Egypt in its Crédit Suisse Frontier Markets 10 (Crédit Suisse, pdf) (tie)

The 5 most-clicked rankings and resources

- The Panama Papers: The Power Players (Panama Papers)

- Have I been pwned (website)

- Global Passport Power Rank 2016 (Passport Index)

- IMF World Economic Outlook (October 2016, pdf)

- IMF and World Bank Spring 2016 Meetings landing page, with webcasts, videos, stories, photos (IMF)

The 5 most-clicked Weekend Edition stories

- How to hide USD 400 mn (New York Times)

- Foreign Spouse, Happy Life (New York Times)

- This essay got a high-school senior into 5 Ivy League schools and Stanford (Business Insider)

- The Pessimist’s Guide to 2017 (Bloomberg)

- Six signs you will be rejected when you apply for a job at Goldman Sachs (and how to overcome them) (efinancialcareers)

The 5 most-clicked conferences

- RiseUp Summit

- EFG Hermes One on One 2016

- Microfinance Egypt

- Suez Canal Global Conference (tie)

- Egypt Energy Investment Summit (tie)

- The Angel Ticket: Your Guide to Early-Stage Investing

On Your Way Out

Thoughts from readers on the shape of the year to come — and one very sweet comment from a younger reader.

Nearly half of all respondents to our 4Q2016 Enterprise Reader Poll took the time to leave us very thoughtful comments. You also made us blush with your kind words and constructive criticism.

Four themes ran through your comments: You pay your taxes — and you wish others did the same. You believe there will be no progress without investment in education, particularly K-12 and vocational training. More than anything else, you want policy stability from the government in the years ahead. And a very large number of you worry that while the government and business are on the right track, you’re not sure “el sha3b” are willing to put in the work necessary to help the economy turn the corner.

We can’t run everyone’s comments, but we’ve chosen a handful that “spoke for the majority” below. They have, in cases, been condensed for space and clarity. All comments were offered anonymously by readers — we don’t track reader comments by subscriber name or email:

“There’s some serious head-hunting going on in the PE industry from global funds looking at Egypt. Probably a good sign.”

“Managing a business in Egypt successfully is no easy feat. In fact, a disproportionate amount of time, money, energy and emotion is appropriated to benign tasks and problem solving. However, as I constantly hear (and on occasion, contribute to) the drone of complaints relating to the business environment (and the relative value of the USD in particular), I feel it is worth remembering that many of the factors we complain about also serve as barriers to entry. As business owners, we are able to operate safe in the knowledge that others are less able, or less willing, to navigate through the chaos. The absence of healthy competition in many sectors may restrict the creation of multiple economic and social benefits, but it is worth remembering that as individuals we have profited from the protection that the lack of crowding-out provides.”

“The country is not doing enough to encourage the industrial sector. Things that might help: Allocate land on a 10-year right-of-use basis (instead of ownership), renewable in perpetuity if the company is productive and meets certain specs.”

“Speed the justice system up — we need more commercial courts.”

“Economies run on confidence: I hope Egyptians can have that required state of mind and perseverance to achieve the required results, otherwise we are relegated to the dustbin of history for a good 70 years. It’s now or never.”

“Tough year ahead of us, time to tighten your belts and hope for the best. This country will get worse before it gets better — but it will get better.”

“Although we don’t see the light at the end of the tunnel now, it is more likely coming in 2018, not 2017. But we still invest: I am opening my new restaurant next month.”

“RUN.”

“What happens in the economy going forward hinges upon the government not only sticking to its ‘announced’ austerity measures,but the speed and consistency with which they enact changes, rule of law and frankly their clarity on the way forward — otherwise we’re back to square -1.”

“We had a great year in 2016 and we hit our targets, even after the currency devaluation. I am in the pharma industry and despite the fact that until now we have not been able to increase the prices (important, because we are In the red now), there has been a run on medication after the devaluation causing our sales to accelerate.”

“Make it easier for people to start businesses.”

“It’s all about security. The system is so fragile. Anything can set the recovery path back by six months in the blink of an eye (e.g. the Cathedral bombing).”

“We need to cleanse the Wahhabism that has taken control of Egyptians’ minds.”

“Two major macro risks in the next 3 to 6 months: 1. The CBE increases moral suasion to commercial banks to bring EGP to a stronger rate of +/- EGP 16 : USD1 or more. If this happens, a de facto peg has been re-established and the gains from exchange rate liberalisation are lost. 2. Having implemented major reforms recently, which is a significant positive change compared to previous administrations, there is a risk that the government may ease off on reform execution. The reforms require constant weekly / monthly monitoring and evaluation if they are to deliver the intended benefits … and even then, the actual results are likely to be lower than the expected results.”

“I’m a banker (well, it seemed like a good idea when I first took the job) and jokes aside, I truly do believe that the potential to achieve, even now, exists in Egypt; and while I do assign some of the blame for our recent economic challenges to the Egyptian public, I am a proponent of "big government" and believe that the Government can and must do more … sans corruption, inefficiency, cronyism, and so on and so forth, ad infinitum. So as a banker what’s my modest outlook? Positive, I believe. Difficult and fraught with problems and the excuses (and fantasies) of government officials … but hopeful. Just noticed that I didn’t support anything I said with hard data, but it’s Thursday morning and I’m already thinking of Thursday afternoon.”

Fan mail that made our hearts melt: “I just love reading Enterprise every morning especially because I’m just 16 years old, but you give lots of insights about the economy and it makes me learn something new every day on the way to school.” If you wrote this email and you want a summer internship, email patrick@enterprise.press.

** If you’re the person who wrote to us about aluminum, would you please email us on editorial@enterprise.press if you’re willing to have a chat on background?

The markets yesterday

EGP / USD CBE market average: Buy 18.8237 | Sell 19.1723

EGP / USD at CIB: Buy 18.65 | Sell 18.85

EGP / USD at NBE: Buy 18.65 | Sell 18.85

EGX30 (Tuesday): 12181.98 (flat)

Turnover: EGP 1.3 bn (193% above the 90-day average)

EGX 30 year-to-date: +73.9%

THE MARKET ON TUESDAY: The EGX30 closed flat yesterday, with index heavyweight CIB easing 0.6%. Top performers included Qalaa Holdings (up 9.0%), EK Holding (+3.5%), and Amer Group (+3.2%). The day’s worst performers included GB Auto (down 3.8%), TMG (-3.6%), and Telecom Egypt (-3.1%). Market turnover stood at EGP 1.3 billion, with foreign investors the sole net buyers

Foreigners: Net long | EGP +65.2 mn

Regional: Net short | EGP -4.1 mn

Domestic: Net short| EGP -61.1 mn

Retail: 74.3% of total trades | 79.8% of buyers | 68.7% of sellers

Institutions: 25.7% of total trades | 20.2% of buyers | 31.3% of sellers

Foreign: 7.5% of total | 10.0% of buyers | 4.9% of sellers

Regional: 8.3% of total | 8.2% of buyers | 8.5% of sellers

Domestic: 84.2% of total | 81.8% of buyers | 86.6% of sellers

WTI: USD 53.80 (-0.19%)

Brent: USD 55.96 (-0.23%)

Natural Gas (Nymex, futures prices) USD 3.70 MMBtu, (+1.87%, January 2017)

Gold: USD 1,142.30 / troy ounce (+0.31%)

TASI: 7,257.2 (+1.3%) (YTD: +5.00%)

ADX: 4,469.1 (+0.3%) (YTD: +3.76%)

DFM: 3,542.2 (-0.3%) (YTD: +12.41%)

KSE Weighted Index: 380.8 (+0.2%) (YTD: -0.25%)

QE: 10,304.8 (-0.4%) (YTD: -1.19%)

MSM: 5,761.0 (+0.6%) (YTD: +6.56%)

BB: 1,211.33 (+0.3%) (YTD: -0.38%)

Calendar

29 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meets to review rates.

29-30 December (Thursday-Friday): Cairo’s 5th International Conference on Business, Economics, Social Science, and Humanities (BESSH-2016), Intercontinental Citystars, Cairo.

01 January (Sunday): New Year’s Day, bank holiday

07 January (Saturday): Coptic Christmas, national holiday.

13 January (Friday): Egypt to attend Africa-France Summit 2017 in Mali.

25 January (Wednesday): Revolution (police) day, national holiday.

30 January – 2 February 2017 (Monday-Thursday): Arab Health Exhibition, Dubai International Convention & Exhibition Center, UAE.

14-16 February 2017 (Tuesday-Thursday): Egypt Petroleum Show 2017 (EGYPS), CIEC, Cairo.

31 March – 03 April (Friday-Monday): Cityscape Egypt conference, Cairo International Convention Centre, Cairo. Register here.

16 April (Sunday): Coptic Easter Sunday.

17 April (Monday): Sham El Nessim, national holiday.

27 May (Saturday): First day of Ramadan (TBC)

26 June (Monday): Eid Al-Fitr (TBC)

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.