Egypt’s education services have weathered the covid-19 storm on equity markets

Education stocks have weathered the covid-19 storm in equity markets that has dragged down other industries, underscoring its position as a defensive sector even in the face of a global pandemic. The industry’s performance over the past five months confirms the hypothesis we put out in March that it was on track to be resilient. At the time, the EGX was in decline, but education was falling at just half the rate of the broader market.

Which education companies are listed on the EGX? CIRA, which operates K-12 schools Mavericks and Futures, as well as Badr University, is the sector heavyweight. There are also two other companies that are listed under the EGX’s education services industry: Cairo for Educational Services — a subsidiary of CIRA — and Suez Canal Company for Technology Settling (SCTS), which owns and operates the Sixth of October University.

As a whole, equity markets saw a steep sell-off in March, but traditional defensive plays, including education, were not hit as severely, Pharos Holding equities analyst Diyar Hozaien explained to Enterprise. “Education proved in this crisis that it is indeed a very resilient sector. It’s just not a service that consumers will stop demanding because of current circumstances — even if these circumstances are a pandemic,” she said.

On a year-to-date basis, the education sector has outperformed the benchmark EGX30. The index is down 21.5% YTD, whereas education services are now up 5.22% YTD.

The sector's performance has bounced back from a drop in mid-March and is now inching back up towards its December 2019 peak. At the beginning of the covid-19 market meltdown in late February and early March, it was down 6.68% YTD on the EGX30. Now, education services are up 5.22% YTD. By way of comparison, banks — which are traditionally strong market performers — are down 19.43% since the beginning of the year.

The only sectors in the green on the EGX on a YTD basis other than education: Telecoms, contracting and construction engineering, textiles, and paper packaging.

The drop in March was limited both in depth and duration and came directly after schools were instructed by the government to suspend in-person teaching and move to remote learning platforms, CIRA CEO Mohamed El Kalla explained to Enterprise. Investors were concerned about education providers’ ability to quickly and effectively deliver remote learning services, and those that succeeded in that area bounced back immediately, El Kalla said. “CIRA is a classic example of that: Within 72 hours of the government announcing the move to remote learning, all of our classrooms were fully moved to our online platform.” El Kalla chalked up the concerns at the time to a “lack of clarity,” saying investors were unsure if providers would rise to the challenge — and also had no outlook on what the following few months would look like.

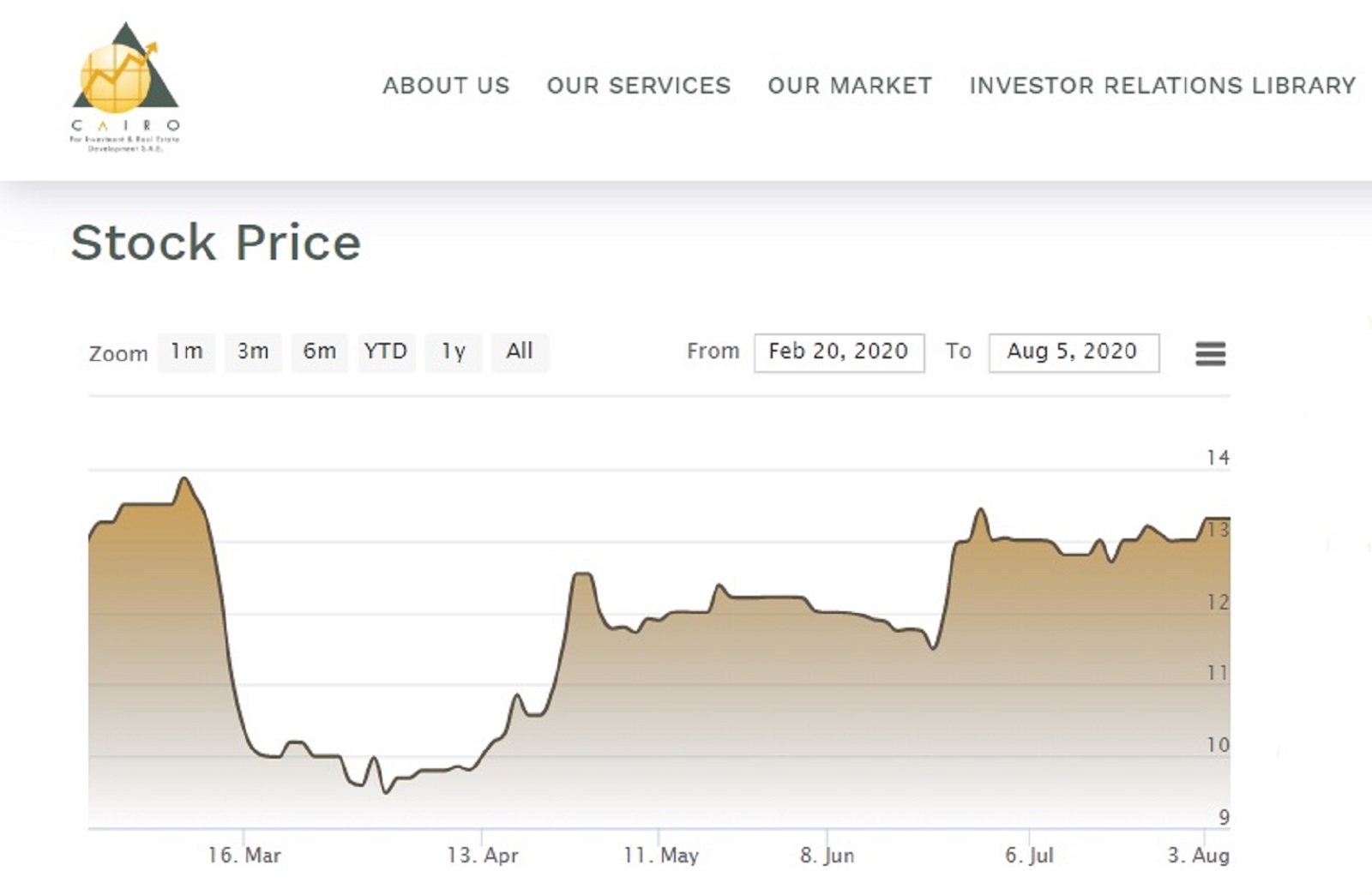

And as for individual education service providers: CIRA’s shares saw what El Kalla describes as “low turbulence” in March. CIRA shares dipped from EGP 13.87 on 4 March to a low of EGP 9.49 on 31 March. Since then, the company’s shares have rallied, closing at EGP 13.30 apiece as of Thursday, when it was last traded. SCTS shares dropped to EGP 26.53 on 17 March from an all-time high of EGP 47.02 on 11 December 2019. The company’s shares have been rising on low trading volumes since March, closing at EGP 40.00 on 27 July — the last day the stock saw any trading activity. CAED shares have seen more ups and downs than its industry peers on the EGX: The company’s share price dropped to EGP 8.20 apiece on 16 March and has since continued to swing to highs and lows, before settling at EGP 9.50 on 22 July — the last day on which the stock traded hands.

Even with the limited bout of turbulence, El Kalla says that investor sentiment remained strong throughout the pandemic. “Investors have a very growth-focused mindset and they know that the population is growing, which means demand for education services will continue to grow as well.” The limited concerns that were there in mid-March were quickly quelled once schools showed they were able to handle the transition. For CIRA, that was helped by the fact that they already had the necessary infrastructure in place from before the pandemic, noted Pharos’ Hozaien.

As you’d expect from a defensive play, CIRA has continued to perform well financially: In the first nine months of its fiscal year (September-May), CIRA reported a 32% y-o-y increase in net profit to EGP 330.4 mn, while its net revenues soared 54% y-o-y during the period, coming in at EGP 991.9 mn. CIRA also reported that its new projects are all on track to be completed on schedule, after facing minor delays at the outset of the pandemic.

Some education service providers faced other hurdles in the early days of the shift to online learning, including disputes with parents about tuition fees and payments for services the schools were no longer providing, Hozaien told Enterprise. However, these were not reflected in investor sentiment on the sector and did not result in a dip in equity performance, she said. We dove into the dispute in June.

Investors have more clarity as we head into the new academic year. Schools have announced that they will be pushing ahead with a blended learning model — and they have proven their ability to effectively deliver using that model, El Kalla says. Those that initially struggled have had the summer months to adjust and ensure that they will be ready once they open their doors for the new year.

If anything, the shift to blended learning models has actually been a “net positive” for the education industry, GEMS CEO Ahmed Wahby told Enterprise. “Because schools are splitting up classrooms for a rotational system, there are fewer students per classroom and therefore more individual attention.” This has also helped to bolster a positive outlook for investors on the sector, he said.

Your top education stories of the week

Your top five education stories of the week:

- Egypt received a USD 15 mn grant from the United States Agency for International Development (USAID) to improve basic education for students and literacy for adults as well as train new teachers.

- Emaar Misr and ElSewedy Education signed an MoU last week to establish The Knowledge Hub Universities project which will host many global universities’ branches in Egypt such as UK’s Coventry University, according to Ahram Online.

- Developing Africa’s Egyptian Cultural Centers: Prime Minister Mostafa Madbouly has tapped the ministry of higher education to prepare an integrated plan to develop all Egyptian cultural centers in Africa as a way to develop bilateral relations with other countries, reports Al Masry Al Youm.

- Egypt ranked no. 42 in US News’ global ranking for quality of education, jumping nine places from last year.

- Some 70k students applied to take the 2020/2021 admission exams for public universities. Thanaweyya Amma results were announced last week and the country had a 81.5% passing rate, according to Ahram Online.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.