- GERD turns on its first turbine + the debt market is heating up. (The Big Stories Today)

- The biggest talking points on the 2022 Winter Olympics. (For Your Commute)

- More interstellar zebala? (For Your Commute)

- The smart tech of the future is both transformative and a bit creepy. (Tech)

- We have another Korean thriller series to binge-watch. (On the Tube Tonight)

- Say “bonjour” to Le Relais de l'Entrecôte. (Eat This Tonight)

Sunday, 20 February 2022

PM — Watch the geopolitics

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, wonderful people. It’s shaping up to be a brisk week, if today’s news cycle is any indication.

#1- GERD is officially generating electricity: Ethiopia began generating power from one of 13 turbines in the USD 4.2 bn Grand Ethiopian Renaissance Dam (GERD) at an event attended by Ethiopian Prime Minister Abiy Ahmed, the Associated Press reports. Ahmed continued to assure that the dam won’t harm downstream countries Egypt and Sudan, saying that Addis Ababa wants to “export our [no-pollution] electricity to Europe through Sudan and Egypt.” The dam has been a source of tension between the three countries as talks on the filling and operations of the dam were deadlocked again over the summer and Ethiopia moved ahead with two fillings without an accord with Cairo and Khartoum.

Egypt responds: Today’s milestone represented a “further breach of obligations” under the 2015 Declaration of Principles signed between the three countries, according to a Foreign Ministry statement (pdf).

The news is getting heavy coverage abroad: Reuters | AFP | Financial Times | Bloomberg | BBC.

#2- It’s a debt-heavy news day: Misr Italia Properties closed its first EGP 794 mn securitized bond issuance in its EGP 2.5 bn securitization program, sole financial advisor, transaction manager, bookrunner, underwriter, and arranger EFG Hermes said (pdf) earlier today. Meanwhile, Raya Holding is reportedly eyeing issuing EGP 2 bn of securitized bonds this year, and Banque Misr has received a USD 250 mn loan from a Gulf banking syndicate.

ALSO- The Hyatt Regency Cairo West hotel is hosting its grand opening event this evening, according to a press release (pdf). The luxury 250-room hotel, which opened its doors in its soft opening in September, marks the return of the Hyatt brand to Cairo after a 10-year hiatus. Hyatt signed a franchise agreement for its establishment with Al Dau Development back in 2019. Tourism and Antiquities Minister Khaled El Enany, Hyatt Hotels Group President Peter Fulton, and Al Dau Chairman Bassel Sami Saad are among those set to attend the event.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Goldman to advise on FAB’s EFG acquisition bid? Sources told Bloomberg over the weekend that EFG Hermes is poised to appoint Goldman Sachs to advise it on First Abu Dhabi Bank’s acquisition bid. The Emirati lender earlier this month offered to purchase at least 51% of EFG’s shares for EGP 19.00 apiece.

- Alpha Dhabi eyes Egypt: Alpha Dhabi Holding — one of the UAE’s biggest companies — is looking for potential acquisitions in the “promising” Egyptian market.

- Egypt to manufacture mRNA covid vaccines… eventually: Egypt is among six African countries that have been selected by the World Health Organization to locally manufacture Moderna / Pfizer-esque mRNA vaccines. The catch: The global health body says that we might be waiting until 2024 until the shots receive approval.

HAPPENING NOW-

The Nebu Expo for Gold and Jewelry 2022 continues today at the Royal Maxim Palace Kempinski Hotel in New Cairo. The event wraps tomorrow

The House of Representatives preliminarily approved proposed amendments to the Capital Markets Act, which would allow utilities and other companies to raise capital by securitizing future cashflows, among other things, according to Al Ahram.

US climate envoy John Kerry is in town today for a two-day visit, during which he will meet with Foreign Minister Sameh Shoukry for the inaugural meeting of a US-Egypt climate working group ahead of this November’s COP27 summit in Sharm El Sheikh, according to a US State Department statement. Kerry will also deliver an address at the American University in Cairo on the future of international climate action.

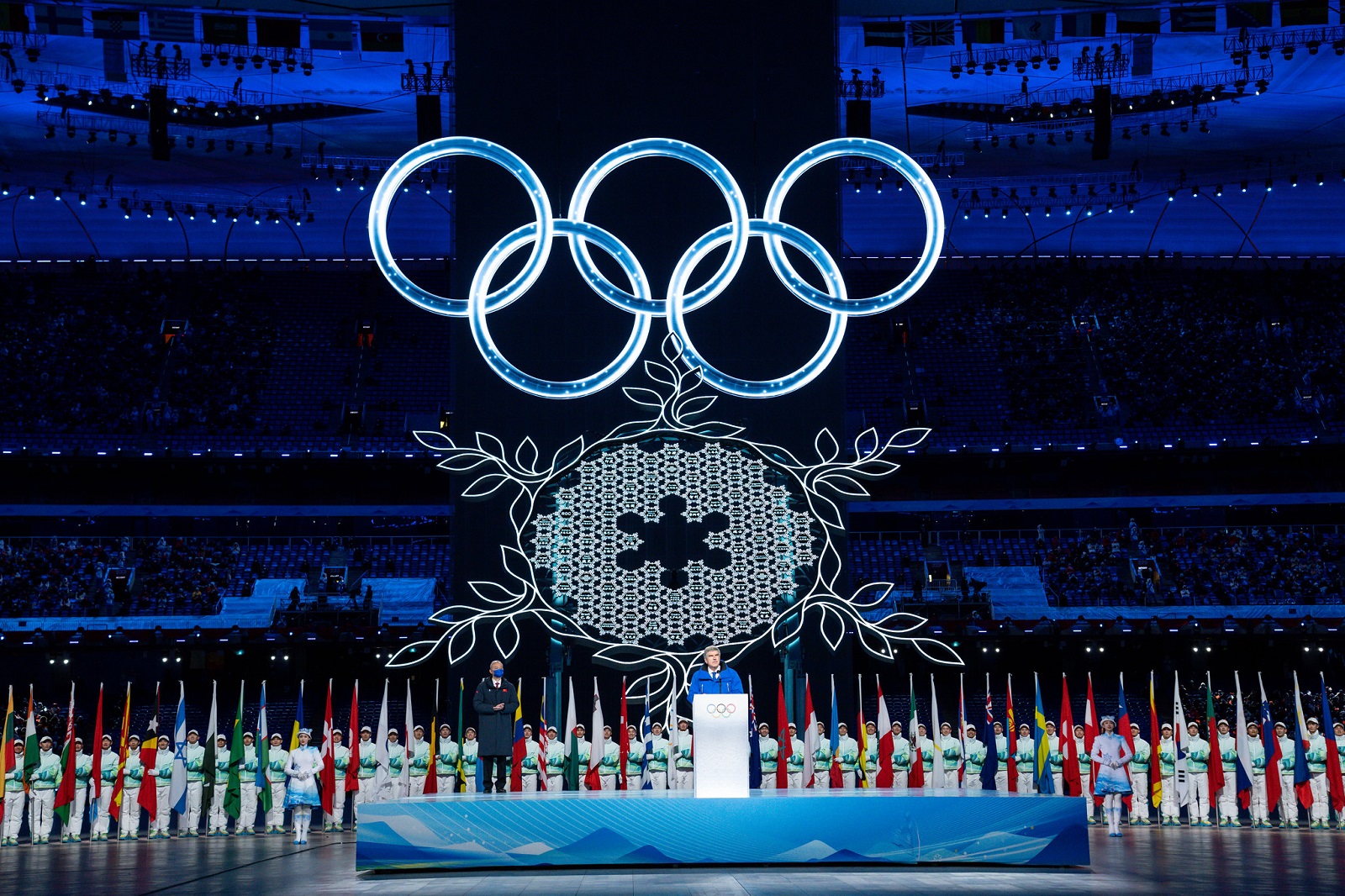

The closing ceremony at the 2022 Winter Olympics was wrapping up as we dispatched this afternoon’s edition. We have the full rundown on the Games, including the biggest medal hauls and the political issues that peppered the conversation about the event, in For Your Commute, below.

THE BIG STORY ABROAD

UKRAINE WATCH- Russian troops will continue their military drills near the Ukrainian border in Belarus “indefinitely,” Belarusian Defense Minister Viktor Khrenin said today. The estimated 30k troops will not leave today as planned due to the “increase in military activity near the external borders” in eastern Ukraine’s Donbas, where there’s an uptick in shelling between Russia-backed separatists and Ukrainian forces.

The decision on sanctions is split: After Ukrainian President Volodymyr Zelensky urged the west to impose sanctions against Russia before any potential invasion, not after, German Chancellor Olaf Scholz said it would be more prudent to keep Russia guessing and avoid any escalation that imposing sanctions preemptively could cause.

The story is getting ink from CNBC, Reuters, Bloomberg, and the Financial Times.

|

???? CIRCLE YOUR CALENDAR-

A call for tech startups: The Information Technology Industry Development Agency (ITIDA) and US-based VC firm Plug and Play have launched an incubator and accelerator program for digital transformation-focused startups in partnership with our friends at USAID. The newly launched “Smart Cities” innovation hub will select 20-30 Egypt-based companies for its inaugural three-month program, which starts in March. Startups can apply here before applications close on 28 February.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☔ TOMORROW’S WEATHER- There’s a slight chance of rain tomorrow while the weather gets a nudge warmer at 22°C during the day and 11°C at night, our favorite weather app tells us.

???? FOR YOUR COMMUTE

The 2022 Winter Olympics has wrapped: The final events at the 2022 Winter Olympics took place earlier today and the closing ceremony is close to finishing. From a lead-up that was overshadowed by a diplomatic boycott and the ever-present threat of covid, China’s turn at hosting the games may go down as one of the most notable in recent memory. Here are three talking points now the games is over:

#1- The formula remained more or less the same: More snow = more medals. At the end of the games, the top of the medals table looks more or less the same as it did at the end of the 2018 games. Four of the five countries with the biggest medal hauls — together sweeping up almost half of the medals up for grabs — did similarly well last time around, and (shocker) are countries with plentiful supplies of snow. Norway came out on top, snagging 16 golds and 37 in total. Which country came in second depends on how you’re measuring success: Germany got the second-largest number of gold medals and 27 in total, while Russia ROC got the second-biggest medal haul with 32. Rounding out the top five were Canada and the US.

But countries that aren’t exactly renowned for their wintery environs still made it onto the table. Australia clocked four medals, Spain got a silver, and the Netherlands managed an impressive 17 medals, including eight golds.

#2- China’s Olympic Bubble strategy remained impressively airtight: Ahead of the games, much was made of how China’s zero-covid strategy would hold up as athletes from around the world descended on the country. But the country’s containment efforts have worked impressively well, with reported cases inside the bubble falling to single digits during the final days of the event, according to Bloomberg. Over the past month, a total of 435 cases were reported among athletes, coaches and stakeholders, a remarkably low figure held down by constant testing, mandatory mask-wearing, and the banning of foreign spectators from the events.

#3- It was the most politically-contentious games in recent memory: Foregrounded by deteriorating China-West relations and an ultimately symbolic diplomatic boycott by several nations, the 2022 Winter Olympics will go down as perhaps the most politically-fractious games this side of the Cold War. With Beijing’s actions in Xinjiang one of the focal points of criticism, China got the games off to a controversial start by selecting Uyghur cross country skier Dinigeer Yilamujiang as the final torchbearer, prompting accusations from Washington that the country was attempting to whitewash its actions against the Muslim ethnic minority group. Coverage of the games in the Western press was overwhelmingly negative, whether focusing on the country’s human rights record, the use of fake snow or athletes’ complaints about the food.

A rocket set to crash on the moon highlights the need to better control our interstellar zebala: Last month articles in the US press reported that an out-of-control SpaceX rocket was on course to crash into the moon at the beginning of March. Based on the findings of astronomer and space junk-tracker Bill Gray, it was said that the four-ton booster rocket would strike at speeds of 5.7k miles per hour, carving out a 65-foot crater on the dark side of the moon. But, in a fortunate turn of events for Elon Musk’s overworked publicist, new information that came to light last week suggested that the rocket is not actually owned by SpaceX but is a part of China’s Chang’e 5-T1 rocket.

The mistake highlights a significant problem: we aren’t tracking all the debris we’re firing into space. While US agencies do track objects that could hit Earth’s surface, the whereabouts of space junk seems to be largely ignored, astronomers tell Vox Recode. NASA only bothers to monitor debris that could potentially threaten its assets while the newly-created Space Force hasn’t been clear about how it tracks objects close to the moon. It is also rather difficult to accurately gauge how objects are moving through space, with many variables at play that can change their trajectories.

This time the situation isn’t hazardous, but…: With more and more countries and companies laying out plans to launch satellites into space, these accidents could start being more dangerous. One solution posed is an “international database of all launches with their trajectories, as well as funding for at least one person to track them,” Jonathan McDowell, an astrophysicist at the Harvard-Smithsonian Center for Astrophysics, told Vox.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

Netflix’s latest Korean production: Zombie drama series All of Us Are Dead. The 12-episode zombie survival story is a thrilling adrenaline rush as it follows a group of desperate Gen-Z high schoolers trying to survive a zombie apocalypse on school grounds, with minimal resources to give them a helping hand. The Korean series has become the streaming website’s fifth most popular non-English-language series debut, Variety reports, with 361 mn hours of streaming since its debut in late January. It’s not quite the blockbuster landing that Korean thriller Squid Game had, but it does beg the question: Why is Korean cinema such a successful source of content for Netflix? NBC News discusses the rising popularity of K-Pop series, while The Guardian has a review.

⚽The English Premier League’s Week 26 fixtures continue, with Leeds United and Manchester United hitting the field at 4pm, just a few minutes after we hit “send” on this afternoon’s edition. Wolverhampton v Leicester City kicks off at 6:30pm.

In La Liga, all eyes will be on Barcelona as they play against Valencia at 5:15pm, while Real Betis will clash with Mallorca at 7:30pm. The day wraps with Athletic Bilbao v Real Sociedad at 10pm.

Bayern Munich is currently playing against Greuther Fürth which is at the foot of the Bundesliga table, while Borussia Dortmund hopes to reduce the gap with Bayern in its difficult game against Borussia Mönchengladbach at 6:30pm. Hertha BSC plays against RB Leipzig at 8:30 pm.

In Serie A, Inter will play against Sassuolo at 7pm, hoping to benefit from AC Milan’s stumble as number 1 in the table as it eyes to be top of the league. Udinese will clash with Lazio at 9:45pm.

Egypt’s Pyramids FC vs Zambia’s Zanaco at the CAF Confederation Cup is still ongoing. Al Masry is set for a tough clash against Mazembe in the same tournament at 6pm.

???? EAT THIS TONIGHT-

Bust out your beret and practice your “bonjour”: Le Relais de L’Entrecôte just landed in Cairo. The famed French bistro is now open at two locations on opposite ends of town: Sheikh Zayed’s Arkan and the Fifth Settlement’s 5A. Staying true to the brand, the restaurant offers its single-course menu: A walnut salad and their renowned steak frites plate, paired with their delicious dark mustard sauce. Our favorite dessert to round out the experience is the chocolate profiterole.

???? OUT AND ABOUT-

(all times CLT)

Moscow Ballet on Ice is performing Swan Lake and Cinderella on Ice at the Cairo Opera House, with the first performance tonight at 8pm. The ballet company will perform the show until this Thursday, 24 February.

???? UNDER THE LAMPLIGHT-

Mercy Street promises to keep you engaged as it tackles thorny social issues in the US: The book, written by New York Times bestselling author Jennifer Haigh, touches on everything from abortion to white supremacy to narcotics as it follows 43-year-old Claudia. The Boston resident counsels patients at Mercy Street, a women's health clinic that performs abortions. While the clinic is seen as a second chance for many, it starts each morning with anti-abortion protesters at its doors. As protests intensify, Claudia finds solace through her visits to Timmy, a cannabis distributor. Claudia meets with several of his customers, each of whom play an important role in the narrative on the country’s most divisive issues.

???? GO WITH THE FLOW

EARNINGS WATCH-

Abu Dhabi Islamic Bank reported EGP 1.45 bn in net income in 2021, up 22% y-o-y, according to the bank’s financial statement (pdf). The bank’s interest income rose 13.4% y-o-y to record EGP 8.2 bn for the year.

Odin Investments’ losses widened to EGP 2.55 mn in 2021, from EGP 2.21 the previous year, according to the firm’s financial statement (pdf). Revenues rose 9.5% annually to record EGP 18.38 mn for the year.

Logistics company Egytrans reported EGP 18.27 mn in net income in 2021, up 39.9% y-o-y, according to its financial statement (pdf). Revenues rose 35.8% y-o-y to EGP 293.52 mn.

Suez Canal Bank reported EGP 604.68 mn in net income last year, up 0.5% y-o-y, according to its financials (pdf). Interest income was essentially flat at EGP 4.28 bn.

EGBank posted EGP 695.34 mn in net income in 2021, rising 11.2% y-o-y, its financial statement (pdf). Interest income was up 3.3% y-o-y to EGP 7.61 bn.

MARKET ROUNDUP-

The EGX30 fell 1.4% at today’s close on turnover of EGP 501 mn (51.4% below the 90-day average). Foreign investors were net sellers. The index is down 4.8% YTD.

In the red: Heliopolis Housing (-5.2%), Palm Hills Development (-5.1%) and Qalaa Holdings (-4.4%).

???? TECH

The smart tech of the future is both transformative and a bit creepy: 2030 isn’t that far away, but the smart tech likely to be at the world’s fingertips — outlined in a recently-released report (pdf) by strategic foresight consultancy The Future Laboratory and Vodafone Smart Tech — looks set to catapult us into another world. The report presents a vision of 2030 where smart tech currently being developed is poised to offer unprecedented connectivity, both individually and globally.

This tech will offer more immersion, but will also have more control over our daily lives. 2030 smart tech will be a lot more immersive, bolstered by stronger infrastructure (some countries could be well into 6G territory) and consumer demand for seamless interactions with devices customized according to personal preference. While these tech developments will allow us to make better use of our resources, space, and time, they’ll also harvest more of our data, monitor more of our activities, and put more choices about our lives in the hands of devices.

Let’s start with the really outlandish stuff — mind and body-controlled digital devices: By 2030, some smart tech will be so responsive as to “remove the need for active interaction entirely,” the report tells us. Case in point: The AlterEgo device, which picks up the signals sent from the brain to the mouth when a user “says” thoughts in their head. AlterEgo translates these brain signals into words, so users can have full human-computer interactions with AI assistants or machines without saying anything aloud. The Mediated Atmosphere project uses sensors to track user heart rates and facial expressions, to automatically regulate their workspace by adjusting light and sound.

Also coming our way: “Hyper-sensory versions of reality.” Extended reality (XR) — basically any combination of real-and-virtual reality, including VR, augmented reality, and mixed reality — is set to become a major feature of our daily lives, with the lines between tangible and intangible becoming blurrier. XR technologies, forecast to add USD 1.5 tn to the global economy by 2030, will fundamentally alter how we experience the world. We might be projecting content onto a nearby surface as we read a recipe or visit a museum, or we might be entering the metaverse or following work instructions using specially-designed smart glasses.

And tech you’ll forget is even there: 2030 smart tech will be deliberately unobtrusive, like the minimalist wooden control pad by mui Lab that controls temperature, opens smart doors, plays music and performs a host of other tasks, but is specifically designed to not engage a user’s attention.

Smart tech could also meaningfully address some of today’s most pressing social problems — like waste, poor urban planning, and health issues, the report shows. That’s the direction being taken with smart cities, including here in Egypt.

Tech will offer innovative ways to enhance environmental sustainability: Consumers will be shown, through data, how their environmental footprints are altered by their daily choices. Dimpact, for example, helps users assess the environmental impact of consuming digital media content, while Doconomy allows individuals, corporations and brands to measure their environmental footprints — and calculate the environmental impact of financial transactions. Personal devices will be increasingly geared towards sustainability, and designed to work across different generations of tech, to cut down on waste. Resources like food, or solar energy, may in the future be automatically shared between homes, coordinated by smart tech devices that communicate directly with one another.

In smart cities, vehicles and infrastructure will optimize space and anticipate human needs: Smart, autonomous mobility systems will slash commute times and make city environments greener and more livable. Electric, autonomous vehicles will be the norm for ride-hailing services, with apps like Quarter Car offering vehicle partitions so users can opt for privacy. Argodesign is testing a project where autonomous drones deliver groceries to outdoor fridges, which are automatically stocked based on consumers’ previous purchases. Urban connectivity will give rise to things like vertical farming, and buildings being used as energy-producing community utilities.

And digital solutions could help facilitate independent living, diagnose illnesses, and even alleviate pain: Assistive tech like Vodafone’s Connected Living app automates some tasks, while helping users perform others. The app is designed for people with intellectual disabilities, but the tech can also help the elderly live independently. 2030 AI will be able to monitor vital measurements — including heart and respiratory rate, hydration, blood pressure and blood sugar levels — to prevent chronic health conditions before they even appear. Google is currently exploring an optical sensor that monitors cardiovascular health, which could be put in a bathroom mirror to track blood flow dynamics, like changes in skin color. Meanwhile, VR tech will increasingly be used as a way of delivering medical treatments — including treatment that reduces activity in the five regions of the brain associated with pain.

But what about the ethical issues? All this monitoring and data gathering will put the onus firmly on companies to show they’re taking meaningful action to safeguard data privacy. Researchers at the CyLab Security and Privacy Institute are currently working on a prototype of a label that could be put on smart devices — ranging from security cameras to toothbrushes — offering privacy information vetted by experts. And MIT-launched tech company Butlr was designed to provide real-time data on an individual’s movements, body temperature and behavior, but without violating privacy. The tech uses passive infrared sensors, which detect only body heat — so it can’t identify who you are, only where you are and where you’re going.

How much of this will land in Egypt by 2030? It’s unclear: The future outlined in the Vodafone report is a global one, and doesn’t give country-specific data. So it’s reasonable to imagine that the rollout of these tech developments will vary, and that the rate of adoption will depend on the state of each country’s digital infrastructure.

But our appetite for smart tech is clearly soaring: Smart home device adoption in Egypt is growing rapidly, we noted last year. As of January 2021, smart home devices were in 1.6 mn homes, up from 280k in January 2020. Market value rose to USD 133 mn in January 2021 from USD 94 mn in January 2020, and device purchases saw a 94% y-o-y increase in 2019, according to data from last year’s Digital 2021: Egypt report by Data Reportal.

???? CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of a 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

1H2022: The Transport Ministry to sign a memorandum of understanding with Abu Dhabi Ports to set up a transport route across the Nile to transport products from Al Canal’s Minya sugar factory.

January-February 2022: Construction work on the Abu Qir metro upgrade will begin.

February: Hassan Allam Construction’s new construction firm established with Russia’s Titan-2 to handle construction work on the Dabaa nuclear power plant begins its operations.

Mid-February: End of grace period to comply with new minimum wage for firms who sent in exemption requests.

Mid-February: A Hungarian delegation will arrive in Egypt for talks over a potential investment in an industrial area in the SCZone.

19-21 February (Saturday-Monday): Nebu Expo for Gold and Jewelry 2022.

20-21 February (Sunday-Monday): The Red Sea Maritime Transport and Logistics Conference (RSMTL), Nile Ritz Carlton, Cairo.

21 February (Monday): Hearing at Cairo Economic Court (pdf) on FRA lawsuits filed against Speed Medical.

22 February (Tuesday): The Egyptian National Railway is holding a forum to gauge public interest in its plans to delegate the management and operations of freight transport to the private sector.

22-24 February (Tuesday-Thursday): Investment Forum, General Authority For Investments (GAFI) Main Office, Nasr City.

26 February (Saturday): Speed Medical will elect a new board during ordinary general assembly (pdf).

27 February (Sunday): British-Egyptian Business Association (BEBA) green finance event with Finance Minister Mohamed Maait, Semiramis Intercontinental, Cairo

28 February (Monday): Applications close for the incubator and accelerator program run by Information Technology Industry Development Agency (ITIDA), US-based VC firm Plug and Play, and USAID.

28 February- 1 March (Monday-Tuesday): The Future of Data Centers Summit.

End of February: Lebanon to receive gas from Egypt via a pipeline crossing Jordan and Syria.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will replace the existing “closed” financial management system.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourism Organization Middle East committee meeting.

March: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

3 March (Thursday): Fawry’s extraordinary general assembly (pdf) to vote on EGP 800 mn capital increase.

9-18 March (Wednesday-Friday): The 55th edition of the Cairo International Fair.

15-16 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

25 March (Friday): Egypt will host Senegal in the first leg of their 2022 FIFA World Cup qualifiers' playoff (TBC).

26 March (Saturday): Egypt-EU World Trade Organization dispute settlement consultations end.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

28 March (Monday): The second leg of the 2022 FIFA World Cup qualifiers' playoff between Egypt and Senegal (TBC).

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

April: Fuel pricing committee meets to decide quarterly fuel prices.

April: Ghazl El Mahalla shares will begin trading on the EGX.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

14 April (Thursday): European Central Bank monetary policy meeting.

Mid-April: Trading on the Egyptian Commodity Exchange to start.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

5-7 June (Sunday-Tuesday): Africa Health ExCon, Al Manara International Conference Center, Egypt International Exhibitions Center, and the St. Regis Almasa Hotel, New Administrative Capital.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve Finterest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.