- Egypt could get its first SPAC within weeks as consortium of Egyptian and international firms approaches FRA. (The Big Stories Today)

- “Bee-washing” threatens wild bee species in Switzerland. (For Your Commute)

- Cuba’s homegrown vaccines could be the key to getting the “global south” jabbed up. (For Your Commute)

- Watch the behind the scenes of the Saqqara discovery with Tombs of Egypt on Shahid. (On The Tube Tonight)

- How Civil Wars Start by Barbara F. Walter looks at the warning signs of civil wars ensuing and how to stop them. (Under The Lamplight)

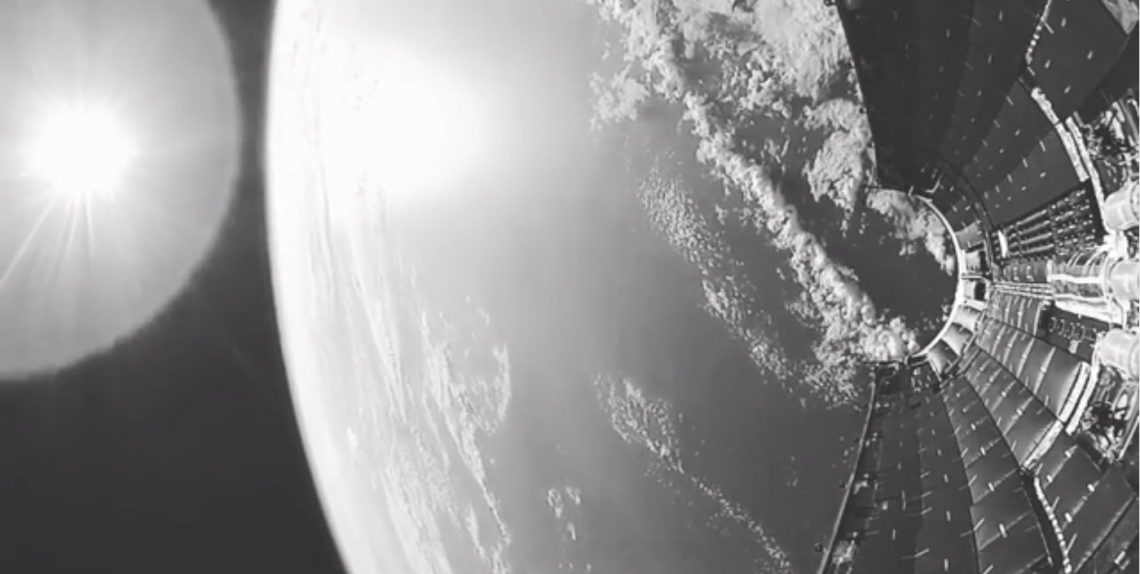

- We need to regulate the satellite race as it becomes a growing threat to humanity. (What’s Next)

- Novak Djokovic could lose his #1 title as French Open latest to say ‘no jab, no playing’. (On The Tube Tonight)

Monday, 17 January 2022

PM — It’s time to regulate the satellite race

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, friends. We’re only through two days of the week so far, but it already feels like it should be Thursday. As we expected yesterday, the newsflow is picking up today, so let’s get to it.

THE BIG STORIES TODAY

#1- Make way for our first SPAC: A consortium of Egyptian and international companies is planning to file for a license from the Financial Regulatory Authority to establish a SPAC within weeks, Zulficar & Partners founding partner Anwar Zeidan told Enterprise. The SPAC would be the first ever to list on the EGX, and will have an initial capital of EGP 10 mn, which is the minimum requirement set by the FRA. This comes a couple of months after the FRA issued the rules and regulations for establishing local blank-check firms, after the regulator greenlit EGX boss Mohamed Farid’s proposal to allow SPACs in Egypt.

#2- Are we going to see a revival of our Samurai bond plans? Finance Minister Mohamed Maait and Japan’s ambassador in Cairo discussed potentially issuing FCY bonds in Japan as part of Egypt’s debt diversification strategy, according to a ministry statement (pdf). The statement does not provide further details on the potential plans. Longtime Enterprise readers will remember that the government had been mulling selling JPY-denominated bonds back in 2019.

HAPPENING NOW-

The World Art Forum is ongoing at Cairo’s National Museum of Egyptian Civilization until Wednesday, 19 January. The inaugural edition of the forum, which kicked off yesterday, will see artists from around the world participating.

The World Future Energy Summit is also ongoing in Abu Dhabi. The three-day summit will bring together leaders in the renewable energy industry as part of the Masdar-hosted Abu Dhabi Sustainability Week.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Suez Canal revenues are expected to hit USD 7 bn in 2022, up 11.1% from last year, Suez Canal Authority boss Osama Rabie said yesterday.

- Lots of cooperation with South Korea: South Korea is providing a USD 1 bn soft loan to Egypt and is eyeing participating in the construction of the Dabaa nuclear plant, the country’s ambassador said ahead of President Moon Jae-in’s visit to Egypt this week.

- …And South Korea’s Myoung Shin could soon locally produce electric microbuses with state-owned Engineering Automotive Manufacturing Company, with the two companies set to sign a cooperation agreement during Moon’s visit.

THE BIG STORY ABROAD-

Credit Suisse Chairman António Horta-Osório is stepping down following an investigation into an alleged breach of covid-19 rules and other matters relating to “personal conduct,” the Wall Street Journal and Financial Times report. The personal conduct issues include his alleged use of corporate aircraft for personal use.

|

FOR TOMORROW- Consoleya will kick off its Startup Meet-up series tomorrow with a talk from Ayman Ashour, founder and principal at Newton International Management. The talk, titled Exits and Reset Dilemmas, will see Ashour discuss how to plan for your startup’s exit and the connections you’ll need along the way. Our friend Hossam Allam from Cairo Angels will moderate the discussion. The event will take place from 6-9pm — you can register using this link.

???? CIRCLE YOUR CALENDAR-

South Korean President Moon Jae-in is due in town from Wednesday to Friday, the first visit to Egypt by a South Korean president in 16 years. Moon will meet with President Abdel Fattah El Sisi during a regional tour that will also see him swing through the UAE and Saudi Arabia.

Applications are open until 31 March to join the Femtech Accelerator Program run by Flat6Labs and women’s healthcare firm Organon. The four-month-long virtual accelerator will support women-led digital healthcare start-ups operating in MENA to build products, test market fit and improve business models. You can register at this link.

National flag carrier EgyptAir will operate a flight from Casablanca to Cairo this Wednesday, 19 January, to bring home Egyptian expats stranded in Morocco following border closures.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- Is anyone else freezing? The cold front is continuing, with a daytime high of 16°C tomorrow and nighttime low of 9°C, our favorite weather app tells us.

???? FOR YOUR COMMUTE

“Bee-washing” threatens wild bee species in Switzerland, reports Bloomberg’s CityLab. A study out of Switzerland shows that the proliferation of registered beehives across 14 Swiss cities — which have almost tripled between 2012 and 2018 — is threatening wild bee species, calling into question the sustainability of urban beekeeping. Honey bees are increasingly being installed by beekeeping firms serving clients looking to up their green credentials, a practice that researchers at York University have coined bee-washing. The research of Swiss cities, which shows how honeybees are bred by pollinators without consideration to native bees, most of which don’t produce honey, indicates that honeybees often beat out wild bee species, butterflies and other local insects in foraging green spaces.

Cuba could be the key to getting the “global south” jabbed up, as it has developed five homegrown covid-19 vaccines and boasts one of the world’s highest vaccination rates, CNBC reports. The Caribbean country’s jabs are reportedly 90% effective in preventing symptomatic covid-19 cases after three doses, and — vitally — are cheap and easy to manufacture at scale, making them an optimal choice for low-income countries. However, the World Health Organization has yet to approve Cuba’s vaccines, partially because of progress being slowed down as the international body’s assessments of Cuba’s production facilities is based on what some say are “first-world standards.”

How can we encourage crypto growth in Africa? The continent’s most popular sport may be a good place to start: As part of the growing crypto sports marketing trend, Binance, the world’s largest digital currency exchange platform, inked an agreement with the African Cup of Nations to become the official crypto and blockchain sponsor for this year’s championship, Quartz reports. Setting its sights on Africa’s most popular sport, this is the company's latest move in its quest to have a stronger presence in Africa’s “hot market” for crypto, blockchain, and Web3 startups. Crypto adoption grew by more than 1,200% by value from July 2020 to June 2021, making Africa the third fastest-growing crypto economy, according to data from Chainalysis, as users turn to digital coins to avoid bank and exchange restrictions. Despite its growing popularity in Africa, crypto still isn’t regulated in most countries, with some financial authorities, like Nigeria, disapproving its use.

In case you needed a reminder: Leave your machete at home before getting on a plane: The US’ Transportation Security Administration (TSA) has released a video on Twitter showing the strangest items confiscated at airports in 2021. While the TSA has given the #1 spot to a chainsaw, we think the weirdest thing has to be #8: A breakfast burrito filled with meth. Other contenders on the list include a machete, fireworks, a cleaver, a can of bear spray, various firearms, and a wine bottle holder that looks like a gun. The last spot on the list went to bullets hidden in a deodorant stick, which the TSA suggests was due to the passenger “sweating bullets.”

???? ENTERPRISE RECOMMENDS

Watch the behind the scenes of the Saqqara discovery with Tombs of Egypt + How to spot a potential civil war in the modern age

???? ON THE TUBE TONIGHT-

(all times CLT)

Tombs of Egypt: The Ultimate Mission is now on Shahid: The docuseries follows archaeologist Zahi Hawass during the 2020 excavation of the Saqqara Necropolis, where 59 sarcophagi were found in a three-month mission that made headlines worldwide. The series provides exclusive insight into this mission, using live footage as well as CGI, 2D computer graphics, 2D and 3D maps, and x-ray analyses. You get to know the team, how they do their work, and what they aim to uncover going forward. Tombs of Egypt also goes in depth about how the team opens each sarcophagus and the tools they use to determine who it is they found and the story behind each mummy.

⚽ What’s happening in Afcon today? Burkina Faso will play against Ethiopia while Cape Verde will play against Cameroon in two Group A matches today at 6pm.

Al Ahly makes another appearance in the Egyptian League Cup: Al Ahly is currently playing against Al Ismaily after starting the match at 2:30pm. Later at 5pm, El Gouna will face El Mokawloon and The National Bank will face Smouha.

Serie A: Milan will compete against Spezia and Bologna will face Napoli, both at 7:30pm, while Fiorentina and Genoa will hit the field at 9:45pm.

IN OTHER SPORTS NEWS- Novak Djokovic won’t be playing in the French Open while unvaccinated either: The tennis player made headlines this past week after Australia barred him from playing in the first Grand Slam tournament of the year, cancelling his visa due to his being unvaccinated. However, his lack of a covid-19 vaccine may hinder his ability to compete elsewhere as well after the French Sports Ministry said there would be no exemption from France's new vaccine pass law when it came to the French Open which will take place in May, reports Reuters. The new law forbids people from entering public spaces if they have not been inoculated against the virus. Djokovic’s continued resistance to being vaccinated could threaten his title as world tennis #1 male player as other competitions, such as ATP tournaments in Indian Wells and Miami in March, are unlikely to allow him to compete as well, Tennis365 writes.

???? OUT AND ABOUT-

(all times CLT)

The Cairo Contemporary Dance Center is kicking off a course on Rhythm & Musicality starting today to teach participants how to translate music into movement through their dancing. The classes will be on Monday and Thursday from 7:30pm to 9pm and will run until 10 February.

Shahira Kamal will perform her latest EP Dokki ya Mazzika at The Room New Cairo tomorrow at 9pm.

???? UNDER THE LAMPLIGHT-

Why do civil wars continue to break out — and how are some countries managing to nip them in the bud? Over the last two decades, the number of active civil wars around the world has almost doubled. In How Civil Wars Start, political scientist Barbara F. Walter details the warning signs of civil wars, who starts them, and what the main triggers are. Walter spent her career studying civil conflict in places like Iraq and Sri Lanka, and she uses that knowledge alongside international research and case studies as the foundation for her hypotheses. Walter outlines how social media now plays a role in their spark and has redefined the dynamics of civil war in the modern world, where many countries face a threat of internal violence. After knowing how they start, Walter delves into how to end them, drawing on the experiences of countries that remained stable in the face of growing unrest.

???? GO WITH THE FLOW

Market roundup on 17 January

The EGX30 rose 0.2% at today’s close on turnover of EGP 701 mn (40.6% below the 90-day average). Regional investors were net sellers. The index is down 0.8% YTD.

In the green: Rameda (+5.5%), Raya Holding (+4.3%) and Speed Medical (+3.3%).

In the red: MM Group (-3.2%), Cleopatra Hospital (-2.0%) and EFG Hermes (-1.8%).

???? WHAT’S NEXT

Competition and crowding in space is becoming a growing concern as one of the biggest threats to humanity’s future: The World Economic Forum (WEF) dedicated a chapter to outer space in its Global Risks Report 2022 (pdf) as more governments and private sector companies rush to take advantage of new technologies in the orbit. The result could be everything from space collisions and geopolitical tensions to a geomagnetic storm disrupting satellite-based services and causing massive, cascading economic and societal consequences on Earth.

Elon Musk’s SpaceX is already monopolizing space: In less than three years, SpaceX has launched around 1.8k satellites to create a satellite internet web called Starlink that aims to bring high-speed broadband service to the world, reports a Wall Street Journal video (watch, runtime: 06:14). Starlink’s growing dominance in space means that there might not be enough room for rivals including Britain-based OneWeb, Amazon’s Project Kuiper, and China’s domestic satellite industry. These new satellites operate in what is called low-Earth orbit, which is already crowded with satellites for weather forecasting or taking pictures as well as the International Space Station and the Chinese space station.

Besides the monopoly and (literal) crowding, Musk’s satellites are raising the risk of collisions: That was China’s complaint to the United Nations late last year, detailing two instances when the nation had to maneuver its space station out of the way of two separate Starlink satellites. Musk was less than apologetic over the complaint, saying there is plenty of room in space. Maybe he should have been more contrite, however, as researchers found that 58% of all known close-crash encounters in space are due to Starlink satellites — or 2.5k incidents every week.

And a collision would not be pretty… Satellites move at 17k miles per hour — 250 times faster than a car on a highway. If one of Starlink’s satellites were to hit the Chinese space station it would destroy it and kill all the people within, explains Jonathan McDowell, a scientist at the Harvard-Smithsonian Center for Astrophysics, to the WSJ video.

Neither is all the junk we’re putting into orbit: Humanity is edging towards doing to space what we did to the oceans through pollution, OneWeb founder and chairman Greg Wyler writes in an op-ed for CNN. With companies promoting the quantities of satellites they send into space, not quality, there’s a greater risk of collisions that end up with a build-up of debris that can destroy whatever comes into its path, he explains. Space companies can remove failed satellites, but there is still no space vacuum that can remove the mns of pieces of shrapnel that could be created. If we’re not careful, the commercialization of satellites could ruin low-earth orbit for hundreds of years — or even permanently.

Nonetheless, space is going to get even more crowded — and soon: Satellite players are moving along with plans to launch thousands of satellites into space over the coming years. China is planning on launching as many as 10k satellites to create a new StarNet network (and compete with SpaceX, of course), according to Asia Times. Meanwhile, Project Kuiper aims to launch more than 3k satellites into orbit and OneWeb has its eye on a web of 600 satellites. Overall, around 70k satellites are expected to be launched in the coming decades, the WEF report estimates. That’s not all, with at least five new government-developed space stations planned to be developed by 2030 with powers such as China, Europe, France, Germany, India, Japan, NATO, Russia, the UK and the US currently building space infrastructure.

The solution: Space needs to be regulated — or re-regulated, let’s say: There’s already a space law in place from 1967 called The Outer Space Treaty. The treaty defines space as the “common heritage of mankind” to be explored and used “for the benefit and in the interests of all countries,” according to How Stuff Works. In the pre-Musk era of the 1960s, the creators of the treaty had not put into consideration that a company or country could monopolize space and there have been calls to amend the now outdated agreement. What could ensue is a repeat of the dynamics during the European age of global exploration, where countries with a lot of territory became substantial players in global affairs over the next centuries, argued a panel of Duke University professors.

So how would one go about regulating space in the modern day? So far, there isn’t a solid answer. A major treaty like this one could take a decade to write and there is now a global debate on how to regulate space in a uniform way that all countries can abide by. Needless to say, it’s a slow process with so many parties involved and so much to consider, McDowell adds. “Few effective governance tools have emerged in recent years to reflect new realities, such as the pressing need for an authority to govern satellite launches and servicing, space traffic control and common enforcement principles,” the WEF report writes. The new regulations need to set norms on how much can one country or company access space, controlling the trajectories of spacecraft and their subsystems, the deployment of non-nuclear weapons into space, as well as who can conduct operations on the moon — such as China wanting to mine into the lunar surface to extract Helium 3, reports Foreign Policy.

???? CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: The World Economic Forum annual meeting, location TBD.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

January: Sovereign Sukuk Act executive regulations expected to be finalized.

January: Tenth of Ramadan dry port tender to be launched.

January: Three-month trial period of ACI for air freight to begin.

9 January – 6 February (Sunday-Sunday): 2021 Africa Cup of Nations, Cameroon.

Second half of January: Egypt will host the Egyptian-Bahraini Joint Committee.

Second half of January: Regulations for installing EV charging stations will be published.

15-19 January (Saturday-Wednesday): World Art Forum, National Museum of Egyptian Civilization, Cairo.

17-19 January (Monday-Wednesday): World Future Energy Summit, Abu Dhabi.

18 January (Tuesday): Founder and Principal of Newton International Management Ayman S. Ashour will give a talk titled Exits and Reset Dilemmas at Consoleya.

19 January (Wednesday): EgyptAir will operate an exceptional Casablanca-Cairo flight to bring home Egyptians expats stranded in Morocco following border closures.

20 January (Thursday): Kadmar Shipping’s new line transporting agricultural crops between Alexandria and Russia begins its operations.

20-21 January (Thursday-Friday): South Korean President Moon Jae-in will visit Egypt as part of his diplomatic tour of the region.

23 January (Sunday): Deadline for Macro Pharma to IPO on the EGX.

25 January (Tuesday): The IMF will release its World Economic Outlook.

25 January (Tuesday): 25 January revolution anniversary / Police Day.

25 January (Tuesday): Techne Summit announces awardees of Corporate Innovation Program.

25-26 January (Tuesday-Wednesday): Federal Reserve interest rate meeting.

27 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

30-31 January (Sunday-Monday): Ins. Federation of Egypt medical ins. forum.

End of January: The Egyptian-Romanian business forum will take place with the aim of strengthening joint investment relations.

January-February 2022: Construction work on the Abu Qir metro upgrade will begin.

February: Hassan Allam Construction’s new construction firm established with Russia’s Titan-2 to handle construction work on the Dabaa nuclear power plant begins its operations.

February: Ghazl El Mahalla shares will begin trading on the EGX this month.

February: Suez canal transit fees set to increase 6%, exempting cruise ships and LNG carriers.

Mid-February: End of grace period to comply with new minimum wage for firms who sent in exemption requests.

Mid-February: A Hungarian delegation will arrive in Egypt for talks over a potential investment in an industrial area in the SCZone.

3 February (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3 February (Thursday): January PMI figures for Egypt, Saudi Arabia, and the UAE will be released.

4-20 February (Friday-Sunday): 2022 Winter Olympics, Beijing.

11 February (Friday): Deadline for Anghami SPAC merger.

11-13 February (Friday-Sunday) FIBA Intercontinental Cup, Cairo.

14-16 February (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

15 February (Tuesday): The Industrial Development Authority’s deadline for receiving offers from companies for licenses to manufacture steel products.

15 February (Tuesday): Orange Ventures’ deadline to receive applications from seed-stage fintech startups.

19 February (Saturday): Public universities begin the second term of the 2021-2022 academic year.

19-21 February (Saturday-Monday): Nebu Expo for Gold and Jewelry 2022.

End of February: Lebanon to receive gas from Egypt via a pipeline crossing Jordan and Syria.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will replace the existing “closed” financial management system.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

9-18 March (Wednesday-Friday): The 55th edition of the Cairo International Fair.

15-16 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

July: A law governing ins. for seasonal contractors will come into effect.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

Late October – 14 November: 3Q2022 earnings season.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.