- From fresh lockdowns to a renewed vaccine race, everyone is freaking out about Omicron. (For Your Commute)

- We just got our hands on our biggest batch of Pfizer vaccines. (What We’re Tracking Today)

- Parliament discusses bill to encourage setting up nonprofit universities. (Happening Now)

- The Netflix category we didn’t know we needed: Christmas reality TV. (On the Tube Tonight)

- Salt of the Earth of Sahel fame has made its way to Cairo. (Eat This Tonight)

- Read Elif Shafak’s The Island of Missing Trees: A story of inherited trauma, displacement, and grief. (Under the Lamplight)

- We still don’t know if Ezz Steel is acquiring a stake in Egyptian Steel. (Go With the Flow)

- Egypt’s remittance inflows on track to hit record high this year + outpace MENA peers. (The Macro Picture)

Sunday, 28 November 2021

PM — It’s nothing but Omicron as far as the eye can see

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, nice people, and welcome to the accidental Omicron edition of EnterprisePM. The news cycle here at home is eerily calm, with no major stories grabbing our attention today so far. Abroad, it’s a different picture: The newly identified covid-19 strain and how to avoid an exact repeat of March 2020 is all anybody can talk about in the global press. We have the latest updates and insights in The Big Story Abroad and For Your Commute, below.

But first: Our largest-yet batch of Pfizer shots is here: 3.89 mn doses of Pfizer vaccines arrived at Cairo Airport through the Gavi / Covax program on Saturday, according to a Health Ministry statement. By our count, the delivery brings the total number of Pfizer jabs we’ve received so far to 12.1 mn.

HAPPENING NOW-

The House of Representatives is currently discussing proposed amendments to the Private and Nonprofit Universities Act which would encourage public entities to establish nonprofit universities in partnership with international and private universities, according to Masrawy. The amendments come as part of the state’s push to establish 15 nonprofit universities and colleges in the coming years and aim to make the venture more attractive.

The Creative Industry Summit kicked off this morning at Nile Ritz-Carlton and continues until this Wednesday, 1 December.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Introducing What’s Next: Enterprise is launching What’s Next — the first exclusive platform in frontier markets to identify the next generation of great businesses in Egypt, the UAE and Saudi Arabia — in partnership with EFG Hermes and Inktank.

- Gas export plans get a bump: The Madbouly government signed on Thursday agreements with Greece and Israel that could see Egypt import more natural gas from Israel and increase shipments to Greece.

- Aldar-ADQ’s offer for SODIC is final: Aldar Properties and Abu Dhabi sovereign fund ADQ reportedly won’t up their bid for upmarket developer SODIC again if shareholders reject the price of the ongoing mandatory tender offer.

THE BIG STORY ABROAD

The emergence of Omicron covid-19 variant is plastered on the front pages of all the major news outlets this afternoon: Financial Times | WSJ | Reuters | CNN | New York Times.

Omicron who? Just yesterday, the World Health Organization called the Omicron strain a “variant of concern” as travel bans to southern Africa and other countries where Omicron has been detected popped up across Europe, the US, Canada, the Middle East and Asia. So far, early evidence shows that Omicron has “a large number of mutations,” according to the WHO, and may be transmitted more easily. There is also evidence that it could hold a greater risk for reinfection for those who have already had covid.

More cases detected: Since we last wrote to you this morning, the new variant has been detected in the UK, Australia, and Italy in travelers returning from southern Africa. Hong Kong, Israel, Belgium, and Botswana had previously also announced detecting cases of the variant.

And more lockdowns and travel bans: Saudi Arabia has barred flights to and from Malawi, Zambia, Madagascar, Seychelles, Mauritius, Angola, and Comoros, according to the Saudi Press Agency. Meanwhile, the UK announced new measures in a bid to keep the variant under control.

We get into the latest updates and details in For Your Commute, below.

|

FOR TOMORROW- Egypt Defense Expo begins tomorrow and runs until Thursday, 2 December at the Egypt International Exhibition Center.

PSA- Calling all college seniors and recent grads: You have until tomorrow to register for a career development training program from the CIT Ministry’s Digital Egypt Youth initiative. The program will be held online in January 2022.

???? CIRCLE YOUR CALENDAR-

Young professionals can now apply for the recently-launched McKinsey Forward program which focuses on leadership, business, and the transition to digital, McKinsey announced in a press release (pdf). The six-month program aims to teach participants how their business can combat challenges and use them to their advantage, integrate tech, and be adaptable and resilient during times of change. Forward will be available without charge to those eligible to apply — one of the requirements is having less than five years of work experience. You can apply via this link before the 12 December deadline.

The Cairo International Film Festival continues its 10-day run after kicking off on Friday. The festival wraps next Sunday, 5 December.

KfW Development Bank is launching its open call for green project proposals in Egypt as part of their Investing for Employment facility (pdf) this Tuesday, 30 November. The facility will award grants to projects that contribute towards job creation. You can find out more about the facility and the application process here.

A new month is around the corner. The key news triggers to keep your eye on as we approach December:

- PMI: Purchasing managers’ index figures for November for Egypt, Saudi Arabia, and Qatar will be released on Sunday, 5 December. Figures for the UAE, which normally drop on the same day as Egypt and Saudi, will be released two days later on Tuesday, 7 December.

- Foreign reserves: November’s foreign reserves figures will be released during the first week of the month.

- Inflation: Inflation figures for November will be released on Thursday, 9 December. Data for inflation typically drops on the 10th of every month, but is moved up one day if that falls on a Friday.

- Interest rates: The Central Bank of Egypt’s Monetary Policy Committee will hold its final meeting for the year to review interest rates on Thursday, 16 December.

The new round of Silicon Waha’s Startup Factory will kick off on 10 December at the Assiut Technology Zone. The program will offer marketing tips and tricks for startup founders, who can apply here.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- The last day of off-season warm weather for awhile: The mercury will rise to 34°C tomorrow during the day and fall to 19°C at night, with the weather expected to get significantly colder (and more appropriate for this time of year) as the week progresses, according to our favorite weather app.

???? FOR YOUR COMMUTE

The Omicron vaccine race is on: Researchers at Moderna, BioNTech, Johnson & Johnson and AstraZeneca are racing to test the efficacy of their vaccines against Omicron, reports the Financial Times. The number of mutations in the virus’ spike protein means existing vaccines are less likely to recognise it, putting previously vaccinated or infected individuals at risk. Because of their structure, mRNA vaccines should be the easiest to adapt to the new variant and to scale up, experts said. Shares in mRNA vaccine companies rose on Friday as news of the new variant spread, with Moderna jumping 21%, BioNTech jumping 17% and Pfizer rising 7%. Experts have noted that antivirals will likely be key should vaccines prove ineffective against the new strain as their efficacy is not affected by mutations in the spike protein, though drugmakers have yet to test them against Omicron.

The UK brings back mandatory face masks + post-travel isolation measures to stop the spread of Omicron: Visitors to the UK will now be required to take a PCR within two days of arriving and self-isolate until they receive a negative result, the UK government announced yesterday. Contacts of suspected Omicron cases — even those who are vaccinated — will have to isolate for 10 days. Face mask requirements will be reintroduced in shops and on public transport but not in restaurants or pubs. So far, the UK has detected two cases of Omicron linked to travel to southern Africa. The UK relaxed travel restrictions less than a week ago after its removed quarantine requirements for travelers who have taken Sinovac, Sinopharm and India’s Covaxin.

Omicron is already sidelining possible progress: The World Trade Organization's biennial ministerial conference has been postponed after Switzerland tightened travel restrictions amidst the spread of the variant, according to a statement. The irony is that one of the key topics to be discussed in meetings was how to improve the availability of vaccines in the developing world, the FT reported. The conference was meant to run from 30 November- 3 December and a new date has yet to be set.

Now imagine how bad things would be right now if China had tried to “coexist” with covid-19: China could see over 600k covid-19 cases daily if it were to abandon its “Covid Zero” strategy in favor of reopening its borders and loosening its restrictions, according to a study by the Chinese Center for Disease Control and Prevention. Critically, this study was conducted and published pre-Omicron. Under a US-style reopening, which would see China fully reopen its borders and do away with strict curbs like quarantines and lockdowns, the study forecasts severe cases would surge to nearly double the peak of the initial outbreak in early 2020. This would have “a devastating impact on the medical system of China and cause a great disaster within the nation,” the researchers wrote in the study. China has been facing pressure from analysts and economists to open its borders to avoid an economic crisis for months, but has so far only considered partially opening its borders with financial hub Hong Kong.

Meanwhile, back in regular covid-19 land: Merck’s antiviral molnupiravir was shown to be less effective than previously reported, reducing risk of infection by 30% not 50%, the Financial Times noted. A full analysis of the company’s trial results showed that the oral pill, previously promised to reduce relative risk by 50%, is less effective than preliminary data from initial trials on a small sample of patients indicated. Merck’s shares lost 4% in New York on Friday. Molnupiravir was approved in the UK earlier this month and is still under review in Europe.

???? ENTERPRISE RECOMMENDS

Read Elif Shafak’s The Island of Missing Trees + Christmas reality TV is Netflix’s newest trend

???? ON THE TUBE TONIGHT-

(all times CLT)

Netflix is trying to make Christmas reality TV a thing: The streamer is rolling out a series of reality TV shows with a holiday-themed twist in what we think is an effort to bring together two highly-watched genres. In Blown Away, five glass-blowing artists compete to create the best Christmas decorations, whether it’s a sculpture, a tree, or winter wonderland installations. The contestants are given a prompt such as “create something that reminds you of the best Christmas gift you received” and then have to explain the motives behind their work. Similarly in School of Chocolate, contestants take to the kitchen to compete to create edible cocoa masterpieces. Master Chocolatier Amaury Guichon sets challenges for the contestants, who are prompted to use chocolate to build an optical illusion, an architectural project, an interactive piece, and a “gravity-defying” creation.

⚽ Chelsea will play against Manchester United in the English Premier League at 6:30pm tonight. The blues aim to tighten their control over the league, but put the reds in the line of fire as interim coach Michael Carrick seeks to avoid any additional losses before handing over the technical leadership of the Devils to the new coach. Meanwhile at 4pm, Manchester City has a difficult match ahead against West Ham, while Brentford is going up against Everton, Burnley against Tottenham Hotspur, and Leicester City against Watford.

Today’s match between Real Madrid and Seville could potentially tip the scales at the top, as they face off in La Liga at 10pm. In another big match, Atletico Madrid goes out to face Cadiz at 7:30pm and the former has a chance to rise to second place from its current position at fourth, provided that it grabs the three points.

In the Italian League: Milan is playing against Sassuolo at 4pm while a clash between the league leader Napoli and Lazio is taking place at 10pm.

???? EAT THIS TONIGHT-

Salt of the Earth has made its way to Cairo: The Sahel restaurant recently opened its doors in Garden 8 in New Cairo, offering a variety of international, beautifully presented dishes of excellent quality and taste. Taking a cue from the name, Salt of the Earth’s aesthetic relies on wood, plants, and colorful granite for a relaxing outdoorsy feel. We can’t get enough of their prawn spaghetti with sun-dried tomatoes as well as their truffle angel hair pasta with braised chicken and wild mushrooms. Other dishes we found special were their truffle infused shrimp amborio, charbroiled ribeye, and all their poke bowls. Finally, their dessert is an experience you can’t miss out on, with options such as layered souffle pancakes (that come surrounded with fruits and granola) and their pain perdu with caramel sauce.

???? OUT AND ABOUT-

(all times CLT)

Back to Egypt: A Brazilian Collection of Photographs displays 90 photographs taken in Egypt during the 1870s by the former emperor of Brazil, Dom Pedro II. The joint venture between the Embassy of Brazil in Cairo and the Culture Ministry runs till 30 November at the Gezira Art Center in Zamalek, with opening hours from 10am to 2pm and from 5pm to 9pm.

???? UNDER THE LAMPLIGHT-

Elif Shafak’s The Island of Missing Trees is a showcase of her undeniable literary skills: We consider Shafak a master of her trade, skillfully weaving together words to create complex worlds full of emotion and meaning. She describes her latest novel, The Island of Missing Trees, as “the book she’s waited years to write” as she explores inherited trauma, displacement, and grief. The book starts with two lovers whose background makes their romance forbidden amid a divided Cyprus in 1974: Greek Kostas and Turkish Defne. After Defne gets pregnant, things quickly take a turn and the love becomes a mixture of joy and sorrow as they begin to understand the consequences. The book then follows their daughter Ada’s experience as she moves to London with her father after tragedy befalls the mother. It’s her sorrow that then drives the story as she struggles to create a future while being unable to let go of a past that she never got a chance to live. The Guardian is out with a powerful review.

???? GO WITH THE FLOW

MARKET NEWS-

Ezz Steel’s alleged acquisition of a stake in Egyptian Steel is still unconfirmed: Early reports that Ezz Steel is eyeing Ahmed Abou Hashima’s stake in Egyptian Steel emerged again in the local press, this time with sources close to the matter claiming the acquisition of the 18% stake was completed in a EGP 1.5 bn transaction. Ezz Steel again neither confirmed nor denied the accuracy of the reported size or status of the acquisition, saying in a disclosure to the EGX (pdf) it is still completing the necessary procedures.

Egyptians Housing eyes snapping up 99.9% of Edge Development: Egyptians Housing and Development will conduct a fair value study to determine the value of the 99.9% stake (40 mn shares) in Edge Development and Project Management it’s looking to acquire, according to a disclosure to the bourse (pdf). Egyptians Housing and Edge are both subsidiaries of Odin Investments.

MARKET WATCH-

The EGX30 fell 1.3% at today’s close on turnover of EGP 775 mn (46.6% above the 90-day average). Foreign investors were net sellers. The index is up 4.0% YTD.

In the green: Rameda (+3.1%), Mopco (+1.1%) and Heliopolis Housing (+0.9%).

In the red: Orascom Development Egypt (-5.9%), AMOC (-5.1%) and Pioneers Properties (-4.1%).

???? THE MACRO PICTURE

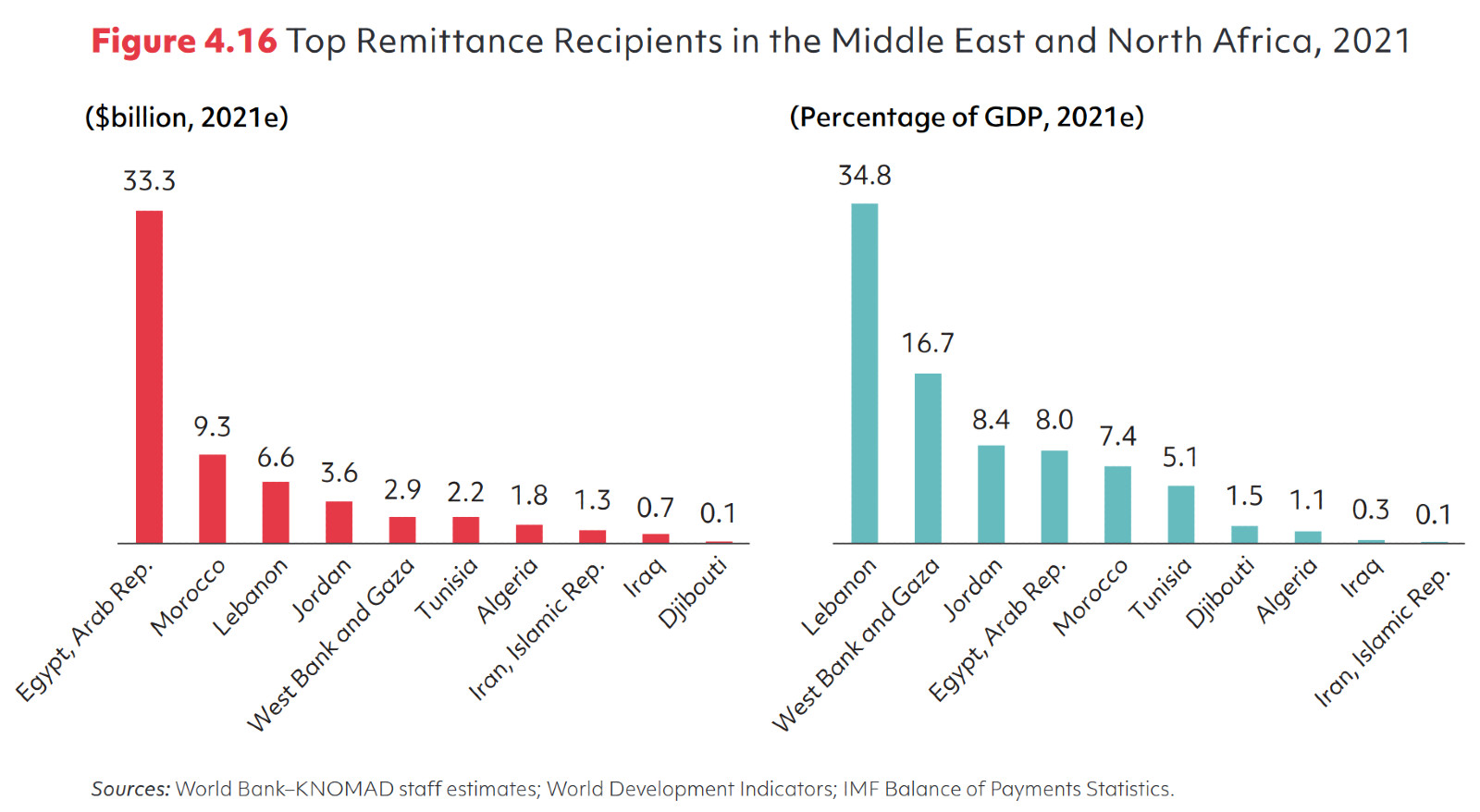

Remittance inflows to Egypt are on course to hit a record high this year as higher oil prices and the global economic recovery fuel an increase in transfers. Transfers from Egyptians abroad are projected to increase almost 13% to USD 33 bn this year, making Egypt one of the world’s top five recipients of remittances in USD terms, the World Bank has said in a new report (pdf).

Best in class: Egypt will have by far the largest remittance inflows among developing countries in the MENA region, according to the bank’s projections. Accounting for 54% of total inflows, the “surprisingly strong” transfers into Egypt are expected to help regional remittances rise almost 10% this year to USD 62 bn, the report says.

Part of a global trend: The World Bank is now projecting global remittance flows to rise 7.3% this year to reach USD 589 bn. “Remittance flows from migrants have greatly complemented government money transfer programs to support families suffering economic hardships during the covid-19 crisis,” said Michal Rutkowski, the World Bank’s global director for social protection and jobs, in a statement. “Facilitating the flow of remittances to provide relief to strained household budgets should be a key component of government policies to support a global recovery from the pandemic.”

Behind the rise in global inflows: “Drawdown on savings by migrants, greater use of official channels for remittances (both due to less physical travel and fintech payment innovation), access to [monetary] handouts in host countries, and a stuttering loosening of prior covid-related lockdowns,” Hasnain Malik, chief equity strategist at Tellimer Research, wrote in a note last week.

But Egypt is also benefiting from other trends: The rebound in oil prices this year has helped to boost transfers from GCC countries, where the vast majority of Egyptian expats are based, the World Bank said. The rebound in economic activity in the US and Europe has also fueled inflows.

Don’t take these figures as gospel: There remains a risk that Egyptian remittances could fall short of these projections after several GCC countries announced that they would bar unvaccinated people from entering their countries.

A vital stop-gap: Remittances have been vital over the past two years to make up for the covid-induced slump in foreign direct investment, and for the second consecutive year remittance flows to low- and middle-income countries are projected to exceed FDI. Remittances are expected to account for 8.4% of Egypt’s GDP by the end of 2021, according to the World Bank, which says they are “of paramount importance” to bringing in foreign currency following the collapse in tourism revenues and flat-lining FDI.

A huge tourism-shaped hole: The increase in transfers has plugged some of the shortfall in tourism revenues caused by the shutdown of international travel. Before covid, tourism revenues were one of the country’s principal sources of foreign currency and the sector accounted for around 12% of GDP. In 2020 proceeds collapsed by two-thirds to just USD 4.4 bn, and though the industry has begun to recover this year with the gradual normalization of travel, revenues remain far below pre-pandemic levels.

Remittances > FDI: Though the value of remittances have long exceeded FDI in the country’s balance of payments, the two have been moving in opposite directions over the past two years, with incoming investment falling as transfers have risen. The USD 29.6 bn in remittances received last year dwarfed FDI, which came in at just USD 5.85 bn. During the first six months of 2021 Egypt received USD 15.9 bn in remittances, while net FDI registered just USD 1.85 bn.

Coming in 2022: The World Bank is forecasting transfers to Egypt and the rest of North Africa to slow to 3% in 2022 after rising 8.6% this year in anticipation of OPEC adding more crude supply to global markets, causing a slip in oil prices. Globally, flows will increase by a more moderate 2.6% next year, the report said.

Covid or no covid, flows could temper next year: A resurgence in covid cases is the obvious risk going forward, though Tellimer’s Malik says that inflows could be hit either way. The economic consequences of a serious covid flare-up poses a risk to remittance flows, but the continued relaxation of travel restrictions could also hit inflows as more people resume traveling with banknotes instead of using digital payment systems.

???? CALENDAR

24 November-7 December (Wednesday-Tuesday): Designated period for SODIC shareholders to subscribe to Aldar Properties and ADQ’s mandatory tender offer (pdf).

26 November-5 December (Friday-Sunday): The 43rd Cairo International Film Festival.

28 November-1 December (Sunday-Wednesday): Creative Industry Summit, Nile Ritz-Carlton.

29 November (Monday): Deadline for registration for MCIT’s online career training program by Digital Egypt Youth.

29 November-2 December (Monday-Thursday): Egypt Defense Expo, Egypt International Exhibition Centre.

30 November (Tuesday): Launch of open call by KfW for green project proposals in Egypt as part of their Investing for Employment facility (pdf).

End of November: El Nasr Automotive expects to have found a replacement for Dongfeng as its partner for its local EV assembly plans.

1 December (Wednesday): Unvaccinated members of the public will be banned from government buildings from this date; unvaccinated students will be prevented from accessing university campuses.

1 December (Wednesday): Government departments will begin moving to offices in the new capital.

2 December (Thursday): The 23rd OPEC and non-OPEC ministerial meeting.

5 December (Sunday): Purchasing managers’ index figures for November for Egypt, Saudi Arabia, and Qatar will be released.

7-8 December (Tuesday-Wednesday): North Africa Trade Finance Summit.

8-10 December (Wednesday-Friday): Global Forum for Higher Education and Scientific Research (GFHS), Cairo, Egypt.

9-10 December (Thursday-Friday): The US’s Summit for Democracy. Egypt is not among the invitees.

10 December (Friday): Capmas will release November inflation figures.

10 December (Friday): Silicon Waha’s Startup Factory program kicks off in Assiut Technology Zone.

12 December (Sunday): Raya Holding’s Ordinary General Assembly meeting.

12 December (Sunday): Deadline to apply to the McKinsey Forward program for young professionals.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

14 December (Tuesday): Inquiry session for the Industrial Development Authority’s licenses to manufacture steel products.

14-19 December (Tuesday-Sunday): The Cairo International Festival for Experimental Theater.

14-15 December (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

15 December (Wednesday): Deadline for joint stock companies and investment companies in Cairo to join e-invoicing platform.

15 December (Wednesday): Target date for snackmaker Edita to wrap up due diligence on its acquisition of the Ole brand owner Egyptian Belgian Company.

15 December (Wednesday): The European Bank for Reconstruction and Development will give its final approval for a USD 100 mn facility to state-owned Banque Misr to finance local SMEs working on green projects.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

End of 4Q2021: EdVentures plans to have closed at least one more edtech investment round.

End of 4Q2021: Fawry plans to have launched its MyFawry card.

1H2022: The World Economic Forum annual meeting, location TBD.

1H2022:: e-Aswaaq’s tourism platform will roll out its ticketing and online booking portal across Egypt.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

Second Half of January: Egypt will host the Egyptian-Bahraini Joint Committee.

1 January 2022: Capital gains tax comes into effect on the EGX for local investors.

7 January 2022 (Friday): Coptic Christmas.

10-13 January 2022 (Monday-Thursday): World Youth Forum, Sharm El Sheikh.

15 January (Saturday): Target date for the finalization of snackfood giant Edita’s acquisition of the Egyptian Belgian Company, owner of the Ole brand.

17-19 January 2022 (Monday-Wednesday): World Future Energy Summit, Abu Dhabi.

27 January 2022 (Tuesday): National holiday in observance of 25 January revolution anniversary / Police Day.

11 February 2022 (Friday): Deadline for Anghami SPAC merger.

11-13 February (Friday-Sunday) FIBA Intercontinental Cup, Cairo.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

15 February 2022 (Tuesday): The Industrial Development Authority’s deadline for receiving offers from companies for licenses to manufacture steel products.

19 February 2022 (Saturday): Public universities begin the second term of the 2021-2022 academic year.

March 2022: 4Q2021 earnings season.

March 2022: World Cup playoffs.

2 April 2022 (Saturday): First day of Ramadan (TBC).

22-24 April 2022 (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April 2022 (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April 2022 (Monday): Sham El Nessim.

25 April 2022 (Monday): Sinai Liberation Day.

Late April – 15 May 2022: 1Q2022 earnings season

May 2022: Investment in Logistics Conference, Cairo, Egypt.

2 May 2022 (Monday): Eid El Fitr (TBC).

16 June 2022 (Thursday): End of 2021-2022 academic year for public schools.

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

30 June 2022 (Thursday): June 30 Revolution Day, national holiday.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

8 July 2022 (Friday): Arafat Day.

9-13 July 2022 (Saturday-Wednesday): Eid Al Adha, national holiday.

30 July 2022 (Saturday): Islamic New Year.

Late July – 14 August 2022: 2Q2022 earnings season.

6 October 2022 (Thursday): Armed Forces Day, national holiday.

8 October 2022 (Saturday): Prophet Muhammad’s birthday.

18-20 October 2022 (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

Late October – 14 November 2022: 3Q2022 earnings season.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.