- Maait announces emergency measures to release goods amassing at Egypt’s ports. (The Big Story Today)

- Iraq clashes leave 23 dead after Moqtada Al Sadr quits. (The Big Stories Abroad)

- Meet our Founder of the Week: Sherif Aziz, co-founder of SubsBase

- How has 2022 been for your business? Let us know. (What We’re Tracking Tonight)

- NASA will make a second attempt to head to the moon later this week. (For Your Commute)

- It’s the final day of the Egyptian Premier League season. (Sports)

- The Charles Dickens Museum will display 11 new unpublished letters as part of a wider collection of the famed author’s personal belongings. (For Your Commute)

- Need something new to watch? A South African businessman moonlights as a diamond smuggler to Netflix’s Ludik. (On the Tube Tonight)

Tuesday, 30 August 2022

Houston, we’ve had a problem

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Happy hump day, wonderful people. We have another relatively big news day here at home, courtesy of the government throwing out a lifeline to importers. We have our customary afternoon brief on the story below, but first:

***

Take our Fall Reader Survey today and we’ll have the results for you in a couple of weeks — just in time to give you a sense of what everyone else is thinking heading into budget season.

How has 2022 been for your business? And how do you feel about what’s left of the year? Are you investing? Do you plan to hire new staff (or make cuts to your existing staff) now or in 2023? What’s the USD / EGP rate you expect to use for your 2023 budget? Where do you see your industry as a whole heading?

Let us know in our Fall Reader Survey. It won’t take more than a few minutes to complete — and we’ll be sharing the results with the entire community.

***

#1- The Madbouly government just announced measures to clear the logjam in Egypt’s ports: A package of emergency measures to release goods amassing at Egypt’s ports will be introduced in the “coming days”, Finance Minister Mohamed Maait said this morning.

Among the changes: Goods awaiting the Form 4 customs document will be released and customs fines for late filing have been suspended.

Fighting fire: The measures are aimed at mitigating problems caused by the new requirement for importers to use letters of credit (L/C) which have made it almost impossible for them to get most goods into the country. Speculation has risen in recent days that the Central Bank of Egypt and the government are preparing to ease the restrictions and allow importers to use documentary collection for some types of goods.

#2- Is the chase for Alex Medical entering the end game? The Financial Regulation Authority has approved (pdf) a mandatory tender offer submitted by Tawasol Holdings and LimeVest to purchase 74% of Alexandria Medical Services. The consortium yesterday offered to pay EGP 47.67 a share for the stake, a bid that values Alex Medical at EGP 742.4 mn.

^^ We’ll have more on both of these stories in tomorrow’s EnterpriseAM.

MAKING HEADLINES IN THE REGION-

Iraq, where the death toll from yesterday’s clashes has grown to at least 23. Shia cleric Moqtada Al Sadr has called on his supporters to stand down after they stormed the presidential palace on Monday, sparking clashes with security forces that left at least 23 dead and 380 injured. In response to the violence, the UAE has suspended flights to and from Baghdad today, Iran closed its land borders and Kuwait advised its citizens to evacuate the country. Protests were sparked yesterday after Al Sadr unexpectedly resigned from politics following months of deadlocked negotiations to form a government with rival Iran-backed parties. (BBC | AP | Sky News | Reuters | Khaleej Times)

THE BIG STORIES ABROAD-

#1- The Musk-Twitter soap opera continues to get clicks: Tech b’naire Elon Musk has added fresh accusations by a whistleblower on Twitter’s failure to protect user data and security problems as a new reason to terminate a USD 44 bn bid to take over the company. The latest efforts by Musk to call out Twitter saw his legal team filing another notice that includes Twitter’s former chief of security, Peiter Zatko, allegations of “egregious deficiencies” by Twitter on privacy and security issues. (Bloomberg | CNBC | Wall Street Journal).

#2- The latest from Ukraine: The conflict is back on the global front pages as Ukrainian forces mount a counteroffensive to retake the country’s southern Kherson region seized by Russian forces. (NYT | Washington Post | Financial Times)

#3- Good news / bad news on Europe’s energy crisis:

The good news: Europe is nearing its gas storage goal two months ahead of its target, despite limited Russian gas supplies and surging gas prices, Bloomberg reported, citing inventory data. Gas reserves were up to 79.94% as of 27 August, compared with a 80% target by 1 November .

The bad news: Gazprom is tightening the screws on France’s gas supplies, announcing today that it will immediately reduce deliveries to French supplier Engie due to contractual disagreements, prompting a French minister to accuse Moscow of using energy as a “weapon of war.” The Russian gas giant will tomorrow cut flows through the vital Nordstream pipeline that supplies to Germany to zero for three days for what it said was unscheduled maintenance. (Reuters | Bloomberg)

HAPPENING NOW-

The Madbouly government is holding consultations on its privatization strategy with representatives from the food and hospitality sector. The government is holding workshops and consultations with stakeholders from different industries every Sunday, Tuesday, and Thursday on its privatization plans. You can find more details on the schedule of the meetings here.

PSA- It’s deadline day for:

- Listed companies to file their 2Q financials;

- Student applications for government non-profit universities.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Maait looks to shift the economic narrative with media blitz: Egypt plans to issue CNY-denominated bonds worth more than USD 500 mn and has updated some fiscal targets for FY 2022-2023, Finance Minister Mohamed Maait said at a presser yesterday.

- Chinese firms could be looking to build a massive solar panel parts factory: There’s talk of Chinese players coming on board to build a major industrial complex for manufacturing solar-panel components.

- Solar energy company KarmSolar will sell a minority stake to investors via a capital increase as it looks to expand its presence in Egypt and across the region.

|

???? CIRCLE YOUR CALENDAR-

The Africa Women Innovation and Entrepreneurship Forum (AWEIF) is taking place in Cairo for the first time on 26-27 September, according to a press release (pdf). The hybrid event will bring together more than 60 African and global policy and business experts to discuss how gender integration can boost SME growth.

The Arab Pensions and Social Ins. Conference takes place on 28-29 September in Sharm El Sheikh. The conference will bring together state-run social ins. organizations and public and private pension providers to discuss widening coverage through region-wide pension reform.

PSA #2- Exporters have until 15 September to apply to join the fifth phase of FinMin’s export subsidy program, according to a statement. Cabinet has given its approval to pay a total EGP 10 bn out to exporters, with payments to be made on 1 October and 1 December. The program allows exporters to receive overdue subsidies in a single payment rather than in installments over four to five years, in return for a haircut.

Ration card holders now have until 30 September to register their mobile numbers to their cards, in a move meant to make it easier for the Supply Ministry to contact them, the ministry said in a statement yesterday.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- Expect a daytime high of 39°C tomorrow and a nighttime low of 24°C, according to our favorite weather app.

???? FOR YOUR COMMUTE

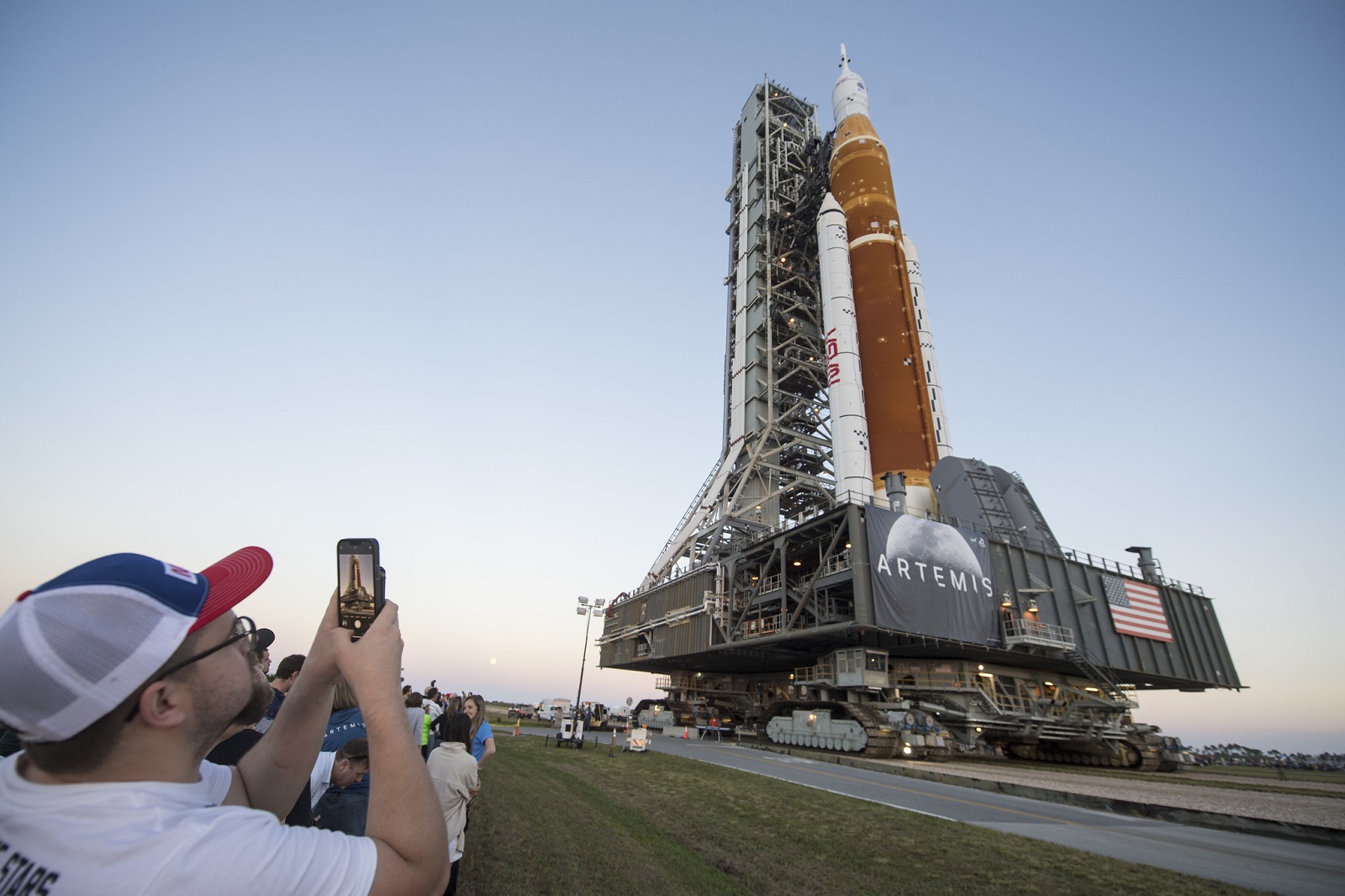

Why is NASA going to the moon again? NASA’s Artemis I rocket launch, which was scheduled for yesterday, as we noted this morning, was canceled due to a technical issue in one of the rocket’s four engines, the Wall Street Journal writes. A second launch will be attempted on Friday. But what would prompt the space agency to spend close to USD 100 bn for another moon landing? Certainly not a mere bout of nostalgia. Renewed interest in the moon is primarily due to the discovery of frozen water in several impact craters on its surface. But that is not all as the New York Times previously reported.

There are several reasons for a second moon landing: “The moon is in some sense a Rosetta Stone,” David A. Kring of the Lunar and Planetary Institute said. Its desolate conditions preserve rocks perfectly and allow us to peer through hundreds of mns of years and deepen our knowledge of our solar system. On another level, Artemis I could be perfect practice to expand human spaceflight ambitions: Through space to further planets like Mars, but also towards a greater inclusion of women and people of color on these missions. Political motivations are also key as China hopes to install a lunar base in the 2030s, the pressure to compete rises in the US. Ultimately, however, this all points in one direction as NASA administrator Bill Nelson put it: “We explore because that’s part of our nature.”

Eleven unpublished letters penned by Charles Dickens will be displayed for the first time in his museum. The letters were acquired in 2020 by the Charles Dickens Museum and are part of a larger collection of 300 items including books, sketches and personal items, the BBC writes. The letters are particularly fascinating because they offer us a glimpse into Dickens’ mind from his 30s to his 50s.

Museum curator Emily Dunbar argues that some of the author’s personal writing demonstrates his awareness of his great fame and self-importance. Dunbar specifically refers to a letter Dickens wrote in February of 1866. In this missive, the Oliver Twist author objects to the interruption of his epistolary endeavors due to a Sunday postal service cancellation and feels “so hampered by the proposed restriction that I think it would force me to sell my property here.”

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

Netflix’s new South African title Ludik is highly entertaining: The Afrikaan series centers on Daan Ludik, a businessman from humble beginnings who has built a furniture empire. We quickly learn that the CEO and family man also leads a secret business smuggling diamonds. Daan’s life soon starts to spiral out of control when a member of his family gets kidnapped — and that’s when the action kicks off. With just six episodes, you can expect an intense, fast-paced story with plenty of thrills. There are distant echoes of David Chase’s masterpiece The Sopranos — though Ludix isn’t quite as complex. But what it may be lacking in intricacy and depth, it more than makes up for in terms of entertainment. The characters are relatable, the actors are excellent, and the cinematography is fantastic (watch trailer, runtime: 2:14).

⚽ We’ve reached the end of a long Egyptian Premier League season: It has been quite a stressful season for the players, the coaching teams, and for us as local football fans. Alas, the season is finally coming to an end tonight.

We already know who made it to the top, and who’s at the very bottom of the league: Zamalek (77 points), Pyramids (71 points) and Al Ahly (67 points) have taken the first three spots, relegation has been confirmed for Eastern Company (30 points) and Misr Lel Makasa (15 points). However, the fight against relegation is still going strong between three teams: El Mokawloon (35 points), Ghazl El Mahalla (35 points) and El Gouna (33 points).

Today’s matches: At 4:30pm: Al-Ahly v Ceramica Cleopatra, Ahli Bank v Enppi, Smouha v Farco. At 6:30pm: Ismaily v Tala’ei El-Geish. At 9:30 pm: Zamalek v Eastern Company, Pyramids v El Gouna, Ghazl El Mahalla v Al Ittihad, El Mokawloon v El Masry.

Over in the UK, Gameweek 5 of the English Premier League kicks off today. At 8:30pm, Crystal Palace will play against Brentford, and Fulham will play against Brighton.

At 8:45pm, Southampton v Chelsea kicks off, and at 9pm, Leeds will face Everton.

Meanwhile in Italy, the top teams have important games in Serie A today: Milan will face Sassuolo at 6:30pm, while two matches will start at 8:45pm: Inter v Cremonese, and Roma v Monza.

???? EAT THIS TONIGHT-

Treat yourself to a scrumptious experience at Bocca’s new venue: The social house and eatery has been on our list of go-to spots for years, and its newest branch in Sheikh Zayed’s Park Street did not disappoint. The chic ambiance in both its indoor and outdoor areas added to an already pleasant experience. Their diverse menu boasts a mix of oriental and international cuisine, including some of our long-standing favorites, such as their delectable Steak and Fries and the excellent Bocca Burger. Their portions are quite generous as well, so make sure you’re adequately hungry (or have someone to share your food with) before you order. And you must leave room for dessert — you don’t want to miss their Pizzokie. Along with its newest spot in Zayed, Bocca has branches in Mohandeseen and Waterway 2.

???? OUT AND ABOUT-

(all times CLT)

Tuesdays are the new Fridays at Cairo Jazz Club’s TMP: Dance like it’s the weekend at CJC’s Tuesday Midweek party, with DJunkie spinning the tracks on deck.

The last days of the Cairo Opera House’s annual Citadel Music Festival are upon us, with performances by singer Norhan Abou Taleb and Mohamed Mohsen scheduled for tonight. The festival will close with a bang tomorrow with iconic musician Omar Khairat taking the stage along with the Cairo Opera Orchestra.

???? UNDER THE LAMPLIGHT-

The Riviera House is a captivating true story of one woman’s efforts to prevent the Nazis from stealing precious artwork during World War II. There are two main characters in this intriguing tale: Éliane Dufort, a young woman who uses her resilience and knowledge of art to survive the war, and Remy Lang, a vintage fashion entrepreneur who — while seeking solace to grieve the unexpected death of her husband and daughter — discovers the truth about her bloodline. The Riviera House is a well-written, vivid story with likable characters. This poignant epic by author Natasha Lester is about life, loss, secrets, surprises, heartache, and survival. If you enjoy thoroughly researched WWII time-travel tales (with a dash of romance), we highly recommend you pick this up.

???? GO WITH THE FLOW

The EGX30 rose 0.1% at today’s close on turnover of EGP 1.39 bn (38.6% above the 90-day average). Foreign investors were net sellers. The index is down 15.2% YTD.

In the green: GB Auto (+6.2%), Palm Hills Development (+3.7%) and Abou Kir Fertilizers (+2.7%).

In the red: Oriental Weavers (-3.2%), E-Finance (-2.5%) and Elswedy Electric (-1.8%).

???? FOUNDER OF THE WEEK

OUR FOUNDER OF THE WEEK- Every Tuesday, Founder of the Week looks at how a successful member of Egypt’s startup community got their big break, asks about their experiences running a business, and gets their advice for budding entrepreneurs. Speaking to us this week is Sherif Aziz (LinkedIn), co-founder and chief business officer of SubsBase.

My name is Sherif Aziz, and I’m the co-founder and chief business officer of SubsBase.

Prior to founding SubsBase I worked in sales roles for around five years at Microsoft during the early days of the cloud’s launch in Africa. I then took a job for a year in Backbase, a fintech company based in Amsterdam that works with some of the largest banks in the world to digitize their user experience. When I moved back to Egypt I rejoined Microsoft and worked on launching their startups initiative for a while before joining RiseUp as chief commercial innovation officer.

Witnessing the development of the entrepreneurship ecosystem in Egypt during my time at RiseUp drove me to start my own business. My co-founder reached out looking for a co-founder. It was a SaaS business, something I was very familiar with, so I jumped at the opportunity. We found that no subscription management platform existed in the region and we began working on SubsBase together.

I had to give up steady income to build my own business. Like most entrepreneurs, I spent a year without any salary, but that's the price you pay. I don't think I will be able to go back to working in a corporation even though it's more financially stable. At the end of the day I see value in what I’m doing and that’s what matters.

SubsBase works with any recurring revenue company. Those include SaaS companies, lenders, ins. companies and real estate companies, because installments, ins. payments, and mortgages are all types of recurring payments. We have quite a few startups as clients but our focus at the moment is more on enterprises. We’re talking to e-commerce players that are building subscription boxes or building meal-planning services or that are shifting their advertising plans from single payment to subscriptions and bundles.

There are huge overheads involved in subscription-based models. Companies have to develop the tech, create the right pricing plans, and then from there they have to automate the payments, collect these payments and then make sure all of that's reflected in their accounting system and do all of the invoicing. We jump in and automate the whole process for them and ensure that they’ll be able to scale the model if they expand to different markets or add new lines of business.

We’re developing an advisory part of the business that aims to help businesses transition to subscription based business models. We're seeing a lot of companies making that transition because it’s being viewed as a more sustainable model. We view ourselves as catalysts for that change. Through the knowledge that we have we can become a thought leader in the market and can speed up these companies’ growth. We're working on educational podcasts that teach people in the market about subscriptions. We’re also working on building a content library on all things related to subscriptions on our website.

We recently set our objective and key results and we are very keen on building our KPIs. We have two main objectives as a company, one is impacting innovation and second is resilient growth. These are two very important things for us. We need to be constantly innovating whether on the product level or on how we sell, how we onboard our customers, and things like that but we also need to do it in a resilient, maintaining profitability and growth.

SubsBase recently raised USD 2.4 mn in a seed round led by Global Ventures. HALA Ventures, P1 Ventures, Plus Venture Capital (+VC), Plug and Play, Ingressive Capital, Camel Ventures, and existing investors Falak Startups and Arzan Venture Capital also participated in the round.

If I had only enough money to do one thing, I would spend it on customer acquisition. We already have a very stable product, and now we're just working on adding more features. So if I had to focus on only one thing it would be on acquiring more customers, whether that would entail growing the sales team or investing more on the branding and marketing side to recruit more customers. The additional profit made from the new influx of customers could then go towards innovating the product.

Experienced founding teams are the local startup scene’s biggest strength. Earlier on when the ecosystem was first developing in Egypt it was predominantly made up of young entrepreneurs, straight out of school trying to build businesses. But now I'm seeing more and more experienced people with very strong backgrounds and track records building amazing companies as well as entrepreneurs who made exits and are now working on something new.

Brantu is one startup that I think is killing it. I like how they pivoted into the production as a service (PaaS) model. They’re building great technologist fashion. I also admire KERB, a global parking app based in Jordan that allows you to rent your parking space to other people looking to park their vehicles or bikes. I think they're doing a great job and they’re building something massive there.

I play a lot of tennis in my spare time: I usually play every morning. I also enjoy watching shows, definitely prefer it to listening to podcasts, since I’m more visual. I watch two types of shows. I watch comedy shows like Brooklyn Nine-Nine, when I want to lay back and not think about work at all and those are great because they do not require me to focus at all. I also watch more intense shows like Suits that can be very interesting and entertaining. I recently watched WeCrashed on Apple TV+ and found it very interesting.

???? CALENDAR

OUR CALENDAR APPEARS in two sections:

- Events with specific dates or months are right here up top

- Events happening in a quarter or other range of time with no specific date / month appear at the bottom of the calendar.

AUGUST

August: Sharm El Sheikh will host the African Sumo Championship.

29 August-2 September (Monday-Friday): Africa Climate Week, Gabon.

30 August (Tuesday): Deadline for companies to file 2Q financial statements.

30 August (Tuesday): Deadline to apply for government non-profit universities via the tansik (enrollment) website.

30 August (Tuesday): The government hosts public consultations on its state ownership policy document with representatives from the food and hospitality sector.

31 August (Wednesday): Late tax payment deadline.

31 August (Wednesday): Deadline for qualifying companies to submit offers to manage and operate a soon-to-be-established state company for EV charging stations.

31 August (Wednesday): Submission deadline for fall 2022 cycle of EGBank’s Mint Incubator.

31 August (Wednesday): Beltone convenes its general assembly to restructure the board following the change of ownership.

SEPTEMBER

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

September: Egyptian-German Joint Economic Committee.

September: A delegation from Germany’s Aldi will visit Egypt to look at potential investments.

September: Government to launch an international promotional campaign for Egyptian tourism.

September: Egypt will host the second edition of the Egypt-International Cooperation Forum (ICF).

1 September (Thursday): Credit hikes for ration card holders will come into effect.

1 September (Thursday): Madbouly government set to introduce new social protection measures.

1-2 September (Thursday-Friday): Egypt and UN-led regional climate roundtable ahead of COP27, Santiago, Chile.

1-3 September (Thursday-Saturday): The Union of Arab Banks is organizing a forum on money laundering and terrorism financing in Sharm El Sheikh.

3 September (Saturday): The National Dialogue board of trustees holds a meeting to set the agenda for the dialogue and choose rapporteurs for the involved committees.

4 September (Sunday): The government hosts public consultations on its state ownership policy document with electricity players.

4 September (Sunday): Industrial Development Authority’s deadline for companies interested in providing various services in the industrial zones in Qena and Sohag to submit a written expression of interest.

5-8 September (Monday-Thursday): Gastech 2022, Milan, Italy.

6 September (Tuesday): The government hosts public consultations on its state ownership policy document with building and construction players.

6-9 September (Tuesday-Friday): Gate Travel Expo 2022, El Qubba Palace, Cairo.

7-9 September (Wednesday-Friday): African Finance Ministers to meet in Cairo to coordinate an African-led position during COP27.

8 September (Thursday): European Central Bank monetary policy meeting.

8 September (Thursday): The government hosts public consultations on its state ownership policy document with experts and think tanks.

11 September (Sunday): The government hosts public consultations on its state ownership policy document with accommodation and food services players.

13 September (Tuesday): The government hosts public consultations on its state ownership policy document with sports industry players.

11-13 September (Sunday-Tuesday): Environment and Development Forum (EDF), InterContinental City Stars, Cairo.

14 September (Wednesday): Expedition Investments’ MTO for Domty expires.

15 September (Thursday): Deadline for B Investments to respond to Adnoc’s bid for TotalEnergies Egypt.

15 September (Thursday): The government hosts public consultations on its state ownership policy document with water and sewage utilities players.

15 September (Thursday): Deadline to apply for the fifth phase of the export subsidy program.

15 September (Thursday): Egypt and UN-led regional climate roundtable ahead of COP27, Beirut, Lebanon.

18 September (Sunday): Deadline for brokerage firms, asset managers and financial advisors to register with the Egyptian Securities Federation.

19-22 September (Monday-Thursday): EFG Hermes One on One Conference, Dubai.

20 September (Tuesday): Fifth Egypt and UN-led regional climate roundtable ahead of COP27, Geneva, Switzerland.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

22 September (Thursday): Deadline to submit prequalification applications for companies interested in submitting a proposal for sea water desalination projects

25-27 September (Sunday-Tuesday) A delegation of executives at Egyptian real estate companies visit Saudi Arabia to present developers with investment opportunities in Egypt’s real estate sector.

26–27 September (Monday-Tuesday): The Africa Women Innovation and Entrepreneurship Forum (AWIEF) at the Cairo Marriott Hotel.

27-29 September (Tuesday-Thursday): Africa Renewables Investment Summit (ARIS), Cape Town, South Africa.

28-29 September (Wednesday-Thursday): The sixth edition of Arab Pensions and Social Ins. Conference in Sharm El Sheikh.

OCTOBER

October: House of Representatives reconvenes after summer recess

October: Air Sphinx, EgyptAir’s low-cost subsidiary to commence operations.

October: Fuel pricing committee meets to decide quarterly fuel prices.

1 October (Saturday): Use of Nafeza becomes compulsory for air freight.

1 October (Saturday): Start of 2022-2023 school year.

1 October (Saturday): 2022- 2023 academic year begins for public universities.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

10-16 October (Monday-Sunday): World Bank and IMF annual meetings, Washington, DC.

15 October (Saturday): Cairo Metro will launch a global tender for maintenance work on the power stations and overhead catenary system of Line 1.

16-19 October (Sunday-Wednesday): Cairo Water Week 2022, Nile Ritz Carlton, Cairo.

18-20 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October-14 November: 3Q2022 earnings season.

NOVEMBER

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): Autotech auto exhibition, Cairo International Exhibition and Convention Center.

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7 November (Monday): The inauguration of the first line of the high-speed rail.

7-13 November (Mon-Sun): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

DECEMBER

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday) — First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

4Q 2022: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

4Q2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.