- Egypt could boost LNG export volumes with untapped capacity at Idku and Damietta liquefaction facilities… (The Big Story Today)

- … which could be a saving grace for Europe’s worsening energy crisis as Germany moves into the “alarm stage.” (The Big Story Abroad)

- The timeless The Little Prince novella was apparently inspired by a plane crash in Egypt. (For Your Commute)

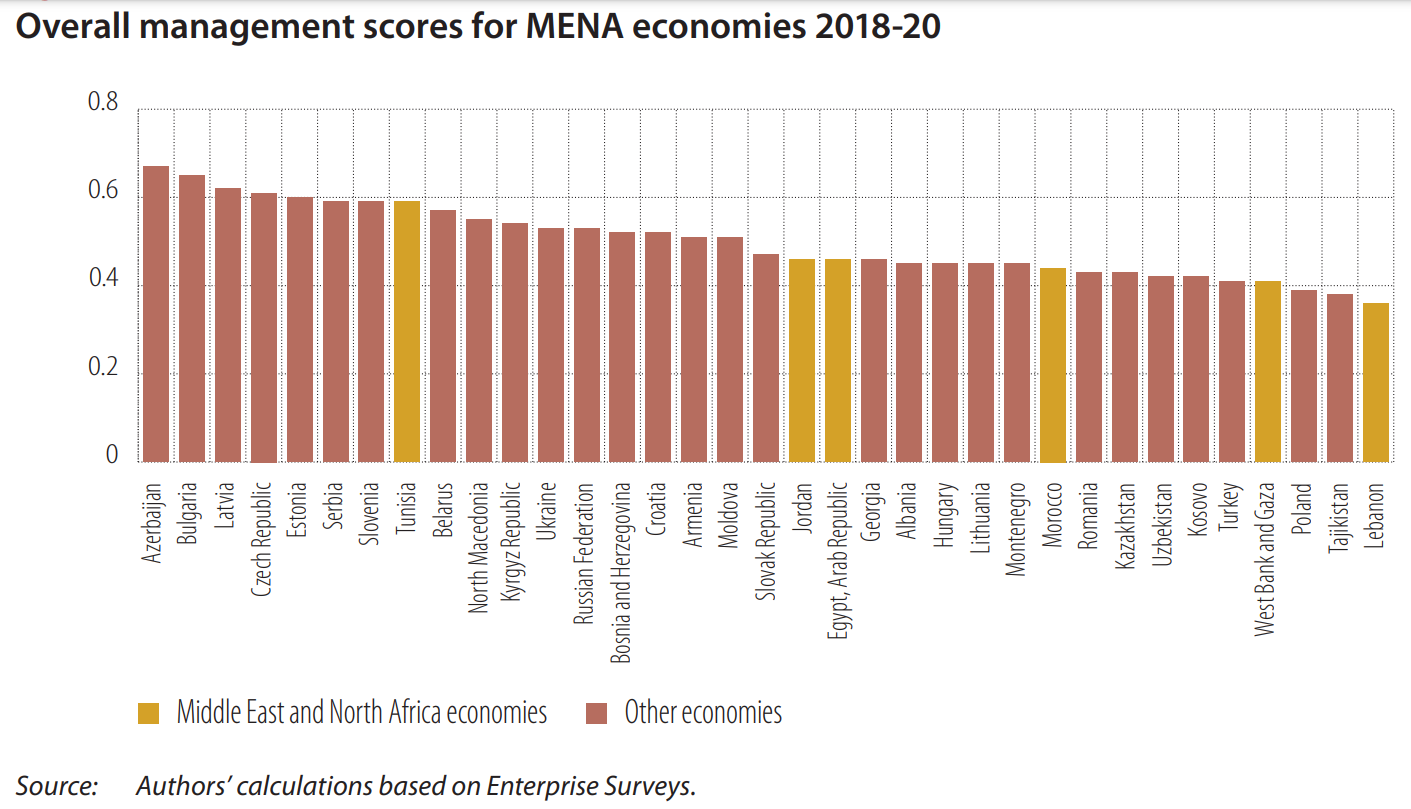

- MENA still has a lot to do when it comes to governance and management, but Egypt seems like it’s on the right track. (The Macro Picture)

- This year’s Liveability Index sees Vienna, Copenhagen, and Zurich as the best cities to live in. (For Your Commute)

- Cha Cha Real Smooth serves as a reminder of the good in the world and the kindness of others. (On The Tube Tonight)

- Craving fresh sushi and noodle bowls? Head to Garnell for a refreshing dining experience. (Eat This Tonight)

- When It Clicked podcast unravels the thinking process behind some of the great business decisions of the modern world. (Ears To The Ground)

Thursday, 23 June 2022

PM — Inspiration for The Little Prince struck in Egypt

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Well, friends, we’ve made it to the end of the week. We hope you have a restful (or otherwise enjoyable) weekend ahead of what will likely be a shortened workweek: Next Thursday, 30 June is expected to be a national holiday in observance of June 30 Revolution Day.

THE BIG STORY TODAY

Egypt still has capacity at its Idku and Damietta liquefaction facilities it can use to boost LNG export volumes, Oil Minister Tarek El Molla said today, according to a ministry statement. El Molla’s statement comes after Egypt signed last week an agreement with Israel and the EU that will see Tel Aviv send more gas to Egypt’s facilities for processing before being shipped to Europe. The agreement also covers cooperation on infrastructure utilization to help efficiently increase gas shipments to the EU.

The availability of extra capacity at our facilities is great news, considering…

THE BIG STORY ABROAD, which is the escalation of the energy crisis in Europe as the continent’s face-off with Russia continues to roil energy markets. Germany moved into the second phase — the “alarm stage” — of its national gas emergency plan after several days of lower gas supplies to Europe through its Nord Stream 1 pipeline. Although Germany is officially labeling the situation as a “gas crisis” and gas is a “scarce commodity,” Economy Minister Robert Habeck, higher prices will not yet get passed on to industrial or household consumers. If Germany moves into the third phase of its emergency plan, the government could begin rationing gas supplies to factories and households. The story is getting plenty of attention from the Financial Times, Reuters, and CNBC.

HAPPENING SOON-

The Central Bank of Egypt (CBE) will hold its latest policy meeting today against the backdrop of rising inflation and an acceleration of the biggest global tightening cycle in decades. Coming on the back of worsening inflation data and the Federal Reserve’s huge 75-bps rate hike last week, emerging economies across the world will come under increasing pressure to act as liquidity tightens and borrowing costs rise.

We don’t really have a consensus on what the outcome of today’s meeting will be: A narrow majority of analysts we surveyed last week expect the CBE to keep things steady this month while it assesses the impact of recent rate hikes on inflation in June and July. Meanwhile, a poll conducted by Reuters this week has the CBE raising interest rates. Its survey of 17 analysts forecasts a 50 bps increase in the benchmark rate to 11.75% and a 25 bps hike in the lending rate to 12.50%. The central bank has already raised rates by 300 bps since March in response to inflation and external pressures.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- FinMin wants to cut reliance on hot money: Egypt needs to focus less on attracting portfolio flows and more on foreign direct investment and export growth, Finance Minister Mohamed Maait said on the sidelines of the Qatar Economic Forum this week.

- POLL- Real estate players react to the government’s new regulations: Real estate developers facing new regulations designed to protect consumers and reduce market risk are broadly happy with the new rules, but are concerned that red tape could slow down the process.

- Alhokair Group subsidiary FAS Energy is planning to invest some USD 450 mn (SAR 1.7 bn) to construct a 500 MW solar plant in Egypt in partnership with the Electricity Ministry and the Egyptian Electricity Transmission Company.

|

???? CIRCLE YOUR CALENDAR-

The Big 5 Construct Egypt (pdf) construction industry exhibition runs from 25-27 June at the Egypt International Exhibition Center (EIEC) in Cairo.

Amcham AGM next week: Our friends over at Amcham will hold their annual general meeting on Monday 27 June at the St. Regis Cairo Hotel. Finance Minister Mohamed Maait will address the gathering.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- Expect Friday to be particularly unpleasant as the mercury reaches 42°C during the day, our favorite weather app tells us. Saturday will be a tiny bit cooler at 40°C while temperatures will drop to 23-25°C during the weekend.

***

WE’RE LOOKING FOR SMART, TALENTED PEOPLE to help us build some very cool new things. Today, we run two daily publications, five weekly industry verticals, and a monthly newsletter designed to make our readers feel just a bit smarter.

We have tons more in the pipeline — come help us build new publications. We offer the chance to work in a fast-paced newsroom on a broad range of topics and in a variety of formats. Our goal is simple: To create value for our growing community of >199k readers by telling stories that matter.

We’re looking for editors who want to run publications and teams, editors to help reporters craft stories and talented reporters. Egyptian and foreign nationals alike are welcome to apply. So are job-switchers: If you’re an equities analyst tired of the rat race, we’re a great place to come work.

Apply directly to jobs@enterprisemea.com and mention Patrick in your subject line.

Or hit this link for more information. It’s worth it — trust us.

***

???? FOR YOUR COMMUTE

The timeless The Little Prince novella was apparently inspired by a plane crash in Egypt: Antoine de Saint-Exupéry penned one of the most read, most beloved, and most translated books of our time, The Little Prince, after crashing his plane in the Western Desert in 1935, shows an exhibition at the Musée des Arts Décoratifs in Paris, Arab News reports. The show highlights how Saint-Exupéry — who was saved, along with his mechanic by bedouins three days later — “had some hallucinations” in the desert, “which was really the starting point of ‘The Little Prince,’” said the show’s curator, Anne Monier.

Vienna snags top spot in the latest ranking of the world’s most liveable cities: This year’s edition of the Economist Intelligence Unit’s Global Liveability Index has put Austria’s Vienna as the best place to live, saying “stability and good infrastructure are the city’s main charms for its inhabitants, supported by good healthcare and plenty of culture and entertainment.” Denmark’s Copenhagen came in second, while Switzerland’s Zurich and Canada’s Calgary and Vancouver round out the top five.

Our neck of the woods didn’t fare particularly well: Iran’s Tehran ranked at #162, Algeria’s Algiers at #169, Libya’s Tripoli at #170, and finally at the very bottom of the list is Syria’s Damascus at #172.

Egypt’s position in the rankings is still unknown, with more of the list to be released during a virtual event on Thursday, 7 July. You can register for a session here.

Loss of biodiversity across the world may trigger sovereign debt crises: The decline of ecosystem services and overall environmental degradation will likely have major macroeconomic consequences, according to a report (pdf) by a group of economists from the universities of Cambridge, East Anglia, Sheffield Hallam, and SOAS. The report — which is the first sovereign credit rating that takes into account ecological destruction — looks at how nature loss could impact credit ratings, default probabilities, and the cost of borrowing. In a “partial ecosystem services collapse scenario … China and Malaysia would be hit hardest,” with drops in their creditworthiness possibly adding USD bns to their debt service costs, the report says. The groundbreaking research makes a strong case for why credit rating agencies should incorporate nature-related risks, and how ignoring biodiversity loss could have grave implications for investors and governments.

Advertisers are turning to no-charge streaming platforms to reach more people. Ad-supported platforms — such as Tubi, Freevee and Xumo — as well as the ad-supported versions of subscription services like HBO Max are expected to outpace traditional subscription-based platforms in terms of revenues, the Wall Street Journal reports, citing Insider Intelligence data. Once regarded as “the second-class citizens of streaming,” these platforms are expected to bring in USD 19 bn in revenues this year, more than doubling what they made in 2020. “People are creating their own bundles right now, and they are only willing to pay for a certain number of apps,” Pluto TV CEO Tom Ryan says. “We want to complement those paid apps.”

Netflix is quickly jumping on the bandwagon as well: The streaming giant is currently exploring the potential of creating an advertising-supported tier of its service, the Wall Street Journal reports, citing sources familiar with the matter. NBCUniversal and Google are reportedly in the running to help Netflix build this new product by providing ad-serving technology, the sources indicated. However, the plans are still in an early stage and no decisions have been made. This comes as Netflix faces a rough time after its stock plunged from just below USD 600 at the beginning of the year to USD 180 this week, and the company reported a loss of 200k global subscribers in 1Q2022, for the first time in a decade.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

Amid a slew of unsettlingly dark new movies, the heartening Cha Cha Real Smooth feels like a warm blanket. This is the second feature film by 25-year-old writer-director-actor Cooper Raiff, who plays Andrew, a Bat Mitzvah party host who befriends Domino (stellarly played by Dakota Johnson), a young mom of an autistic 14-year-old. Domino had resigned herself to a lifetime of watching her daughter Lola sit in corners by herself, while other kids her age socialize and party. Enter Andrew, who somehow manages to get Lola dancing, and forms a heartwarming connection with both mother and daughter. The coming-of-age narrative examines how cold the world can be, then reminds us of how warm it could be when filled with the right people. The American dramedy premiered at the 2022 Sundance Film Festival, and landed the coveted Audience Award. It is available to stream on Apple+ (watch, runtime, 3:00).

⚽ There’s no football over the weekend, but local games will resume on Sunday.

????EAT THIS TONIGHT-

Craving fresh sushi and noodle bowls? Head to Garnell for a refreshing dining experience. With seven branches spread across Greater Cairo, chances are you won’t have to drive too far to grab a bite at one of their spacious diners in Heliopolis, New Cairo, Maadi, Zamalek, or Sheikh Zayed. The vibes are instantly energizing at their different locations, and the service is impeccable. Their menu has something for everyone: Soups, salads, teppanyaki, sushi, vegetarian options, main dishes, and desserts. We were fans of the creamy lava rolls and chicken noodle bowls, and their sashimi pleased our taste buds.

???? OUT AND ABOUT-

(all times CLT)

Khoyout Troupe will play back your life story in a unique improv performance at Dawar Arts tomorrow at 8pm: The talented group of performers are bringing an improvisational form of theater that relies on real stories from the audience. You bring your life story and emotions to the theater, and they play them back to you through improvised performances and music. While attendance is without charge, registration is required.

Cairo Jazz Club 610 is hosting the last Brunch Bunch of the season on Saturday. ZKordy, Moenes & Momo will spin their eclectic beats starting 2pm through midnight.

???? EARS TO THE GROUND-

WHAT’S NEXT- When It Clicked podcast explores the moment where fate hangs in the balance: Each episode — which usually runs for around 25 minutes — focuses on a specific company that made an unconventional decision that could make or break the business. This could be Google Docs deciding to opt out of a “save” button (listen, runtime: 26:56) or how Shopify decided to base its business model on small businesses (listen, runtime: 25:34), with host Ilana Strauss talking to the decision makers to unravel their thinking process and that moment when things just clicked. The podcast is still fairly new, with only five episodes out so far, but it’s an easy listen and really underlines the effectiveness of disrupting the market, even in the littlest of ways.

???? UNDER THE LAMPLIGHT-

Read about three courageous Syrian women entrepreneurs who succeeded despite the circumstances: 25 Mn Sparks by Andrew Leon Hanna tells the tale of three Syrian women in the Za’atari refugee camp in Jordan. Yasmina is a wedding shop and salon owner, Malak is a young artist who uses the camp as her canvas, and Asma is a social entrepreneur and poet whose life work is a storytelling initiative for children. Hanna details these women’s stories and includes Malak and Asma’s works in the book, whose underlying message is that determination and good intentions can sometimes overcome the darkness in the world.

???? GO WITH THE FLOW

The EGX30 fell 1.8% at today’s close on turnover of EGP 386 mn (53.7% below the 90-day average). Foreign investors were net sellers. The index is down 21.0% YTD.

In the green: Abu Dhabi Islamic Bank (+2.6%), Rameda (+0.9%) and AMOC (+0.6%).

In the red: MM Group (-4.9%), Madinet Nasr Housing (-4.1%) and CIB (-3.0%).

???? THE MACRO PICTURE

What is holding back Egypt and MENA’s business environment? A June report (pdf) by the EBRD, EIB, and World Bank looks at how to unlock the private sector’s potential in MENA. The Enterprise Survey (no relation to yours truly) looks at 5.8k formal businesses across six MENA economies — Egypt, Jordan, Lebanon, Morocco, Tunisia, and the West Bank and Gaza — between late 2018 and 2020. It looks at issues such as governance, management, trade and innovation, and access to finance to assess the region’s progress over the years and where MENA still struggles.

The top issues for businesses in Egypt and across the region: Across the nearly 3.1k Egyptian firms surveyed, tax rates were most cited as a top business obstacle (by some 24% of firms). Businesses in other economies in the region also cite tax rates as one of their top challenges, alongside a lack of access to finance.

That contrasts with the results of our annual reader poll: In 2018, the vast majority of businesses we polled cited inflation as the top challenge facing them, while finding and retaining talented employees took the lead as the biggest concern in 2019. In our most recent edition of the poll earlier this year, taxes were actually the smallest concern for businesses, with concerns over bureaucracy, supply chain issues, and talent retention eclipsing tax rates by a wide margin.

Governance has plateaued or declined in some countries in the region — but Egypt is improving: MENA countries’ governance standards have broadly remained stagnant or deteriorated in the last decade, according to the report. In Egypt, governance has been gradually improving since 2015, although the report suggests it was faring better back in 2009.

Businesses across MENA use connections and business associations to gain preferential treatment more frequently than in other regions, the report found. The data found correlations between firms with more connections, and factors that put them at an advantage — for example, more access to external finance.

Strong management is key to better business: “Management practices explain a major part of the gap in total factor productivity between countries,” the report says, as better managed firms have higher operating income, are more outward-oriented, and invest more in research and development. Every MENA country except for Tunisia came in the bottom half of 35 MENA and Europe and Central Asia (ECA) economies ranked for management practices. Egypt is in the middle of the rankings, while Lebanon was in last place. Azerbaijan, Bulgaria, and Latvia made it to the top three of the rankings.

Countries with a dominant public sector don’t do as well on management: The survey data showed a correlation between poor management practices in MENA and rates of partial government ownership. Public sector companies in the region sometimes choose managers based on connections instead of merit, according to the study, meaning “underperforming managers are less likely to be dismissed.”

That’s another reason to welcome the Madbouly government’s privatization program, which will see the state sell stakes in state-owned firms to local and international investors in a bid to fully exit dozens of sectors within the next few years. The plan aims to more than double the private sector’s role in the economy to 65% over the next three years, and attract USD 40 bn in investment over the next four years.

We were flagged as having the biggest issue with access to finance: About 69% of MENA firms in the study needing a loan were credit constrained, compared to 59% in ECA. But Egyptian firms are more credit constrained than businesses in any other country, with 90% of all companies in need of a loan reporting being credit constrained. Stringent collateral requirements, complex application procedures and high interest rates were cited as the biggest factors that discourage companies from applying for a loan.

But we’re working to improve that: Financial inclusion and SME financing have been a priority for the government in the past few years, particularly with the Central Bank of Egypt’s financial inclusion and SME lending mandates to banks, and its continued recommendations on how to aid small businesses to obtain financing. International institutions like the EBRD are also providing more financing packages to Egyptian banks to on-lend to SMEs.

???? CALENDAR

OUR CALENDAR APPEARS in two sections:

- Events with specific dates or months are right here up top

- Events happening in a quarter or other range of time with no specific date / month appear at the bottom of the calendar.

JUNE

21-23 June (Tuesday-Thursday): Commonwealth Business Forum, Kigali, Rwanda.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

25-27 June (Saturday-Monday): Big 5 Construct, Egypt International Exhibition Center.

26 June (Sunday): The deadline for private companies to pre-register ahead of bidding for the second phase of the PPP national project to establish and operate 1k language schools.

27 June (Monday): AmCham annual general meeting, St. Regis Cairo Hotel.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

30 June (Thursday): Deadline for bids for National Democratic Party HQ redevelopment contract.

June: Egypt will launch a unified ticketing system for all means of transport at the Adly Mansour Interchange Station.

June: Eastern Company meets to decide on prices of its tobacco products amid rising production costs and scarcity of raw materials.

JULY

July: A law governing ins. for seasonal contractors will come into effect.

July: Actis’ expected sale of its majority stake in Lekela to Infinity and Masdar’s Infinity Power.

First week of July: Fuel pricing committee meets to decide quarterly fuel prices.

First week of July: The national dialogue called for by President Abdel Fattah El Sisi kicks off.

1 July (Friday): FY 2022-2023 begins.

1 July (Friday): Official rollout of e-receipt system begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July-14 August: 2Q2022 earnings season.

AUGUST

August: Work to extend the capacity of the Egypt-Sudan electricity interconnection to 600 MW to be completed.

August: Sharm El Sheikh will host the African Sumo Championship.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

SEPTEMBER

September: Egypt will display its first naval exhibition, Naval Power.

September: Estate Waves Egypt real estate exhibition through metaverse technology.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

September: The sixth session of the Egyptian-German Joint Economic Committee.

6-9 September (Tuesday-Friday): Gate Travel Expo 2022, El Kobba Palace, Cairo.

8 September (Thursday): European Central Bank monetary policy meeting.

18 September (Sunday): Deadline for brokerage firms, asset managers and financial advisors to register with the Egyptian Securities Federation.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

26–27 September (Monday-Tuesday): The Africa Women Innovation and Entrepreneurship Forum (AWIEF) at the Cairo Marriott Hotel.

OCTOBER

October: Fuel pricing committee meets to decide quarterly fuel prices.

1 October (Saturday): Use of Nafeza becomes compulsory for air freight.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

10-16 October (Monday-Sunday): World Bank and IMF annual meetings chaired by CBE Governor Tarek Amer, Washington, DC.

18-20 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October-14 November: 3Q2022 earnings season.

NOVEMBER

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): The Autotech auto exhibition kicks off at the Cairo International Exhibition and Convention Center.

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

DECEMBER

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

JANUARY 2023

January EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

MAY 2023

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

EVENTS WITH NO SET DATE

2Q2022: The Sovereign Fund of Egypt will invest in two companies in the financial inclusion and non-banking financial services sectors.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 2Q2022: Door for bidding for the contract to redevelop the site of the former National Democratic Party HQ to close.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

3Q2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.