- Ibnsina’s investment arm to pour EGP 440 mn in logistics. (The Big Stories Today)

- A new USD 50 mn VC fund from Benya eyes Africa’s IoT and AI startups. (The Big Stories Today)

- Egypt’s invite to a “democracy summit” in Washington got lost in the mail. (The Big Story Abroad)

- Could the next big Hollywood blockbuster be filmed in Saudi? (For Your Commute)

- A darker, regional take on Mean Girls. (On the Tube Tonight)

- Easy’s: Your comfort food fix with a carnivorous kick. (Eat This Tonight)

- Catch the lineup from the Cairo Jazz Festival + go gallery hopping tonight. (Out and About)

- The water wars are a-coming. (Water)

Sunday, 7 November 2021

PM — It’s a good day for investment news.

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, ladies and gentlemen. It’s been a relatively calm Sunday so far, but it’s shaping up to be an interesting day for the business community as we’re getting news of fresh investments in everything from logistics to a new VC fund. The rest of the week is also looking eventful (at least on the politics / diplomacy side), as Foreign Minister Sameh Shoukry heads to Washington tomorrow as Egypt appears to have been snubbed from a “democracy summit” next month.

THE BIG STORIES TODAY

#1- EGX-listed Ibnsina Pharma’s investment arm is investing EGP 440 mn in establishing a logistics service provider. The third-party logistics business, Ramp Logistics, will focus on warehousing, transportation and outsourcing other 3PL services, according to an EGX disclosure (pdf).

#2- Benya Capital is launching a USD 50 mn VC fund as the IT infrastructure contractor eyes a larger expansion strategy, Chairman Ahmed Mekky said ahead of the Cairo ICT Expo, according to Al Borsa. The VC fund will focus primarily on tech, IoT and AI startups in Africa.

#3- Saudi investment company Rajhi-Invest has joined education investment fund Lighthouse Education platform, investing EGP 75 mn, according to a press release (pdf). Total investment has now exceeded the EGP 500 mn targeted for its first close, the statement notes.

^^ We’ll dive into these stories and more in tomorrow morning’s edition of EnterpriseAM.

HAPPENING NOW-

Two conferences open their doors at the Egypt International Exhibition Center today: The four-day transport conference TransMea 2021, and the 2021 Cairo ICT exhibition, which also wraps on Wednesday.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- EBRD is more optimistic about Egypt’s growth outlook: Egypt’s economy is on track to grow 4.9% in FY2021-2022, the European Bank for Reconstruction and Development (EBRD) said in its latest Regional Economic Prospects report on Thursday.

- Suez Canal transit fees are set to increase by 6% for most ships starting February 2022, as the Suez Canal Authority looks to capitalize on rising traffic, which it expects to increase by almost 7% next year.

- The Sisi administration wants to grow renewable energy capacity to cover 42% of the country’s electricity needs by 2030, Oil Minister Tarek El Molla announced at the UN’s COP26 climate summit in Glasgow on Thursday.

THE BIG STORY ABROAD-

There’s no one story dominating the front pages of the global press this afternoon. That said, China is getting a lot of play: A stronger than expected boost in the country’s exports in October suggests the country’s economic slowdown could be easing, Reuters reports, while coal imports to China doubled as the government seeks to bring down prices amid nationwide fuel shortages, according to Bloomberg. The coal tidbit is particularly interesting considering tens of countries and organizations signed an agreement at COP26 last week to phase out the use of coal power. China did not sign onto the pact, despite being one of the world’s major emitters.

Meanwhile, plenty are keeping their gaze firmly fixed on Washington politics: US President Joe Biden has managed to pass a controversial USD 1 tn infrastructure bill — but he still has to contend with an electoral backlash and deep divides among Democrats. (New York Times | Financial Times | Washington Post | Wall Street Journal).

ALSO- Egypt didn’t make the guest list for US President Joe Biden’s democracy summit, which is set to bring more than 100 countries together in Washington on 9-10 December for talks on protecting rights and freedoms globally, Reuters reports. The summit is seen as a key test of Biden’s pledge to return the US to global leadership following Donald Trump’s more isolationist (and embarrassing) tenure.

Some invitees’ policies are less than democratic: Rights campaigners have branded the tentative invite list “problematic,” questioning the inclusion of countries like the Philippines and Poland, where civil rights have long been shrinking. Iraq and Israel are the only countries in the Middle East to have made the cut.

The snub comes as Shoukry heads to the US for high-level talks tomorrow: Foreign Minister Sameh Shoukry will hold talks with US Secretary of State Antony Blinken during the two-day US-Egypt Strategic Dialogue, which kicks off tomorrow, the Egyptian Foreign Ministry and the US State Department said in separate statements over the weekend. The meetings, which will also be attended by senior officials from USAID and the Department of Defense, will cover “international, regional, human rights and bilateral cooperation on economic, judicial, security, educational and cultural issues,” the State Department said.

|

???? CIRCLE YOUR CALENDAR-

Inflation: Inflation figures for October will be released this Wednesday, 10 November.

Public sector workers have until next Monday, 15 November to get vaccinated or risk not being allowed into their workplaces.

The two-day Africa FinTech summit kicks off next Tuesday, 16 November. The summit looks at innovation in the fintech ecosystem, venture capital and other forms of investing, and will also discuss the rise of healthtech.

The British are coming: British royal family members Prince Charles and the Duchess of Cornwall will be in town next Thursday and Friday, 18 and 19 November.

☀️ TOMORROW’S WEATHER- It’s nowhere near sweater season yet, with an unseasonably warm daytime high of 30°C tomorrow. The mercury will cool off in the evening, falling to a low of 20°C, according to our favorite weather app.

???? FOR YOUR COMMUTE

Should Elon sell USD 21 bn worth of Tesla stock? Ask Twitter: Tesla founder, world’s richest person and Twitter-storm instigator Elon Musk has set up a Twitter poll asking his followers whether or not he should sell 10% of his shares, worth USD 21 bn, in the company and promising to abide by the results. The poll will close later this evening and currently has around 55% of 2 mn respondents in favor of the sale.

Why? A common question when it comes to Musk. This time, he’s vocalizing his hurt feelings over the Biden administration’s attempt to impose higher taxes on US b’naires, who are not taxed on tradable assets like stocks until they are sold. Musk’s latest Tweet comes a week after he challenged a UN official to explain “exactly how” donating more of his wealth could help solve world hunger.

Regular people who pay taxes appear less than charmed by Musk’s approach: “Looking forward to the day when the richest person in the world paying some tax does not depend on a Twitter poll,” tweeted one University of California economist.

Anti-vaxxers gain first success in court battle against Biden’s vaccine mandate: The Biden administration’s mandatory vaccination requirement for workers was suspended by a federal appeals court on Saturday, just two days after the White House announced the move. The scheme is now on hold pending an in-depth judicial review, the BBC reports, after Republican-appointed judges froze the requirement in response to one of several lawsuits lodged by conservatives against the emergency measure. The mandate was set to force companies with more than 100 employees to ask their employees to get vaccinated or undergo regular testing after 4 January.

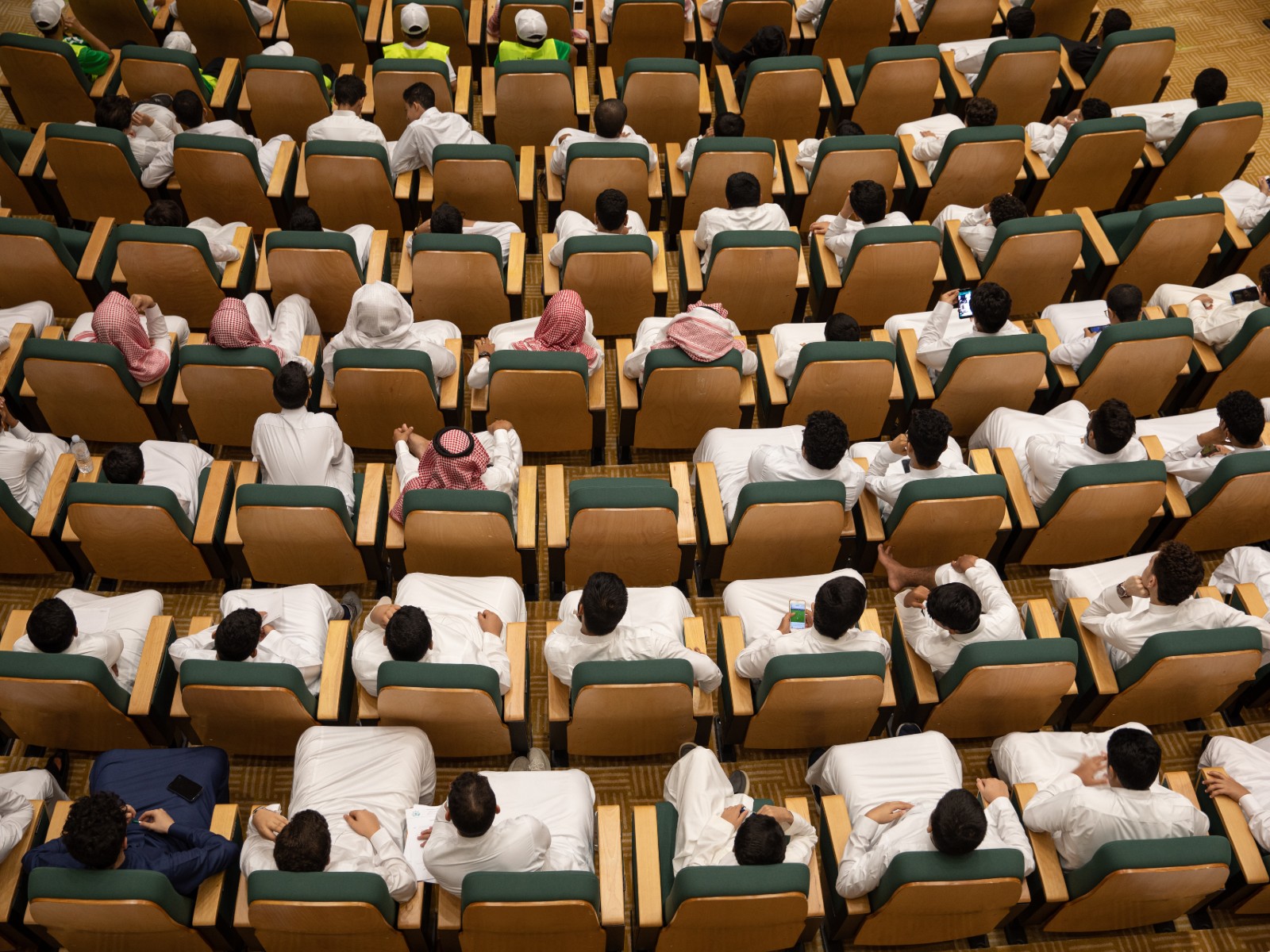

Saudi Arabia is investing USD 64 bn in developing its entertainment industry. The kingdom’s latest project is to position itself as a prime (not to mention, unseen) production location for foreign films, Bloomberg reports, in an effort to diversify its economy away from oil. KSA will be contending with regional favorites Morocco and Jordan, to serve as the backdrop for Hollywood blockbusters, and has already signed on as a location for a Gerard Butler thriller. Netflix is also looking to the kingdom, with the streaming company signing up for an eight feature film agreement with a Saudi studio in its efforts to produce more regional content.

Bye bye Dubai, hello Riyadh? This is a major change of tune for KSA, where cinemas were only allowed to begin operations in 2018, after having been banned for some 35 years. The kingdom is even looking forward to its first film festival, the Red Sea Film Festival in Jeddah, which is due to hold its inaugural edition next month. The moves are part of a sustained effort to put Saudi Arabia on the region’s media production map, which also include challenging Dubai’s established position as the Middle East’s media hub with the soon-to-launch Saudi Media City.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

A timely take on bullying and mental health: We’re a bit late to the party, but we need to add our voices to the chorus of viewers who couldn’t stop watching Netflix’s Jordanian high school drama, Al Rawabi School for Girls. Released over the summer, the series follows the lives of students at the prestigious all girls school in Amman, but focuses on the character of Mariam, who is bullied by popular girl Layan and her entourage. But when Mariam hatches a series of plots to get her revenge (enlisting her head-in-the-clouds best friend and the awkward emo new girl) things start to get out of hand. What starts off as a story of petty locker-room pranks gradually takes a darker turn, touching on bullying, mental health, harassment, patriarchy, and the violence against women enacted by society, and the women themselves.

Our honest opinion? Though the show isn’t without its plot holes, the cast of relative newcomers give strong performances and portray relatable characters. The show is miles better than Netflix’s first attempt at an Arab high school drama, 2018’s Jinn, which was pretty much unwatchable. All we can say is, suspend your misgivings and make sure to watch it through till the end — the final episode packs a powerful emotional punch

⚽ The 11th round of the English Premier League concludes today with four matches, three of which start at 4pm: Arsenal vs. Watford, Everton vs. Tottenham, and Leeds vs. Leicester City. The last match, between West Ham and Liverpool, will be at 6:30pm.

In the Spanish League: Valencia will play host to Atletico Madrid in the Spanish League at 5:15pm. Osasuna faces Real Sociedad and Mallorca faces Elche at 7:30pm. Seville goes out to face Real Betis at 10pm.

In Italy: the Derby della Madonnina kicks off between Milan and Inter at 10:15pm.

????EAT THIS TONIGHT–

Sahel smoke n' roll sandwich shop Easy's recently brought its truck to Palm Hills' Street 88, serving hearty beef (and seafood) sandwiches that are perfect for when you’re searching for a comfort food fix with a carnivorous kick. Whether you order the brisket sandwich or the pulled beef, or opt for a seafood roll, remember to order a side of their loaded, cheesy fries (just trust us on this one). And treat yourself with a chocolate chip cookie (pro tip: ask them to heat it up first) for the cherry on top. Grab it on your way home or order in if you’re feeling lazy (home delivery is only available to 6th of October peeps so far, though).

???? OUT AND ABOUT-

(all times CLT)

Sunday blues: Cairo Jazz Festival passed you by? You have one last chance to catch performers from the 2021 lineup, 9pm tonight at Cairo Jazz Club. Sudanese blues guitarist Tariq Alhawy opens the night alongside Egyptian group The All-Star Blues Experience, before cover band The One Four Five hits the stage.

A good day for gallery-hopping: Two exhibitions are kicking off today in close proximity to one another; veteran painter Evelyn Ashamallah’s What’s Left Unsaid will open in downtown at Access art space (formerly Townhouse Gallery), while illustrator and designer Hicham Rahma will be showing his work at Picasso Gallery in Zamalek. Both galleries will open their doors to the public at 7 pm.

Make up your own mind about K-Stew’s Lady Di performance: From “note-perfect” to “arthouse-bizarro,” Kristen Stewart’s depiction of Princess Diana in new biopic Spencer has divided critics and whipped up Oscars buzz. Zamalek Cinema is putting on a special screening of the film tomorrow night at 7pm.

???? UNDER THE LAMPLIGHT-

South African author Damon Galgut earned the 2021 Booker Prize for Fiction last Wednesday for his novel The Promise. Structured around four funerals across four decades in one white South African family, the novel charts the upheavals, ambitions and disappointments of the post-apartheid era. It’s the first time Galgut has snagged the prestigious literary prize despite being nominated twice previously. Judges described The Promise as “a book that is a real master of form,” and one that is, “really dense with historical and metaphorical significance.”

Not feeling it? Try any of the five other shortlisted novels for this year’s Booker. And for the speed-readers among you, there’s alwalegalys the 13-title-strong longlist.

???? GO WITH THE FLOW

MARKET NEWS-

Is Ezz Steel looking to acquire a stake in Egyptian Steel? In a bourse disclosure (pdf) today, Ezz Steel neither confirmed nor denied that it was looking to acquire the stake currently held by Ahmed Abou Hashima in Egyptian Steel, of which he is CEO and chairman. Responding to news (pdf) that it was close to sealing the transaction, Ezz Steel said that no announcement would be made until after the completion of the necessary fair value studies and legal and technical procedures.

The Egyptian International Pharma Industries (EIPICO) reported EGP 358.7 mn in net income in 9M2021, up 5.7% y-o-y, according to its financials (pdf). It reported EGP 2.5 bn in revenues during the period, up 14.9% y-o-y.

The EGX30 fell 0.5% at today’s close on turnover of EGP 382.6 mn (74.9% below the 90-day average). Local investors were net sellers. The index is up 6.55% YTD.

In the green: Rameda (+5.5%), Ibnsina Pharma (+3.5%) and Ezz Steel (+3.5%).

In the red: GB Auto (-4.6%), Fawry (-3.6%) and Orascom Development Egypt (-2%).

???? WATER

Access to water may drive the twenty-first century’s conflicts, hydropolitics experts are warning, as climate change, rapid economic growth and the pressure of a growing world population compound to drive a scramble for water sources, writes the BBC. Water contamination and a scarcity of water for irrigation are leading to increased migration from water-scarce regions and creating friction between neighboring nations. (Stop us if this reminds you of a certain dam that rhymes with HERD and has caused its own drama…). In addition to better resource management, diversification of water sources, and water rationing, new research has shown that community cohesion and AI tools can help us avert future water crises.

How bad have things gotten worldwide? According to UNICEF, an estimated four bn people — almost two-thirds of the world’s population — live in water-stressed conditions for at least one month each year, and more than two bn live in countries with inadequate water supply. The UN agency estimates that half of the world’s population could be living in areas threatened by water scarcity by 2025 and up to 700 mn people could be displaced by water scarcity by the end of the decade.

Can AI help? Believe it or not, it might. Organizations like the World Bank, the UN and the Red Cross are looking to AI to predict and preempt humanitarian disasters, using the technology to send early warning signs that a mass migration or a famine are on the horizon. One project, a Global Early Warning Tool by the Water, Peace and Security Partnership (WPS), collates data about factors like rainfall, drought, flooding, agricultural production, crop failures, population density, wealth and corruption to produce a map of conflict warnings, and claims to have an accuracy rate of 86%.

The tool’s most interesting find: Factors like efficient resource management, improved awareness, socially responsible behavior, rationing and transparency help governments and communities are a better predictor of water-related conflict than pure access to resources. According to the tool, Egypt has areas of low (<10%), with pockets of high (40-80%) baseline water stress, and continues to be rated a peaceful zone.

Egypt has for years made water security a top priority, working to limit the impact of the Grand Ethiopian Renaissance Dam (GERD) on our water supply. More than 85% of the water that flows into the Blue Nile originates in Ethiopia’s highlands, and the threat that Ethiopia will fail to release water from the hydroelectric GERD in the event of a drought downstream remains imminent. In efforts to diversify its water resources, Cairo has announced plans to invest a potential EGP 45 bn before the middle of the decade in desalination plants and is also working on implementing an ambitious water-saving plan that could cost nearly USD 50 bn through 2037.

Ethiopia is hardly exceptional in looking to advance its own interests at the expense of downstream neighbors. Globally, more countries are damming rivers and building power plants to secure water supply and electricity as water scarcity pushes them to seek out secure water sources. The effect of Turkey’s Ilisu Dam on the Tigris, which it began filling in 2019, for example, has been acutely felt on the opposite side of the border in Syria, Iraq and Iran, and resulted in the outbreak of a health crisis in Iraq in summer of 2019. In West Africa, some experts have drawn connections between the rise of terrorist group Boko Haram with the humanitarian crisis that has resulted from the drying up of Lake Chad, as lost agricultural livelihoods and rising poverty give rise to an environment in which extremist thought found receptive minds.

The geopolitical ramifications of rising sea levels and drought will be massive, with migration flows shifting as people migrate away from areas that are no longer habitable due to a shortage of freshwater or flooding. India, which relies heavily on rivers that originate in China, is increasingly feeling the pinch of water scarcity as China develops megaprojects such as the Medog Dam being planned in Tibet, which China claims will produce triple the amount of electricity by the world’s largest power station — its own Three Gorges Dam on the Yangtze River. India is rushing to build its own hydropower project to mitigate the impact that the Chinese dam could have on its side of the border. These projects are creating a domino effect in further-downstream Bangladesh, which is doubly threatened by rising sea levels and water shortages. Jakarta, Indonesia, is similarly threatened by both flooding and drought, as groundwater depletion causes it to sink and rising sea levels threaten to flood it, making it potentially uninhabitable within 30 years.

But effective resource management and strong governance remain key: How communities respond to crises is key to the future of their water security. In 2018, Cape Town was 90 days away from Day Zero, the day that the city's municipality would shut off its water supply, but managed to avert the crisis through a series of measures that included water-saving initiatives, rationing, reducing water loss, and utilization of greywater — domestic wastewater generated by houses or businesses. Similarly, California, which has lived under threat of drought since as far back as the 1920s and 1930s and experienced its driest year in a century due to climate change, is one of the world’s biggest exporters of water-intensive crops like pistachios, walnuts and almonds. In 2009, the state-wide water conservation program Save Our Water was established by the state’s water management and conservation agencies to change daily water habits among Californians.

Want more on how humans are managing water resources? Check out this cool visual essay from the BBC on the mega-dams that have reshaped our planet.

???? CALENDAR

November: The French-Egyptian Business Forum is set to take place in the Suez Canal Economic Zone.

November: Egypt will host another round of talks to reach a potential Egyptian-Eurasian trade agreement, which can significantly contribute to increasing the volume of Egyptian exports to the Russia-led bloc that includes Armenia, Belarus, Kazakhstan and Kyrgyzstan.

31 October – 12 November (Sunday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

7-10 November (Sunday-Wednesday): Cairo ICT 2021, Egypt International Exhibition Center, New Cairo.

7-10 November (Sunday-Wednesday): TransMea 2021, Egypt International Exhibition Center, New Cairo.

8 November (Monday): Egypt CSR Forum, International Citystars, Cairo.

8-9 (Monday-Tuesday): US-Egypt Strategic Dialogue kicks off in Washington, DC.

11 November (Thursday): Deadline for Anghami SPAC merger.

15 November (Monday): Unvaccinated public sector workers won’t be allowed into their workplaces.

15-21 November (Monday-Sunday): Intra-African Trade Fair 2021, Durban, KwaZulu-Natal, South Africa.

16-17 November (Tuesday-Wednesday): Africa fintech summit, Cairo.

18-19 November (Thursday-Friday): British royal family members Prince Charles and the Duchess of Cornwall visit Cairo.

25 November (Thursday): Rameda Pharma’s annual general meeting (pdf), at which it will decide on the sale of a 5% stake in the company from an individual shareholder to an unnamed foreign institutional investor.

25-27 November (Thursday-Saturday): RiseUp Summit, Cairo, Egypt.

26 November-5 December (Friday-Sunday): The 43rd Cairo International Film Festival.

29 November-2 December (Monday-Thursday): Egypt Defense Expo, Egypt International Exhibition Centre.

30 November (Tuesday): Launch of open call by GIZ and KfW for green project proposals in Egypt as part of their Investing for Employment facility (pdf).

1 December (Wednesday): Unvaccinated members of the public will be banned from government buildings from this date; unvaccinated students will be prevented from accessing university campuses.

1 December (Wednesday): Government departments will begin moving to offices in the new capital.

7-8 December (Tuesday-Wednesday): North Africa Trade Finance Summit.

8-10 December (Wednesday-Thursday): Global Forum for Higher Education and Scientific Research (GFHS), Cairo, Egypt.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

14-19 December (Tuesday-Sunday): The Cairo International Festival for Experimental Theater.

14-15 December (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

15 December (Wednesday): Deadline for joint stock companies and investment companies in Cairo to join e-invoicing platform.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1Q2022: Launch of the Egyptian Commodities Exchange.

7 January 2022 (Friday): Coptic Christmas.

27 January 2022 (Tuesday): National holiday in observance of 25 January revolution anniversary / Police Day.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

19 February 2022 (Saturday): Public universities begin the second term of the 2021-2022 academic year.

1H2022: The World Economic Forum annual meeting, location TBD.

2 April 2022 (Saturday): First day of Ramadan (TBC).

22-24 April 2022 (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April 2022 (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April 2022 (Monday): Sham El Nessim.

25 April 2022 (Monday): Sinai Liberation Day.

May 2022: Investment in Logistics Conference, Cairo, Egypt.

2 May 2022 (Monday): Eid El Fitr (TBC).

16 June 2022 (Thursday): End of 2021-2022 academic year for public schools.

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

30 June 2022 (Thursday): June 30 Revolution Day, national holiday.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

30 July (Saturday): Islamic New Year.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday.

18-20 October 2022 (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.