- The UAE’s Aldar wants a controlling stake in upmarket real estate developer Sodic. (Speed Round)

- GSK is walking back plans to exit Egypt through a sale, but Acdima still wants to bid. (Speed Round)

- Race for Alex Medical to heat up later this month. (Speed Round)

- Our big recycling plans are getting a boost from Japan. (Speed Round)

- Egypt is “one of the most compelling economic stories” in the MENA, Africa and Eastern Europe, but challenges remain, HSBC says. (Macro Picture)

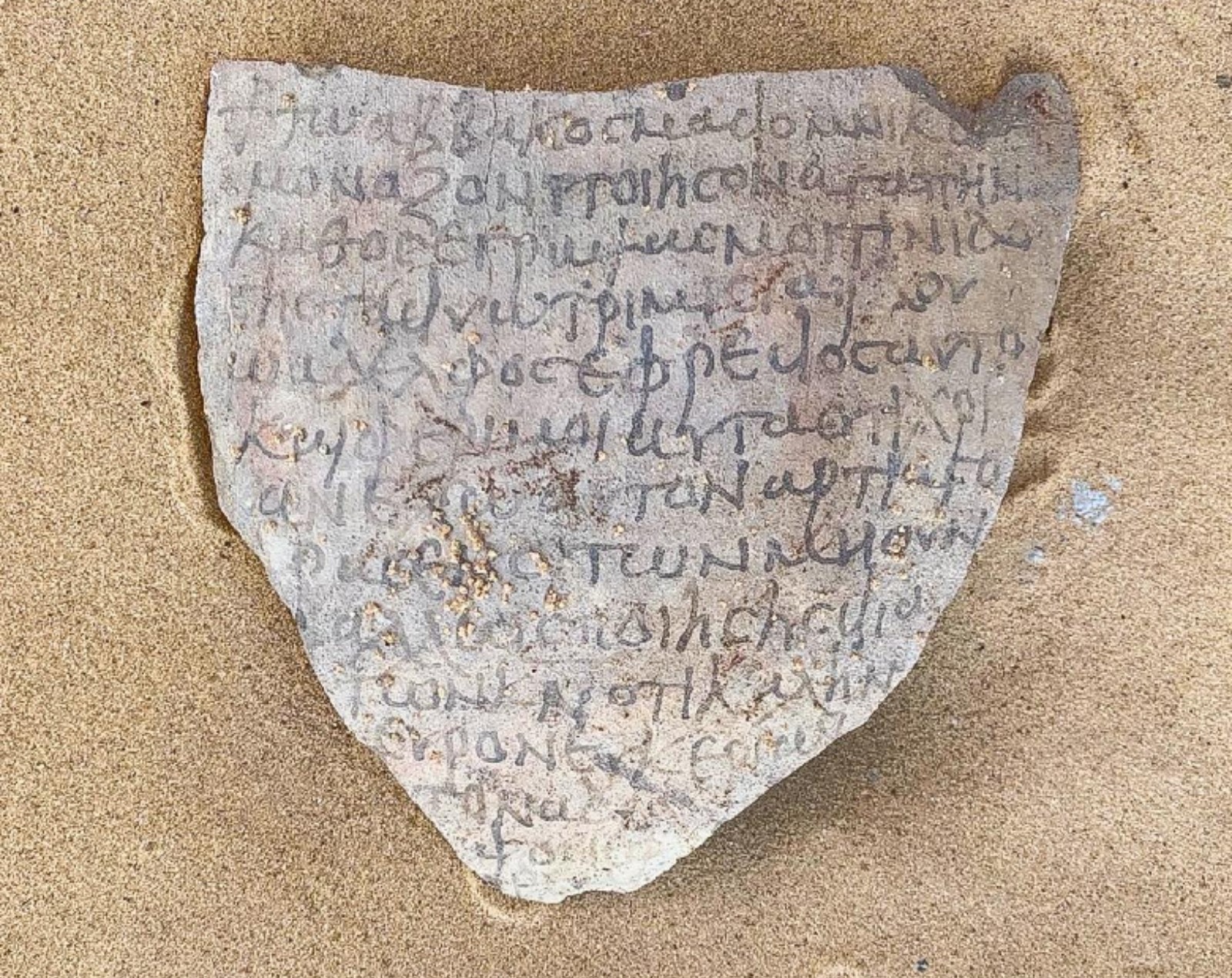

- Ancient Christian ruins discovered in Bahariya Oasis. (Image of the Day)

- Cairo Photo Week continues, and it’s awesome. (Circle your Calendar)

- It’s a really, really busy day for football fans. (On the Tube Tonight)

Sunday, 14 March 2021

EnterprisePM — That M&A boom? It’s still going as Aldar eyes Sodic and Acdima pushes to start DD on GSK’s Egypt arm

TL;DR

WHAT WE’RE TRACKING TONIGHT

Good afternoon, everyone. We begin the week with a continued flurry of M&A news, which looks set to dominate domestic business news for another week.

The blockbuster news involves much-needed foreign investment as the UAE’s Aldar properties said it was looking to acquire a controlling stake in upmarket real estate developer Sodic.

Meanwhile, on an M&A that once was, GlaxoSmithKline appears to be rethinking plans to exit Egypt after talks with Hikma over the latter acquiring its Egypt assets broke down (which we covered in EnterpriseAM this morning). Acdima, meanwhile, says it wants to start due diligence on GSK’s Egypt arm.

And the bidding war for Alexandria Medical Services appears to be heating up with a consortium that includes Tana Africa Capital looking to buy 100% of the hospital operator.

M&A in the investment management industry hit last year its highest level since the 2008 financial crisis as intense competitive pressure spurs more consolidation, the Financial Times reports. Total M&A involving asset and wealth managers nearly tripled, rising to USD 38.9 bn in 2020 from USD 13.6 bn the year before. Nine transactions had pricetags exceeding USD 1 bn, including Morgan Stanley’s USD 7 bn acquisition of Eaton Vance and Franklin Templeton’s USD 4.5 bn buyout of Legg Mason.

Look for more of the same in the year to come: The gaping size difference between the biggest players and the rest of the pack will see “the largest asset managers … continue to hunt for acquisitions to ‘leverage their scale’ to boost revenues and cost savings,” while smaller players will be open to M&A because of the “immense challenges” of going head-to-head with the big fish, the salmon-colored paper writes.

CATCH UP QUICK on the top stories from today’s issue of EnterpriseAM:

- The third wave of the pandemic appears to be on our doorstep — and it could accelerate as Ramdan arrives.

- All 12 analysts in our interest rate poll see the central bank leaving rates on hold when it meets on Thursday.

- Banque Misr will take 90% of CI Capital, but the firm will remain listed on the EGX.

HAPPENING NOW- The House of Representatives is discussing proposed changes to the Bankruptcy Act in an ongoing plenary session. The changes — which gives creditors more a greater say in deciding the future of bankrupt businesses and give more avenues for struggling borrowers to settle with lenders before filing for bankruptcy, among other things — are now in their final stages after having been finalized at committee-level earlier this year.

MPs were back to plenary sessions today after going on recess earlier this month. On the agenda:

- A EGP 2 bn overdraft for the FY2020-2021 state budget is up for discussion in today’s plenary session;

- The general assembly will also look at the Water Resources Act tomorrow;

- The House Economic Committee is set to resume discussing the Sovereign Sukuk Act today;

- The Central Agency for Organization and Administration’s plan for informal laborers is also up for discussion at the House Manpower Committee today.

THE BIG BUSINESS STORY ABROAD- A US federal judge ordered a temporary halt on the US investment ban on Xiaomi, with a complete reversal likely to follow, the WSJ reports. The ruling casts more doubt on the Trump-era Pentagon decision in January to add consumer electronics giant Xiaomi to a list of companies it believes are linked to the Chinese military, effectively blacklisting it from US investment. This comes just after US President Joe Biden in February paused legal action taken by the Trump administration against Tiktok and WeChat, while his administration revisits whether the apps really pose a threat. The Department of Defense had cited an award given to Xiaomi founder in 2019 by the Chinese state, and the company’s ambitions in 5G and artificial intelligence technology, as grounds for the ban, which the judge called “deeply flawed” as some 500 entrepreneurs had received similar awards while 5G and AI are “becoming industry standards for consumer electronics devices.”

|

FOR TOMORROW-

Life coach Arfeen Khan is giving a talk at a virtual AmCham event tomorrow. The AmCham event will be open to members only and you can sign up from their website.

???? CIRCLE YOUR CALENDAR-

Photopia’s Cairo Photo Week 2021 is up and running until 20 March. The photo festival will feature over 100 activities including workshops, panels, photo challenges, exhibitions, portfolio reviews and photo walks throughout the week, all led by more than 80 local and international photographers. You can check out the event program on Photopia’s website, there’s plenty to look at on the group’s Instagram feed @cairophotoweek, and both physical and virtual tickets are available here.

A masterclass on advanced color grading is taking place today at 5-9pm. Taught by Menna Hossam (Behance), participants will learn how to transform images into mystical art pieces. All you need is to bring a laptop with Photoshop installed on it.

Talking sustainable manufacturing with BEBA: The British-Egyptian Business Association (BEBA) will host a virtual conference on how Egyptian and UK firms can work together on sustainable manufacturing projects in Africa in the post-Brexit environment on Tuesday, 23 March. Check out the agenda here (pdf).

AUC Press’s Mad March book sale will be ongoing for the rest of the month. The sale is open to the general public every day from 10am–6pm CLT at AUC Tahrir Bookstore & Garden.

???? FOR YOUR COMMUTE-

The pandemic-induced baby drought is hurting the global economy as major economies report dwindling birth rates, raising concerns that the supply of future taxpayers to service the enormous debt incurred to fund economic aid and public pension systems is looking even thinner than before, Bloomberg reports. Within two decades, 10-15% fewer adults may join the workforce as a result, experts tell the publication, and it's going to lower potential growth rates and make debt less sustainable in the long term. This issue is pronounced in certain countries in Asia and Europe with aging populations. France reported its lowest birth rate since World War II, 15 Italian cities reported 22% fewer births, while Chinese authorities saw a 15% decline in registered newborns in 2020.

US regulators are cracking down on Tesla and other automakers who test unfinished driverless tech on users: The National Transportation Safety Board (NTSB) is calling for stronger federal requirements on the design and usage of automated driving technologies on public roads, NTSB chief Robert Sumwalt said in a letter to its sister agency, the National Highway Traffic Safety Administration (NHTSA) which enforced recalls of vehicles. Tesla has been testing its Level 2 Autopilot system — which means vehicles have some automated functions, but require drivers to remain attentive and keep their hands on the wheel — in its cars “with limited oversight or reporting requirements” said Sumwalt.

???? ON THE TUBE TONIGHT-

(All times in CLT)

Netflix original series The One has been released today. Based on a novel by John Marrs, the series follows a dating company known as The One that uses DNA analysis to match you to the love of your life in a show combining relationship drama and murder mystery set in a futuristic world. Decider is a fan while CNN gave it a shrug.

The follow-up to 1988's Coming to America, Coming 2 America (see what they did there?) has been released on Amazon Prime. In the comedy film, Eddie Murphy and Arsenio Hall team up to help the soon-to-be-King of Zamunda who returns to America to find the son he never knew he had. You can check out these reviews by the New York Times and the Los Angeles Times.

It’s another Super Sunday in the English Premier League: Southampton and Brighton kicked off at 2pm in the first game of the day and the score now stands at 2-1 in favor of Brighton. Meanwhile, Leicester and Sheffield United will kick off their match soon at 4pm.

The biggest games of the day are being saved for last: London arch rivals Tottenham and Arsenal face off at The Emirates at 6:30pm before Man Utd and West Ham meet each other at 9:15pm in a six-pointer in the race for the top four.

Serie A action is also about to get under way, with Torino going up against Inter Milan and Parma playing Roma, both at 4pm. Later in the day, underfiring Juventus will go head-to-head with relegation-threatened Cagliari at 7pm and AC Milan will kick off against Napoli at 9:45pm.

Celta Vigo and Athletic Club have just kicked off their mid-table clash in La Liga, while Granada and Real Sociedad will play at 5:15pm, Eibar versus Villareal at 7:30pm, and Sevilla versus Real Betis at 10pm.

Here at home: Al Mokawloon are currently playing against Ghazl El Mahalla in the Egyptian Premier League.

☕ DRINK THIS TOMORROW-

A coffee subscription sounds pretty good to us right about now. TBS has launched My TBS Cup — a EGP 299 monthly subscription that will give you two coffees a day. Of course, even without the subscription, TBS is a great place to get something quick to eat on the go, from their bakery section to their ‘make a sandwich’ counter. We love their blueberry muffins and their mini pizzas. Meanwhile, you’ll really be upping your sandwich game if you add their pesto or caramelized onions to your sandwich. And as Ramadan nears, we’re awaiting their yearly innovative creations, but their already existing Butler Box is a great hit at any suhoor.

???? OUT AND ABOUT-

(All times in CLT)

The Comedy Bunch are at The Room Art Space in New Cairo tonight at 9pm. The event will be hosted by Ahmed El Hareedy and feature comedians Abdelrahman Ahmed, Yara Fahmy, Khalid Elshoky, and Koala Sandwich Live.

Brush It is organizing a Pottery, Paint, and Sip night on Tuesday at 6-8pm at Ora Restobar in New Cairo. All participants will be given a large plant pot to paint as well as all the necessary equipment — and of course something to sip. Bring your creativity and join the paint party by registering online here.

???? UNDER THE LAMPLIGHT-

Environmental catastrophe from the perspective of those affected: Despite the amount of attention we give to environmental issues, it’s still hard to understand the real-life consequences of pollution from the perspective of those that are most heavily impacted. How Beautiful We Were by Imbolo Mbue is a novel set in the fictional African village of Kosawa, and tells of a people living in fear amid environmental degradation wrought by an American oil company. From pipeline spill and toxic drinking water, the novel explores what happens when the reckless drive for profit, coupled with the ghost of colonialism, threatens a community’s livelihood and safety.

???? TOMORROW’S WEATHER- We’re not sure whether we should have our summer or winter clothes hung in the closet. Tomorrow’s weather will see daytime highs of 28℃ and nighttime lows of 13℃, our favorite weather app tells us. The meter will dip down to 24℃ on Tuesday and Wednesday then gradually increase to 31℃ on Saturday and Sunday.

SPEED ROUND: M&A WATCH

UAE’s Aldar makes offer for majority stake in Sodic

The UAE’s Aldar wants a controlling stake in Sodic: Emirati real estate firm Aldar Properties has submitted a non-binding offer to acquire at least 51% of real estate giant Sodic’s shares for EGP 18-19 per share, the two companies said in separate bourse disclosures (here and here -pdfs) this morning. The offer’s midpoint price values the company at EGP 6.6 bn, a 14% premium to Sodic shares’ closing price at the end of last week, reflecting Sodic’s “robust fundamentals and share price performance,” over the past year, Aldar said. The company has submitted a request to perform due diligence, which will now be referred to the Sodic board for consideration. Aldar said the acquisition, if successful, would be executed through “a consortium controlled and majority owned by Aldar.”

The offer is “a compelling liquidity event and value proposition for Sodic’s shareholders,” Aldar said in its statement.

A consortium of Sodic stakeholders led by Act Financial is “currently exploring all possible scenarios” in the wake of the offer, Act Financial Managing Partner Moustafa Abdel Aziz told Enterprise. “All the recent news that we have been seeing in the market confirms Act Financial’s vision that consolidation and M&A will be the main driver for growth in all sectors,” said Abdel Aziz. Act Financial, Hassan Allam Properties and Concrete Plus Engineering and Construction collectively hold 14.98% of Sodic’s shares, making the consortium Sodic’s largest shareholder.

Sodic’s shares soared by as much as 7% at market open on the news, tripping EGX circuit breakers when the stock broke 5%. Sodic’s shares were up 4.7% at market close, ending the trading day at EGP 17.02 apiece. Reuters also has the story.

Aldar has been signposting a major move in the Egyptian market for a while: Aldar CEO Talal Al Dhiyabi had in 2019 said the company was eyeing investments in Egypt’s real estate market — a point reiterated last month by CFO Greg Fewer, who said that Egypt was its priority market for outward expansion. Aldar’s new operating model announced earlier this year grants its development business “a mandate to expand its operations into the Egyptian market to pursue attractive long-term opportunities, particularly in the development of integrated mixed-use communities,” according to the company’s disclosure.

SPEED ROUND: M&A WATCH

GSK is staying put — for now

GSK puts Egypt exit on the backburner: GlaxoSmithKline has shelved plans to sell its units in Egypt and Tunisia following the breakdown of talks with UK-listed Hikma Pharma, the company said in a disclosure (pdf) to the EGX today. The pharma giant initially wanted to sell its entire 91.2% stake in its Egypt-based pharma and manufacturing business, but said today that it is backing out of a sale. “GSK’s shareholders’ immediate focus is stabilising the operations of our company and the supply of meds and consumer healthcare products to our patients,” it said.

Acdima asked on 10 March to start due diligence on GSK’s Egypt operations, but GSK said in a separate statement (pdf) that its global parent company “is not willing to sell its shares in GSK SAE and therefore is not engaging in any sale process with any party at this time.” Still, GSK’s local board is meeting today to discuss the matter and will “announce its decision on Monday, 15 March 2021,” the statement said. Hapi Journal reported this morning that Acdima was planning to submit a bid this month.

This comes a few days after GSK and Hikma announced they had ended talks without an agreement. GSK chose to pursue talks with Hikma back in January, rejecting advances from Egyptian pharma companies Acdima and Rameda. Neither company has disclosed why the talks broke down.

SPEED ROUND: M&A WATCH

On your marks…

Race for Alex Medical to heat up later this month: A consortium of Mabaret Al Asafra Hospitals and investment firm Tana Africa Capital will submit an offer to acquire 100% of Alexandria Medical Services before the end of March, intensifying the race for the healthcare player, Al Mal reports, citing sources close to the transaction. Tana Africa, which holds a minority stake in Mabaret Al Asafra, plans to cover a “big part” of the transaction and is also mulling loans from local banks, the sources said. Mabaret Al Asafra’s board is due to sit down in the coming days to hash out the final details of the bid, they added.Tana and Mabaret Al Asafra first lodged interest in Alex Medical back in January, reportedly reaching out to the Abu Dhabi Commercial Bank (ADCB) which acquired its 51.5% stake. Neither Mabaret Al Asafra nor Tana Capital were available to comment on the story.

Bidding war heating up? A consortium made of Saudi’s Tawasol Holdings and Speed Medical subsidiary Speed Hospitals Company is also looking to acquire the firm. Tawasol — already a 26% shareholder of Alex Medical — is eyeing the remaining 74% stake in the company and will reportedly offer to purchase the shares at EGP 38.09 apiece. The two could potentially be joined by an unnamed local healthcare investor, sources said earlier this month. ADCB confirmed last week that it’s looking to offload its entire stake and tapped CI Capital as its sell-side advisor.

SPEED ROUND: DEVELOPMENT

Japan is funding our recycling efforts

Egypt will receive USD 3.6 mn from Japan to support an ongoing United Nations Industrial Development Organization (UNIDO) project to promote recycling practices under the terms of an agreement signed by Japanese ambassador to Egypt Masaki Noke and UNIDO last week, the International Cooperation Ministry, the Japanese government and UNIDO said Tuesday. The project will provide technical assistance to SMEs and will focus on integrating the private sector in plastic recycling, and is a part of UNIDO’s Program for Country Partnership with Egypt launched last year.

Egypt has struggled to integrate the private sector companies into the waste-management industry, and has attempted to draw them in with investment incentives under the Waste Management law passed last year. The government has also initiated door-to-door recycling awareness-raising campaigns, and has said it aims to recycle around 80% of solid waste by 2026.

GO WITH THE FLOW

The EGX30 rose 0.3% at today’s close on turnover of EGP 897 mn (39.6% below the 90-day average). Local investors were net sellers. The index is up 4.1% YTD.

In the green: Fawry (+6.8%), Orascom Development (+5.7%) and Sodic (+4.7%).

In the red: CI Capital (-7.3%), AMOC (-2.6%) and Orascom Investment (-2.5%).

THE MACRO PICTURE

HSBC confident of Egypt’s prospects, but challenges remain

Egypt is “one of the most compelling economic stories” in the MENA, Africa and Eastern European regions but continues to face “significant risks” and many structural obstacles, HSBC said in a note last week. Reforms over the past four years have put the economy in a strong position to rebound from the covid shock and weather future economic turbulence, yet the country’s large debt pile, precarious sources of hard currency and weak investment will pose serious challenges for policymakers, Simon Williams, HSBC’s chief economist for Central and Eastern Europe, the Middle East and Africa (Ceemea), wrote in the note.

Growth to pick up in 2H2021: HSBC is optimistic that the economic recovery will remain on track, and is forecasting the economy to grow at a 2.5% clip during FY2020-21 and near 5% in FY2021-22. Economic activity will pick up steam during the latter half of the calendar year, underpinned by strong domestic consumption and fuelled in part by remittances, which surged to a record high in 3Q2020. The bank is also confident that the country’s tourism sector will begin to attract more visitors as we near 2022, while an unexpectedly strong economic rebound in Europe — one of Egypt’s largest trading partners — will help to support exports and add fuel to the recovery.

Look beyond consumption and things start to look more uncertain: “Outside of consumption, signs of a broader rebound in activity are difficult to see,” Williams writes, noting the private sector business activity contracted in January and February this year.

Here’s why:

#1 Productive FDI continues to remain low, with levels among the weakest in the Ceemea region, and existing investments are dominated by the public sector, Williams says. That is in stark contrast to the strong foreign appetite for the EGP carry trade, as well as to strong consumer spending. “Although consumption is a powerful driver of short-term growth, it is investment that lifts long-term potential,” Williams writes. The combined 400 bps interest rate cut by the CBE last year created momentum for capex, but according to Williams, this “may start to fade” as the central bank tapers off its cheap lending programs for sectors vulnerable to the covid fallout.

#2 Trade supported economic growth during the pandemic because imports fell faster than exports — not due to more exports. The HSBC economist links this to the wider story of Egypt’s current account weakness, with merchandise exports being traditionally lower than imports and leading to an enduring — and widening — trade deficit. This is usually compensated by a strong services balance, this time around the slowdown in tourism and weaker remittance inflows takes away this advantage.

#3 The commodities boom could undermine CBE’s room to ease: Should the recovery take longer, pressure is likely to build up for further monetary easing. The CBE has room to drive rates lower, but this would prove challenging if booming global food and energy prices continue to trend higher. Rate cuts could also make EGP debt less attractive for foreigners, which won’t help if it happens before other key sources of FX (tourism and remittances) recover, Williams said.

Finances are on a firmer footing: Tax reforms and spending cuts put public finances in a much better position to handle the economic shock caused by the pandemic, and gave the government room for fiscal support while limiting the impact on the budget deficit. Revenues have been unexpectedly strong, supported by the Finance Ministry’s efforts to expand the tax base and covid-era measures to bring informal businesses into the fold such as conditioning state support to SMEs on registering into the formal sector, Williams notes.

And debt sustainability has improved: The Finance Ministry succeeded in lengthening the average maturity of government debt to a little over three years in FY2019-2020 from closer to 1 year in FY2012-2013, alleviating short-term debt servicing costs. Foreign investors are also now playing a bigger role in the country’s financing mix. The proportion of foreign debt ownership is still low by global standards though, and at 20% of total debt, still has room to grow. That said, foreign portfolio investment is now at a record high of USD 29 bn, having staged a full recovery from the emerging-market sell-off caused by the pandemic last year.

But high debt levels and a large fiscal deficit continue to pose problems: While the budget deficit has been narrowing, a “fiscal overhang” remains unresolved and it isn’t just cyclical. It stems from “heavy debt servicing costs that amount to some 10% of GDP, … [absorbing] the equivalent of 60% of all revenues and nearly 90% of taxes.” With the state coffers being increasingly subject to a growing need for external funding, the economy needs to sustain a real growth rate of 5.5% (and nominal growth of nearly 14%) to drive the debt stock sustainably lower, “leaving little room for error,” Williams notes.

And there is “much policy work still to be done”: Low levels of national savings, heavy state involvement in the economy, weak capital formation, a “still-low” business environment ranking, and high levels of poverty. Egypt’s GDP structure also suffers from a “marked structural imbalance” owed to a low level of goods exports and weak real wages.

Authorities are increasingly recognizing those structural shortfalls, and have since 2017 introduced “a raft of reforms designed to overhaul the investment climate and prioritise export sectors,” he writes.

You can read a summary of the report here (pdf).

IMAGE OF THE DAY

Ancient Christian ruins uncovering monastic life in the Western Desert’s Bahariya Oasis during the fifth century AD were discovered in the Egyptian desert, according to an Antiquities Ministry statement. A French-Norwegian archaeological team made the discovery, which includes 19 structures and a church carved into the bedrock, the statement said.

CALENDAR

March: Potential visit to Cairo by Russian President Vladimir Putin.

11-14 March (Thursday-Sunday): First edition of Afaq Real Estate Expo, Tolip El Galaa Hotel, Cairo, Egypt.

11-15 March (Thursday – Monday): Al Bazaar fair for handicrafts and house decors, Cairo International Conference Centre, Cairo, Egypt.

11-20 March (Thursday-Saturday): Photopia’s Cairo Photo Week 2021 will take place with this year’s theme being Depth OFF Field.

13-14 March (Saturday-Sunday): The Marketers League Conference will take place at Kundalini Grand Pyramids Hotel in Giza. This year’s theme is Beyond the Pandemic.

15 March (Monday): AmCham event featuring life coach Arfeen Khan.

16 March (Tuesday): AmCham webinar featuring business tech expert Patrick Schwerdtfeger. Non-members can register here.

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 March (Tuesday): The second edition of the Egypt Retail Summit takes place at the Nile Ritz Carlton hotel.

23 March (Tuesday): The British-Egyptian Business Association (BEBA) virtual conference on sustainable manufacturing in Africa.

25-27 March (Thursday-Saturday): The Real Gate real estate exhibition, Egyptian International Exhibition Center, Cairo.

29-30 March (Monday-Tuesday): Arab Federation of Exchanges Annual Conference 2021.

31 March (Wednesday): Deadline to visit the moroor and get an RFID sticker affixed to your car’s windshield — or run afoul of the Traffic Police.

31 March (Wednesday): Income tax deadline for individuals. Real estate tax deadline.

1-3 April (Thursday-Saturday): HVAC-R Egypt Expo.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7 June-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

27 June – 3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.