- Speed Medical could partner up with Tawasol Holding and others in an acquisition bid for Alexandria Medical. (Speed Round)

- Discussion on the long-awaited Sovereign Sukuks Act begins in the House today. (What We’re Tracking Tonight)

- How the automotive sector’s recovery is playing out in the markets + HC’s top picks for 2021. (Go with the Flow)

- The East Med Gas Forum will officially become a regional organization tomorrow. (What We’re Tracking Tonight)

- What is the “great chip shortage,” why it matters and how countries are adapting to it. (Macro Picture)

- An avalanche of daily emails giving you anxiety? This computer scientist has advice on how to manage it. (Parting Shot)

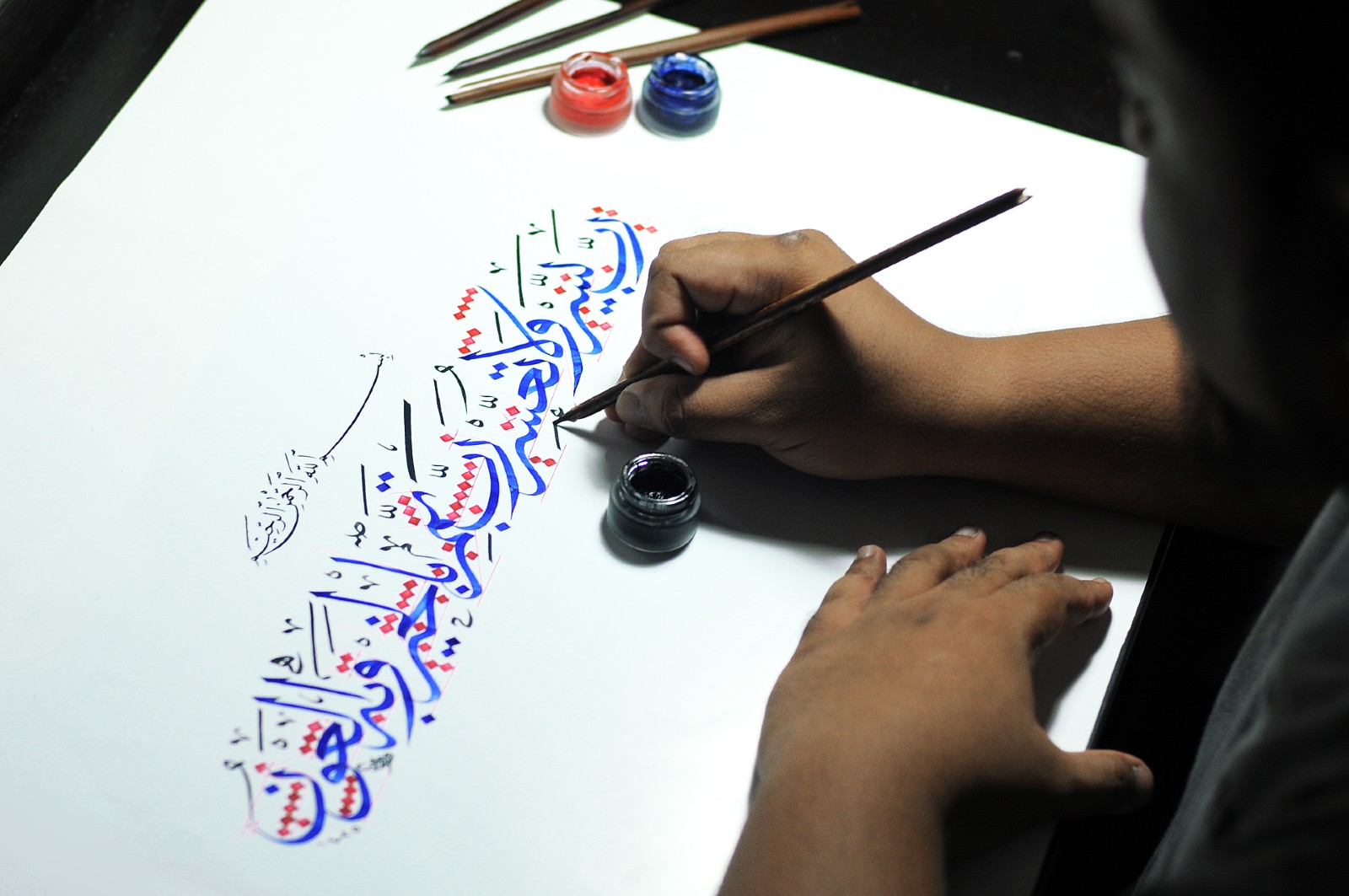

- How Egypt and other countries are fighting to preserve the ancient art of calligraphy. (Culture and Arts)

- A day in Egyptian rap beefs: Who’s been catching “Ls” and who’s dropping fire bars (What We’re Tracking Tonight)

Sunday, 28 February 2021

EnterprisePM — The House is finally on sovereign sukuks.

TL;DR

WHAT WE’RE TRACKING TONIGHT

Good afternoon, everyone. If you’re like some of us here and have had your fill of covid-related news, we give you a bit of a reprieve today, starting with the House of Representatives.

HAPPENING NOW- The House Economic Committee is discussing the Sovereign Sukuk Act today, after putting a few final touches on the bill earlier this month, Youm7 reported. The proposed law sets the framework for how the securities are sold and traded and defines the different types and uses of sukuk, among other things. Its passage in a final House vote would bring Egypt closer to its first issuance, which the government plans to roll out in both in EGP and foreign currency as soon as the bill is ratified. The size of the country’s inaugural sale is so far unknown.

COMING UP- Amendments to the Competition Act that would give our monopoly watchdog sharper teeth will be the only thing on the committee’s agenda tomorrow and on Tuesday. They passed the cabinet late last year, and earned a preliminary approval from the House committee earlier this month. They seek to give the Egyptian Competition Authority the right to block mergers and acquisitions before they happen as the authority has been for years only able to raise red flags after a transaction is completed.

Meanwhile, a bill to establish an online portal for Egyptians seeking to go on the Umrah pilgrimage passed a general assembly vote earlier today, the newspaper separately reported.

|

FOR TOMORROW-

The Eastern Mediterranean Gas Forum is launching, with the foreign ministers of Greece, and Cyprus expected to attend the opening of the forum’s regional office which will be based in Cairo. The meeting is expected to see the organization’s charter, signed in September, activated next month and officially establish it as a regional organization.

A virtual session titled “How to Stay Safe in Cyberspace” is set to take place at 1pm CLT as part of the AUC SpeakUp Dialog series. Speakers include: Facebook’s MEA Safety Policy Manager Sylvia Musalagani; TikTok’s North Africa Content Operation Director Hani Mohamed Kamel; the National Council for Women’s Cooperation member Dina El Serafy; and AUC’s Computer Science and Engineering Association President Ahmed Khater. The event will be held in Arabic with simultaneous translation into English.

The Aswan Forum for Peace and Development also begins tomorrow and will run until Friday, 5 March under the title “Shaping Africa’s new normal: Recovering stronger, rebuilding better.”

???? CIRCLE YOUR CALENDAR-

The IDC Future of Work conference is kicking off next Monday, 8 March, under the theme “The Path to Business Resiliency”. The event will take place virtually and will discuss how organizations can accelerate their digital transformation strategies to address challenges around technology, policy, and operations. Experts and business leaders from Egypt and Jordan will run the sessions.

It’s Rugrats meets American Gladiator at the Tough Mudder event this weekend: The event features a mud and obstacle course. There will be two types of events, the Tough Mudder Classic (a 10-12km loop of mud-soaked mayhem loaded 30 obstacles) and the less-tough Tough Mudder 5k (a 5k collaborative teamwork challenge with 13 obstacles). You can learn more about Tough Mudder Egypt and register for the event on their website.

???? FOR YOUR COMMUTE-

Aladdin actor Mena Massoud dropped the teaser poster of his next film In Broad Daylight (Fe Ezz El Dohr) — which will be filmed in Egypt. Massoud will be joined by Egyptian actress Myrna Noureldin in the film, while Kareem Sorour is the screenwriter and Morcous Adel will direct the film, according to Esquire Middle East. This will be the Egyptian-Canadian actor’s first major role since the Disney live action remake.

???? LISTEN TO THIS-

Egypt’s hip hop scene is aflame with diss tracks: We thankfully have lived long enough to see Egyptian hip-hop grow its own (benign we hope) rap beefs. The latest war of words began publicly in November when Egyptian rapper Abyusif released a diss track titled Okay that targeted rapper Marwan Moussa. After some back-and-forth on social media, Moussa released his track Msh Okay earlier this month, slamming Abyusif. Things accelerated from there, with Abyusif’s release of Megatron and Moussa’s quick response with Megatroll. The videos quickly rose on the charts and have garnered mns of views.

This isn’t the first time rappers have made fame with diss tracks, with Wegz last year becoming one of Egypt’s top artists from songs such as Dorak Gai which made fun of singer Mohamed Ramadan. Ramadan also went head-to-head with actor Ahmed El Fishawy who had made fun of the singer’s track Number One and created a parody of it. Nile FM made sure to outline the beef.

However, all the dissing has been put on the backburner, as everyone celebrated the return of Marwan Pablo who made a comeback after announcing his retirement from the music scene last year with his song Ghaba that was released on Thursday.

???? ON THE TUBE TONIGHT-

Want to know more about the writer of Citizen Kane? Hint: it’s not Orson Welles: Netflix has released a biopic about the man recruited to write the screenplay Herman J. Mankiewicz. Mank is about why Mankiewicz wrote Citizen Kane — what experiences inspired him to write it and were essential to it, and why he was the only person who could have done so. Mank got thumbs up from The Guardian, The New Yorker, and The Vulture. Citizen Kane is largely featured in film studies curriculums as the film that introduced filmic concepts such as deep focus and nonlinear storytelling, and some even consider the film to be the first film noir.

The English Premier League’s double gameweek has been kicking off strong, with Leicester City and Arsenal as well as Crystal Palace and Fulham already on the field. So far the match results stand at 3-1 in favor of Arsenal while Crystal Palace and Fulham are still tied at 0-0. Tottenham and Burley will face off soon at 4pm CLT while Chelsea and Man United will play at 6:30pm CLT and Liverpool will go head-to-head with Sheffield at 9:15pm CLT.

Meanwhile, in our local Premier League, Aswan are already playing against National Bank, with the score still at 0-0 going into half-time, while Al Ahly will face off against El Gaish at 7:30pm CLT.

Serie A has six matches on for you tonight, with Atalanta currently finishing up the match against Sampdoria, with Atalanta winning 1-0 in minute 51. Crotone will go up against Cagliari, Inter Milan against Genoa, and Udinese against Fiorentina, all at 4pm CLT. Meanwhile, Napoli will play versus Benevento at 7pm CLT and Roma versus Milan at 9:45pm CLT.

La Liga’s five matches today started up with Celta Vigo and Valladolid who started playing at 3pm CLT. Cadiz and Real Betis will hit the field at 5:15pm CLT, while Granada and Elche will play at 7:30pm CLT. The last two matches of the day will both start up at 10pm CLT, with Villarreal versus Atletico Madrid and Real Madrid versus Real Sociedad.

???? EAT THIS TONIGHT-

Healthy, vegan, and delicious, Sincerely V was once upon a pre-covid time an office favorite of ours at Enterprise. The online restaurant features innovative and delectable new recipes to make sure both you and your body enjoy what you eat. Their colorful recipes boast a lot of tofu, lentils, and assorted vegetables for noodle bowls, sandwiches, and shawermas. We recommend their teriyaki tofu bowl and their moroccan lentil kofta. Sincerely V was created by Russian native Victoria Diachkova who has lived in Cairo since 2003 after choosing to stick to a plant-based diet. She graduated from the Institute of Integrative Nutrition in 2018 and is also a certified health coach. Her goal is to “show how exciting eating vegetables could be.”

???? OUT AND ABOUT-

Picasso East Gallery in New Cairo is holding the opening of its new exhibit titled “Foresight” which will feature more than 30 artists including Ahmed Sheha, George Bahgoury, and Mostafa el Feky. The opening will start at 5pm CLT today with some of the displayed artists to be present.

Egyptian contemporary and abstract artist Tayseer Hamed is giving an art talk today at 5pm CLT at Zamalek’s Nile Art Gallery to discuss contemporary visions derived from heritage, and identity. You can check out Hamed’s work from his page on Ubuntu’s site.

Up and coming young singer Habiba Azab will be performing today at 9pm CLT at Cairo Jazz Club in Agouza. You can check out her music on her Instagram page @habibaazabmusic.

???? UNDER THE LAMPLIGHT-

Stephen King’s new thriller titled Later will be out tomorrow, following a young boy with psychic abilities that he uses to help the police find a killer who has threatened to strike from beyond the grave. You can preorder the book to drop onto your Kindle upon release from Amazon — where the book is currently ranked as a number 1 bestseller.

Get into a better headspace, with Cleaning Up Your Mental Mess: 5 Simple, Scientifically Proven Steps to Reduce Anxiety, Stress, and Toxic Thinking by Caroline Leaf. The doctor uses clinical research and compelling case studies, to provide a scientifically proven five-step plan to find and eliminate the root of anxiety, depression, and intrusive thoughts in your life in a mere 21 days.

???? TOMORROW’S WEATHER- Expect a continuation of this weekend’s sunny skies, with highs of 22℃ and nighttime lows of 9℃.

SPEED ROUND: M&A WATCH

Bidding war for Alex Medical heats up…

Speed Medical could partner with Tawasol for Alex Medical acquisition bid: Tawasol Holdings appears to be exploring teaming up with Speed Hospitals Company — a subsidiary of Speed Medical — on its potential acquisition of 100% of Alexandria Medical Services, Al Mal reports, quoting sources close to Speed Medical. The two could potentially form a consortium with an unnamed local healthcare investor, sources added. Talks are currently underway to determine how the three will distribute Alex Medical’s shares following the acquisition, the sources said. A formal offer could be lodged in as early as this week, they added.

Speed Medical confirmed that it is in talks with Tawasol, but as of yet, “nothing has been signed,” the company said in a regulatory filing to the EGX (pdf). Any partnership with Tawasol will be done through Saudi Treatment Group — an “affiliate” of Tawasol, the statement said. The specifics and nature of this affiliation are unclear. We reached out to Tawasol’s financial advisor on the transaction, Prime Capital, but it wasn’t available for a comment as of dispatch time.

Background: Tawasol already holds a 25.9% stake in Alex Medical. It announced earlier this month it’s looking to purchase the 74.1% it doesn’t already own in the EGX-listed hospitals operator. Of the 74.1% stake, 51.5% is held by Abu Dhabi Commercial Bank (ADCB), which became Alex Medical’s majority shareholder following the collapse of BR Shetty’s UAE-based NMC Healthcare on allegations of fraud. The remaining stake belongs to Egyptian-British entrepreneur Tamer Abdullah, who was reported in December to be looking at a stake increase himself, and the rest is in freefloat on the stock exchange.

Alex Medical also looks to be fielding a competing offer, which ADCB received from a consortium of Mabaret Al Asafra Hospitals and investment firm Tana Africa Capital in January.

Who’s Alex Medical? It operates the Alexandria New Medical Center, which serves over 300k patients a year (pdf), many of whom come from nearby governorates with large rural areas.

IN OTHER M&A NEWS- ADQ Holding’s Agthia to wrap up due diligence on Atyab next month: Emirati state-owned investment firm ADQ Holding’s food subsidiary Agthia plans to wrap up in March due diligence ahead of its acquisition of Atyab brand owner Ismailia Agricultural and Industrial Investments, according to a local press report quoting sources close to the transaction. The acquisition is expected to be completed no later than the end of the first half of 2021, the sources said. Agthia, which is 51% owned by ADQ, will be looking to acquire at least 75% of the Egyptian meat and poultry company, in a takeover that could be valued at EGP 3 – 3.2 bn, we noted last October.

GO WITH THE FLOW

How auto’s recovery is playing out in the markets

The EGX30 fell 0.8% at today’s close on turnover of EGP 1.59 bn (8.5% above the 90-day average). Foreign investors were net sellers. The index is up 6.27% YTD.

In the green: Orascom Investment Holding (+7.3%), Ibn Sina Pharma (+3.7%) and Oriental Weavers (+3.4%).

In the red: MM Group (-5.3%), Sidi Kerir Petrochem (-3.9%) and Alexandria Minerals Oil Company (-3.5%).

Automotive’s rebound reflected in the markets: Analysts are focusing on the auto sector today following GB Auto’s annual earnings release last week which saw the company report record profits for 2020. Higher-than-expected earnings has analysts calling a buy on the stock, with Prime Research saying it offers an 8% upside and suggests that the industry began to see green shoots towards the end of 2020 after a rough first half of the year. Pharos, meanwhile, pointed out that revenues came in 6% higher than analysts had penciled in. This was driven by growth in GB’s passenger car and two- and three-wheeler segments, despite a drop in commercial vehicle and construction equipment sales.

Auto sales had a good 2020 despite the pandemic. Passenger car sales rose 32% y-o-y to 168k, and sales of trucks and buses were also up, even as the pandemic forced a partial lockdown on the economy, figures from the Automobile Market Information Council recently showed.

On the macro front, HC Securities is bullish on the economy: A private sector recovery is picking up speed, driven by the lower interest rate environment, moderate inflation, and the stable EGP, HC’s research team said in a note. Monetary and fiscal support introduced in response to the pandemic, together with the fresh IMF support, has helped the economy perform better than anticipated, they said.

The bad news: Lower tourism receipts in 2020 is expected to lead to a wider current account deficit of c. 4% of GDP in FY2020-2021, despite the country’s balance of payments forecast to record an oil trade surplus and remittances expected to rise 10%, they added.

HC’s top stock picks are real estate, finance, and certain high-performing names in the consumer sector. They include Orascom Construction, Eastern Company, GB Auto, CIB, Abu Dhabi Islamic Bank, EFG Hermes, TMG Holding, SODIC and Orascom Development Egypt.

EARNINGS WATCH- Madinet Nasr Housing & Development’s (MNHD) net profit inched up 2% to EGP 1 bn in 2020, it said in its earnings statement (pdf). Consolidated revenues climbed to EGP 3.1 bn from EGP 2.2 bn last year as pre sales grew 11% y-o-y, driven by increased demand for the real estate developer’s Taj City and Sarai projects. “While 2020 was a challenging year, for the economy in general and the real estate market in particular … MNHD continued delivery of outstanding operational performance and financial results backed by strong capabilities of land bank, managerial, financial, and human resources,” CEO Ahmed El Hitamy said.

Oriental Weavers net income increased 30% in 2020 to EGP 1.1 bn, compared to EGP 855 mn in 2019, the company said in a filing to the EGX (pdf).

Pioneers Holding’s net profit was down 12% in 2020 to EGP 946 mn, compared to EGP 1.1 bn in 2019, according to the company’s financials (pdf).

Amer Group’s net profit fell to EGP 25.5 mn in 2020, down from EGP 56.4 mn last year, its full year earnings (pdf) showed.

Arabian Cement reported net losses of EGP 122.8 mn for 2020, down from a net profit of EGP 29 mn last year, according to its consolidated financials (pdf).

CULTURE & ARTS

How we’re preserving calligraphy

Fears abound that technology and digital culture will efface calligraphy: It’s one of our most ancient and enduring forms of self-expression, whether decorating artwork, adorning mosques, or carrying messages of social change. But in the present day, the position of Arabic calligraphy in our lives is far from straightforward as it fights to stay relevant. Specialized calligraphy institutes like the 1928-founded Khalil Agha school have struggled to survive amid a lack of job prospects for learners and waning interest.

These fears have prompted a revival movement of sorts: Egypt was among sixteen Arab countries to register Arabic calligraphy with UNESCO as intangible heritage in 2020. Last year was designated The Year of Arabic Calligraphy by Saudi Arabia — later extended into 2021 — as a means of preserving and supporting the art form. And initiatives spearheaded by artists, including writers and graphic designers, seek to highlight its cultural value.

Arabic calligraphy is as old as Islamic civilization itself: Calligraphy emerged with the first written version of the Quran in 664-656, and developed into two major styles: Kufic and Naskh. Architectural calligraphic friezes were especially popular in Egypt in the Fatimid and Ayyubid dynasties. And the 1922 founding of the Royal School of Calligraphy in Cairo marked a key moment in the history of Arabic calligraphy, believes one graphic designer who specializes in the art form.

Now it lives on as inspiration for modern-day designers: With its focus on geometry, harmony and proportion, Arabic calligraphy has influenced designers in Egypt and throughout the Arab world for as long as Islamic civilization has existed, believes university art professor Dalia Attieh (pdf). It is a key element in regional interior design as it reinforces the sense of Arabic culture and religion, according to architecture blog Comelite Arch. Egyptian contemporary jewelry designer Azza Fahmy famously draws inspiration from calligraphy, with particular collections inspired by notable poets. Egypt-based Lebanese light designer Nadim Spiridon integrates motifs from Arabic calligraphy into his work. And for architectural designer Nedal Badr, consciously raising awareness of Arabic calligraphy is a key part of what he does, he noted during the 2019 Paris Design Week.

…And in street art: “Khatt: Egypt's Calligraphic Landscape” shows the ubiquity of calligraphy as art and a way of capturing what’s happening in the minds and daily lives of Egyptians, Scene Arabia notes. The book documents khatt — Arabic street calligraphy — on trucks, boats, cinemas, shops, and in Hajj paintings. Efforts to keep Arabic calligraphy alive include Calligraffiti — an art form combining calligraphy, typography, and graffiti — which has evolved into a global movement, and the Kufigraffiti movement, launched by a team of Egyptian graphic designers in 2018 (watch, runtime: 02:12). Street art is now one of the most popular contemporary forms of calligraphy, with artists like El Qaqa and El Seed (he of the famous Garbage City mural) creating famous works in public spaces.

WANT TO LEARN CALLIGRAPHY? AUC New Cairo is set to offer a two-week course for EGP 3.5k from 4-15 July, which may be the best bet for serious learners. Heliopolis Public Library offers workshops for children every Friday. Art Cafe Egypt was offering courses as of September 2020. Azza Fahmy Studio has previously offered 5-day workshops for EGP 4k or USD 300, and the Galileo Art Center has also offered standalone courses. If you’re willing and able to go further afield, Ahlan language school offers 10 or 20-hour courses in Amman. And two good online options for self-study are this course by Udemy that works with the Thuluth Script, and this by Arabic Calligraphy that incorporates six scripts, including Kufic, Naskh and Thuluth.

MACRO PICTURE

Finding yourself on a wait-list for the PS5? Thank the global micro-chip shortage: Supply disruptions are once again back in the forefront of news. This time it’s with electronic devices and car production, which have been hit by a shortage in semiconductors — the building blocks of microchips that power everything from washing machines, smartphones, refrigerators, cars, and laptops to essentials such as medical devices and military equipment. While the semiconductor industry is massive, it has seen a shift in the past period that has led to supply chain gaps and overreliance on chip producing countries (which could potentially leverage the need for chips in geopolitical relations), according to CNBC (watch, runtime: 09:26).

Who are the players in the semiconductor industry? Fabless chip companies design the chip, while foundries actually undergo the semiconductor manufacturing process. While there are still a few integrated device manufacturers (who both design and manufacture chips) such as Intel, more and more US semiconductor firms are adopting the fabless model and are outsourcing manufacturing to foundries such as Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung. While the US semiconductor industry has captured 47% of global sales, they’ve only locally manufactured around 12% of the world’s chips.

How did this all start? Covid-19, lockdowns and stay-at-home boredom: When the pandemic set it, everyone transitioned into doing everything from home from work to schooling to entertainment. This pushed many people to begin to upgrade computers, smart speakers, tablets, and gaming consoles. WFH also forced businesses to scramble to set up and improve remote work systems and cloud infrastructure. The demand for semiconductors rose, and the supply couldn’t catch up. To put this phenomenon into figures, the global sales of semiconductors increased 6.5% y-o-y in 2020 to USD 439 bn, while December 2020 alone saw an 8.3% increase to USD 39.2 bn.

Demand is only expected to increase in 2021, with the onset of new 5G networks needing more 5G-enabled smartphones, coupled with the increase in internet-of-things devices and remote work expected to stay on for a while longer. American semiconductor firm AMD is expecting shortages for the company’s processors to continue through the first half of 2021 as AMD’s manufacturing partners continue to build capacity, CEO Lisa Su had said in January, according to tech news outlet CRN.

De-globalizing chip manufacturing: While there isn’t a way to up chip production in the short-term, countries are looking at ways to avoid this crunch in the future. China has earmarked USD 1.4 tn in its five-year plan to gain semiconductor independence through its homegrown industry, reported The Financial Times. Meanwhile, US President Joe Biden ordered economic and security experts to look for gaps in the semiconductor supply chain, to be able to shore up the country’s chip supply using local resources as well as working more closely with trade partners, according to a White House briefing.

Why the auto industry should pay attention to this: Cars now require a good amount of chips to run complicated in-vehicle computer systems as well as older semiconductors to run processes such as power steering. The automotive industry is feeling the squeeze more acutely after cancelling orders of chips last year over fear of the pandemic hitting sales. When they decided they needed these chips, they were put on a long backlog of other orders from computer and electronics firms. Automaker General Motors has said it could lose some USD 2 bn because the semiconductor chip shortage forced it to temporarily shut down some auto manufacturing plants, reported Reuters.

And EV makers have to contend with other shortages: Tesla is shifting some cars to a type of battery that uses iron instead of nickel, amidst shortages and rising prices, CEO Elon Musk tweeted on Thursday.

PARTING SHOT

The onslaught of daily emails is affecting productivity: If you’ve gotten anxiety looking at the number of unread emails in your inbox, well join the club. The issue has gotten so messy that Cal Newport, a US academic and computer scientist, has written a new book called A World Without Email, which was picked up in an op-ed by the FT’s Pilita Clark. The average worker now sends and receives about 126 business emails a day, Newport reports, with the cheap and easy format of emails contributing to a “hyperactive hive mind” — a new way of office working that revolves around an ongoing conversation of unscheduled messages that simply interrupts important tasks.

So how should we make our inbox less anxiety-inducing? Newport says the problem needs a “much bigger structural overhaul” than just writing better subject lines. He points to online project management tools such as Trello that drive more focused work on specific tasks or set hours when a worker cannot be interrupted. Another suggestion is hiring an “attention capital ombudsman” who will investigate and address complaints of maladministration to lead to more administrative support in workplaces. Such changes, Newport admits, can be “a pain in the short term”, but explains that the long-term productivity gains will be worth it.

CALENDAR

February: France’s finance minister, Bruno Le Maire, is set to visit Egypt.

6-27 February (Saturday-Saturday): Mid-year school break (public schools — enjoy the break from bumper-to-bumper traffic).

7-28 February (Sunday-Sunday): The Finance Ministry will receive applications from companies wishing to take part in the second phase of its program for the immediate payout of export subsidy arrears to exporters, minus a 15% fee.

17 February (Wednesday): MENA x CEO MENA Entrepreneurship & VC Panel: Investor Perspectives from New York to North Africa will be hosted by the Columbia Entrepreneurs Organization.

20 February (Saturday): Final results of applications for private university places will be announced on the Higher Education Ministry’s electronic university admissions site

22-24 February (Monday-Wednesday): Second Arab Land Conference on land management, efficient land use, among other topics.

22 February- 5 March (Monday-Friday) Egypt will host the World Shooting Championship in 6 October’s Shooting Club, with 31 countries set to participate

26 February (Thursday): The Afro Future Summit will take place virtually.

26-28 February (Thursday-Saturday): The second edition of the Egypt International Art Fair will be held at Dusit Thani Lakeview Cairo.

28 February (Sunday) Deadline for businesses, sole traders, and those generating income from sources other than their day job to file wage tax returns through the electronic filing system.

March: Potential visit to Cairo by Russian President Vladimir Putin.

1 March: Eastern Mediterranean Gas Forum comes into effect.

1-5 March (Monday-Friday): Aswan Forum for Peace and Development will take place virtually.

8 March (Monday): The IDC Future of Work Egypt conference will be held virtually featuring experts from Egypt and Jordan.

9-11 March (Tuesday-Thursday): EduGate 2021 – Enter The Future conference, Kempinski Royal Maxim Hotel, Cairo, Egypt.

11-13 March (Thursday-Saturday): Cairo Fashion & Tex trade show, Cairo International Convention Centre, Cairo, Egypt

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 March (Tuesday): The second edition of the Egypt Retail Summit takes place at the Nile Ritz Carlton hotel.

25-27 March (Thursday-Saturday): The Real Gate real estate exhibition, Egyptian International Exhibition Center, Cairo.

31 March (Wednesday): Deadline to visit the moroor and get an RFID sticker affixed to your car’s windshield — or run afoul of the Traffic Police.

1-3 April (Thursday-Saturday): HVAC-R Egypt Expo.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7 June-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

27 June – 3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.